Home Security Industry Expert Reviews ADT This ADT review will cover everything you need to know about the company, its products, and the experience you might expect owning them. The company is one of the most well-known and largest in the industry, offering a wide...

Above Lending reviews for 2023, including our personal loan review of the company, highlight ease of use and excellent customer service from a highly-rated lending institution that also functions as its own broker. Partnering with Cross River Bank, member FDIC, Above Lending offers debt consolidation and personal loans through its online platform, where consumers can check their eligibility without cost or obligations.

While Above Lending provides a mostly online experience where customers can fill out and submit documents, calling the company to begin the process is necessary. The extra step ensures the company can match you to the financial product you need before performing the next steps. However, the procedure differs from other online lending platforms that promote a higher level of convenience.

Above Lending ranks high on our list of the best personal loan companies while just slightly missing the mark in our best debt consolidation companies review.

Pros

Pre-qualifying won’t affect credit score

No pre-payment fees or penalties

No fees to apply

Funding available in 1 to 7 days

Borrow up to $50,000

Cons

Not available in all states

Minimum requirement information unavailable

Origination fee may apply

Minimal information on website

Above Lending Features and Benefits

Above Lending checks most of the boxes expected from an industry-leading debt consolidation lender. However, the company’s general website provides limited company and borrowing details until consumers call to unlock the more detailed customer area of the site.

- Loan amounts from $1,000 to $1,000

- Pre-qualifying won’t affect credit score

- Direct lender payments unavailable

- No early payment penalties

- Repayment terms from 12 to 84 months

- Interest rates from 5.9% – 36%

- An origination fee of up to 5% may apply

- Not available in all states

- Direct lending organization

Above Lending Reviews for Debt Consolidation

Editorial Rating

Trusted Company Reviews Rating Score for Above Lending Debt Consolidation: 7.3

Our rating criteria span a range from average to specific customer reviews, loan requirements and specifics, and customer convenience. While Above Lending scored highly across multiple factors, a lack of convenience details hurt the company on our debt consolidation ranking.

Our rating criteria span a range from average to specific customer reviews, loan requirements and specifics, and customer convenience. While Above Lending scored highly across multiple factors, a lack of convenience details hurt the company on our debt consolidation ranking.

Above Lending provides excellent features, such as–

- a wide interest rate range

- flexible debt consolidation loan terms

- low origination fees.

However, we felt that a more user-friendly experience from the start would be a better fit for many debt consolidation customers.

Above Lending Debt Consolidation Facts

Potential Above Lending customers can check their debt consolidation or personal loan eligibility without affecting their credit score after contacting the company at the phone number on its website.

After the initial contact, customers can set up an online account to input personal and financial information without having to provide documentation. Above Lending will then review the information and respond with information regarding the loan or loans the customer may qualify for.

After choosing the desired debt consolidation loan, clients can formally apply for it by providing documentation of the facts stated in the pre-qualification step, identification, and other documents.

Above Lending offers debt consolidation loan amounts from $1,000 to $50,000 with interest rates between 5.9 and 36% and terms ranging from 12 to 84 months. No prepayment penalties apply for paying off a consolidation loan early.

Above Lending provides excellent features, such as a wide interest rate range, flexible debt consolidation loan terms, and low origination fees. However, we felt that a more user-friendly experience from the start would be a better fit for many debt consolidation customers.

Above Lending Debt Consolidation Facts

Potential Above Lending customers can check their debt consolidation or personal loan eligibility without affecting their credit score after contacting the company at the phone number on its website.

After the initial contact, customers can set up their Above Lending login, where they can then input personal and financial information to get pre-approved loan options without having to provide documentation. Above Lending will then review the applicant’s information and respond with information regarding the loan or loans the customer may qualify for.

After choosing the desired debt consolidation loan, clients can formally apply for it by providing documentation of the facts stated in the pre-qualification step, identification, and other documents.

Above Lending offers debt consolidation loan amounts from $1,000 to $50,000 with interest rates between 5.9 and 36% and terms ranging from 12 to 84 months. No prepayment penalties apply for paying off a consolidation loan early.

| Interest Rates | 5.9% – 36% |

| Origination Fee | 0 – 5% |

| Loan Terms | 12 – 84 months |

| Minimum Credit Score | unknown |

| Loan Amounts | $1,000 – $50,000 |

| BBB Rating | 4.76 / A+ |

Above Lending Interest Rates

Most online lenders offer debt consolidation interest rates between 6% and 35.99%. Above Lending’s rates are right in line with those averages.

For pre-qualifying and final loan approval, Above Lending will consider several factors, including the customer’s credit score, credit history, debt-to-income ratio, financed amount, employment and income factors, and other indicators, to determine the approved interest rate.

How to Get an Above Lending Debt Consolidation Loan

Three steps are involved when applying for a debt consolidation loan with Above Lending. As a potential customer, you must first contact the company to open an online user account. Once online, you can input your personal and financial information into the website form.

Above Lending will then perform a soft inquiry on your credit report to determine your basic eligibility. The soft inquiry will not affect your credit score, and other entities won’t have access to the information or the fact that an inquiry happened.

If you’re pre-qualified based on the information provided, Above Lending will compile one or more loans that you’ll likely receive approval for from its lending partner, Cross River Bank. You’ll then have an opportunity to review the debt consolidation or personal loan options and detailed information about each.

Once you’ve chosen an option, if any, you can formally apply for the loan of your choice. If your information checks out after supplying the documentation and you’re approved, Above Lending will transfer the funds to your bank account within a few days, minus any origination fees if they apply.

With the funds in your bank account, you’ll be responsible for dispersing the money to your existing creditors. Above Lending doesn’t provide an option to pay them directly.

Approval and Acceptance

Pre-qualification with Above Lending doesn’t equal final loan acceptance. However, pre-qualification is an excellent indicator of probable final approval, provided the information given in the pre-qualification step is current and accurate.

Above Lending Debt Consolidation Loan Requirements

Above Lending provides no information or guidelines regarding minimum approval requirements. However, the initial consultation and pre-qualification steps are no-obligation and no-cost methods of determining your approval odds with the company. Basic legal requirements for acquiring a loan include the following items.

- Social Security number

- 18 years of age or older in most states

- Legal identification

- Verifiable address

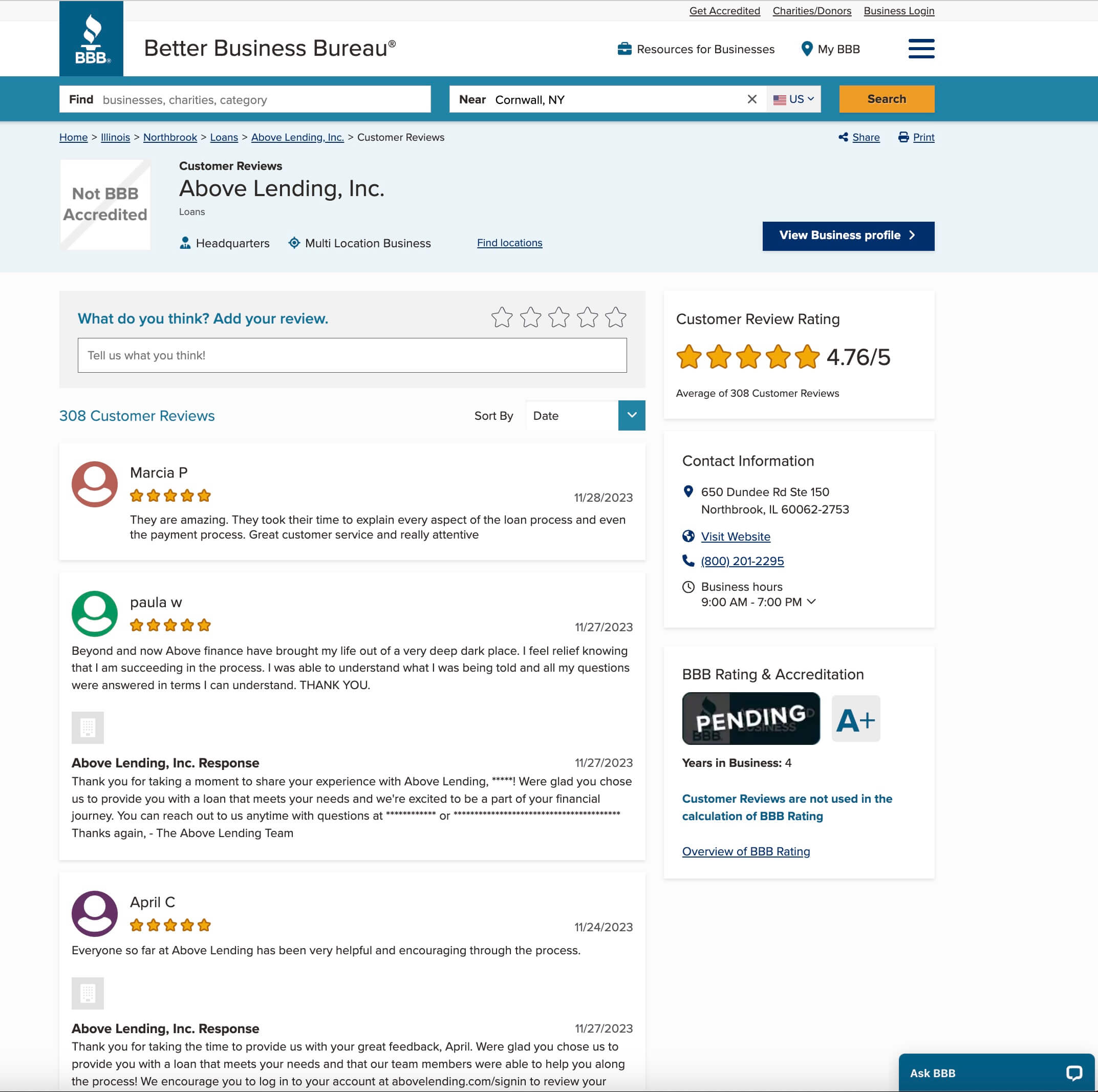

Above Lending BBB Reviews

Above Lending is a licensed and regulated loan company. We verified Above Lending’s licenses at the NMLS, the regulatory agency that regulates lenders’ licenses.

Above Lending’s office locations include the following locations:

- 650 Dundee Road, Suite 150, Northbrook, IL 60062

- 7322 Southwest Freeway, Suite 900, Houston, TX, 77074.

At the Better Business Bureau (BBB), Above Lending maintains a high rating and receives a low volume of complaints. Importantly, the company has achieved an A+ rating without even seeking BBB accreditation, further demonstrating their commitment to customer satisfaction.

- Excellent customer reviews: Above Lending BBB reviews have an average customer rating of close to 5/5 stars from over 300 reviews.

- High BBB rating: Above Lending’s BBB rating is A+ rated.

- Low complaints: Above Lending BBB complaints are less than 10!

The Better Business Bureau awards Above Lending an A+ grade for its responsiveness to customer concerns and complaints.

Likewise, Trustpilot rates the company at 4.7 of 5 stars based on reviews from over 2,000 customers. Less than 5% of the reviews on Trustpilot gave Above Lending a 3-star rating or lower. A full 95% of reviews have 4-star or above ratings.

Also cited on Trustpilot is Above Lending’s excellent history of responding to customer complaints. The company has replied to at least 94% of negative reviews on the site.

Is Above Lending Worth It?

Debt consolidation through any lender is a big commitment with potential risks and advantages. Above Lending offers a wide range of interest rates and loan-length terms, as well as modest origination fees if they apply to your situation.

However, the company does require customers to contact it directly before moving forward with the application process. While this step has advantages, such as receiving a brief consultation about which financial service might serve you best, most other online lenders provide this information upfront on their websites.

If the inconvenience of having to call the company before acquiring more information is acceptable, though, Above Lending may be able to provide the flexible debt consolidation terms you desire.

Above Lending Reviews Vs. Top Debt Consolidation Lenders

The following table briefly summarizes Above Lending’s loan requirements and terms.

| Feature | Above Lending |

Other personal loan lenders

|

| Credit score range | 600 to 850 | 600 to 750 |

| Loan amounts | Loans up to $50,000 |

$1,000 to $35,000

|

| APRs | 5.99% to 35.99% |

7.99% to 35.99%

|

| Repayment terms | 12 to 84 months | 12 to 60 months |

| Collateral required | No | No |

Above Lending Vs. Upstart

Above Lending and Upstart both offer pre-qualification steps that don’t affect consumers’ credit scores before committing to a debt consolidation loan application. However, Upstart partners with multiple lending institutions compared to Above Lending’s use of a single source. For this reason, Upstart may better serve those with lower credit scores or unique financial situations.

Our Upstart review showcases a couple of advantages over Above Lending when it comes to ease of use as well. By providing useful information on its website, customers can quickly determine if pursuing a pre-qualification approval is worth their time. Above Lending falls short in this area by offering only minimal information on its site.

Above Lending Vs. LendingClub

Above Lending and LendingClub are both lending institutions that act as their own online broker. Both companies offer debt consolidation pre-approval without affecting clients’ credit scores. And both offer financial services from limited sources rather than act as complete online marketplaces.

Our LendingClub review, however, describes a full-service online bank that offers a full suite of financial tools and account options. The primary differences between LendingClub and Above Lending regarding debt consolidation loans are Above Lending’s higher borrowing capacity and wider range of loan-length term options.

Above Lending Vs. Credible

Our Credible review shares information about a highly rated company that makes it onto our best debt consolidation companies list.

While Above Lending may not appear as if it can compete with Credible at first glance, a deeper look shows that it has some advantages over one of our top picks.

Credible offers a wider range of potential loan amounts and has similar loan-length availability to Above Lending. Its partnerships with multiple lenders and ease of use put it a step ahead of Above Lending.

| Feature | Above Lending | Upstart | LendingClub | Credible |

| BBB Grade / Rating | 4.76 / A+ | 1.24 / A+ | 4.56 / A+ | 1.29 / A+ |

| Average Reviews Rating | 4.7 | 3.4 | 4.4 | 4.6 |

| Interest Rates | 5.9% – 36% | 5.39 – 35.99% | 6.34 – 35.89% | 4.60 – 35.99% |

| Origination Fee | 0 – 5% | 0 – 12% Varies by Lender | 3 – 8% | 0 – 12% Varies by Lender |

| Loan Terms | 12 to 84 months | 36 to 60 months | 36 or 60 months | 12 to 84 months |

| Minimum Credit Score | Unknown | 300 | 600 | No minimum stated |

| Loan Amount | $1,000 to $50,000 | $1,000 to $50,000 | $1,000 to $40,000 | $600 to $100,000 |

| Joint Applicants Accepted | No | No | Yes | No |

| Mobile App Available | No | Yes | Yes | Varies by lender |

However, Above Lending offers potential benefits, including a much higher customer satisfaction rating with the Better Business Bureau and a more modest origination fee if one applies.

Frequently Asked Questions

Is Above Lending Legit?

Is it better to borrow from a bank or a lending company?

How does debt consolidation work?

Source

Image Sources:

- Better Business Bureau, Above Lending Inc., BBB review

- Abovelending.com website

- TrustPilot, Above Lending review

Deane Biermeier

Editorial Reviews

Ring Home Security System Review

A 2024 Ring Security System Review (tried and tested) Searching for reviews on Ring home security systems? This Ring security system review will cover everything you need to know about the company, its products, and the experience you might expect owning them. I...

Emma Mattress Review

Home Security Expert Reviews SimpliSafe vs. Alternatives (2024)

This Simplisafe review will cover what you need to know about the company’s home security products, services, and background. We touch on its installation procedures, including that it offers both DIY and professional options, and we talk about the SimpliSafe app,...

Vivint Home Security System Review

Must Reads

How To Get a 100K Business Loan

If you're starting a new business or expanding an existing one, we don't have to tell you about the massive number of moving parts involved. Funding the transition is just one part—albeit a big one. As expected, entrepreneurs often spend most of their time honing...

Can I Refinance My Private Student Loan? Learn Options for 2024!

The weight of student loan debt can feel overwhelming, especially for graduates of professional programs like law school and medical school. According to the latest data from the American Bar Association, the average law school graduate owes approximately $130,000 in...

Review Liberty Home Guard Vs. American Home Shield Warranties

Overall, Liberty Home Guard offers top-rated service with its affordable and comprehensive home warranty plans. Detailed Comparison of American Home Shield vs. Liberty Home Guard AHS vs Liberty American Home Shield Liberty Home Guard Monthly Price $29.99 to $69.99...

Best Egg Vs. SoFi Which A+ Graded Company is Better for You?

Best Egg Loan Reviews Vs. SoFi Personal Loan Reviews Examining Best Egg loan reviews Vs. SoFi personal loan reviews reveals two similar approaches to online lending from two very different types of companies. Where SoFi offers full online banking services and lending,...

Debt Consolidation Vs Personal Loan

The primary difference between a personal loan and a debt consolidation loan has little to do with the loan itself and more to do with how consumers use the funding. The application processes can differ slightly in that when consolidating debt, it's wise to account...

Fitting Hearing Aids: All You Need To Know, by Dr. Ruth Reisman

How to Correctly Fit Hearing Aids Properly fitted hearing aids can significantly improve sound quality, enhance comfort, and optimize the efficiency of your hearing devices. This is particularly crucial for seniors with tinnitus, as correctly fitted hearing aids can...

Medical Guardian vs. Life Alert: Which Medical Alert System is Better?

Welcome to our comprehensive showdown between Medical Guardian and Life Alert – two titans in the world of medical alert systems. If you're seeking the ultimate safeguard for your loved ones or yourself, you're in the right place. We're about to dive deep into this...

How to Choose a Mattress With Confidence: Everything You Need to Know

You've heard it said that we'll spend somewhere around a third of our lives in bed—And the math works out. While we're mostly awake for life's larger portions, taking care of ourselves all the time is essential—Not just the two-thirds we remember best. Learning how to...

Happy Head vs. Hims vs. Keeps: Best & Worst ways to regrow hair!

Happy Head vs. Hims vs. Keeps: What is the best product to regrow hair? Are you ready to stop hair loss and regrow a thick head of hair? Happy Head, Hims, and Keeps offer effective hair loss and regrowth treatments for men and women. Harnessing the power of...

Which is Better?: Identity Guard Vs. LifeLock

Which is Better?: Identity Guard Vs. LifeLock At first, an Identity Guard vs. LifeLock comparison may look like a toss-up. Both companies have been in the game longer than most, and both offer solid identity theft protections and plans with variable coverages to allow...