Trustedcompanyreviews.com offers free content, reviews and ratings for consumers to read, aimed at helping them compare their options. We may receive advertising compensation from companies featured on our website, influencing the positioning and sequence in which brands (and/or their products) are displayed, as well as affecting the assigned ratings. Please note that the inclusion of company listings on this page does not constitute an endorsement. We do not feature all available providers in the market. With the exception of what is explicitly outlined in our Terms of Service, we disclaim all representations and warranties regarding the information presented on this page. The details, including pricing, displayed on this site may undergo changes at any time.

Best Personal Loans From Top Lenders

Looking for the best personal loans from top lenders? You’re in the right place. Whether you’re consolidating debt, funding a large purchase, or covering unexpected expenses, finding the right lender can make all the difference. We’ve reviewed and ranked the top personal loan companies for 2025 based on low rates, fast funding, and excellent customer service.

Why trust Trusted Company Reviews

- Comprehensive review rating system.

- We work closely with consumers and experts to create editorial ratings.

Trusted Company Reviews #1 Pick for 2025

- Easy pre-qualification process

- Best chance for low-rate loan approval

- Fast funding (often within 1 day)

Why we love it 💖

Credible offers some of the highest approval rates for personal loans, whether you have fair or excellent credit. This makes it one of the top options for securing fast financing at competitive rates.

Find a Lender You Can Trust

From our list of top-rated personal loan companies, higher ratings are awarded to lenders with more positive customer reviews and fewer complaints. To qualify for our rankings, companies must meet strict compliance standards, including verified licensing, maintaining industry-average low rates, and providing full transparency on their websites.

Our expert ratings prioritize competitive interest rates, low fees, high approval odds, and strong customer satisfaction — so you can feel confident choosing from the options below.

Our Highest Rated Personal Loan Companies

- Lowest Number of Complaints

- Fair to Excellent Credit Acceptable

- Demonstrates a Strong Approval Rate for Applicants

- Best Variety of Reputable Loans

- Amounts from $2,000 to $50,000

- Direct lender payments are available

- Credit scores over 700 get the best rates

- Secured loan options are available

Via Credible.com's website

- No Minimum Credit Score

- Borrow up to $50,000

- Short Credit History OK

- Receive Funds within 24-Hours

Via Credible.com's website

- Minimum Credit Score: 600

- Soft Credit Check to Pre-Qualify

- Offers Home Equity Loans

- Small Business Loans Available

- Has the Highest BBB Customer Review Rating

- A Direct Lender

- Also a Bank

- Lower Rates With a Co-Borrower

Via Credible.com's website

- Borrow up to $50,000

- Low Fixed-Rate Loan Options

- No Prepayment Fees

- Minimum Credit Score: 600

- Cash-Back Credit Cards Available

Why is Credible the best place to get a personal loan for fair credit?

Credible is ideal for fair credit applicants seeking personal loans due to its easy access to a network of top-rated lenders. Unlike other online loan marketplaces that may partner with dozens of lenders, Credible conducts extensive due diligence and is highly selective in choosing personal loan companies to work with.

A Diversified List of Top Personal Loans

Through Credible, you can access personal loans from reputable lenders such as Avant, Best Egg, Happy Money, LendingClub, LightStream, OneMain Financial, Reach Financial, SoFi, Universal Credit, Upgrade, Upstart, and more. This diverse list of lenders increases the likelihood of finding the right loan for your specific needs, whether it’s meeting income or credit score requirements.

Aside from personal loans, Credible offers student loan refinancing, private student loans, mortgage loans, and home insurance options.

Better Approval Odds of Qualifying for a Loan

By offering a diverse range of personal loans, Credible gives consumers a better chance of qualifying for a loan. Not all lenders use the same FICO score or personal loan requirements. For example, Upstart uses artificial intelligence and considers factors beyond just a person’s credit score and credit report to determine eligibility. As a result, consumers with low to fair credit have a higher likelihood of qualifying for a personal loan through Credible.

Best of all, you’ll know within minutes if you qualify. Credible allows you to quickly get pre-qualified for a personal loan, and once pre-qualified, you’ll be directed to the lender’s system to complete the remaining steps. Many consumers receive their funds within a day or two, with transparent loan details provided in an easy-to-view format.

Innovative Technology for Faster and Easier Loan Approval

At its core, Credible is a technology company. Through its innovative platform, it connects borrowers with top-rated lenders, offering a seamless and user-friendly way to find a loan and receive funds quickly.

Credible’s advanced technology streamlines the personal loan process, making it faster and easier than applying through traditional banks or direct lenders.

Although Credible is not a direct lender, it partners with leading banks, fintech companies, and financial institutions to provide you with personalized loan offers.

By partnering with reputable institutions, Credible serves as a one-stop shop for personal loans and other financial products. The platform delivers fast, accurate loan offers using the latest data from lenders and credit bureaus, ensuring you get the best possible options.

Credible’s BBB Reviews, Ratings, and Complaints

| Source | Rating | Number of Reviews | Complaints |

| BBB | A+ | Less than 10 | Less than 10 |

| Trustpilot | Excellent: 4.8 out of 5 stars | 7,904 | NA |

| Consumer Affairs | Good: 3.4 out of 5 stars | 25 | NA |

Compared to other personal loan companies, Credible’s customer reviews, BBB rating, and low number of complaints place it far ahead of its competitors. This demonstrates that they offer a high-quality product that consumers are satisfied with—and ultimately, that’s what matters most. At TrustedCompanyReviews.com, our mission is to help consumers make smarter purchasing decisions, save money, and avoid unreliable lenders and companies.

At the Better Business Bureau (BBB), Credible maintains an A+ rating. With fewer than ten complaints listed, Credible shows a strong commitment to quality service and customer satisfaction. We last checked Credible’s BBB rating in May 2025.

At TrustedCompanyReviews.com, we’ve tested and tried Credible, and it works.

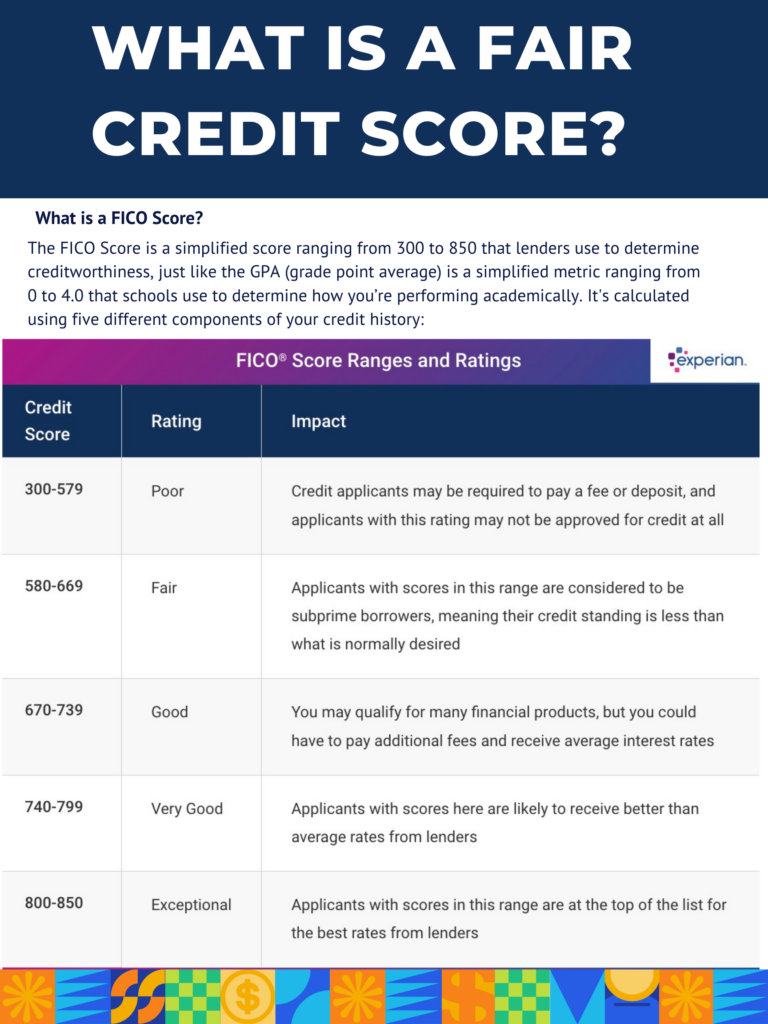

FICO Score Requirement for Personal Loans for Fair Credit:

According to Experian, fair credit is defined as a FICO® Score of 580 to 669 or a VantageScore® of 601 to 660. A credit score of 580 or below is considered “poor credit,” and consumers with scores that low should generally avoid applying for personal loans, as the associated fees and interest rates can be very high.

Instead, those with poor credit should focus on improving their credit by using a secured credit card. Regular use of a secured card, combined with paying off the balance in full each month, can help gradually improve credit scores. There are also credit cards available with no security deposit required, designed for consumers with limited credit histories to help them build credit. Check out our list of top credit cards for building credit with no security deposit required.

That said, personal loans are still available for individuals with credit scores below 600. Through Credible, lenders like Upstart consider factors beyond just your credit score, offering loan options even for those with low to fair credit.

TIP: While personal loans are available for credit scores under 600, it’s important to carefully review the rates and fees before proceeding. As mentioned above, lenders like Upstart, available through Credible, take a more holistic approach in evaluating applicants, making personal loans accessible to a wider range of credit scores.

Benefits of Using Credible for a Small Business Loan

Credible’s personal loans can be used for business purposes, providing a flexible alternative to traditional small business loans. Even startups can qualify for these loans through Credible, offering an accessible funding option for new ventures.

One key benefit of using a personal loan for business is that your payment history is reported on your personal credit report. This differs from traditional business loans, which typically report using an EIN. As a result, business owners have the added advantage of building their personal credit as they repay the loan.

Note: Credible offers personal loans, not business loans, but these personal loans can sometimes be used for business-related purposes.

Directory for Top Lenders and Personal Loans Near Me

As more consumers search for personal loans near them, we’ve decided to share our research on lenders operating in specific locations.

Check out some of our latest local reports on states with stringent lending laws.

- Top personal loan companies in Texas

- Best home equity loans in TX

- Top personal loans in California

- Best personal loans for New York state residents

- Best personal loans in California

- Top-rated loans in Colorado Springs, CO

- Best personal loans in Iowa

How Much Does It Cost to Get a Personal Loan Through Credible?

Let’s address the big question: What’s the catch, and how much does it cost?

You’ll be happy to know that using Credible is completely free, regardless of your credit score. Credible gets paid by the lenders only if you secure a loan through their platform. It’s performance-based, meaning they only get paid when they successfully help you obtain a loan.

If you choose to get a loan, each lender will charge interest, and some may also charge loan origination fees.

Credible Offers Full Disclosure and Transparency:

Credible clearly illustrates each loan’s rates, payment options, and terms – all in an unbiased manner, without the pressure of a salesperson trying to sell you something. This transparency ensures you have all the information you need to make an informed decision.

Personal Loan Interest Rates (APRs)

Actual rates may vary and are for illustrative purposes only.

How to qualify for the lowest interest rate and fees for a personal loan: The lowest rates typically require excellent credit and, in some cases, may be reserved for specific loan purposes or shorter loan terms.

Origination fees charged by lenders on Credible’s platform range from 0% to 12%. Each lender has its own qualification criteria, which may include autopay or loyalty discounts. For example, some lenders require borrowers to enroll in autopay prior to loan funding to qualify for the autopay discount.

All rates are determined by the lender and must be agreed upon between the borrower and the lender.

For example, for a loan of $10,000:

- With a three-year repayment term

- An interest rate of 7.99%

- A $350 origination fee

- An APR of 10.43%

The borrower would–

- Receive $9,650 at the time of funding

- Make 36 monthly payments of $313.32

- Total cost of loan: $11,279.43

Assuming all payments are made on time and the borrower fully adheres to the loan terms, the total amount paid over the life of the loan would be $11,279.43.

Fair credit? Click here to get pre-approved Credible personal loan offers now.

Best Personal Loan for Building Credit:

Upstart personal loans can be a valuable tool for building credit, especially for those with limited or fair credit (typically a FICO score of 580-740).

You can gradually improve your credit score by making consistent, on-time monthly payments. Late payments can negatively impact your credit, so responsible borrowing is key.

As long as the loan company reports your positive payment history to the credit reporting agencies as you make monthly payments, the loan will help your credit score improve. Therefore, always verify that your payment history will be reported monthly to the credit bureaus, especially if you want to get a personal loan to build good credit.

Explore Upstart’s options and compare them with other credit-building loans to find the best fit for your needs. Credit builder cards designed for fair or bad credit, where responsible use gradually increases your score, can also be a solid option if Upstart doesn’t work for you.

Final points to consider for applicants with low credit scores:

- Upgrade has no minimum income requirements.

- Upstart uses AI and other methods to judge a borrower’s creditworthiness beyond just basing it solely on credit scores.

- LendingTree offers a wide range of loan terms and options.

- OneMain Financial has no minimum credit score.

Best Personal Loans for Good to Excellent Credit

Wells Fargo Bank, PNC, and PenFed also provide attractive options with no origination fees but require excellent credit for approval.

Rather than applying directly through these lenders, we recommend using Credible to compare your options before getting locked in on a loan.

What are personal loan origination fees?

Most lenders charge a loan origination fee for fair credit personal loans. This up-front fee usually comes from the loan before it hits your bank account.

Make sure you incorporate this origination fee into the equation when doing the math and adding up the total cost of borrowing.

Loan origination fees can be flat fees of anywhere from $25 to $500 or are often based on a percentage of your loan amount. On average, percentage-based loan origination fees are between 1% and 10% of your loan amount, varying by lender.

Best Personal Loans with No Origination Fee

For borrowers with excellent credit, direct lenders like Discover, SoFi, and LightStream offer personal loans with no origination fee or prepayment penalties.

Many lenders, not mentioned on this page, do charge high loan origination fees.

Examples of Personal Loans with High Loan Origination Fees:

- LendUp’s loan origination fee is between 10% to 20% of the loan amount.

- Spotloan’s loan origination fee is 15% to 30% of the loan amount.

- OppLoans loan origination fee is 5% – 35% (variable).

- CashNetUSA personal loans have a loan origination fee of 11.99% – 27.99%.

Here are some tips for finding a personal loan with a lower origination fee:

- Use Credible’s free personal loan marketplace to compare rates from multiple lenders.

- Look for lenders with no-origination-fee options.

- Negotiate the origination fee with the lender.

- Borrow a smaller amount of money to reduce the amount of the origination fee.

Is a Personal Loan Program Right for Me?

A personal loan can help you consolidate high-interest debt into an affordable fixed-rate loan, simplifying your monthly bills and potentially saving you money. Personal loans can also be used to pay for medical bills, home improvement projects, credit card refinancing, and other large purchases.

Do the Math and Compare Cost of Borrowing

Add up the cost of what you plan to use the personal loan to pay. For example, if you’re planning to purchase a new walk-in bathtub.

First, calculate the total cost of the tub, including installation, plumbing adjustments, and any additional features. Then, subtract your available savings to determine the loan amount needed.

Next, consider your financing options. Credit cards are convenient but have high-interest rates. The company’s preferred lender may offer tailored plans, but interest rates might still be high. Your chosen lender, including a personal loan from our top-rated personal loans list, offers more options and potentially lower rates.

Choose the option that fits your budget and helps you achieve your dream.

Unsecured Loans

Unsecured loans provide quick funding without collateral, ideal for large purchases. In contrast, secured loans require collateral, which can be claimed if the loan isn’t repaid.

Debt Consolidation Loans

A debt consolidation loan could help you consolidate debt for a lower interest rate and enjoy a simplified repayment plan. They can be a good option for consumers who qualify.

Using a Personal Loan vs. Credit Card for Large Purchase

Should you use a credit card or a personal loan for that big purchase?

Here’s a quick breakdown to help you decide:

| Feature | Credit Card | Personal Loan |

| Pros | Widely accepted, rewards, easier to qualify |

Fixed rate, predictable payments, larger loan amounts

|

| Cons | High interest rates, snowballing debt, impacts credit utilization |

Requires good credit, prepayment penalties, origination fees

|

Should you use a personal loan or credit card to purchase a $1200 bathtub?

Hypothetically speaking, let’s suppose you have good credit. Upstart and LendingTree are offering you personal loans with around a 9% interest rate. Your other option is to use your credit card which has an interest rate of 24%.

Let’s do the math:

- Credit Card (24% APR, 24 months): $63.45 monthly payment, $322.69 total interest, $1522.69 total cost

- Personal Loan (9% APR, 48 months): $29.86 monthly payment, $233.38 total interest, $1433.38 total cost

Takeaway:

With a personal loan, you can save $89.31 on this purchase.

Understanding Personal Loan Rates (APR)

This section helps you navigate the world of personal loan Annual Percentage Rates (APR), empowering you to make informed decisions. Understanding the factors influencing APRs allows you to compare lenders and secure the most advantageous loan for your needs.

Explaining the Secrets of Your APR:

- Credit Score: This reigns supreme. A stellar credit score unlocks lower interest rates, while a lower score translates to higher rates.

- Loan Term: Shorter loan terms typically come with lower interest rates compared to longer ones.

- Loan Amount: Larger loan amounts may attract lower interest rates compared to smaller ones.

- Debt-to-Income Ratio: This reflects your ability to manage debt. A lower ratio indicates better financial health, potentially leading to lower interest rates.

- Lender’s Risk Assessment: Each lender has its own criteria for evaluating risk, which can influence the offered interest rate.

Key Takeaways: to help you get the best APR and Rate

- Advertised APRs are for qualified borrowers with excellent credit. Your actual rate may vary based on your individual circumstances.

- Analyze the total cost of the loan, including origination fees, prepayment penalties (if applicable), and interest charges.

- Leverage comparison tools like Credible and LendingTree to compare rates and terms from multiple lenders.

- Contact lenders directly for personalized quotes and clarify any doubts you may have.

Putting It All Together:

Consider borrowing $10,000 with a 36-month repayment term and an 18.49% APR (including a 5% origination fee). You would receive $9,500, and your monthly payments would be $346.65. Over the loan term, you would pay back a total of $12,479.52.

Remember, this is just an example, and your actual rate and total cost may differ.

Armed with this knowledge, you can confidently navigate the personal loan landscape and secure the best possible loan for your financial journey.

Editor’s Verdict

Credible: #1 Rated Personal Loan for Fair Credit (and Beyond)

Our #1 pick, Credible, shines for fair credit borrowers with its diverse selection of top-rated lenders (think Upstart, LendingClub, Discover, Upgrade, SoFi, and LightStream).

- Pre-qualify and compare rates in minutes.

- All for free

- High approval rate

- No impact on your credit score

- You will not get spammed by many lenders

Their strict vetting process and tech-driven approach make finding the perfect loan a breeze.

Related Article: Best Budgeting Apps

Upstart Consolidation Loans–Best for Credit Card Refinancing:

Upstart uses AI to consider factors beyond just credit scores, opening doors for borrowers with a low FICO score or limited credit history. Upstart’s consolidation loans are an excellent choice if you want to refinance credit card debt.

Get personalized rates and flexible repayment options, making Upstart a strong contender for alternative scoring models.

(BONUS: They’re also part of Credible’s network – APPLY NOW)

LendingTree offers the most options:

LendingTree offers a diverse range of options for all credit levels. While the sheer volume of lenders to choose from might require extra research, it also increases your chances of finding the best fit.

Plus, they offer additional loan types like home equity and small business loans.

Best Direct Lender–LendingClub:

LendingClub has the highest rating for direct lenders. Personal loans are distributed directly from LendingClub to you, with fixed rates for the life of the loan.

However, be mindful of potential downsides:

LendingClub personal loan origination fees can exceed 5%, and pre-qualification and final approval require hard credit checks, versus Credible and Upstart using soft credit checks.

Additionally, compared to Credible, Upstart, and LendingTree, you might have fewer offers to compare and choose from.

Certain states, such as Colorado, have different laws governing personal loan companies, which could result in a higher average APR on loans.

Disclosures:

TrustedCompanyReviews.com may receive compensation if you click on links to certain products in this article. This does not affect the ranking or placement of Credible or other lenders on our list, nor does it impact how we review and rate them. We aim to provide transparent and unbiased reviews to help consumers make informed decisions.

NMLS# Disclosure:

Credible Operations, Inc. NMLS# 1681276, “Credible.” Not available in all states. Visit www.nmlsconsumeraccess.org.

Credible’s Prequalified Rates Disclosure:

Prequalified rates are based on the information you provide and a soft credit inquiry. Prequalification does not guarantee that a lender will extend you an offer of credit. Final approval, including loan rates and terms, is determined solely by the lender. Advertised rates may not be available to all borrowers and typically assume excellent credit. See full Credible disclosure.

Best Rate Guarantee:

If you find a better rate after prequalifying with Credible, you may be eligible for a $200 gift card. Terms Apply.

Partial Market Disclosure:

Not all available financial products or providers are included in our comparisons. We strive to present a diverse set of products to suit different financial needs, but our reviews do not cover every provider on the market.

*Read rates and terms at Credible.com