Should You Get the Chase Freedom Unlimited Card?

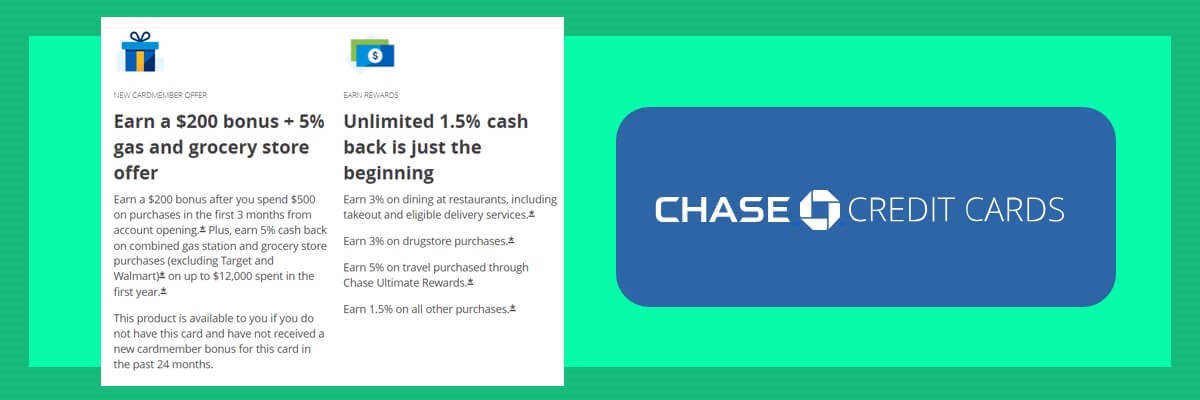

Our Chase Freedom Unlimited credit card review highlights a 1.5% cash-back card with robust introductory offers and up to 5% cash-back rewards on travel and other purchases. There is a small catch, though: to earn the 5% back, purchases must be made through Chase Travel. This card also offers 3% bonus rewards for gas and groceries for the first 12 months and 0% interest for 15 months on purchases and balance transfers.

Intro offers include a $200 cash-back reward for spending just $500 in the first three months, 3% bonus rewards for gas and groceries for 12 months, and 0% interest for 15 months. This card also made the list of 2024’s best-rated credit cards for gas and groceries, only second to Upgrade’s cash-back card.

Before we dive into our review of the Chase Freedom Unlimited card, let us briefly talk about another popular Chase card that consumers have been asking about.

The Chase Slate Edge vs. Freedom Unlimited Card

The Chase Slate Edge credit card offers a long 0% introductory APR on purchases and balance transfers for 18 months, with a chance to reduce your regular APR over time.

When comparing the Chase Freedom Unlimited versus Chase Slate Edge, these are the key differences you should know about:

- Rewards: Chase Freedom Unlimited offers cash-back rewards on purchases, while Chase Slate Edge does not offer any rewards.

- Introductory APR: Chase Freedom Unlimited offers a 0% introductory APR for 15 months on purchases and balance transfers, while Chase Slate Edge offers a 0% introductory APR for 18 months on purchases and balance transfers.

- Regular APR: Both cards have the same regular APR range. However, Chase Slate Edge offers an ongoing APR reduction, while Chase Freedom Unlimited does not.

- Travel benefits: Chase Freedom Unlimited offers some travel insurance benefits, while Chase Slate Edge does not.

The Chase Slate Edge card is ideal if you’re looking for a balance transfer card or to finance a large purchase, but doesn’t offer any rewards programs. That said, you have better choices for balance transfer cards, which can be found on 2024’s list of the top-rated balance transfer cards for fair credit. Additionally, low-interest personal loans can be a valuable tool to consolidate high-interest debt. You can explore our 2024 list of top-rated personal loans.

Compare Low APR Loan Options

Pros

Unlimited 1.5% cash back on all qualified purchases

$200 cash-back for spending $500 in the first 3 months

Potential for high reward returns, especially during the first year

No annual fee

Long, 15-month 0% intro APR

Cons

A 700+ credit score is necessary for approval

5% gas and groceries rewards limited to first 12 months or $12k

3% foreign transaction fees

Chase Freedom Unlimited Review: Features and Benefits

The Chase Freedom Unlimted credit card has a lot going for it beyond its enticing introductory offers. 5% rewards on travel spending and 3% drugstore, dining, and take-out service rewards are on top of the card’s potentially lucrative 1.5% rewards on every other qualified purchase for everyday items and more.

Chase places no limit on the number of reward points that never expire, which customers can earn at 1.5%. Additionally, no annual fee applies, making it a solid financial tool for everyday use.

- APR 20.49% – 29.24%

- 0% APR for 15 months

- No annual fee

- $200 cash-back for spending $500 in the first 3 months

- Complimentary service vendor bonuses

- 5% cash-back at gas and grocery stores for the first 12 months or $12k

- 1.5% cash-back at gas and grocery stores after the intro offer

- 5% cash-back on travel purchases

- 3% cash-back on drugstore, dining, and take-out services

- Robust mobile app

- Free VantageScore 3.0 credit score access

- Intro balance transfer fees of $5 or 3% of each transfer

- Balance transfer fees of $5 or 5% after the intro offer

- 3% foreign transaction fees

- $10 or 5% cash advance fee

- Cash advance interest rate equals 29.99%

- Late payment fees of up to $40

- Best for Good to Exceptional credit score above 700

Chase Freedom Unlimited Review: Editorial Rating

Trusted Company Reviews Rating Score for Chase Freedom Unlimited: 9.8

The Chase Freedom Unlimited rewards card doesn’t offer the lowest possible interest rate among credit cards, nor does it provide the greatest cash-back return percentages.

However, it offers solid returns on everyday spending with no annual fee and the potential to earn unlimited reward points usable for things like statement credits, direct deposit, Amazon shopping credits, gift cards, and travel benefits.

Our review list of the best credit cards for gas and groceries includes the Chase Freedom Unlimited card, even though the highest gas and grocery rewards are limited to the first year or first $12,000 spent in the categories.

| Rewards | 1.5% on everyday spending, 3% on dining and drugstore purchases, 5% on travel spending |

| Intro Offer | $200 cash-back / 0% APR for 15 months / 5% on gas, groceries, and travel for 12 months |

| Rewards Redemption | Redeem points for cash-back statement credits or direct deposit, Amazon shopping credits, gift cards, or travel rewards |

| APR | 20.49% – 29.24% |

| Annual Fee | $0 |

| Credit Score Requirements | 700+ |

About Chase Freedom Unlimited®

Besides the unlimited rewards customers can earn at 1.5% returns on most purchases, the card also features powerful introductory offers and higher reward earnings for purchases at drugstores and travel merchants.

The Chase Unlimited rewards card comes with no annual fee, interest rates of between 20.49% and 29.24% for purchases, and a 29.99% APR on cash advances. Transferring balances from other cards is possible at $5 or 3% of each transfer, whichever is greater, for an intro period of 60 days and $5 or 5% after that.

An introductory 0% interest term runs for 15 months after card approval, and customers can receive a $200 cash-back bonus for spending $500 on eligible purchases in the first three months of card ownership. Late payment penalty fees are $40 per occurrence, with the potential loss of introductory interest rates.

Chase Freedom Unlimited Credit Limit

The minimum credit limit upon approval for the Unlimted® card is $500. However, many customers with excellent credit histories and scores report starting limits of over $5,000, with some reporting substantially higher amounts.

Chase Freedom Unlimited Approval Odds

Chase generally requires Unlimted® card applicants to have a good to exceptional credit score over 700 for approval. However, some applicants who have slightly below the minimum score have reported being approved for the card.

Chase considers several factors when determining approvals, interest rates, and credit limits after customers apply for the card. Factors include, but aren’t limited to, credit score, credit history, and income amounts.

Is Chase Freedom Unlimited a Good Credit Card?

For those with good to exceptional credit who can take advantage of Chase’s rewards program by using the card for everyday and travel spending, the Unlimted® card can be a good and effective financial tool for maximizing savings.

Its excellent introductory offers make it appealing. However, its ongoing benefits and lack of an annual fee also make it a solid choice for everyday use in the long term.

Chase Mobile App Features

Chase provides its cardholders access to its to its robust mobile app where customers can manage their card and perform several other functions, such as the following tasks.

- Check balance and available credit

- Schedule and execute payments

- Monitor their VantageScore 3.0 credit score

- See transaction histories and statements

- Open a new account

- Track their overall monetary health

- Apply for additional financial services

- Redeem rewards points

- Contact Chase Bank

- Add their card to a digital wallet and pay bills

- Book reward travel and hotels

- Explore and activate other membership benefits

- Trade and invest with J.P. Morgan Wealth Management

How to Use Chase Freedom Unlimited®

Using the Chase Freedom Unlimted credit card to maximize rewards benefits is straightforward, with no activations or special planning necessary. Simply use your card for everyday, dining, and travel spending for the best benefits and redeem them on the company’s website or mobile app.

Rewards are redeemable for cash-back direct deposits, credit statements, Amazon shopping credits, gift cards, or travel rewards.

Chase Freedom Unlimited Reviews

Experts and customers agree in Chase Freedom Unlimited reviews that the card offers high-qualify benefits with little or no hassle. Multiple expert review sites rate the card at 5 of 5 stars, while customer review sites and some others award average ratings in the mid to high 4-star range.

Customers who rate the card highly generally like its ease of use for everyday spending and simple yet lucrative rewards system. Those who report lower scores cite lower-than-expected credit limits, higher-than-expected interest rates, and customer service inconsistencies.

Chase Freedom Unlimited Vs. the Competition

As an all-around credit card with no annual fee, the Unlimted® card is among several competitors and similar cards in Chase’s own product lineup. Here’s how the card stacks up against some of the competition.

Chase Freedom Unlimited Vs. Flex

The Chase Freedom Unlimited and Unlimited Flex cards are both from Chase and offer similar benefits in most respects. The glaring difference between the two is that the Flex card offers high 5% rewards on spending categories up to $1,500 on a rotating quarterly basis instead of the smaller but unlimited rewards potential of the Unlimited card.

| Chase Freedom Unlimited® | Chase Freedom Flex® | |

| Rewards | 1.5% on everyday spending, 3% on dining and drugstore purchases, 5% on travel spending | 5% rewards on quarterly bonus spending categories, 3% on dining, takeout, and drugstores, 1% on everything else |

| Intro Offer | $200 cash-back / 0% APR for 15 months / 5% on gas and groceries for 12 months | $200 cash-back / 0% APR for 15 months / 5% on gas and groceries for 12 months |

| APR | 20.49% – 29.24% | 20.49% – 29.24% |

| Annual Fee | $0 | $0 |

Chase Freedom Unlimited Vs. Sapphire Preferred

While the Sapphire Preferred® card from Chase offers more potentially lucrative rewards than the Unlimited® card, the Sapphire comes with a higher minimum interest rate and a $95 annual fee.

| Chase Freedom Unlimited® | Chase Sapphire Preferred® | |

| Rewards | 1.5% on everyday spending, 3% on dining and drugstore purchases, 5% on travel spending | 5x points for travel / 3x points for dining, groceries, and streaming / 1x points on other qualified purchases / $50 annual hotel discount |

| Intro Offer | $200 cash-back / 0% APR for 15 months / 5% on gas, groceries, and travel for 12 months | 60,000 bonus points intro offer worth $600 after spending $4,000 in the first 3 months |

| APR | 20.49% – 29.24% | 21.49% – 28.49% (variable) |

| Annual Fee | $0 | $95 |

Chase Freedom Unlimited Vs. Capital One Quicksilver

For simplicity, it’s hard to beat the Capital One Quicksilver rewards perks of 1.5% cash back on every qualified purchase. However, for traveling, dining, and drugstore spending, the Chase Freedom Unlimited card holds a slight edge over the Quicksilver in those categories.

| Chase Freedom Unlimited® | Capital One Quicksilver | |

| Rewards | 1.5% on everyday spending, 3% on dining and drugstore purchases, 5% on travel spending | 1.5% cash-back on all eligible purchases |

| Intro Offer | $200 cash-back / 0% APR for 15 months / 5% on gas, groceries, and travel for 12 months | $200 cash-back / 0% APR for 15 months |

| APR | 20.49% – 29.24% | 19.99% – 29.99% |

| Annual Fee | $0 | $0 |

Chase Freedom Unlimited Vs. Discover it Cash Back

The Chase Freedom Unlimited versus Discover it Cash Back showdown comes down to ease of use. While the Discover it Cash Back card offers significant rewards, it does so using quarterly-activated categories and involves $1,500 spending rewards limits.

| Chase Freedom Unlimited® | Discover it® Cash Back | |

| Rewards | 1.5% on everyday spending, 3% on dining and drugstore purchases, 5% on travel spending | 5% cash-back on quarterly-selected categories up to $1,500 spending limit / 1% on all other qualified purchases |

| Intro Offer | $200 cash-back / 0% APR for 15 months / 5% on gas, groceries, and travel for 12 months | Unlimited cash-back matching after the first year / 3% introductory balance transfer fee |

| APR | 20.49% – 29.24% | 17.24% – 28.24% |

| Annual Fee | 0% | 0% |

Chase Freedom Unlimited Vs. Wells Fargo Active Cash

The Wells Fargo Active Cash® card gives the Chase Freedom Unlimited® card a run for its reward money. The Unlimited card offers 1.5% rewards for everyday spending, while the Active Cash card beats it with 2% rewards for the same expenditures. However, the Unlimited also offers extra reward percentages in other categories, which are likely to appeal to those who travel and dine out.

| Chase Freedom Unlimited® | Wells Fargo Active Cash® | |

| Rewards | 1.5% on everyday spending, 3% on dining and drugstore purchases, 5% on travel spending | 2% cash-back on all eligible purchases |

| Intro Offer | $200 cash-back / 0% APR for 15 months / 5% on gas, groceries, and travel for 12 months | $200 cash-back / 0% APR for 15 months |

| APR | 20.49% – 29.24% | 20.24% – 29.99% |

| Annual Fee | $0 | $0 |

Frequently Asked Questions

Does Chase Freedom Unlimited have foreign transaction fees?

What credit score do you need for Chase Freedom Unlimited?

Is Chase Freedom Unlimited hard to get?

Does Chase Freedom Unlimited have rental car insurance?

Does Chase Freedom Unlimited have travel insurance?

Source

Image source: chase.com