College Ave student loans reviews highlight an online fintech lender featuring easy use, excellent customer service, and flexible repayment terms. The organization scores highly on multiple customer and expert review sites, averaging around 4.6 out of 5 stars between them. College Ave is a fixture on the online loan marketplace, Credible, which features the company as a trusted partner. Our best personal loans review showcase Credible as a leading lending format.

Starting in 2014, College Ave now partners with three banking institutions, including M.Y. Safra Bank, Firstrust Bank, and First Citizens Community Bank. The company provides student loans, parent loans, and student loan refinancing in all 50 states.

FAFSA In the News

If you’re enrolling in college this season, you’re likely no stranger to the glitches affecting the recently updated FAFSA forms online. Meg Oliver of CBS News reported that delays in the system mean that some colleges have had to push back their financial deadlines. Other reports say that FAFSA completion rates are down significantly this year due to the problems and other reasons.

However, despite the issues, filling out the FAFSA form and taking advantage of federal student aid packages and loans is still the best way to begin funding higher education. While College Ave student loans reviews showcase a lender providing excellent service and solid benefits, private student loans are primarily designed as a backup to federal loans instead of a direct alternative.

Student Loans

Pros

Associate’s degree and career loans available

0.25% autopay discount available

Multiyear approvals available

Multiple loan term options

Pre-qualifying won’t affect credit score

Cons

Potentially high interest rate

Higher than average credit score required for approval

Vague about approval requirements

A degree is a requirement for refinancing

College Ave Student Loans Reviews: Features and Benefits

College Ave student loans reviews describe an online student loan and refinancing provider that scores well with both customers and experts. In addition to high review ratings, the company also scores points in our review for its many benefits, with just a small handful of negative attributes.

- Fixed APR between 4.43% and 17.99% for student loans

- Fixed refinance APRs from 6.99% to 13.99% with autopay discount

- Variable student loan refinance rates same as fixed rates

- Variable student loan rates from 5.59% to 17.99%

- No application or origination fees

- Cosigner release application available after 50% of payments are complete

- Pre-qualify without affecting credit score

- Loan terms of 5, 8, 10, 15, and 20 years

- Refinance terms of 5 to 20 years

- Parent loan terms of 5 to 15 years

- Loan amounts from $1,000 to the total cost of education

- The minimum refinance amount is $5,000

- Multiyear approvals available

- 5% or $25 late payment fees apply after 15 days

- A degree is necessary for refinancing

- $35,000 minimum income to qualify for loans or refinancing without a cosigner

- Typically requires a 680 credit score to qualify

- Must be a US citizen or permanent resident to apply

College Ave Student Loans Reviews: Editorial Rating

Trusted Company Reviews Rating Score for College Ave Student Loans: 9.4

Existing customers and experts agree in College Ave student loans reviews that the organization stands out for its excellent customer service, flexible repayment terms, ease of use, and its ability to help answer student loan questions. Our review rates the company at 9.4 out of 10 possible points for many of the same reasons.

However, some factors are worth considering before choosing College Ave as your student loan or refinancing source. First, College Ave isn’t forthcoming with its qualification requirements. While the vast majority of student borrowers require a cosigner, most borrowers and cosigners with College Ave have credit scores higher than 680 and an income of at least $35,000 annually.

Secondly, College Ave’s more minor negatives include the existence of late fees for payments made more than 15 days after the due date and a relatively restrictive cosigner release rule stating that loans must be 50% paid off before applying for release. Additionally, while College Ave features low interest rates, the company’s higher-end APRs are quite high, approaching 18%.

| Fixed APR | 4.43% to 17.99% |

| Variable APR | 5.59% to 17.99% |

| Refi Fixed APR | 6.99% to 13.99% |

| Refi Variable APR | 6.99% to 13.99% |

| Loan Terms | 5, 8, 10, 15, 20 yrs |

| Refi Terms | 5 to 20 years |

| Repayment Options | Immediate, interest-only, deferred, fixed |

| Loan Amounts | $1,000 to the total cost of attendance |

How Do College Ave Student Loans Work?

College Ave student loans are available to parents and students attending an approved higher education institution at least ½ time. The company provides student loan lending for career education and associate’s degree programs through doctorate programs. College Ave even offers repayment deferrals for up to 48 months to accommodate residencies.

APR terms with College Ave include interest rates of between 4.43% to 17.99% and 5.59% to 17.99% with variable rate terms. Repayment term loan lengths with the lender are 5, 8, 10, 15, and 20 years. Four repayment plans exist, including immediate, interest-only, fixed, and deferred.

Loan amounts with College Ave start at $1,000 and can go as high as the total cost of education. Students and parents can pre-qualify for borrowing in the company’s listing at Credible. Pre-qualification incurs only a soft credit inquiry that doesn’t affect your credit score and won’t appear on future credit inquiries. A hard credit inquiry will occur after formally applying for the loan or refinancing.

College Ave offers multi-year loan approvals in some cases. This means borrowers approved for the program won’t have to reapply each time additional funds are necessary. Repayments for the deferred payment option and increased payments for all other choices begin after a grace period of six months after the student graduates or reduces their enrollment below ½ time attendance.

College Ave Student Loan Rates

College Ave student loan rates vary by product and the borrower’s creditworthiness. Fixed rates for student loans are between 4.43% and 17.99%, while variable rates start at 5.59%, with lower interest rates generally applying to shorter loan lengths. All student loan interest rates are subject to a 0.25% decrease for customers who choose the autopay repayment option with College Ave.

Qualification Requirements: Does College Ave Require a Cosigner?

College Ave doesn’t offer a list of specific qualification requirements for its student loans. However, our research indicates the following parameters are typically necessary for the approval of students or students with a cosigner.

- Must be a citizen or permanent resident of the United States

- In general, a credit score of 680 or higher is necessary for approval. However, the company is vague about the details.

- No bankruptcies on current credit record

- $35,000 minimum annual income

- Must be enrolled at least ½-time for student loans

- Must have a degree for refinancing

- Students must meet SAP guidelines for their school for parent loans

Repayment Details

College Ave offers several repayment options for students and parents.

- Loan length terms for students are 5, 8, 10, 15, and 20 years

- Loan length terms for parent loans are 5 to 15 years

- First payments are due after the grace period ends

- The grace period is six months after graduation or after the student stops attending school at least ½ time.

- Four repayment structures are available.

Repayment Options

- Immediate loan repayments begin 30 to 60 days after disbursement to the school and include full principal and interest payments.

- Interest-only loans require making interest payments only while in school, with full payments beginning after the grace period.

- Fixed loan repayments consist of $25 payments during school, with full payments starting after the grace period.

- Deferred loans require no payment while in school. However, interest will accrue from the loan disbursement date. Full payments begin after the grace period.

Parent Loan Repayment Options

College Ave student loans reviews often note the differences in repayment terms for student and parent loans with the company. Parent student loans have three repayment options instead of the four choices of typical student loans.

- Interest-only loan repayment requires paying only the loan interest while the student attends school.

- Interest plus payment loan options allow your choice of payment in addition to paying the interest each month while the student is in school.

- Immediate or full-payment loans include making the full monthly principal and interest payment from the loan’s inception.

College Ave Student Loan Refinancing Details

Applying for refinancing through College Ave follows a process similar to the one for student loans. A pre-qualification step is available that only makes a hard inquiry on your credit report once you formally apply for the funding.

The minimum refinancing amount with College Ave is $5,000, and maximums vary by degree program. The maximum refinancing loan amount for up to a bachelor’s degree is $150,000. Medical, dental, veterinary, and pharmacy degrees have a maximum of $300,000.

Interest rates for refinancing vary from 6.99% to 13.99 percent with the autopay option, and loan terms range from five to 20 years.

College Ave Student Loans Reviews

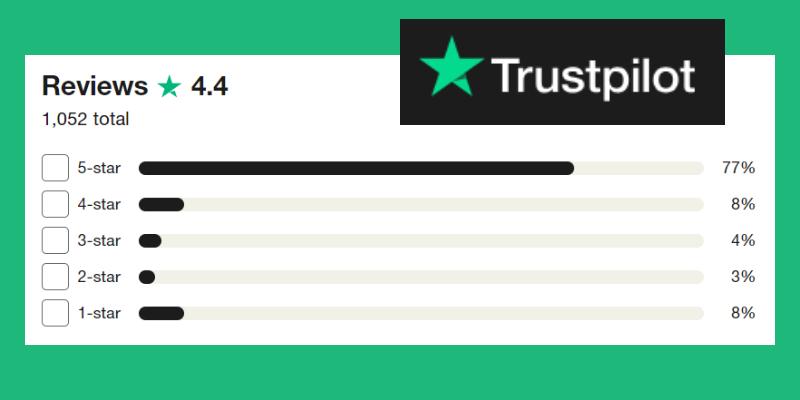

College Ave student loans reviews are mostly positive and include a 4.4 out of 5-star rating at Trustpilot. 85% of reviewers on the site award the company four or five stars in reviews, while 8% give it just one star.

The positive reviews tend to share common traits, including excellent customer service, easy application process, flexibility, and professionalism. Negative reviews often focus on the company’s high interest rates.

5-star

Clear instructions on-line. Less so by phone but I require patient instruction and repeated same script instructions don’t work for me. Helping a grandson, so complicated. Got it done, though. – Wayne, Trustpilot

5-star

Because they were understanding they were patient and all of my question’s and I had a lot of them. – Kimberly, Trustpilot

4-star

The site was pretty simple and easy to use , I would recommend it to anyone even folks like me that are old and not so tech savvy. – Keith, Trustpilot

1-star

I was going to co sign for my daughter but after reading that for $7,000 she could be paying you back an astronomical rate, I found this very upseting. – Mary, Trustpilot

Frequently Asked Questions

Is College Ave student loans legit?

Is College Ave student loans good?

Is College Ave a federal loan?

How long does College Ave loans take?

How can I apply for financial aid?

Source

Image Sources: collegeave.com – trustpilot.com