Home Security Industry Expert Reviews ADT This ADT review will cover everything you need to know about the company, its products, and the experience you might expect owning them. The company is one of the most well-known and largest in the industry, offering a wide...

LifeFone Reviews (Cost, Complaints, Pros, and Cons)

Welcome to our in-depth LifeFone review. Our team has extensively researched this product, including a detailed examination of its medical alert system and analysis of customer feedback. As we age, safety and independence become increasingly important, and medical alert systems have become a popular solution for seniors and their families. However, choosing the right medical alert system can be overwhelming with so many options available.

In this review, we’ll take a closer look at LifeFone’s medical alert systems for seniors, including their features, costs, and overall effectiveness. Additionally, we’ll provide you with some tips on how to get the best price on LifeFone medical alert systems. As a physician and writer certified in clinical research by the National Institutes of Health (NIH), I’ve had the opportunity to compare LifeFone with other top-rated medical alert devices and personal emergency response systems (pers), such as Medical Guardian and Philips Lifeline.

While I found LifeFone to be reliable, affordable, and satisfying for its customers, we also found some serious allegations made by its clients in customer complaints. In this review, we will address these allegations and thoroughly analyze the pros and cons of LifeFone’s medical alert devices. [1] [2]

LifeFone Company Description

As evidenced by a plethora of positive LifeFone reviews, LifeFone’s range of devices includes in-home systems, mobile devices, and GPS tracking devices, ensuring that customers have access to assistance both at home and on the go. In addition to emergency response services, LifeFone also offers caregiver tools. Their easy-to-use equipment and highly rated customer service have made LifeFone a trusted choice for those seeking peace of mind and reliable medical alert systems since 1976.

Pros

Established brand: LifeFone has been in business for over 40 years and has established a reputation as a reliable and trusted medical alert system provider.

Multiple device options: The company offers a range of device options, including a pendant, wristband, and mobile device, providing customers with options that fit their specific needs and preferences.

Flexible pricing: LifeFone offers a range of pricing options, including monthly, quarterly, and annual plans, with no activation or cancellation fees.

Integration with healthcare providers: LifeFone offers integration with healthcare providers and hospitals, allowing for seamless care coordination.

Cons

Price: The company’s products and services can be more expensive than some other medical alert system providers.

Additional cost for customization: While the company offers customization options for its products, these come at an added cost, which could make the overall price of the service more expensive and could be a concern for customers who are looking for a more budget-friendly option.

Technical issues: Some customers have reported technical issues with LifeFone’s products, such as connectivity problems or false alarms, but these may be considered inherent issues in all medical alert systems.

Review LifeFone’s Best Features

LifeFone stands out among other medical alert systems because of the many types of LifeFone medical alert systems available to customers, which include both in-home and mobile devices. Their devices are easy to set up and use, and they offer a variety of optional services to further enhance the safety and well-being of their customers. LifeFone also offers caregiver tools including daily check-in calls, medication prompts, system status notifications, and customer tracking services to people who use their on-the-go systems. These tools not only offer peace of mind for subscribers but also provide reassurance for their loved ones, making LifeFone a trusted choice for those seeking reliable and comprehensive medical alert services.

Another of their key benefits is their 24/7 assistance from U.S.-based care agents, ensuring that customers always have access to help whenever they need it. Their nationwide cellular coverage means that customers can use their devices anywhere in the United States, providing added peace of mind and security.

LifeFone Medical Alert System Complaints

While LifeFone offers many benefits, we’ll inform you of a few potential drawbacks and complaints. Unfortunately, LifeFone’s website and sales reps won’t reveal what upset customers tell us in online reviews. Whether or not they are all true isn’t the point, it’s the information being brought to your attention that counts. You can then proceed to do your own due diligence to verify the facts and be an informed buyer. Our job at TrustedCompanyReviews.com is to help you be more informed and educated about your options, ultimately making the best buying decision.

LifeFone complaints:

In online reviews, dissatisfied customers of LifeFone’s medical alert systems complained about –

- LifeFone Costs: According to LifeFone customer reviews, one issue is that their pricing, particularly for mobile devices, can be higher than other medical alert system providers. In addition, there are additional monthly costs–LifeFone charges for their caregiver tools in addition to its base subscription fee.

- Unauthorized charges and issues with cancellation policy: LifeFone complaints range from unauthorized charges to difficulty canceling the service and not getting issued a full refund.

- Complaint about LifeFone’s medical alert system features: Some customers have complained that the help button on the device is too sensitive, causing false alarms and unnecessary emergency responses. LifeFone does offer a 30-day free trial for its medical alert systems. During the trial period, you can test the equipment and confirm whether or not the help button’s sensitivity is a problem for you.

- False Advertising: Some customers have complained that Lifefone’s advertising is misleading. LifeFone claims that the company promises 24/7 monitoring, but clients said response times are slow, and assistance is only sometimes available.

- Technical Issues: Some customers have reported technical issues with the equipment. Complaints range from the inability to activate the device to the device malfunctioning in the middle of an emergency.

- Poor Customer Service: Some customers have reported that Lifefone’s customer service needs to be improved. They claim that customer service representatives are unresponsive and do not address their concerns.

LifeFone Customer Service

LifeFone offers 24/7 customer support via phone, and their trained care agents are always available to assist subscribers with any questions or concerns they may have. In addition to phone support, LifeFone provides an online contact form where subscribers can submit questions or request a call back from a care agent. The website also features an extensive FAQ section that covers a wide range of topics related to LifeFone’s medical alert system and solutions. Emergency care instructions are also available.

LifeFone’s customer service also extends to their technicians, who are available to assist with device setup and installation. Furthermore, the company provides a customer service portal, which allows customers to receive assistance with device setup, billing, and other subscription-related issues. Online payment is also available and can be a convenient option for some.

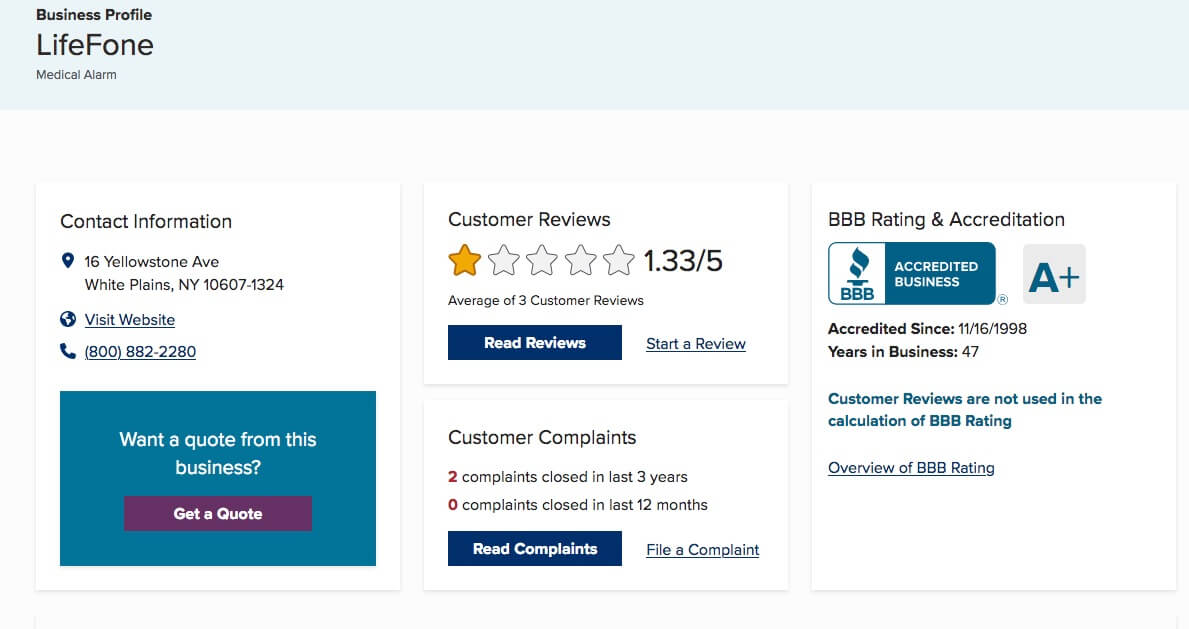

LifeFone BBB Reviews

While LifeFone is generally considered a reputable name in the medical alert industry, it’s worth noting that some customers have shared negative comments and complaints about their experience at the Better Business Bureau (BBB).

Although LifeFone has an A+ rating with the BBB and is accredited, a few negative reviews and complaints have been filed against the company, primarily regarding billing and cancellation issues. For example, multiple LifeFone customers have reported getting charged for services they didn’t receive and had trouble canceling their personal emergency response system (pers) contract, as mentioned above.

According to three consumer reports, LifeFone has an average customer rating of 1.33/5 stars.

To avoid potential problems in the future that are related to billing and having difficulties canceling your LifeFone contract, carefully review your customer agreement before purchasing a medical alert device. Take the time to understand the company’s billing and cancellation policies, including all monthly fees, upfront costs, and payment details. By doing so, you can protect yourself from any issues that may arise in the future because you didn’t do enough up-front due diligence.

Source: BBB, Life Fone, MSS Electronics, Inc.

LifeFone vs. Medical Guardian

When comparing LifeFone to Medical Guardian, both companies are prominent players in the medical alert industry, providing high-quality devices and services to seniors. Although there are many similarities, including the cost of their medical alert systems, there are also some key differences to consider.

Let’s take a closer look at some of the differences:

Customer Reviews: According to consumer review websites such as ConsumerAffairs and Trustpilot, Medical Guardian has a higher overall rating than LifeFone.

Time in Business: LifeFone has been in the medical alert business since 1976, giving them a longer track record of experience, while Medical Guardian was founded in 2005.

Complaints: While both companies have received some complaints, LifeFone has had a few related to billing and cancellation issues, while Medical Guardian has had some complaints about technical difficulties with their equipment. However, it’s worth noting that these complaints are relatively few compared to their overall customer base.

Overall, both LifeFone and Medical Guardian provide quality medical alert systems, with similar pricing for their basic home-based systems. However, if customer reviews and longevity are important factors to you, LifeFone may be a better choice. On the other hand, if you value newer technology and innovation, Medical Guardian may be the better option for you.

LifeFone Replacement Parts

LifeFone offers a lifetime warranty on their medical alert base unit and pendant, which covers any defects in materials or workmanship. If a customer receives a defective unit, they can contact LifeFone’s customer service to request a replacement. However, the warranty does not cover damage caused by accidents, including water damage or dropping the unit.

In cases where the equipment is damaged due to accident or misuse, the customer will need to pay for the replacement. LifeFone offers a replacement policy for damaged equipment, which allows customers to purchase a replacement unit at a discounted rate.

It’s important to note that customers should handle their equipment with care to avoid damage. LifeFone recommends not wearing the pendant in the shower or bath and taking it off before swimming. They also suggest not exposing the equipment to extreme temperatures or harsh chemicals.

In summary, LifeFone offers a lifetime warranty on their medical alert base unit and pendant for defects in materials or workmanship. However, they do not cover damage caused by accidents, including water damage or dropping the unit. Customers can purchase replacement units at a discounted rate through LifeFone’s replacement policy if they damage their equipment.

Frequently Asked Questions

Is LifeFone a good company?

Is LifeFone medical alert legit?

How do LifeFone medical alert systems work?

Which is better, Philips Lifeline or LifeFone medical alert systems?

LifeFone vs. Life Alert – Who's Better?

How much do LifeFone medical alert systems cost per month?

Is LifeFone medical alert systems covered by Medicare?

Where to buy LifeFone systems?

Does the LifeFone medical alert system offer a 30-day risk-free trial?

What medical alert systems have the best and longest battery life?

How long does the battery last on LifeFone medical alert devices?

How to Contact LifeFone?

Are you looking to save money and find the best prices for LifeFone medical alert devices?

Doctor Naheed Ali

Editorial Reviews

Ring Home Security System Review

A 2024 Ring Security System Review (tried and tested) Searching for reviews on Ring home security systems? This Ring security system review will cover everything you need to know about the company, its products, and the experience you might expect owning them. I...

Emma Mattress Review

Home Security Expert Reviews SimpliSafe vs. Alternatives (2024)

This Simplisafe review will cover what you need to know about the company’s home security products, services, and background. We touch on its installation procedures, including that it offers both DIY and professional options, and we talk about the SimpliSafe app,...

Vivint Home Security System Review

Must Reads

How To Get a 100K Business Loan

If you're starting a new business or expanding an existing one, we don't have to tell you about the massive number of moving parts involved. Funding the transition is just one part—albeit a big one. As expected, entrepreneurs often spend most of their time honing...

Can I Refinance My Private Student Loan? Learn Options for 2024!

The weight of student loan debt can feel overwhelming, especially for graduates of professional programs like law school and medical school. According to the latest data from the American Bar Association, the average law school graduate owes approximately $130,000 in...

Review Liberty Home Guard Vs. American Home Shield Warranties

Overall, Liberty Home Guard offers top-rated service with its affordable and comprehensive home warranty plans. Detailed Comparison of American Home Shield vs. Liberty Home Guard AHS vs Liberty American Home Shield Liberty Home Guard Monthly Price $29.99 to $69.99...

Best Egg Vs. SoFi Which A+ Graded Company is Better for You?

Best Egg Loan Reviews Vs. SoFi Personal Loan Reviews Examining Best Egg loan reviews Vs. SoFi personal loan reviews reveals two similar approaches to online lending from two very different types of companies. Where SoFi offers full online banking services and lending,...

Debt Consolidation Vs Personal Loan

The primary difference between a personal loan and a debt consolidation loan has little to do with the loan itself and more to do with how consumers use the funding. The application processes can differ slightly in that when consolidating debt, it's wise to account...

Fitting Hearing Aids: All You Need To Know, by Dr. Ruth Reisman

How to Correctly Fit Hearing Aids Properly fitted hearing aids can significantly improve sound quality, enhance comfort, and optimize the efficiency of your hearing devices. This is particularly crucial for seniors with tinnitus, as correctly fitted hearing aids can...

Medical Guardian vs. Life Alert: Which Medical Alert System is Better?

Welcome to our comprehensive showdown between Medical Guardian and Life Alert – two titans in the world of medical alert systems. If you're seeking the ultimate safeguard for your loved ones or yourself, you're in the right place. We're about to dive deep into this...

How to Choose a Mattress With Confidence: Everything You Need to Know

You've heard it said that we'll spend somewhere around a third of our lives in bed—And the math works out. While we're mostly awake for life's larger portions, taking care of ourselves all the time is essential—Not just the two-thirds we remember best. Learning how to...

Happy Head vs. Hims vs. Keeps: Best & Worst ways to regrow hair!

Happy Head vs. Hims vs. Keeps: What is the best product to regrow hair? Are you ready to stop hair loss and regrow a thick head of hair? Happy Head, Hims, and Keeps offer effective hair loss and regrowth treatments for men and women. Harnessing the power of...

Which is Better?: Identity Guard Vs. LifeLock

Which is Better?: Identity Guard Vs. LifeLock At first, an Identity Guard vs. LifeLock comparison may look like a toss-up. Both companies have been in the game longer than most, and both offer solid identity theft protections and plans with variable coverages to allow...