found a credit monitoring service this month

Trustedcompanyreviews.com offers free content, reviews and ratings for consumers to read, aimed at helping them compare their options. We may receive advertising compensation from companies featured on our website, influencing the positioning and sequence in which brands (and/or their products) are displayed, as well as affecting the assigned ratings. Please note that the inclusion of company listings on this page does not constitute an endorsement. We do not feature all available providers in the market. With the exception of what is explicitly outlined in our Terms of Service, we disclaim all representations and warranties regarding the information presented on this page. The details, including pricing, displayed on this site may undergo changes at any time.

Best Credit Monitoring Services (with FICO Scores+3 Bureaus)

This review covers the best free and paid credit monitoring services, with category winners included to help you pick the right service for your unique situation. According to the Federal Trade Commission, 2.8 million fraud reports plagued the US last year, translating to a staggering $5.8 billion in consumer losses – a 70% year-over-year jump. These aren’t just numbers; they’re a wake-up call. Unless you’re comfortable handing your identity to scammers, it’s time to invest in the power of top-tier credit monitoring.

Why trust Trusted Company Reviews

- Comprehensive review rating system.

- We work closely with consumers and experts to create editorial ratings.

Trusted Company Reviews #1 Pick for 2025

Why we love it 💖

Get credit score monitoring from all 3 bureaus!

Our Highest Rated Credit Monitoring Service Companies

- Credit Monitoring for $29.95 monthly

- Get notified if anything on credit changes

- Lock and Unlock credit instantly

- FICO scores from all 3 credit bureaus

- UNLIMITED toll-free access to ID theft specialists

- Uses VantageScore 3.0 scoring model

- $1 million ID theft insurance

- A+ BBB Rated

- Uses FICO Scores (most used by lenders)

- Helpful for building credit

- Shares credit alerts

- $1 million identity theft insurance

- 24/7 Identity restoration

- Lost wallet assistance

- Best Free Option

- Identity theft insurance is included in the free plan

- Uses VantageScore 3.0 scoring model

- Free plan monitors TransUnion credit bureau

- Credit card and loan offers available

- Credit alerts provided in paid plans

- The best features exist in the free plan

- Offers useful score-improvement and maintenance advice on website

- Digital banking options are available

- Experian is a credit bureau with credit monitoring plans

- Experian Boost availability can help quickly increase your credit score

- $1 million identity theft insurance available

- Uses FICO 8 scoring model

- Free monthly credit report access with the paid plan

- 17% discount for annual plan purchase

- 7-day trial period for paid plan

- Identity protection not as robust as competitors

- Three-bureau credit monitoring

- Uses VantageScore 3.0 scoring model

- Thorough identity protection services are available

- Excellent customer service and ID fraud assistance reviews

- 14-day free trial and 60-day money-back guarantee

- VPN and virus protection are included in all membership plans

- Up to $5 million identity fraud insurance available in top plan

- Bank transaction monitoring provided

- Costs more than some competitors

Best Credit Monitoring Apps

Best Overall: Identity Force (TransUnion)

IdentityForce is primarily an identity theft protection company that offers individual and family plans and can provide family protection as well. The company offers two paid plans called UltraSecure and UltraSecure+Credit, with no free plan choices. ChildWatch protections can be added to the low-cost plan and are included in the higher-cost one. However, only the higher-priced plans include credit monitoring.

IdentityForce Overview

- Robust credit monitoring available in UltraSecure+Credit plan

- Identity protection features are available in all plans

- ChildWatch protections available with any plan

- Payable monthly or annually with a discount for annual payment

- Uses VantageScore 3.0 scoring model

- Plans cost from $19.95 to $35.99 monthly

- High consumer ratings and A+ BBB score

- 30-day trial period

- $1 million ID theft insurance provided

Why We Chose IdentityForce

While IdentityForce’s main business is that of an identity theft protection provider, the company’s thorough examination and monitoring of your credit scores of all three major credit bureaus in its highest-cost plan is superior to most of its competitors. We especially like the ChildWatch program, as children’s credit scores and identity protections are often overlooked.

Best Free Service: Credit Sesame

Best Free Credit Monitoring Service

Several credit monitoring companies provide simple score feedback for free from one or more credit bureaus—While Credit Sesame focuses most of its resources on identity protection, its free credit monitoring stands apart due to the inclusion of a $1 million ID theft insurance, simply not offered by other free credit service providers. Other benefits include monthly updates from your TransUnion credit score using the VantageScore 3.0 model and digital banking availability.

Credit Sesame Overview

- Identity theft insurance is included in the free plan

- Uses VantageScore 3.0 scoring model

- Free plan monitors TransUnion credit bureau

- Credit card and loan offers available

- Credit alerts provided in paid plans

- The best features exist in the free plan

- Offers useful score-improvement and maintenance advice on website

- Digital banking options are available

Why We Chose Credit Sesame

We chose Credit Sesame for having the best free credit monitoring service available. The company has struggled somewhat with customer satisfaction issues in the paid plans. However, CreditSesame’s paid plans go beyond simple credit monitoring. Our focus is on the free option that offers satisfactory credit monitoring and identity theft insurance coverage just for signing up.

Best For Identity Protection: Aura

If you’re looking for the best identity theft protection and credit monitoring all-in-one, Aura is a great choice to consider.

Credit monitoring is just one way to keep an eye on your financial health. Aura combines thorough credit monitoring with extensive identity protection features to provide an all-in-one service. There are no free monitoring plans through Aura. However, its lowest-cost plan starts at $12 per month if you pay annually or $15 monthly.

Best 3 bureau Credit Monitoring Service

Aura’s low-cost credit monitoring plan offers VPN protection and password management, ID theft insurance, fraud protection, and credit reporting from all three bureaus. Family protection plans are also available.

Aura Overview

- Three-bureau credit monitoring

- Uses VantageScore 3.0 scoring model

- Thorough identity protection services are available

- Excellent customer service and ID fraud assistance reviews

- 14-day free trial and 60-day money-back guarantee

- VPN and virus protection are included in all membership plans

- Up to $5 million identity fraud insurance available in top plan

- Bank transaction monitoring provided

- Costs more than some competitors

Why We Chose Aura

Aura offers a wide range of prices for its plans, with the lowest cost being one of the least costly of our competitors and the most expensive being the highest-priced on our list. The features increase as the plan cost goes up. But, even the low-priced option has excellent credit monitoring, identity theft protections, and insurance coverage.

Best For Rebuilding Credit Score: myFICO

Best Credit Monitoring Service with FICO Scores

If you’re looking for the best credit monitoring service with FICO scores, myFICO is also a top contender. myFICO’s least expensive plan provides a general picture of your Experian credit score using the FICO 8 model most used by lenders.

For additional benefits and three-bureau reporting, consider the Advanced or Premier plan for $10 and $20 more monthly, respectively. myFICO’s website provides detailed and abundant information to help you improve and maintain your credit score.

myFICO Overview

- Uses the FICO scoring platform most used by lenders

- The company’s website hosts information to improve your credit scores

- Credit alerts available in all plans

- $1 million identity theft insurance available in all plans

- The Advanced plan only offers quarterly reporting

- The most expensive plan may not be worth the extra cost

- Lost wallet assistance is available

- 24/7 identity restoration assistance is available

Why We Chose myFICO

While myFICO itself can’t raise your credit score, and no free plan options are available, However, if credit score knowledge is what you’re after, the company’s website provides all kinds of information designed to help you rebuild your credit and reports your score using the FICO model which is most often used by potential lenders.

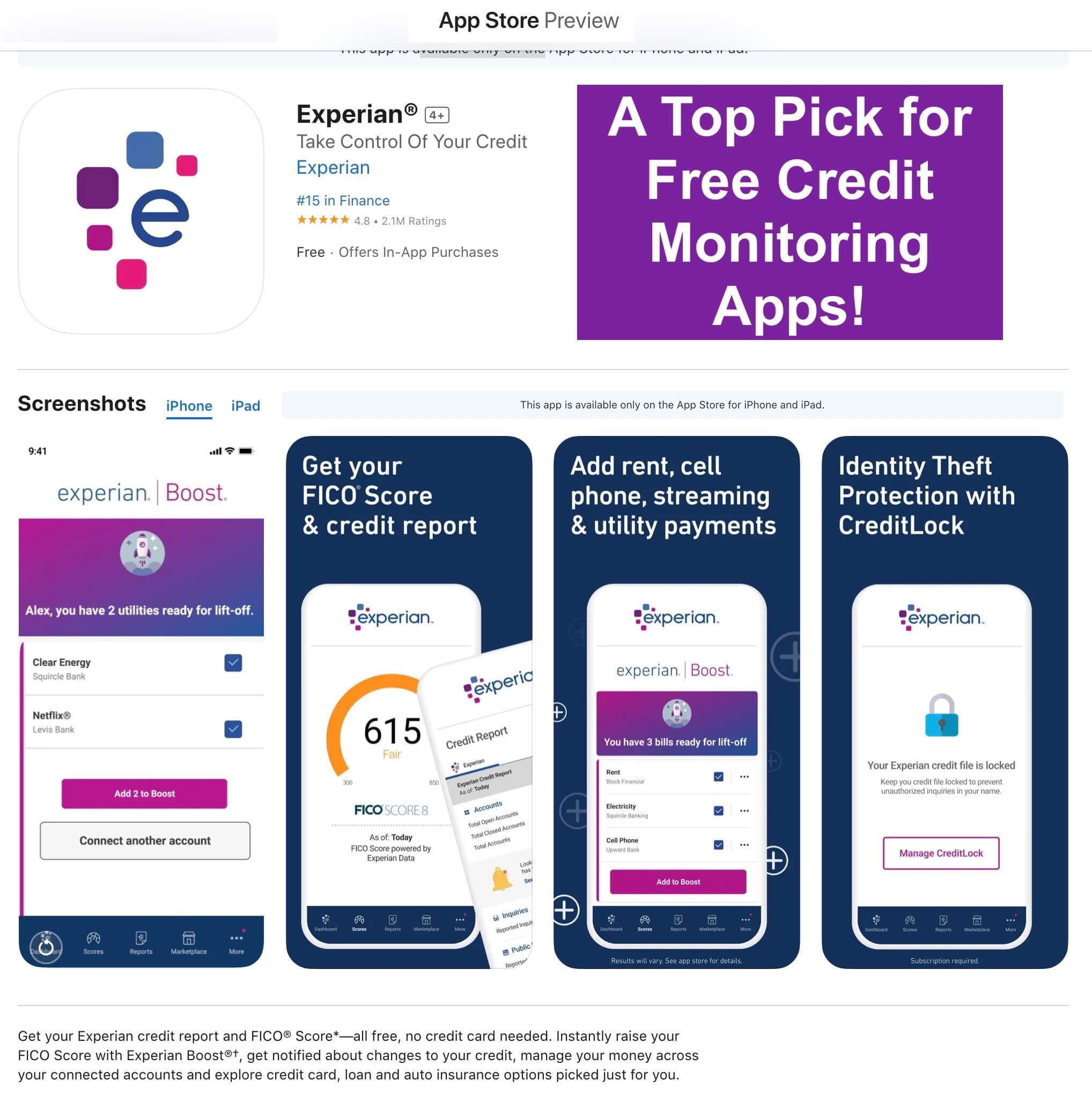

Best Credit Bureau: Experian

Experian is known as one of the three major credit bureaus. However, its credit monitoring service stacks up against its competitors well. The company offers a free plan called CreditWorks and a paid one that goes by CreditWorks Premium.

CreditWorks offers credit monitoring of your Experian credit score using the FICO 8 scoring model, while the CreditWorks Premium plan monitors all three bureaus, provides modest identity protections, and offers $1 million in ID theft insurance. Both programs provide Experian Boost to potentially give your credit score a quick bump up.

Best Free Credit Monitoring App

In the Apple App Store, Experian’s credit monitoring app has over 2.1 million reviews, with an average rating of 4.8 out of 5. This free Experian credit monitoring app has exceptional customer reviews. Credit Karma is another consumer favorite. However, the tool doesn’t provide all the tools needed to qualify for our review though it does offer a way to keep an eye on your VantageScore credit score.

Experian Overview

- Experian is a credit bureau with credit monitoring plans

- Experian Boost availability can help quickly increase your credit score

- $1 million identity theft insurance available

- Uses FICO 8 scoring model

- Free monthly credit report access with the paid plan

- 17% discount for annual plan purchase

- 7-day trial period for paid plan

- Identity protection not as robust as competitors

Why We Chose Experian

Experian offers excellent credit monitoring for free or for a competitive monthly price, especially when taking advantage of the annual payment discount. Using the FICO 8 scoring model boosted Experian’s ranking, as did the inclusion of identity theft protections and insurance.

| Identity Force | Credit Sesame | Aura | myFICO | Experian | |

| Trusted Company Review Score | 9.5 | 9.2 | 8.6 | 9.2 | 9.0 |

| Free credit monitoring available | No | Yes | No | No | Yes |

| Credit score Model | VantageScore 3.0 | VantageScore 3.0 | VantageScore 3.0 | FICO 8 | FICO 8 |

| 3-Bureau credit monitoring | Available | Available | Yes | Available | Available |

| Identity protection available | Yes | Yes | Yes | Yes | Available |

| Mobile app | Yes | Yes | Yes | Yes | Yes |

| Family plan available | Yes | No | Yes | No | No |

| Identity theft insurance | Yes | Yes | Yes | Yes | Available |

| Lowest monthly cost | $19.95 | Free | $15 | $19.95 | Free |

| Highest monthly cost | $35.99 | $19.95 | $50 | $39.95 | $24.99 |

Ratings were last updated on 2025.

What Is a Credit Monitoring Service?

Simply put, a credit monitoring service examines your credit score from one or more of the three main credit bureaus, reports your scores to you using a VantageScore or FICO scoring model, and alerts you to any changes that take place, allowing you to investigate further if necessary. Some services offer limited monitoring for free or more robust services for a fee. Still others offer both free and paid plans. Many credit monitoring services also provide identity theft protections to varying degrees.

How Credit Monitoring Services Determine Your Credit Score

Rather than determine your credit score for you, credit monitoring service companies report your score back to you, which consists of data from one or more of the three major credit bureaus, including Experian, TransUnion, and Equifax, and calculated by either VantageScore or FICO.

VantageScore and FICO produce credit scores as a reflection of information they receive from the credit bureaus. The metrics they use to determine your score include credit history length, credit use percentage, types of credit accounts, recent inquiries or activity, and payment history.

How to Choose a Credit Monitoring Service

Choosing a credit monitoring service starts with analyzing what features you’ll benefit from most versus the cost of the service. If you’re looking to simply keep an eye on your credit and be alerted to illicit or unusual activity on your accounts, a free service that provides a simple credit monitoring app may be all you need to feel comfortable. Credit monitoring apps differ from budgeting apps. However, some of the best budgeting apps do offer credit score reporting.

On the other hand, if your credit rating has suffered or you’ve been an identity theft victim, you may decide that a paid plan with more robust monitoring and ID protection is more appropriate. There are also credit monitoring services, such as Experian, that provide the opportunity to achieve a quick credit score bump.

If you’re looking to build credit for the first time, or rebuild your credit score, consider a monitoring service that provides educational material on their website or an interactive credit monitoring app to get you on your way. Typically these services also promote lenders and credit cards that can help you improve your score over time.

When deciding, get answers to these questions first.

- How much does the best plan for you cost?

- How many credit bureaus are monitored?

- Does the company use VantageScore or FICO scoring models?

- Are other services, like identity theft protection and insurance, available?

- How thorough are the identity protection features if I need them?

- Can I get family coverage if necessary?

- Can I cancel my plan if I’m not satisfied?

Do I Need a Credit Monitoring Service?

Submitting your information to, or paying for, a credit monitoring service isn’t mandatory. However, doing so can bring peace of mind while providing real-life protections that are hard to get anywhere else, whether you opt for a free or a paid monitoring plan.

Credit monitoring services help protect and maintain your credit score by allowing you to watch for activities that may hurt your score. How much you’re willing to pay for such services depends on how comfortable you feel with your credit information.

If you’re looking for how to rebuild credit fast or how to rebuild credit after bankruptcy, a credit monitoring service can provide you with the information you need to manage your credit use and improve your score as quickly as possible.

How We Chose the Best Credit Monitoring Service

To determine our choices for the best credit monitoring services, we evaluated several of the most popular companies in the industry, ranked them according to the metrics below, and chose the best one in each of our categories.

- Availability of free credit monitoring

- Low and high plan prices

- Three-bureau reporting

- Scoring model, VantageScore or FICO

- Identity theft provisions

- Family plan inclusions

Frequently Asked Questions

Two main credit score services, VantageScore and FICO, each provide accurate credit scores based on information provided by the three credit bureaus. However, lenders most often use the FICO scoring model, which can vary widely from your VantageScore credit score.

While several credit reporting agencies exist, Experian, Equifax, and Trans Union are the most respected and best known.

A credit freeze is an action you can take at each of the three major credit bureaus in which you turn off your credit report to lenders. Freezing your credit renders your credit information inaccessible to lenders and would-be identity thieves. The action is easily reversible so that you can unfreeze your credit anytime.

Basic credit monitoring can be free of charge for a basic plan or cost up to around $30 per month and anywhere in between. Credit monitoring plans costing from about $15 per month to over $50 per month also generally include identity theft protections and insurance.

Credit monitoring isn’t considered a hard inquiry at the three credit bureaus and won’t hurt or help your credit score.

Our choice for the best credit monitoring service overall is IdentityForce. The company provides the most beneficial services for the broadest audience. However, the best credit monitoring service for you depends on several factors, including your credit situation and financial goals.

Most credit monitoring companies offer access to your full credit report on a regular basis. However, you can also obtain copies of all three credit bureaus once each year at AnnualCreditReport.com.

The three major credit monitoring companies are Experian, Trans Union, and Equifax.

Rating Criteria

| Criteria | Possible Points |

| Better Business Bureau Grade | A+ Rating: 9 points

B- through A Rating: 4 points C+ or below Rating: 0 points |

| Trustpilot Review Rating | 4.0 and up: 8 points

2.0 to 3.9: 4 points Less than 2.0: 0 points |

| Free Credit Monitoring Available | Yes: 7 points

No: 0 points |

| Three-Bureau Reporting Available8 | Yes: 9 points

Only in most expensive plan: 5 points No: 0 points |

| Best Plan Monthly Cost | Less than $25: 7 points

$25 to $40: 3 points More than $40: 0 points |

| Identity Theft Features | Yes: 7 points

No: 0 points |

| Credit Score Update Frequency in Lowest-Cost Plan | Daily: 8 points

Weekly: 4 points Monthly: 2 points Quarterly: 0 points |

| Credit Score Update Frequency in Highest-Cost Plan | Daily: 8 points

Weekly: 4 points Monthly: 2 points Quarterly: 0 points |

| Family Plan Available | Yes: 5 points

No: 0 points |

| Additional Features | Credit advice: 2 points

Score simulator: 2 points FICO score available: 2 points Mobil app available: 2 points Monitoring alerts: 2 points Digital banking available: 2 points |

| Expert Opinion Score | Up to 20 points |

IdentityForce Pros and Cons

Pros

- 24/7 customer service is available

- A long list of additional identity protection features is available

- ChildWatch protections available

- Payable monthly or annually

- Discounted pricing applies to annual payment

- Competitively priced service

Cons

- Credit Monitoring is only available in the highest-priced plans

- ChildWatch protections aren’t offered in the lowest-cost plan

- Paid subscription required

- Some low customer review ratings regarding the mobile app

- Quarterly credit reports instead of monthly

Credit Sesame Pros and Cons

Pros

- Best features are included in free services

- $1 million identity theft protection in free and paid plans

- Provides credit card and loan offers appropriate for your credit history

- Credit alerts available in top plans

- Offers solid advice for improving credit scores

Cons

- Only one credit bureau monitored in the free plan

- Middle-tier plan additions may not be worth the price

- More thorough identity theft protection available at a similar cost through other providers

- Reports of poor customer service with paid plans

Aura Pros and Cons

Pros

- Compiles credit scores from all three credit bureaus

- Thorough identity protection services are available

- Excellent customer service and ID fraud assistance reviews

- 14-day free trial and 60-day money-back guarantee

- VPN and virus protection are included in all membership plans

- Up to $5 million identity fraud insurance available in top plan

- Bank transaction monitoring provided

Cons

- Full credit reports are only available annually

- Online predator protection only available in the top-tier family plan

- Costs more than some competitors

- Doesn’t offer FICO scores or financial advice

- Can only freeze and thaw Experian credit

myFICO Pros and Cons

Pros

- Uses the FICO scoring platform that most lenders also use

- $1 million identity theft insurance is offered in all plans

- The company’s website is geared toward ways to improve your credit scores

- 24/7 identity restoration aid is available in all plans

Cons

- The Premier plan only adds more frequent credit score updates

- The Advanced plan reduces score updating to quarterly only

- The most expensive plan may not be worth the extra cost

- Plans are generally more costly than some competitors

Experian

Pros

- Credit monitoring provided directly from one of the three major credit bureaus

- Experian Boost availability can help quickly increase your credit score

- $1 million identity theft insurance available

- Widely used FICO score reporting

- Free monthly credit report access with the paid plan

- 17% discount for annual plan purchases and pre-payment

Cons

- The free trial period is likely too short to make an informed purchasing decision

- Premium plan identity protections fall short of the competition at a similar cost