OneMain Financial Reviews | Features and Benefits

With a more than 100-year history, OneMain Financial has proven to be a staple company in the lending industry. It operates as an online company and has physical locations across the country. As a subprime lender, OneMain caters to borrowers with lower credit scores. However, despite higher-than-average interest rates, the company offers solid benefits to those who qualify for a OneMain Financial loan.

- Personal and debt consolidation loans are available

- Loan amounts from $1,500 to $20,000

- Pre-qualifying won’t affect credit score

- Repayment terms from 24 to 60 months

- No minimum credit score is required

- Mobile app available

- Origination fees apply

- Joint borrowing available

- Co-signers allowed

- Secured loans available

- Credit cards available

OneMain Financial Review | Editorial Rating

Trusted Company Reviews Rating Score for OneMain Financial: 8.1

Our rating system evaluates lending institutions based on critical factors important to consumers, such as convenience and accessibility, customer service, overall review scores, banking and loan fees, and loan approval requirements.

OneMain Financial rates well on most of our scoring criteria points, especially those related to loan approval requirements. However, the company’s high starting interest rate and lackluster Better Business Bureau grade cost it some crucial points.

Despite that fact, OneMain’s accessibility as an online and physical location operation and its ability to work directly with customers to help get them approved for a loan stand out as strong points.

One Main Financial Rates Rates and Requirements vs. Similar Lenders

| Lender |

Loan Amounts |

|

| Upstart Personal Loan |

$1,000 to $50,000 |

620 |

| LightStream Personal Loan |

$5,000 to $100,000 |

700 |

| Upgrade Personal Loan |

$1,000 to $50,000 |

600 |

| Sofi Personal Loan |

$5,000 to $100,000 |

|

| Best Egg Personal Loan |

$2,000 to $50,000 |

600 |

| LendingClub Personal Loan |

$1,000 to $40,000 |

660 |

| Avant Personal Loan |

$2,000 to $35,000 |

550 |

| Universal Credit Personal Loan |

$1,000 to $50,000 |

560 |

| OneMain Financial Personal Loan |

$1,500 to $20,000 |

|

| Happy Money Debt Consolidation Loan |

$5,000 to $40,000 |

640 |

Source: Top 5 Best Personal Loans for Fair Credit, Good Credit and Excellent Credit

OneMain Financial Loan Facts

OneMain Financial loans come with relatively high interest rates and an origination fee that varies by state and the borrower’s creditworthiness, as depicted by credit score and history. Origination fees range from $25 to $500 but are limited by law in some states.

Obtaining approval for a OneMain Financial loan starts with a pre-qualification step on the company’s website. Customers can input their personal and financial information on the site and see which loan products they’ll likely gain approval for, minus the final interest rate amount. The pre-qualification step only requires a soft inquiry on the borrower’s credit report that doesn’t affect their score.

OneMain loan customers who desire assistance with the application process can request an in-person interview with a OneMain loan specialist at one of the lender’s physical locations. The specialist will help determine the borrower’s eligibility for a loan before formally applying for one by examining criteria such as the customer’s living expenses, debt amounts, and income.

| Origination Fee |

$25 – $500 |

| Loan Terms |

24 – 60 months |

| Minimum Credit Score |

N/A |

| Loan Amounts |

$1,500 – $20,000 |

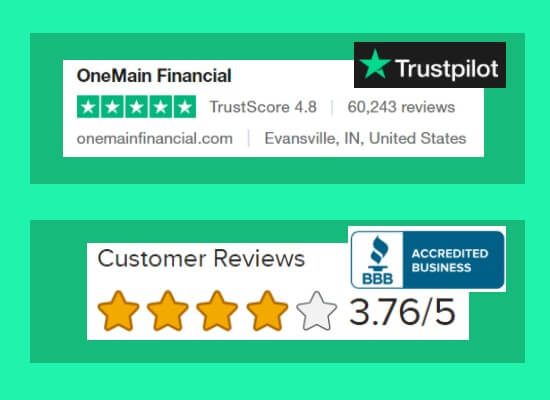

| BBB Rating |

3.76 / B |

OneMain Financial Loan Interest Rates and Terms

The average interest rate OneMain customers pay is just under 26%, depending primarily on credit score and history. OneMain loan origination fees or processing fees range from $25 to $500 and reflect the state of residency in some cases, loan amount, and credit history factors.

Loan amounts with OneMain can range from $1,500 to $20,000. However, unsecured and secured loans have variable minimum and maximum amount limits in several states. OneMain offers its customers term lengths of between 24 and 60 months.

OneMain Secured Loan Information

OneMain Financial offers a secured loan option in addition to its other lending services. A secured loan through OneMain requires collateral worth at least the money financed. Secured loan amounts can equal up to $20,000 in most states. However, several states limit secured borrowing to as little as $7,000.

A OneMain secured loan doesn’t require an in-depth look at a customer’s financial history. The collateral must be owned outright and not under lien by another lender. Secured loans through the company can allow customers to borrow larger dollar amounts or realize a lower repayment interest rate.

How to Get a OneMain Loan

OneMain Financial allows its customers to see what loan product they may qualify for without affecting their credit score. On the company’s website or through an in-person interview, customers can provide personal and financial information that OneMain will use to make an inconsequential soft credit report inquiry and return an answer, including borrowing options if qualified.

After pre-qualification, customers can choose the unsecured or secured loan product they desire and formally apply for it. The formal application step requires the customer to input proof of the statements made in the pre-qualifying step. The formal application triggers a hard inquiry on their credit report that does impact their overall credit score.

OneMain Financial will review the documentation and perform any necessary verification steps before returning an approval or denial. The verification process can last anywhere from a few minutes to three business days. Once approved, OneMain delivers the funds by check or direct deposit.

OneMain Loan Credit Score Requirements

OneMain Financial has no minimum credit score requirements. The company commonly works with borrowers with below-average credit scores and histories. However, the company does require at least some credit history to qualify for an unsecured loan. OneMain also offers a secured loan option and allows co-signers and joint applications to help increase loan accessibility.

OneMain Loan Requirements

While OneMain doesn’t have a stated minimum credit score requirement, borrowers must meet a few basic minimum requirements to apply and secure approval for a personal, debt consolidation, or other loan. OneMain Loan applicants must supply proof of the following information.

- Social Security number

- 18 years of age or older in most states

- Be a U.S. citizen or permanent or non-permanent resident

- Proof of sufficient income

- Proof of legal residence

OneMain Loan Funding and Payments

After approval for a OneMainFinancial loan, some customers may receive funding on the same day. However, most borrowers will see a direct deposit from the company in their bank accounts within one to three business days. OneMain also offers payment by check if desired.

OneMain charges penalty fees for late-payments and insufficient fund returns. Late fees equal $5 to $30 or up to 15% of the payment amount. Insufficient fund penalties can be as much as $50 with OneMain Financial.

The company reports to all three major credit bureaus, including Experian, Trans Union, and Equifax. Interest rates and payments are fixed and won’t vary during the loan term. There are no early payment fees with OneMain, and customers can pay off their loans without additional cost at any time.

OneMain Financial BrightWay Credit Card Reviews

The BrightWay credit card offered by OneMain Financial receives mixed reviews from just over 1 star to 4.7 stars, alongside its accompanying mobile app that allows cardholders to manage their account and track spending from their phone. The Brightway credit card comes in two versions.

The first is designed for customers looking to establish or rebuild credit. The second is an upgraded version of the first, featuring the absence of an annual fee. The yearly fee for the first-version card is $65.

Both cards offer 1% cash back on purchases and potential credit limit increases after six consecutive on-time payments. Both cards have a maximum credit limit of $15,000. The lowest available interest rate is 19.99%.

OneMain Financial Reviews

OneMain Financial reviews are generally good to excellent, ranging from around 3.5 out of 5 stars to 4.8 stars on some platforms. Over 60,000 Trustpilot reviewers award OneMain an average of 4.8 out of 5 stars, with 89% giving the company a 5-star review—less than 5% of reviews ranked at three stars or below. Positive OneMain Financial reviews often state speed and excellent customer service as the primary reasons for the high rating.

OneMain Customer Service

OneMain’s high average ratings are mostly due to the company’s focus on excellent customer service. For borrowers asking for assistance with their loan application or help choosing a OneMain financial product, the company offers in-person meetings to help establish the best move forward.

OneMain Financial Complaints

OneMain Financial complaints tend to reflect miscommunication between the company and consumers. Some OneMain Financial complaints claim the customer was approved for a loan with particular terms, only to discover later that the terms weren’t consistent with the original ones.

Other OneMain Financial complaints cite aggressive sales tactics and attempts to entice customers to borrow more money than necessary.

OneMain Lawsuit

On May 31, 2023, the

Consumer Financial Protection Bureau released a report on the OneMain Financial class action lawsuit. The OneMain Financial lawsuit resulted in an order that the company pay $20 million in redress and penalties due to failure to pay interest refunds to customers who canceled purchases before stated deadlines and for deceitful sales practices. Of the $20 million, half of the amount will be repaid to affected consumers.

A statement in the report from CFPB Director Rohit Chopra declares, “OneMain pressured its employees to load up its loans with extra charges through false promises of easy cancellation with full refunds….We are ordering OneMain to refund borrowers it cheated and to clean up its business practices.”

Is OneMain Financial Legit?

OneMain Financial is a legitimate non-deposit lender, operating for over 100 years under various names and configurations. The company rates well on numerous customer review platforms and has been accredited with the BBB since 2015.