If you’re a homeowner who needs access to funds, a Home Equity Line of Credit, or HELOC, can be a flexible option based on your home’s equity. Unlike traditional loans, it allows you to borrow only what you need over time.

The Consumer Financial Protection Bureau advises homeowners to carefully review the risks and repayment terms before opening a HELOC. In this article, we’ll break those down as we answer the question: How does a HELOC work?

Key Takeaways: How a HELOC Works

|

What Is a HELOC and How Does It Work?

A Home Equity Line of Credit (HELOC) is a revolving credit line secured by the equity in your home. The equity in your home is the value of your home minus what you currently owe on your mortgage.

For example:

Let’s say you purchased your home 10 years ago for $250,000. You’ve paid down $125,000 in principle since then, and currently owe $125,000 on your mortgage. However, the value of your home has increased to $400,000. That leaves you with roughly $275,000 in equity in your home that you could potentially borrow against. ($400,000-$125,000).

Something to keep in mind is that most lenders will not provide a HELOC for 100% of your equity; instead, they cap it at around 85%. This still leaves the example with a potential credit limit of $215,000.

To determine how much you can borrow against your home, use this Free HELOC Calculator.

You’ll need to enter:

- Your home’s appraised value

- Your existing mortgage balance

While the calculator can give you an idea of what you’ll qualify for, you’ll need to discuss your credit score, financial profile, and loan specifics with a banking officer to understand your options.

How Does HELOC Repayment Work?

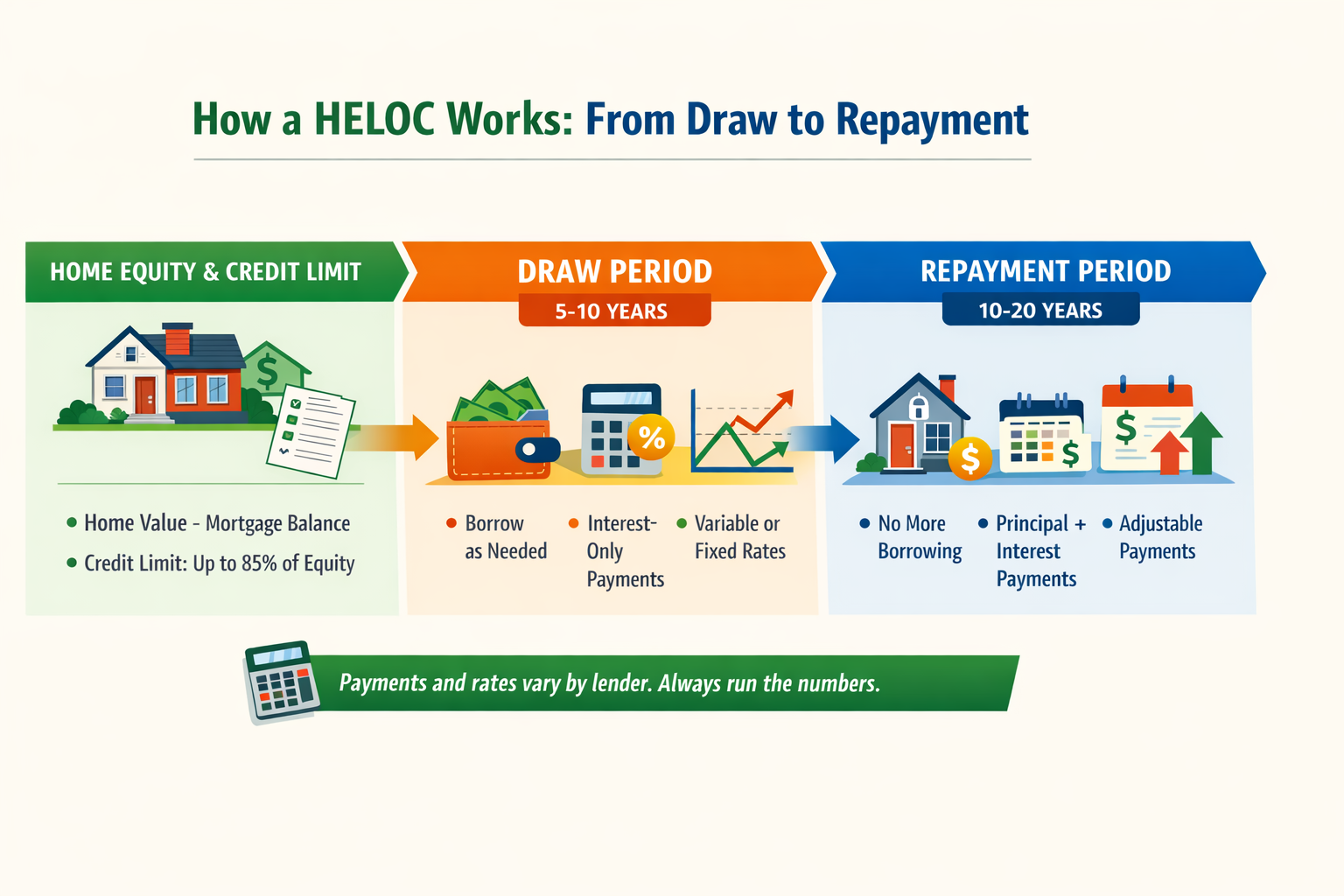

A visual breakdown of how a HELOC works, from accessing home equity during the draw period to repaying principal and interest during the repayment phase.

Unlike a mortgage or most other loans, the HELOC repayment works differently. Your home equity line of credit requires payment during two distinct periods.

Draw Period

The first is called your “draw” period. Typically lasting anywhere from 5-10 years, this is the timeframe in which you can freely pull money from your line of credit. During this time, the bank does not require you to repay any of the loan’s principal. However, you’ll pay monthly interest on the accrued balance.

Furthermore, many HELOCs offer variable interest rates, so your payment will fluctuate with market conditions. However, many HELOCs are now available with fixed APRs.

Hint: When shopping for a variable-rate HELOC, ask the bank whether it caps your interest payments. For example, some banks will cap your payments at a set amount during the draw period, regardless of spikes in variable interest rates.

During the draw period, your borrowed principal will not decrease, even though you’re making monthly payments. You need to keep this in mind as you continue to draw on your HELOC and prepare for repayment.

Repayment Period

Once the draw period ends, the repayment period begins. During this time, the bank no longer permits you to draw from your HELOC and requires you to make monthly payments on both principal and interest.

Similar to your mortgage, your monthly payment applies to both interest and principal, with more of the payment applied to interest at the beginning and more to principal as you pay down the interest.

Much like your interest payments during the draw period, many repayment periods run on a variable interest rate. This means you won’t know the exact amount of your payments in advance.

Hint: Many of the best HELOC lenders offer the option to convert all or some of your principal to a fixed interest rate during the repayment program. If you prefer predictable payment amounts, ask your loan officer whether this is an option.

If you’re concerned about waiting to pay off your debt and not knowing exactly what your payment on your HELOC will be, you might consider a home equity loan or fixed-rate HELOC instead. While a home equity loan is less flexible, they provide more predictable loan repayment schedules.

How Does Interest Work on a HELOC?

Many HELOCs use a variable interest rate. This means that, unlike other types of loans, which generally provide a fixed interest rate, your interest owed can change over time based on market conditions. However, fixed-rate HELOCs from the best providers are often available.

How does a variable interest rate work?

Variable interest rates are not set at a single rate but are tied to the prime rate and fluctuate as it changes. Each individual bank sets a prime rate, determined in part by the federal funds rate (the rate set by the Federal Reserve).

What matters here is understanding that interest rates fluctuate daily, and if your interest rate is based on those fluctuations, it will change regularly. Therefore, your payment will vary from month to month.

Using a HELOC for Debt Consolidation

Some homeowners use a HELOC to consolidate high-interest debt, such as credit cards, into a single payment with a lower interest rate. This approach can reduce monthly interest costs and simplify repayment, especially if you have strong equity and a clear payoff plan.

However, consolidating debt with a HELOC also increases risk. Unsecured debt, like credit cards, becomes secured by your home. If you struggle to make payments, your home could be at risk of foreclosure. For that reason, a HELOC for debt consolidation works best for borrowers with stable income, disciplined budgeting habits, and a plan to avoid running balances back up.

Alternatives to Consider

Depending on your situation, other options may be worth comparing:

- Home equity loan: Offers a lump sum with fixed payments, which can be easier to budget for

- Debt consolidation loan: Combines multiple debts into one unsecured loan, without putting your home at risk

- Personal loan for debt consolidation: May offer faster approval and predictable payments, though rates can be higher

Before choosing any option, it’s smart to run the numbers with a financial calculator and compare scenarios. Small differences in interest rates, loan terms, and repayment structure can significantly affect your total cost over time.

Expert Guidance: Using a HELOC for Debt ConsolidationFrom our on-staff Certified Financial Educator: “If you use a HELOC to consolidate high-interest debt, you must commit to a strict ‘no-new-balance’ rule for your credit cards. Consolidating debt with your home’s equity is only an effective financial strategy if you have a disciplined plan to avoid rebuilding those balances. Without this boundary, you risk a ‘double debt’ scenario: owing on your original credit cards while simultaneously managing a secured loan against your home, which significantly increases your risk of foreclosure.” |

HELOC vs Home Equity Loan: What’s the Difference?

HELOCs and Home Equity Loans are similar in that they provide options to secure funds based on your home’s equity. Both use your home as collateral for your loan, meaning the bank can foreclose on your home if you fail to repay, and both require repayment with interest. However, they are very different otherwise.

HELOC

As discussed, a home equity line of credit is a revolving line of credit that remains open for you to pull from for a set period of time. During that time, you make payments on the interest that accrues on a variable interest rate. At a predetermined point, usually between 5 and 20 years, you can no longer pull from the line of credit and must repay the outstanding balance plus interest.

Benefits

- Flexible funds available when you need them

- Only make interest payments during the draw period

- Use the money for whatever you’d like

Drawbacks

- Monthly payments can vary based on interest rates

- Funds are no longer available during the repayment period

- It can be tempting to pull more money than you can comfortably repay

Home Equity Loan

A home equity loan works differently from a HELOC. Rather than having HELOC funds open to pull from at will, a home equity loan provides you with a set amount upon your request. You’ll then repay that set amount through monthly payments that begin right away.

Benefits

- Fixed payments for predictable budgeting

- Long list of approved uses

- Access to your home’s equity without fear of overspending

Drawbacks

- No access to additional funds beyond the loan amount

- Can take longer to secure than a HELOC

Use these free tools to determine which loan option will work best for you:

How Does a HELOC Affect Your Budget and Credit?

A HELOC is a solid option for borrowing when you have a large or unexpected expense ahead. However, there are budget and credit impacts you should keep in mind.

Budget

While the money from your HELOC may feel like a windfall, it is a loan that you must repay. Borrowers who struggle to stay on budget and don’t closely monitor spending may find it difficult to resist the temptation to tap their HELOC for unnecessary expenses.

Furthermore, borrowers must keep in mind that monthly payments can vary during both the draw and repayment periods, and repayment-period payments will be significantly higher than during the draw period.

Credit Score

Your current credit score will significantly impact your ability to qualify for a HELOC. Beyond that, the HELOC may positively impact your score. If you make timely payments throughout the life of your loan, your score will likely increase overall.

Are HELOC Interest Payments Tax Deductible?

In general, interest on a HELOC is only tax-deductible if the funds are used to buy, build, or substantially improve the home that secures the loan. For detailed rules on eligibility, refer to IRS Publication 936.

Hint: Tax rules change frequently. Always discuss your deductions with a tax professional.

When Does a HELOC Make Sense — and When Doesn’t It?

A HELOC offers both benefits and drawbacks. While it’s a fantastic option in some instances, it may not be appropriate for all borrowers.

When Does a HELOC Make Sense?

- Ongoing Projects: If you have a large, long-term project with unpredictable costs—such as a home renovation—then a HELOC is often better than a lump-sum loan because of its flexible draw period.

- Debt Strategy: If you use a HELOC to consolidate high-interest debt, then you must commit to a strict “no-new-balance” rule on your credit cards to avoid a “double debt” scenario.

- Tax Benefits: If you use your HELOC funds for substantial home improvements, then your interest payments may be tax-deductible according to IRS Publication 936.

When is a HELOC Risky?

- Limited Equity: If your home’s equity is low, then you run the risk of your lender freezing or reducing your credit line if market values drop.

- Variable Income: If your monthly income is unpredictable, then the variable interest rates of a HELOC can make your future repayment period payments difficult to manage.

- Collateral Risk: If you are unable to meet your repayment terms, then you face the risk of foreclosure because your home serves as the secured collateral for the loan.

Optional Planning Tools

Before committing to a HELOC or any borrowing option, it helps to run the numbers and see how different scenarios could affect your budget over time.

Calculators won’t tell you what to choose, but they can help you estimate payments, compare options, and understand how changes in interest rates or loan terms might impact your finances.

Below are the best ones.

Tools for Home Equity Management:

- HELOC Payment Calculator

- Home Equity Loan Calculator

- Mortgage Payoff Calculator

- Cash-Out Mortgage Refinance Calculator

Tools for Debt Consolidation Planning:

- Personal Loan Calculator

- Debt Consolidation Calculator

Tools for Personal Budgeting:

- Budget Calculator

- Early Loan Payoff Calculator

- Savings Interest Rate Calculator

Affordability Tools:

- Home Affordability Calculator

- Car Affordability Calculator