2026 Tax Refund Increase

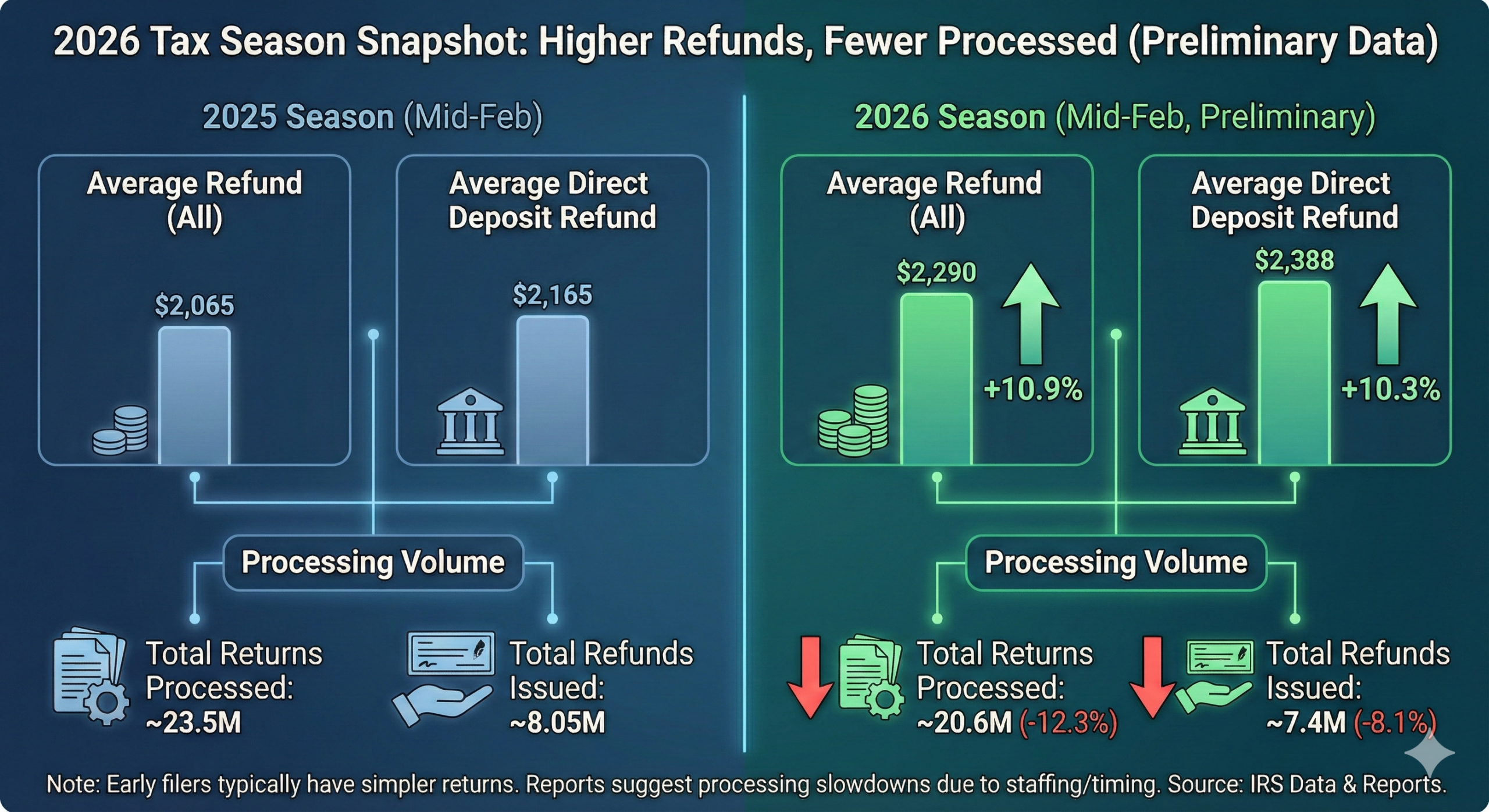

Early IRS data shows average tax refunds rising in 2026, even as total returns processed decline compared to last year.

With average refunds trending higher in 2026, taxpayers are evaluating how to put their returns to work.

Image source: Gemini

Americans seeing higher tax refunds. Here’s what you need to know about the 2026 tax refund increase.

Written by Brett Holzhauer, Senior Financial Writer and graduate of the Walter Cronkite School of Journalism, and edited and fact-checked by Deane Biermeier, Certified Financial Educator at TrustedCompanyReviews.com.

The 2026 tax season started in late January, and the IRS has released preliminary data on what Americans are receiving from Uncle Sam, along with other key figures.

Here’s what you need to know, and how it can impact your tax filing this year.

2025 tax season results so far

The average tax refund so far is $2,388, up over 10% compared to the year prior, according to IRS data. This is notable as President Trump claimed that this tax year would be a significant year for tax filers after the One Big Beautiful Bill was signed into law.

The one alarming factoid is the total returns processed, which is down 12% compared to this time last year. Reports point to the government agency being understaffed.

Here are the results so far in the tax season.

| Return/Refund Category |

2025 |

2026 | % Change |

| Total returns received | 23,589,000 | 22,351,000 | -5.2 |

| Total returns processed | 23,515,000 | 20,623,000 | -12.3 |

| E-filing returns received from self-prepared | 14,434,000 | 14,170,000 | -1.8 |

| Total number of refunds | 8,054,000 | 7,403,000 | -8.1 |

| Total amount refunded | $16.635 billion | $16.954 billion | 1.9 |

| Average refund amount | $2,065 | $2,290 | 10.9 |

| Total number of direct deposit refunds | 8,052,000 | 7,595,000 | -5.7 |

| Total amount refunded with direct deposit | $17.432 billion | $18.135 billion | 4.0 |

| Average direct deposit refund amount | $2,165 | $2,388 |

10.3 |

Typically, the returns filed early are by those with fairly simple taxes (i.e., one W2 form from a full-time employer). Those with more complex taxes (i.e., those with small businesses, investment income) typically file later, skewing averages higher, according to data.

For the 2024 tax year, the average refund was $3,167. Some argue that this year’s average could jump $1,000 as more deductions are in place, such as no tax on tips or overtime.

How (and when) to file

Over 14 million people have already self-filed their taxes this year. Using tax software can make your filing seamless, without the premium cost of using an accountant. Remember that the tax deadline is April 15th. If you won’t make the deadline, be sure to file for a six-month extension. If you miss the deadline and owe the government money, you could incur failure-to-file and failure-to-pay penalties.

Here’s our most recent review of the best tax software platforms, how they stack up for us, and their associated costs.

| Service |

Is there a free version? |

Paid versions and their costs |

| TaxSlayer |

Yes |

|

| TaxAct |

Yes |

|

| FreeTaxUSA |

Yes |

|

For details, check out our overview of the year’s best tax software providers

How to prioritize your tax refund

If you’ve received a few thousand dollars from Uncle Sam, that is an incredible boost to get started on hitting your financial goals for 2026.

Here are a few ways you can use that amount to move your financial situation forward.

- Pay down credit card debt: The average credit card holder has between $5,000 to $6,000 in credit card debt. With the average credit card interest rate near 21%, you could save a significant amount in interest payments using your tax refund to pay this down.

– You may also consider using a balance transfer card to move debt to a low-interest credit card to continue saving. - Start (or add to) an emergency fund: Millions are living paycheck to paycheck, where any one financial hiccup, like a car repair or job loss, can send them into a spiral. It’s recommended that people set aside three to six months of living expenses. While your tax return is likely not enough to meet that, it’s a head start to give you some breathing room.

- Begin investing for retirement: If your tax refund is additional cash you don’t immediately need, putting those dollars to work in the markets is an option worth considering. You can do this inside accounts like a Roth IRA or 401(k) through your employer.

Final Take: File Early, File Smart, Keep More

With average refunds trending higher in early 2026 data, many Americans are seeing a welcome financial boost. However, fewer returns processed so far suggest timing, staffing, and filing strategy may all play a role this season.

Whether your taxes are simple or more complex, choosing the right filing platform can make a meaningful difference in cost, accuracy, and support.

- For straightforward returns with budget-friendly pricing, FreeTaxUSA remains one of the most affordable options available.

- If you want tiered support levels and strong coverage for credits and deductions, TaxSlayer offers flexible plans for a range of needs.

- And for filers with investments, rental income, or small-business income, TaxAct provides expanded features designed for more complex tax situations.

Before filing, compare pricing, included features, and state filing costs to determine which platform aligns best with your financial situation.

The April 15 deadline will arrive quickly — and filing sooner rather than later can help avoid delays and reduce stress.