Insurance can be boring, but companies have come up with ways to be memorable and entertaining. Geico’s ad campaigns and the characters they’ve created have made it one of the most well-known companies in the business, but its insurance products are far from whimsical.

With coverage options available in all 50 states, Geico has a broad reach, and it offers some of the more generous discount programs, especially for federal government employees. The company takes a leading spot in our overview of the best cheap car insurance providers.

Pros

Coverage available in all 50 states

Wide range of discounts available

Below-average insurance cost

Cons

Local agent availability is limited

Some recent negative review scores

About Geico

Geico has been in business for almost 90 years and has grown into a national car insurance company with coverage options for vehicles, homeowners insurance, boats, and more. While it is now open to any potential customers, Geico started as the Government Employees Insurance Company, and it still offers significant discounts for federal employees today.

The company’s insurance products include a wide range of options, but Geico does not offer guaranteed asset protection coverage, or GAP, which is an important insurance product for people with auto financing.

Features and Benefits

Geico’s insurance services look a lot like those of its competitors’, but there are a few key differences to be aware of. One major difference is its pricing, which is typically lower than the national average. That said, the company’s rates don’t undercut USAA’s which are generally among the lowest in the industry for those who qualify.

- Geico has one of the best discount programs in the industry

- Insurance available in all 50 states and Washington D.C.

- Geico’s local agent network is limited

- Geico’s rates are often less expensive than those of its closest rivals

- Rates are often higher for drivers with blemishes on their records

Geico Reviews: Editorial Rating

Trusted Company Reviews Rating Score for Geico: 9.8

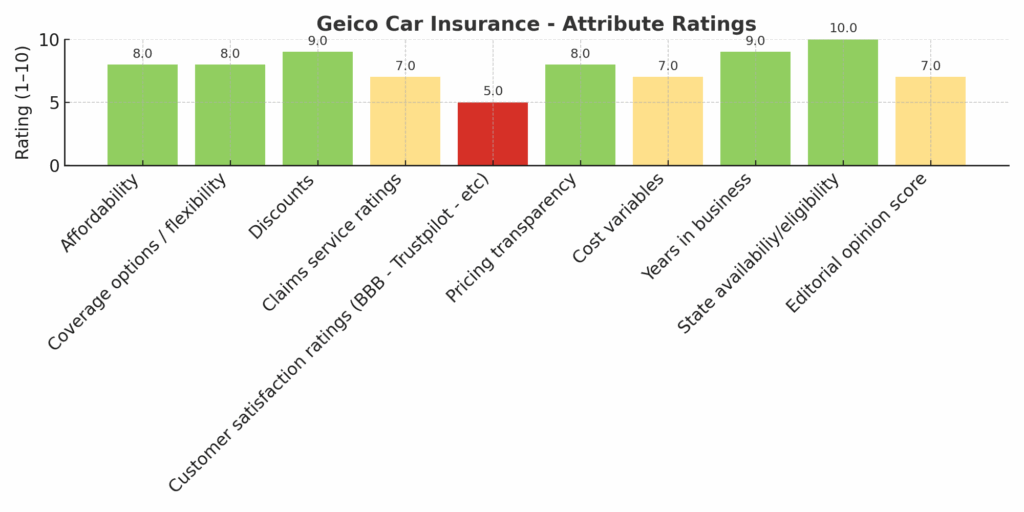

We gave Geico a strong score due to its generous discount programs, strong customer service ratings, and long list of coverage options. While it’s not perfect, the company has a strong track record, and it has accumulated more positive reviews than negative ones. Other companies offer stronger discounts in some areas, and some have more positive reviews, including State Farm.

| Local Agents | 300 agents nationwide |

| Discounts | Multiple, including federal employees, multiple policies, and more |

| Pricing | Generally below the national average car insurance rates |

| Convenience and Customer Service | Above-average customer service, though some complain about claims resolution speed |

Why We Like It

It might be possible to find a cheaper rate with a local carrier or other insurance company, but Geico’s customer service ratings and wide range of insurance products make it one of the easier companies to recommend.

It has a strong online presence, and the company offers several services in its app, including filing a claim and policy information. Customers may be eligible for one of its extensive discount programs, which include multiple policy discounts, federal employee incentives, and more. It doesn’t always provide the absolute cheapest car insurance rates, but on average its prices are better than most.

What We Don’t Like

Despite its generally positive reviews, Geico falls short in a few key areas. It doesn’t offer GAP insurance, which is a fairly common product that can be vitally important to some drivers. Its network of local agents is also quite limited compared to State Farm and other companies, which can be frustrating for people who like high-touch customer service or who prefer personalized interactions.

Additionally, Geico’s usually affordable rates can become the opposite for drivers with “dings” on their records, such as a DUI, speeding tickets, or at-fault accidents.

Geico Car Insurance Reviews

Geico has received a large number of positive reviews, but there are several negative marks to discuss. Many customers complain about the company’s claims resolution process, with several saying they were handed off between multiple agents before moving forward. Others say the process was slow, noting that communication with the company can be difficult at times.

Additionally, a notable chunk of the complaints revolve around pricing, with some saying Geico’s rates change unexpectedly or that customers discovered that they did not have the coverage they thought they were paying for.

On the other hand, many customers say Geico’s agents were very helpful with problem resolution and answering questions. Many praise the company’s app and website, saying they are simple to use and offer robust services.

People also note that Geico’s price match and overall pricing are more favorable than others. The company has also received fewer National Association of Insurance Companies (NAIC) complaints. J.D. Power has also rated the company highly for service.

Who Is Geico Best For?

Geico is a mainstream insurance company with coverage options for almost any driver and good customer satisfaction. The company is a great option for people who don’t qualify for USAA’s coverage and want to save a little money over the national average. Its claims processing and customer service could use some work, but the company is generally well-regarded.

AAA Car Insurance Vs. Geico

Both AAA and Geico are well-known insurance providers with strong reputations and nationwide availability, but they differ in several key areas. AAA is often associated with roadside assistance and membership perks, while Geico is known for its competitive pricing and tech-forward tools.

Geico typically offers lower premiums on average and provides a highly rated mobile app for managing policies, filing claims, and contacting support. On the other hand, AAA may offer more personalized service through its regional clubs and often includes unique benefits for members. When comparing AAA car insurance vs. Geico, it’s important to weigh price against service, perks, and convenience to find the best fit for your needs.

| Feature | AAA | Geico |

| App | Yes, roadside assistance, claims, other services | Yes, claims, customer service, more |

| Availability | All 50 states, Puerto Rico, Washington, D.C. | All 50 states, Washington, D.C. |

| Average Price | $2,293 for full coverage | $1,730 for full coverage |

| Customer Support | Above average, 24/7 support | Above average, 24/7 support |

Geico Alternatives

Geico stands out for its affordability and digital-first convenience, making it a popular choice for cost-conscious drivers who prefer to manage their policies online. However, it’s not always the best fit for people who value personal service or need broader coverage options. If you’re comparing quotes or looking for something different, here are a few other top-rated alternatives from our overview of the best cheap car insurance companies:

- State Farm: Best for personal service and wide coverage options through local agents.

- Lemonade: Best for tech-savvy drivers who prefer fully digital experiences and AI-driven claims.

- USAA: Best for military families and veterans, offering top-tier customer satisfaction and competitive rates.

- Auto-Owners: Best for personalized coverage and claims satisfaction through independent agents.

Frequently Asked Questions

Is Geico Cheaper Than Progressive?

Does Geico Pay Its Claims?

Does Geico Refuse Claims?

Source

Logo image source: geico.com

Chris Teague

Editorial Reviews

Must Reads

6 Common Budgeting Mistakes to Avoid

If budgeting feels harder than it should, you’re not alone. Many people struggle not because they lack discipline, but because they run into the same common budgeting mistakes over and over again. At Trusted Company Reviews, we review personal finance tools and...

When Should I Refinance – Anything?

If you’re carrying a loan, whether it’s a mortgage, car loan, student loan, or personal loan, you’ve probably heard the term “refinance.” Refinancing a loan is when you replace your current loan with a new one to reduce your interest rate, loan duration, or payment...

How Much Should I Be Saving Each Month?

How much should I be saving? In short: how much you should save depends on your income, expenses, and goals, but even saving 5–10% of your income or a small, consistent amount each month is a strong place to start. We’ve all heard the advice about saving. “You should...

How Much Car Can I Afford?

Buying a car is exciting. Many people skip the step of figuring out how much they can afford. Learning this before committing puts you ahead of most buyers. Lenders may approve you for more than you should spend, and dealers tend to focus on monthly payments rather...

Compound Interest Vs Simple

Saving and borrowing money are great ways to get ahead in life, but the interest earned or paid on those funds is where the rubber meets the road for most people. Borrowers pay interest on the amount loaned, and investors earn interest on the money they save, but...

9 Real-Life Factors to Consider When Borrowing Money

Life is expensive, and for many, borrowing for essential purchases is an absolute necessity. Furthermore, according to the United States Census Bureau statistics, debt is inversely related to age, with younger borrowers carrying higher balances overall, many with more...

What Is a Tier One Credit Score?

When applying for a mortgage, auto loan, or premium credit card, you might hear lenders refer to your credit tier rather than your exact credit score. This often leads to the question: What is a tier one credit score, and why does it matter? Lenders use credit tiers...

Petco Vs PetSmart

Often situated within a reasonable distance from each other, many pet owners wonder which retailer offers the best deals, grooming, training, adoption programs, rewards, pet food brands, and overall services. While both are leaders in the pet retail industry, their...

How Can I Lower My Credit-Card Interest Rate?

Credit cards are powerful financial tools that can help in a number of situations, but they don’t come without risks and costs. One of the most impactful costs is the interest rate, which for credit cards is typically far higher than for personal loans and other...

How to Pay for a Funeral: Costs, Options, Loans, and Plans

Our How to Pay for a Funeral article explores viable options for funding a meaningful service to honor your loved one. According to the National Funeral Directors Association, the average cost of a funeral with a viewing and burial has climbed to over $8,000. There’s...