A tax refund is the government giving you back your taxable income if you paid too much throughout the year. So federal tax refunds are not taxable; it’s yours to keep.

However, there’s an important exception that trips up many taxpayers, and it mainly involves state and local tax refunds from the prior year.

Here’s what you need to know.

Key Takeaways

|

Are Federal Tax Refunds Considered Taxable Income?

When you receive a federal income tax refund, you’re getting back money that you already paid to the IRS through withholding or estimated tax payments. Because this refund represents an overpayment of your own funds rather than new income, the IRS doesn’t consider it taxable income.

Think of it this way: if you overpay your electric bill and the utility company sends you a check for the difference, you wouldn’t expect to pay income tax on that refund. The same principle applies to federal tax refunds. You generally don’t need to report your federal refund as income on the following year’s tax return because you’ve already paid tax on that money when you originally earned it.

When Is a Tax Refund Taxable at the Federal or State Level?

There are two different levels of taxes: federal and state. Everyone has to pay federal income taxes, while the majority of Americans have to pay state taxes (nine states do not).

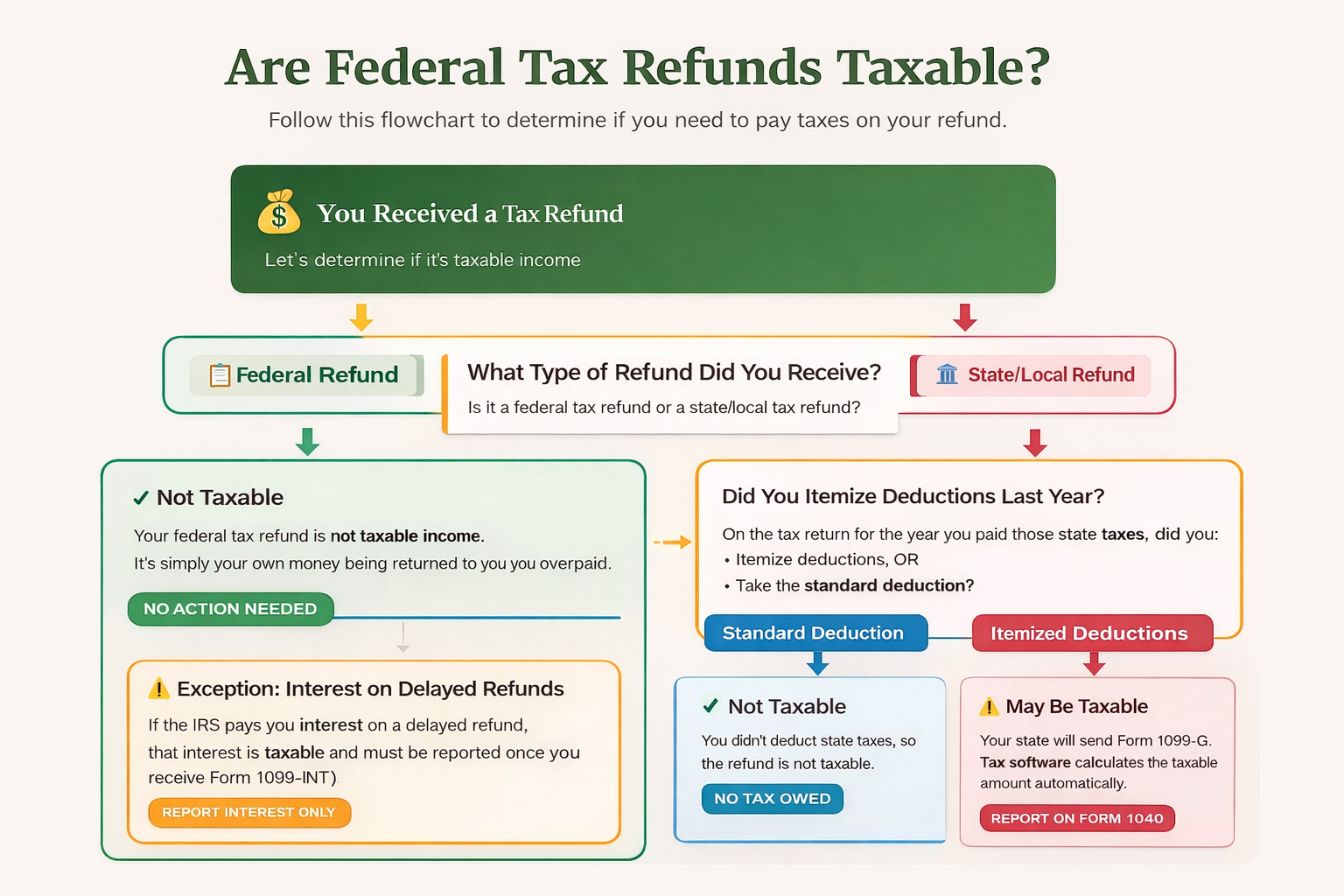

The confusion around taxable refunds usually stems from mixing up federal and state tax refunds. While your federal refund typically isn’t taxable, a state income tax refund may be taxable on your federal return under certain circumstances.

This happens because of something called the “tax benefit rule.” This rule simply says you should’t benefit from the same deduction twice. Here’s an example:

Let’s say in 2024, you paid $5,000 in state income taxes. When you filed your 2024 federal tax return in early 2025, you itemized deductions and included that $5,000 in state taxes. By deducting it, you lowered your federal taxable income by $5,000, which saved you money on your federal taxes.

Now it’s 2026, and you discover your state overpaid you. They send you a $1,000 refund for your 2024 state taxes. If that refund weren’t taxable, here’s what would happen:

- First benefit: You already reduced your 2024 federal taxes by deducting $5,000

- Second benefit: You’re getting $1,000 back tax-free

The IRS says this isn’t fair because you really only paid $4,000 in state taxes (the original $5,000 minus the $1,000 refund), but you got a federal deduction for the full $5,000. The tax benefit rule fixes this by making that $1,000 refund taxable income.

The key factor is whether you itemized your deductions in the year you paid those state taxes. If you claimed the standard deduction instead (like most Americans do), you didn’t receive a federal tax benefit from paying state taxes, so any state refund you receive later won’t be taxable.

This flowchart explains when federal and state tax refunds are taxable, based on whether you itemized deductions or took the standard deduction.

Standard Deduction vs. Itemized Deductions (Why This Matters)

Whether your state tax refund is taxable hinges entirely on how you claimed deductions in the prior year. If you took the standard deduction, your state tax refund is almost always not taxable because you never deducted those state taxes on your federal return in the first place. You didn’t get a tax benefit from paying them, so getting a refund doesn’t create any taxable income.

However, if you itemized your deductions and included state and local taxes (SALT) as part of your itemized deductions, the situation changes. When you deducted those state taxes, you reduced your federal taxable income, which lowered your federal tax bill. If you later receive a refund of those state taxes, the IRS considers that refund taxable income because you already benefited from deducting them.

There’s an important nuance here: the taxable amount is limited to the actual benefit you received. For example, if you paid $8,000 in state income taxes but were limited to the $10,000 SALT cap, and then received a $1,000 state refund, only the portion that actually reduced your federal taxes would be taxable. Your state should send you Form 1099-G showing the refund amount, and you’ll need to calculate whether any portion is actually taxable based on your specific situation.

How State and Local Taxes Affect Whether a Refund Is Taxable

State income tax refunds follow the tax benefit rule described above, but other state and local tax situations can also come into play. If you deducted state and local sales taxes instead of income taxes as part of your itemized deductions, and you later receive a refund or credit from your state, similar rules apply.

Local income taxes work the same way. If you deducted local or city income taxes on your federal return and later received a refund, that refund may be taxable to the extent you received a federal tax benefit from the original deduction.

The IRS only cares about refunds of taxes that you previously deducted on your federal return. If you never itemized, or if you itemized but chose to deduct sales tax instead of income tax, then an income tax refund from your state won’t be taxable.

Where a Taxable Refund Is Reported on Form 1040

If you do have a taxable state or local tax refund, it gets reported as “other income” on your Form 1040. Your state will send you your 1099-G early in the year, showing the amount of your refund. You’ll use that information when filing your federal return.

To make this easier, most tax preparation software handles this calculation automatically. The software will ask you questions about your prior-year deductions and will import your 1099-G information to determine whether any portion of your state refund is taxable. You typically won’t need to manually calculate anything or worry about which specific line on the form to use. The software guides you through the process and populates the correct fields.

Pro TipFrom our on-staff Certified Financial Educator State refund rules can vary depending on where you live and which state or local taxes you deducted in the prior year. Notably, nine U.S. states do not levy a broad state income tax, meaning residents generally won’t receive (or report) state income tax refunds at all. Those states are:

If you live in one of these states, questions about whether state tax refunds are taxable typically won’t apply. However, local taxes or other deductions could still affect your federal return. |

How Tax Prep Software Helps You Get This Right

Determining whether a state tax refund is taxable can be complicated, especially if you were near the SALT deduction cap or had other itemized deduction limitations. This is where using tax preparation software becomes invaluable.

Modern tax software imports your prior-year return data and cross-references it with your current-year forms like the 1099-G. It automatically checks whether you itemized deductions last year, what amount you deducted for state and local taxes, and whether you received any tax benefit from those deductions. Based on this analysis, it correctly calculates how much, if any, of your state refund should be reported as taxable income.

If you’re looking for the right tax preparation solution to handle these calculations and ensure accuracy, check out our comprehensive guide to the Best Tax Prep Software to find the option that best fits your needs and tax situation.