Trustedcompanyreviews.com offers free content, reviews and ratings for consumers to read, aimed at helping them compare their options. We may receive advertising compensation from companies featured on our website, influencing the positioning and sequence in which brands (and/or their products) are displayed, as well as affecting the assigned ratings. Please note that the inclusion of company listings on this page does not constitute an endorsement. We do not feature all available providers in the market. With the exception of what is explicitly outlined in our Terms of Service, we disclaim all representations and warranties regarding the information presented on this page. The details, including pricing, displayed on this site may undergo changes at any time.

The Best Cheap Car Insurance Companies

Car insurance is required for almost everyone and saving money insurance is highly preferable. However, there are so many companies, policies, and coverage options that it can be exceedingly difficult to choose the best cheap car insurance company for your needs. Auto insurance rates are a significant factor impacting many drivers’ insurance choices, but cheap auto insurance that doesn’t do its job isn’t going to save you any money.

This overview will help clear up some of the mystery around affordable car insurance companies by examining their pricing strategies, customer reviews, and coverage options. Let’s get rolling.

Why trust Trusted Company Reviews

- Comprehensive review rating system.

- We work closely with consumers and experts to create editorial ratings.

Trusted Company Reviews #1 Pick for 2026

- Strong customer service and claims resolution ratings

- Generous multi-policy discount programs

- Average rates are significantly lower than the national average

Why we love it 💖

Geico earns high marks from customers for its excellent claims resolution processes, solid customer service, and multiple coverage options.

Our Highest Rated Car Insurance Companies

- Coverage available for autos, motorcycle/ATV, boats, and RVs

- Geico is typically less more affordable car insurance for young drivers

- Discounts are available for veterans, educators, and many others

- Multiple add-on coverage options are available

- Policyholders can file claims online, through the app, or by phone

- Local Geico agents are available in several areas

- State Farm ranks highly in customer service surveys

- Bundling home and auto policies yields strong discounts

- Agents are available across the country

- Some car insurance coverage options may be unavailable in some states

- State Farm rates are higher than many rivals’ average prices

- Higher-risk drivers may find State Farm to be unaffordable

- Auto-Owners is not available in every state

- Features top customer service scores

- Several unique add-on insurance products are available

- Customers enjoy some of the lowest average rates

- Some functions are unavailable online, such as new policy purchasing and setup

- Local agents are available in many states

- Only available to current and former members of the military and family members

- Customers rank USAA extremely highly for service and claims processing

- Banking and other financial products are available

- USAA covers vehicles in all 50 states and Washington, D.C.

- Often significantly cheaper than competitors

- Accident forgiveness and other discount programs are available

- Offers mileage- or telematics-based insurance, depending on the state

- Availability is extremely limited to a handful of states

- Offers multiple add-on products, and discounts are available

- The company has accumulated an abnormally large number of complaints

- Plants trees based on customers’ mileage

- Customers must download the Lemonade app and agree to location tracking

Car insurance premiums may feel like an annoying additional expense with little upside, but it’s an important part of driving that can be a real financial lifesaver when you need it. A paper by the US Department of the Treasury states,”“unaffordable auto insurance leaves many Americans in the predicament of either not driving, which dramatically restricts their economic opportunities, or driving without insurance, which not only is illegal but puts them and other drivers at risk.”

Insurance companies look at several factors when setting car insurance rates, including traffic violations and the driver’s credit score, which means that the costs for every driver and vehicle are different.

In general, the main types of car insurance include liability, comprehensive, and collision, and some states require additional coverage for personal injury protection and medical payments.

Why is Car Insurance Important?

The more protective an auto policy is, the more expensive it will be. That said, the costs associated with paying a monthly insurance premium pale in comparison to the expenses that can arise after a car accident, regardless of the type of car you drive. Uninsured drivers risk financial ruin, but they also risk ruining other drivers’ finances if they can’t pay after an accident, which is why many states require uninsured motorist protection.

Is Car Insurance Required?

Car insurance is required almost everywhere and in almost every situation, even for cheap cars. There may be limited circumstances in which a vehicle can be transported or used without insurance, but the vast majority of road-going vehicles must be covered with an active insurance policy.

Many banks require the owner to maintain insurance if the owner financed the vehicle, and in some cases, GAP (guaranteed asset protection) insurance is required to protect the bank if the vehicle is crashed before being paid off and is worth less than the total-loss insurance payout.

Similarly, you will likely be required to show proof of insurance before being allowed to leave a car dealer with a vehicle purchase.

What Does Car Insurance Cover?

Car insurance policies have specific coverage limits for various costs after an accident, with the policyholder typically being responsible for expenses beyond the limits. Depending on the insurance policy, there may be coverage for medical payments, collision repair, property damage, uninsured motorist protection, bodily injury, and liability.

Many insurers also offer add-on reimbursements and coverage for expenses like rental cars, travel interruption insurance, property damage, pet protection, and more.

Comparing the Best Cheap Car Insurance Companies

Geico

Best Overall

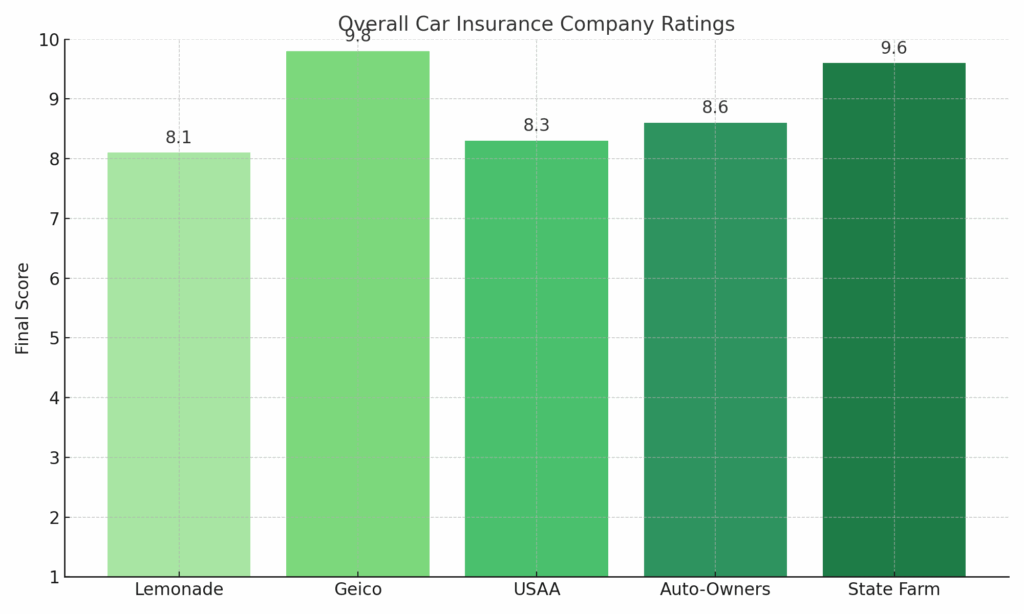

Trusted Company Reviews Rating Score for Geico: 9.8

Review

Geico has been around a long time, and it has grown into a massive insurer covering autos, homes, recreational vehicles, and more. Its customers enjoy strong service and a smooth claims process, and the company’s rates remain reasonable for most drivers. Drivers may be eligible for one of the company’s numerous discount programs, and bundling policies typically result in a significant price cut for most people.

About

Geico, or the Government Employees Insurance Company, was founded in 1936 in Texas, and is today a subsidiary of the Berkshire Hathaway company. While it was originally founded to provide insurance to federal employees and their families, Geico offers coverage to anyone today, and says that it covers more than 20 million vehicles in the United States. Beyond insurance, Geico is well-known today for its advertising campaigns, with the Geico Gecko being a major presence on television airwaves for years.

Features and Benefits

Geico offers a range of add-ons and benefits that make its policies a better value for customers. They include:

- Multiple discount plans – up to 25 percent in some cases

- Optional coverage for rental car reimbursements and more

- Good rates for young drivers and seniors

Why We Chose

We chose Geico primarily for its strong customer reviews. So many companies advertise low rates and fast claims processing, only to have their customers tell a different story, but that’s not the case with Geico. Its customers tend to praise its business practices, with many saying the service experience is hard to beat in the car insurance industry.

Pros and Cons

Pros

- Generous discount programs

- A range of coverage options available

- Good pricing for young drivers and seniors

Cons

- Fewer add-on options than competitors

- Local agent availability is limited

| Average Annual Premium | Availability | Discounts |

| $1,353 | 50 U.S. states plus Washington, D.C. | multi‑policy, multi‑vehicle, federal employee, defensive driving, anti‑theft system, and more |

State Farm

Best for Bundling

Trusted Company Reviews Rating Score for State Farm: 9.6

Review

State Farm consistently scores highly in customer satisfaction surveys, with policyholders praising the company for its strong customer service, expedited claims processing, and local agent network. That said, some interactions require a local agent, which can complicate some issues outside of normal business hours.

About

State Farm was founded in 1922 in Illinois, and is today the largest auto insurer in the United States, covering tens of millions of drivers in the United States. It’s highly rated by customers and offers some of the best bundling discounts in the industry.

Features and Benefits

State Farm customers enjoy a long list of benefits, including:

- Strong bundle discounts

- Multiple other discount programs available

- Online, app, and phone claims

Why We Chose

State Farm made our list because of its generous bundling discounts (renters insurance and others) and strong customer service. The company offers numerous other ways to save, including multiple vehicle discounts, safe driver discounts, and more.

Pros and Cons

Pros

- Generous discounts available

- Highly rated customer service

- Easy claims processing

Cons

- Not the cheapest on average, despite discounts

- State Farm does not offer GAP or online chat

- Local agent model can complicate some problems

Read the Full State Farm Review

| Average Annual Premium | Availability | Discounts |

| $1,480 | 50 U.S. states plus Washington, D.C. | Extensive list, including bundling, Drive Safe & Save (up to 30% telematics), good student, safe driver, anti-theft, multi-policy, and more |

Auto-Owners Insurance

Best Regional Provider

Trusted Company Reviews Rating Score for Auto-Owners: 8.6

Review

Auto-Owners offers excellent car insurance, rivaling that of our top competitors, but was edged out due to its limited availability across the country. Despite that, the company’s pricing is among the best in the industry, and its customers back that up with excellent reviews. Auto-Owners also offers a few innovative add-on insurance products, such as identity theft protection, with some policies.

About

Founded in 1916 in Michigan, Auto-Owners Insurance Company now operates in 26 states and has been a Fortune 500 company since the early 2000s. While it does not have the national advertising presence of many of its competitors, Auto-Owners has sponsored motorsports teams, including some Nascar series cars.

Features and Benefits

Auto-Owners offers many ways to save, and its customers may be eligible for a range of benefits, depending on their policy.

- Many discount programs available

- Classic and modified car insurance available

- GAP insurance available

Why We Chose

Despite its limited service area, Auto-Owners earned a strong score on this list for its extremely reasonable pricing model and strong customer service. The company also offers a good number of discounts, along with coverage options for homeowners and recreational vehicles.

Pros and Cons

Pros

- Extremely reasonable rates

- Strong customer service scores

- Multiple add-ons available

Cons

- Only available for half the country

- Online services limited

Read the Full Auto-Owners Review

| Average Annual Premium | Availability | Discounts |

| $1,890 | 26 states | Multi-policy, paid-in-full, green, safe driving, good student, and more |

USAA

Best for Military Families

Trusted Company Reviews Rating Score for USAA: 8.3

Review

USAA offers some of the best pricing and customer service in the insurance industry, but the big downside is that its products are only available to current and former members of the military and their families. It has accumulated fewer regulatory complaints and poor customer service reviews than other companies, and its customers consistently praise it for smooth claims processing.

About

USAA was founded in 1922 and calls Texas its home. The company offers insurance, banking, and investment services to customers in all 50 states, but only to current or former military members.

Features and Benefits

USAA customers see several upsides, including:

- Telematics- and usage-based rates available

- Safe driving and other discounts available

- USAA offers deployment-related benefits

Why We Chose

We chose USAA for its strong pricing and discount programs, despite its limitation to a small demographic. The company’s strong customer service ratings and wide range of coverage options didn’t hurt, either.

Pros and Cons

Pros

- Strong pricing and discounts

- Great customer service ratings and reviews

- Deployment-related benefits can be extremely helpful

Cons

- Limited to military members and family

| Average Annual Premium | Availability | Discounts |

| $1,361 | 50 U.S. states + Washington, D.C. | safe driver (up to 30% via SafePilot), multi-vehicle, good student, deployment-related “stored vehicle,” loyalty and more |

Lemonade

Best Tech Option

Trusted Company Reviews Rating Score forLemonade: 8.1

Review

Lemonade is more of a tech company than an insurance provider, which has its upsides and downsides, depending on the driver and situation. Its AI-powered quotes and claims and usage-based car insurance will feel foreign to those who may be unfamiliar with a fully digital experiece, but they can be extremely convenient for the right person. The company only operates in nine states, however, severely limiting its availability.

About

Lemonade is the youngest company on this list by far, at just ten years in business. Headquartered in New York City, Lemonade offers a range of insurance products, including life, home, pet, and renters.

Features and Benefits

While it might be intimidating to some, Lemonade’s business practices can be a huge benefit to others.

- Lemonade plants trees based on the mileage its drivers travel

- Discounts are available for EVs, hybrids, and others

- Usage-based rates can make Lemonade exceptionally cheap for some drivers

- The company has a strong financial strength rating of A

Why We Chose

Lemonade has its fair share of customer complaints, but we chose the company for its tech-forward approach to car insurance. The company’s usage-based rate-setting practices also make it significantly cheaper than other options for some drivers, especially those who only drive occasionally.

Pros and Cons

Pros

- EV and hybrid discounts available

- Lemonade plants trees for miles driven

- Some drivers may save a ton of money with usage-based rates

Cons

- Lemonade’s product offerings are only available in eight states

- The company offers fewer discounts than other companies

- Drivers must have the Lemonade app with location tracking kept on

| Average Annual Premium | Availability | Discounts |

| $1,380 (Limited data) | 9 U.S. states (AZ, CO, IL, IN, OH, OR, TN, TX, WA) | Low-mileage bundles, EV/hybrid, mileage‑based telematics |

Frequently Asked Questions

These are some of the most common questions surrounding the best cheap car insurance.

There is no rule against changing your insurance company, but you should check with your current insurer to make sure there are no cancellation charges, and you’ll want to make sure that there are no auto-pay or auto-renew features active on your old policy.

While you may not be legally required to carry insurance on a stored vehicle, it’s generally a good idea to hold some coverage to protect your vehicle against damage. Many storage facilities carry in-house insurance policies, but they often fall short of protecting stored vehicles completely, so it’s important to consider your own policy. You may be able to get reduced auto insurance quotes for stored vehicles, but compare quotes to make sure you’re getting a good deal.