Buying a car is exciting. Many people skip the step of figuring out how much they can afford. Learning this before committing puts you ahead of most buyers.

Lenders may approve you for more than you should spend, and dealers tend to focus on monthly payments rather than long-term cost. The smarter approach is to look at your entire financial situation, not just the sticker price or even the payments.

Key Takeaways

|

The Short Answer: How Much Car You Can Afford Depends on Your Financial Situation

There’s no single dollar amount that works for everyone. What you can afford depends on your income, debt, loan interest rate, and expected maintenance costs.

A good rule is simple:

Your car should fit comfortably into your budget without forcing trade-offs elsewhere.

Related Article: Should I Buy a Car or House First?

Car Affordability Is More Than the Purchase Price

The price on the window is only part of the story.

The True Cost of Owning a Car

When you buy a car, you’re also paying for:

- Depreciation, which starts the moment you drive off the lot

- Interest cost if you finance the car

- Sales tax and registration fees

- Insurance, fuel, maintenance, and repairs

According to the American Automobile Association (AAA), many drivers underestimate these ongoing costs. Greg Brannon, the Association’s Director of Automotive Research

notes: “…consumers should factor in all the expenses involved before making any commitments.”

That’s why you need to measure car affordability by its total monthly impact, and not just the loan payment amount.

Related Article: When Should I Refinance – Anything?

How Much of Your Income Should Go Toward a Car?

Financial experts generally suggest keeping total transportation costs within a reasonable share of your take-home pay. You can minimize surprises along the way by understanding these.

- Monthly car payment

- Insurance

- Fuel

- Maintenance

Pro TipFrom our on-staff Certified Financial Educator: You’ll see a lot of different rules about how much car you can afford. Many of them are from companies that want to sell you a car. However, one of the simplest and most practical guidelines is to simply keep all your car-related costs under about 20% of your monthly take-home pay. That includes your payment, insurance, gas, and maintenance. It’s not a hard rule, but for most, this outlook makes it easier to enjoy the car without putting stress on the rest of your budget. |

Related Article: How Much Should I Be Saving Each Month?

Monthly Car Payment: What Goes Into the Number

When you finance your car, four primary factors go into your monthly payment. These factors combined ultimately determine the amount you’ll pay each month, as well as the total cost of borrowing the money.

1. Principal

The principal is the amount you finance after your down payment, trade-in, and upfront costs. It’s essentially the amount you borrow. A higher purchase price or smaller down payment increases the principal, which raises both your monthly payment and the total cost of the loan.

2. Interest Rate

The interest rate determines how much it costs to borrow the money. Higher interest rates increase your monthly payment and the total amount you’ll pay over time, while lower rates make the loan less costly overall.

3. Loan Term or Length of the Loan

The loan term is the length of time you have to repay the loan. It’s an agreement between you and the lender that you’ll make consistent payments for a pre-determined time. A longer loan term lowers the monthly payment, but it also means paying interest for more months, which increases the total cost. Shorter terms cost more per month but usually save money overall.

4. Credit Score and Creditworthiness

Your credit score helps determine the interest rate you qualify for. Even a small improvement in your score can make a noticeable difference in your monthly car payment and total loan cost. In some cases, improving your credit before buying can save more money than choosing a cheaper car.

Use our free car affordability calculator to help determine how much you might qualify for before heading to the dealer.

Don’t Forget These Extra Costs

Many buyers budget for the loan but forget the add-ons and extra expenses. Virtually all automobile purchase transactions will include some or all of these expenses.

Upfront Costs

- Sales tax

- Title and registration fees

- Dealer fees

These costs often add 10% to 15% to the out-the-door price.

Ongoing Ownership Costs

- Insurance premiums

- Fuel

- Maintenance and repairs

Consumer Affairs says this about ongoing vehicle costs. “Expect to pay just over $900 per year in routine maintenance and unexpected repair costs.”

Additionally, unexpected repairs can quickly make a mess of a tight budget.

The same AAA page as above also offers this advice. “Create a monthly or annual budget and factor in ownership and operating costs before purchase.”

You can use our free financial calculators below to help you create and manage a budget or find other areas of your financial life that could use some attention.

- Monthly Budget Calculator

- Personal Loan Calculator

- Debt Consolidation Calculator

- HELOC Payment Calculator

- Mortgage Payoff Calculator

- Early Loan Payoff Calculator

- Debt Snowball Budget Calculator

Common Car Affordability Rules – and Why They’re Only Guidelines

While investigating car affordability, you’ll likely see several different “rules” online for how much car you can afford. While they all make sense, they’re simply meant to be guidelines, and your financial reality may vary. However, knowing about them is a good practice. Here are a few of the most common ones.

- 20/3/8 rule: Put 20% down, finance for no more than 3 years, and keep the payment under 8% of your income.

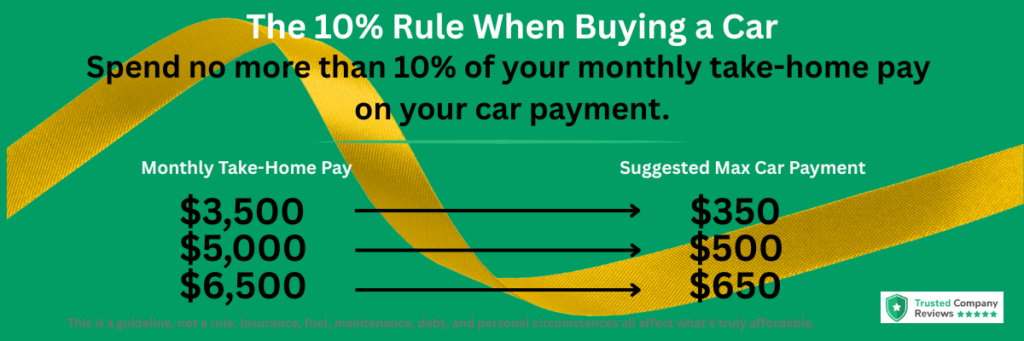

- 10% rule: Spend no more than 10% of your monthly take-home pay on your car payment.

- 15% rule: Keep your monthly car payment under 15% of your take-home pay, often used for new cars.

- 20/4/10 guideline: Put 20% down, finance for no more than 4 years, and keep total car costs under 10% of your income.

- Other variations: Some guidelines focus on total transportation costs, while others only look at the loan payment.

Why These Rules Don’t Work for Everyone

These guidelines can be helpful starting points, but they don’t necessarily account for real life.

For example:

- If you make a living with your car (rideshare driving, deliveries, sales, construction), spending more than average may make sense because the vehicle supports your income.

- If you drive infrequently, some of these ratios may be higher than necessary for your needs.

- Housing costs, debt, family size, and savings goals can all change what’s realistic for your budget.

So, while no single rule can tell you exactly how much car you can afford, it’s good to have an idea of these. The best approach is to use these guidelines as reference points, then look at how a car payment, or more importantly, the entire cost, fits into your overall financial situation.

This is another good use of the car affordability calculator.

A Simple Rule of Thumb for Car Affordability

We mentioned several guidelines for budgeting for a car. Here’s an example of the 10% rule, in which you spend no more than 10% of your monthly take-home pay on your car payment.

Remember that this guideline only deals with the car payment and doesn’t account for any additional costs of car ownership.

Related Article: How Much Money Should I Save Before Buying a House?

New vs Used vs Leasing: Affordability?

Buying a Used Vehicle Can Stretch Your Budget Further

Cars depreciate quickly. Used or certified pre-owned vehicles often offer:

- Lower purchase price

- Slower depreciation

- Similar features to new models

In many cases, the monthly payment difference between new and used is smaller than expected, so it’s worth comparing your options.

Leasing vs Buying

- Leasing usually means lower monthly payments but no ownership. You’ll have restrictions on how many miles you can ultimately drive the vehicle before turning it back into the dealer. You’ll also need to plan for switching vehicles or financing at the end of the lease term, regardless of your financial situation at that time.

- Buying a car usually costs more upfront. However, doing so gives you full ownership of the vehicle. You may build equity over time as the loan balance decreases, especially if you keep the car well beyond its loan term. Ownership also means no mileage limits and greater flexibility, but it comes with ongoing responsibilities.

What’s affordable for your budget depends on how long you plan to keep the car, how well you plan to maintain it, and how often you drive it.

How to Decide What Car You Can Comfortably Afford

That’s a lot of information to take in. Let’s simplify it a bit.

When planning to buy a car, instead of asking “What will I get approved for?”, ask:

- Does this payment still work if my other expenses go up?

- Does this car fit in my budget while still saving for emergencies and goals?

- Would this car still feel affordable after a year of payments?

Related Article: AmONE Vs. LendingTree: Which Loan Marketplace is Better?