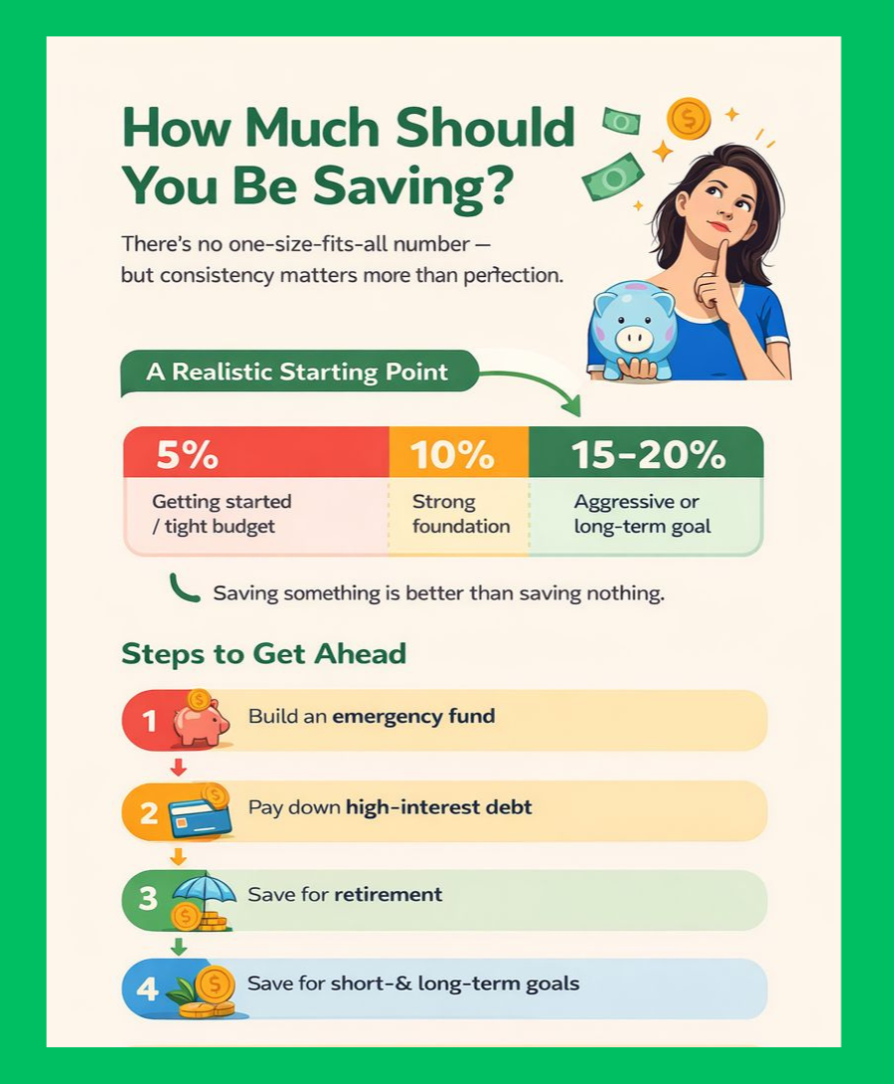

How much should I be saving? In short: how much you should save depends on your income, expenses, and goals, but even saving 5–10% of your income or a small, consistent amount each month is a strong place to start.

We’ve all heard the advice about saving. “You should save at least 20% of your income,” “Have a minimum of 3 months’ expenses in savings at all times,” and my favorite piece of oversimplified advice, “Pay yourself first.”

None of these tips is terrible at its core, but for many, they just aren’t reasonable. Rising housing costs, living expenses, taxes, inflation, and lofty healthcare costs leave most Americans living paycheck to paycheck, and saving money feels like a fruitless effort.

Key Takeaways

|

According to the Federal Reserve, 37% of adults surveyed said they could not cover an unexpected $400 expense with cash or savings. Furthermore, less than half of Americans nearing retirement are on track with their retirement savings. That number drops to less than a quarter for adults in their 20s.

If you, like many others, want to get on track with saving, you’re probably wondering the precise amount to put away each month. Let’s take a look at realistic, modern-day financial goals and saving guidelines, even on a tight budget.

How Much Should I Be Saving Each Month?

Often, the biggest question people have about saving money is, “How much should I be saving each month?” Unfortunately, there isn’t a cut-and-dry answer to this question. It’s one you must determine based on your resources, expenses, and goals. Let’s look.

- Avoid comparisons

- Use a budgeting app

- Use a savings calculator

- Customize your savings to your financial resources and needs

1. Avoid Comparisons

When deciding how much you can realistically save each month, it’s important to avoid comparisons. While some financial strategists push for strict percentages or amounts and demand the tightest of budgets, that may not be an option for you. Your personal finance goals and outlook are as unique as you are, and your strategy must be, too.

2. Use a Budgeting App

First, take a look at your current income and expenses. If you don’t already track your spending, consider a budgeting app to help you see how much of your money goes toward each expense each month. This money-saving strategy helps you determine your actual costs and identify where you can save or reduce spending in certain categories.

3. Use a Savings Calculator

Once you have a solid picture of your earnings and spending, use our budgeting calculator and our savings interest rate calculator to easily determine how much of your money you can put into savings each month. You can customize your budget, or choose from pre-determined Needs/Wants/Savings amounts, such as:

- 50% Needs, 30% Wants, 20% Savings

- 60% Needs, 20% Wants, 20% Savings

- 70% Needs, 20% Wants, 10% Savings

4. Customize Your Savings Plan

Lastly, customize your savings plan to work with your current financial situation. Start with a savings amount that feels manageable and allow flexibility to increase or decrease as needed. It’s okay if you’re currently at 90% needs, 5% wants, and 5% savings. Personalize your budget and savings plan to align with your resources and goals, avoiding increased financial stress.

Related Article: When Should I Refinance – Anything?

What If I Can’t Save Right Now?

If you’re finding saving difficult at this juncture of your life, you’re not alone. Many Americans are living paycheck to paycheck and find saving a challenge. Just know that even small changes now can lead to significant savings over time. Here are a few tips to boost your ability to save, even when you cannot increase your income.

- Carefully monitor your spending and cut out unnecessary expenses.

- Set and stick to a monthly budget to avoid overspending.

- Use a debt snowball plan, if necessary, to pay down debt.

- Refinance loans with high monthly payments to free up cash for debt payoff.

- Consider a debt consolidation to save on interest and pay down debt.

- Consider these factors before borrowing money.

Making even one or two of these changes can quickly help you build savings.

Related Article: Should I Buy a Car or House First?

Here Are the Financial Calculators Our Followers Use to Get Control of Their Finances

When money feels tight, clarity matters. These free, easy-to-use calculators help break big financial questions into manageable steps, so you can see where your money is going and what small changes can make the biggest difference. Whether you’re working on budgeting, paying down debt, or planning ahead, these tools are designed to help you make informed decisions with confidence.

- Savings Interest Rate Calculator

- Debt Snowball Calculator

- Budget Calculator

- Net Worth Calculator

- Debt Consolidation Calculator

- Personal Loan Calculator

- Home Affordability Calculator

- Car Affordability Calculator

- Early Loan Payoff Calculator

- Auto Loan Early Payoff Calculator

- Mortgage Payoff Calculator

- Home Equity Loan Calculator

- Auto Loan Refinance Calculator

What Should I Save for First?

Once you decide to start saving more of your money, you might begin wondering, “What should I save for first?” It’s a valid question. Are emergency funds most important? Should I be saving to pay off debt? Should I be saving for retirement? Let’s take a look at the best strategies.

- Start with an emergency fund.

- Create short-term and long-term savings goals.

- Set up retirement savings.

- Save to tackle debt.

- Save for large purchases.

Save For an Emergency Fund

When developing a savings plan, your number one priority should be to start an emergency fund. Ideally, this fund would cover six months of your expenses in the event of a major emergency, such as a job loss or a decline in health. While the goal is six months, begin by building a starter emergency fund that covers three months, then build from there. Furthermore, if you find yourself having to pull from savings to cover a bill, pay for an unexpected expense, or quickly pay off a debt, don’t fret. Just get back on track the following month.

Create Short-Term and Long-Term Goals

Once you’ve mastered your savings routine and have an emergency fund on board, you can begin to look ahead to short-term savings and long-term financial goals. Your goals are your own, with no right or wrong answer to what you should want for your life. Do you need a new car? Do you want to be 100% debt free? To begin investing? To vacation with your family annually? To buy your little girl her dream dollhouse? Whatever your goals, write them down and open a separate savings account for both short- and long-term goals. Avoid using your emergency fund and begin saving in your new account.

Save for Retirement

We’ll touch on this more in the next section, but once you’re actively saving for your goals, looking ahead to your long-term future is vital.

Save to Tackle Debt

Whether you owe money on credit cards, student loans, personal loans, car loans, or a mortgage, tackling your debt can propel your savings strategy and improve your overall financial outlook. Not only will paying off debt save you money on interest, but it also allows you to put even more into your savings plan.

If you’re feeling overwhelmed by your debt, particularly if you have several debt items at once, you might consider simplifying your payment strategy with debt consolidation. Using this debt consolidation calculator, you can see how much you’ll pay monthly and how much you’ll save in interest.

If you choose to tackle the debts separately, use this debt snowball calculator to determine how long it will take you pay off your debt, and how much interest you can save using this proven method.

Save for Large Purchases

Once you have an emergency fund in place, set up your retirement savings, and have paid off your debt, you can begin saving for large purchases. Would you like a new home? Are you considering some investment properties? Would you like a newer vehicle? Have you been dreaming of a vacation in St. Barts or London? Now is the time to save for your dream purchases without touching your emergency fund.

How Much Should I Save for Retirement?

Social Security provides a monthly benefit for retirees, but for many Americans, it isn’t, or won’t be, enough to fully cover housing, utilities, medical bills, and end-of-life expenses. That’s why planning ahead for your non-working years is so important, even if retirement feels far off.

Looking ahead to non-working years and saving for those expenses is incredibly important, even in your 20’s. But determining exactly how much to save can be challenging. So, let’s take a look at some simple guidelines.

- Save Early

- Don’t Bank on Social Security & Pensions

- Take Advantage of Employer Match

- Determine Your Savings Goal

Save Early

When you’re young, retirement feels like it’s a lifetime away. However, older Americans will tell you that it sneaks up on you when you least expect it. Furthermore, retirement is expensive, and if you’re unable to work during that time, you’ll need financial resources.

Don’t wait until you’ve reached other goals or until retirement begins to close in on you to start saving. Start NOW. Whether you’re fresh out of high school and working your first job, or you’re 34 years old with four kids and a mortgage, start saving NOW. There’s never a wrong time to begin.

Don’t Bank on Social Security & Pensions

While social security and pensions are typically reliable, you should never forego savings in hopes that these income streams will support you in your retirement years. Social security income is often not enough to cover monthly expenses, and pensions can largely reduce or disappear in a moment if you lose your job before the vested period has passed, or if the company goes bankrupt.

Take Advantage of Employer Match

Often, 401(k) savings are the primary retirement savings accounts for workers. These savings accounts are an ideal way to put money back for non-working years. Once set up, your employer automatically deducts your retirement savings from your paycheck, and in some cases, matches your contribution up to a certain dollar amount or percentage.

If you’re able to, it is wise to invest an amount equal to or greater than your employer’s match, as their investment in your account is essentially free money.

Determine Your Savings Goal

Everyone’s retirement savings goals vary as much as expenses and goals. As you work towards saving for your post-working years, set a goal. As you monitor your progress, you can increase your retirement savings contributions when necessary.

Keep in mind that most Americans will live an average of about 80 years, so if you retire at 65, you’ll need savings to cover 15 years of your life.

Where Should I Keep My Savings?

Once you’ve decided to begin saving for short and long-term goals, look for best place to keep your cash. In general, it’s best to diversify your savings by keeping your money in more than one account. Let’s talk about a few of the most common options.

- Standard Savings Account

- High-Yield Savings Account

- Certificate of Deposit

- 401-K

Standard Savings Account

Most banks offer standard savings accounts for their members. These accounts are easy to open, provide you with easy access to your savings (sometimes via a regular debit card), and allow you to earn a small amount of interest on your savings. However, you’ll likely need to maintain a minimum balance to keep the account open, and the interest rates are typically quite low.

High-Yield Savings Account

High-yield savings accounts are a fantastic option for earning more interest on your savings while still maintaining easy access to your funds. These are often found through online banking systems and may require a higher minimum balance and limit withdrawals throughout the year.

Certificate of Deposit

Certificates of Deposit, or CDs, are a fantastic way to earn high interest on long-term savings. These accounts typically require you to leave your funds untouched for a specific period of time and charge penalties for early withdrawal. However, for long-term goals, the high interest savings rates can be quite beneficial.

401(k)

401(k) accounts are employer-sponsored retirement accounts in which you make contributions, and your money compounds through a series of investments. While you can take a loan from your 401(k), you’ll be heavily penalized for doing so. It’s best to leave your retirement investment in place until you’ve reached a minimum age of 59 1/2.