When applying for a mortgage, auto loan, or premium credit card, you might hear lenders refer to your credit tier rather than your exact credit score. This often leads to the question: What is a tier one credit score, and why does it matter?

Lenders use credit tiers to quickly assess your risk level and determine what terms you could qualify for. If you’re in Tier One, you’re considered a low-risk borrower, often making you eligible for the best rates, terms, and loan amounts.

A Tier 1 credit score isn’t an official number issued by FICO, VantageScore, or the credit bureaus. Instead, it’s a lender-created category system used to identify low-risk borrowers who qualify for the most favorable interest rates, higher loan amounts, and premium financial products.

Here’s everything you need to know about what it takes to reach Tier One and how you can reach it.

Key Highlights

|

Credit Scores vs. Credit Tiers: What’s the Difference?

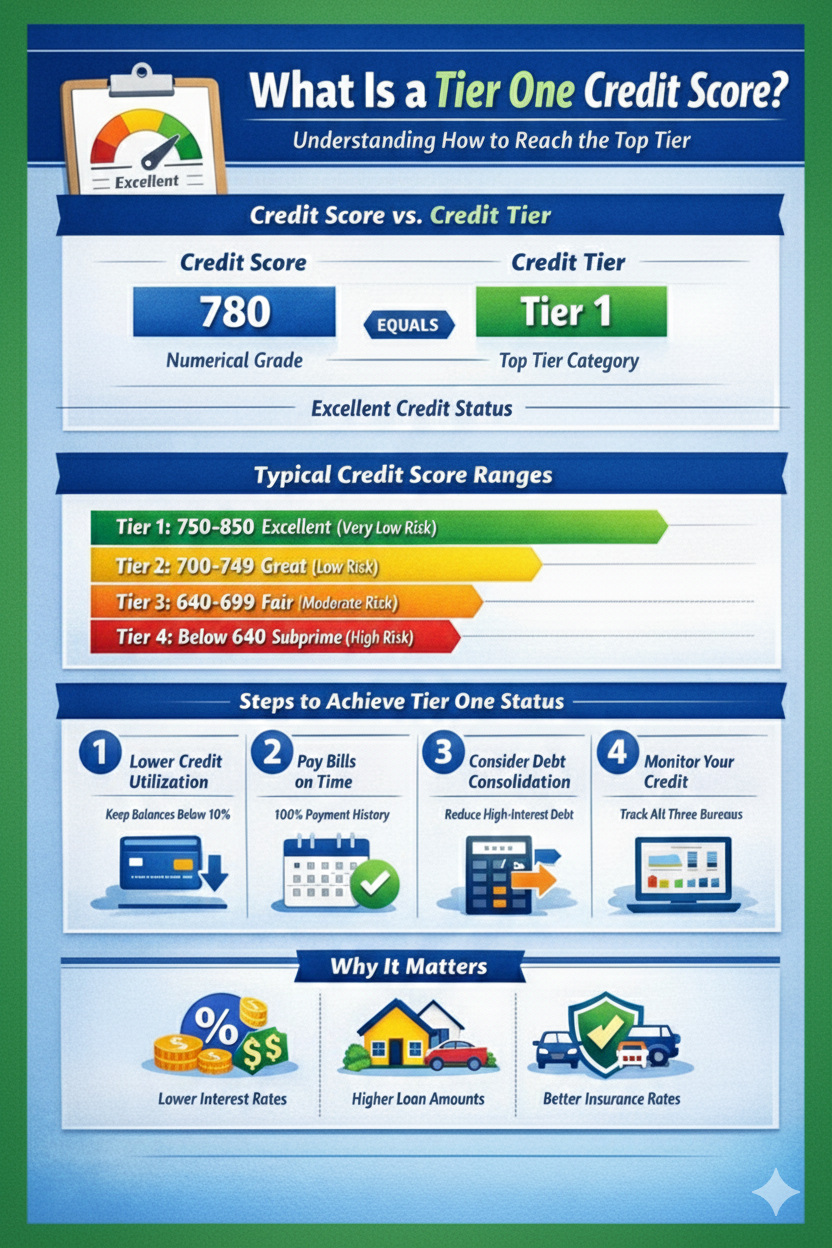

Understanding the difference between a credit score and a credit tier is key. In our world of speedy responses and automation, lenders often simplify borrower qualification by using credit tiers rather than evaluating numerical credit scores.

- Credit Score: A three-digit number calculated using your credit report and credit history. This digit number reflects your overall creditworthiness.

- Credit Tier: A category (e.g., Tier 1, Tier 2) used by lenders to group borrowers based on risk level.

You can think of it like a grading system:

- Your credit score is the numerical grade (e.g., 780).

- Your credit tier is the letter grade a lender assigns to your score (e.g., A+ for Tier 1 credit).

The fact is that you don’t have just one score. Most people have dozens of credit scores based on different models, primarily FICO and VantageScore, and those models may be applied differently by each of the three credit bureaus: Equifax, Experian, and TransUnion.

Rather than evaluating every borrower manually, lenders use tiers to automate decisions. If your score falls within the Tier One threshold, you’re considered a low-risk borrower and may qualify for top rates and terms.

What Credit Score Range Is Considered Tier One?

While each lender uses its own borrower qualification system, Tier One credit generally means you, the borrower, have an excellent credit score in the top range of scoring models. Here’s a general breakdown:

| Credit Tier | Credit Score Range | Risk Level |

| Tier 1 (Excellent) | 750–850 | Very Low |

| Tier 2 (Great) | 700–749 | Low |

| Tier 3 (Fair) | 640–699 | Moderate |

| Tier 4 (Subprime) | Below 640 | High |

Important: These tiers are typically based on FICO scoring models, but some lenders may use VantageScore or custom scoring formulas.

How Many Credit Scores Do You Really Have?

It’s a common myth that everyone has just one “true” score. In reality, everyone has multiple credit scores that vary across several models, each calculated separately by the three major credit bureaus, including Equifax, Experian, and TransUnion.

Common reasons you may see different credit scores:

- Different scoring models: Auto lenders often use FICO Auto Score; mortgage lenders generally use FICO 2, 4, or 5.

- Credit bureaus may have different data, so your credit report and the resulting score can vary dramatically between them.

- Model updates: Newer versions like FICO 10 and VantageScore 4.0 factor in trends, such as your payment history over time.

Because of this, your path to a tier 1 credit score is typically based on consistent credit behavior rather than chasing a single number.

MyCreditUnion states, “The best way to improve your credit score is to pay your bills on time each month, keep your debt balances low, and to be careful about having too many debts at once. Additionally, check your credit report regularly to ensure there are no errors or instances of fraud that may be impacting your credit score. If there are errors, dispute the credit report via the credit bureau customer service channels.”

Why Does Tier 1 Credit Matter?

Even a small difference in your score range can translate into big savings. Here’s how Tier One status can affect your financial life:

- Lower Interest Rate: Borrowers in Tier 1 generally receive the best rates. Even a 1% difference on a mortgage could mean tens of thousands of dollars in savings.

- Higher Loan Amount: Lenders are more likely to approve larger loans or higher loan-to-value ratios for Tier One borrowers.

- Better Terms: Longer repayment periods, lower fees, or better credit card perks.

- Insurance Rates: In many states, your credit tier can affect auto and home insurance premiums, even if you’ve never missed a bill.

A report by the Wisconsin Office of the Commissioner of Insurance mentions credit score implications on the cost of insurance, “Some insurance companies believe there is a direct statistical relationship between financial stability and losses. They believe, as a group, consumers who show more financial responsibility have fewer and less costly losses and, therefore, should pay less for their insurance.

Conversely, they believe, as a group, consumers who show less financial responsibility have more and costlier losses and, therefore, should pay more for their insurance.”

How to Reach a Tier 1 Credit Score: A Strategic Plan

Whether you’re sitting in Tier 2 or Tier 3, getting your credit score to a Tier 1 level is often within reach. Doing so can potentially save you thousands in interest over time. Here’s how to get started:

Step 1: Know where your credit stands.

Start by listing all your credit card balances and their limits. Any card with utilization over 30% is hurting your score the most.

Step 2: Pay down your debts

Paying down your debts or paying them off is a sure-fire way to get closer to reaching Tier 1 credit status. There are several ways to accelerate the process, including these two common methods:

A. Debt Snowball Method (Great for Motivation)

- List debts from smallest to largest.

- Use our Debt Snowball Calculator to create a payoff plan.

- Focus on quick wins to build momentum.

B. Utilization Targeting (Fastest Score Boost)

- Prioritize paying down credit cards with the highest balance-to-limit ratio.

- Drop each card below 30%, then aim for below 10% for best results.

Step 3: Accelerate Your Progress with Debt Consolidation

- Use our Debt Consolidation Calculator to see if consolidating your unsecured debt into a personal loan makes sense by potentially saving you money while simplifying your finances.

- While your score will likely take a small initial hit for the credit inquiry when consolidating, making on-time and consistent payments can ultimately help improve your credit score.

- Many borrowers experience a boosted credit score within just a few months, as consolidation can instantly reduce your credit utilization ratio, provided you don’t take on more debt after consolidating.

- The best debt consolidation providers and personal loan companies offer prequalification tools to help you see the consolidation products you qualify for without initially affecting your credit score.

Step 4: Maintain your Tier 1 Status with a Budget and Auto-Pay

- Use our Budget Calculator to help manage your finances.

- Build a buffer that protects you from late payments by setting up auto-pay for minimum payments on every account.

Pro TipFrom our on-staff Certified Financial Educator: Spending even a small extra amount each month on your debts can shave months, or even years, off your loans and save significant interest costs. Meaning, you can make faster progress toward your Tier One credit status. Many borrowers are shocked to learn how little it takes each month to make a big difference. Use these calculator tools to see what’s possible: |

Monitoring Your Credit: The Key to Staying on Track

Tracking your credit across all three bureaus is essential. The best credit monitoring services can alert you to changes and help you see how close you are to Tier One status.

Read More: 9 Real-Life Factors to Consider When Borrowing Money