If you’re carrying a loan, whether it’s a mortgage, car loan, student loan, or personal loan, you’ve probably heard the term “refinance.”

Refinancing a loan is when you replace your current loan with a new one to reduce your interest rate, loan duration, or payment terms. Many people choose this route after improving their credit score or when the Federal Reserve lowers interest rates, making more affordable loan options available.

Now, you may be wondering, “When should I refinance my loan?” Today, we’ll discuss a few key factors to consider before you move forward.

Key Takeaways

|

When Should I Refinance My Home/Mortgage?

For many, a mortgage is the largest debt they owe. For this reason, keeping an eye on market conditions, such as changes in interest rates, is imperative if you are considering refinancing your mortgage. Let’s look at when and why to refinance your mortgage.

- Look for a drop of 1% or more in interest rates for the best savings

- Adjust your loan term from 30-year to 15-year to save over time

- Convert an Adjustable-Rate mortgage to a fixed rate for stability

- Calculate your break-even point before moving forward

Related Article: How Does a HELOC Work?

Aim for a Lower Interest Rate to Save Over Time

Anytime you’re considering refinancing a loan, look for an interest rate that is at least 1% lower than your current rate for maximum savings.

While 1% doesn’t sound like a significant improvement in your interest rate, it can save you tens of thousands of dollars over the life of your loan. Furthermore, it can significantly reduce your monthly payment, freeing up funds for savings, paying down other debts, or paying down your mortgage principal.

Adjust Your Loan Term

There are no right or wrong choices when it comes to the length of your loan term, but if your financial situation allows, a shorter term saves you in interest and gets you out of debt faster. If you’re working on a debt snowball and want to pay down your mortgage as quickly as possible, consider a 15-year mortgage on your refinance, rather than a 30-year.

On the other hand, if you need more cash on hand monthly, a 30-year loan will likely net a lower payment, leaving you with some wiggle room in your budget.

Ditch Your Adjustable-Rate Mortgage (ARM)

If your current loan is an adjustable-rate mortgage, your monthly payment is heavily affected by interest rates. This can make budgeting and working your way out of debt extremely difficult. Converting your ARM to a fixed-rate mortgage will provide a more stable financial outlook with predictable monthly payments.

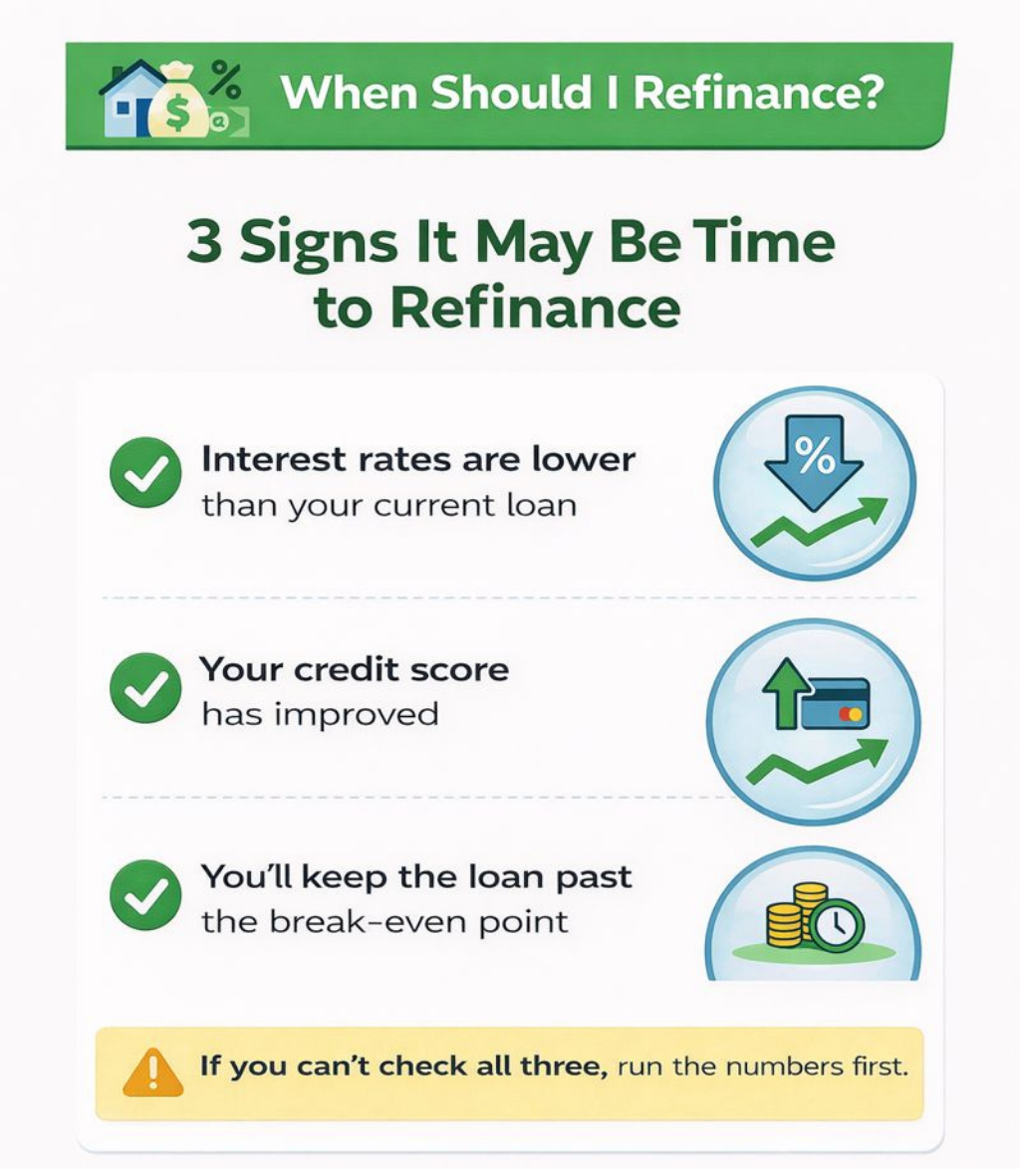

Three simple signs to help you decide whether refinancing may make sense before running the numbers.

How Do Closing Costs and the Break-Even Point Affect Refinancing?

- Closing Costs

- Break-Even Point

- Long-Term Plans

- Reamortizing or Recasting

Closing Costs

The first thing to consider when refinancing your loan is closing costs. If you’re refinancing a mortgage, you’ll pay closing costs in the same way you did when you purchased your home. These costs can range from 2% to 6% of your total loan amount, which is significant depending on what you still owe.

While there are no official “closing costs” when refinancing an auto loan, you may still encounter application or origination fees and prepayment penalties for paying off your old loan early. Take these into consideration when refinancing your vehicle loan.

Break-Even Point

Now that you understand the costs associated with refinancing, you can calculate your break-even point, or the point at which you’ll actually start saving money. To do this, divide your total monthly savings by your total refinancing costs to determine how many months it’ll take before you’re saving on your payment.

Long-Term Plans

Once you’ve determined your break-even point, you’ll have an idea of how long it’ll take you to pay off your loan, how much you can save monthly, and how long it’ll take before you break even. Now you must consider your long-term plans. For instance, if your break-even point is 2 years away and you plan to move out of your home in that same timeframe, refinancing your loan isn’t beneficial. However, if you plan to stay long after the break-even point, it may be a helpful way to free up funds each month.

Re-amortizing or Recasting

If you’ve done the math and find that refinancing is not an option for you at this time, you might consider re-amortizing or recasting your mortgage. Unlike refinancing, this method uses your existing loan to adjust your monthly payment based on what you currently owe and how much time you have left on your loan. Most lenders will charge a fee, often around $250, and require a lump-sum payment toward your principal at the time of recasting. Here’s how it works:

- You apply for re-amortizing/recasting

- If approved, you make a lump sum payment (often a minimum of $5,000)

- Your lender recalculates your monthly payment based on your new loan balance

- You enjoy a lower monthly payment without a new loan

Recasting is an excellent option to pay down your mortgage faster and lower your monthly payment whenever you receive a windfall (such as refunds, winnings, an inheritance, financial gifts, or proceeds from a large sale).

When Is the Right Time to Refinance?

Deciding to refinance your loan is a big decision. You need to be sure that the new loan is beneficial for you and paves the way towards your financial goals. Before you make your decision, evaluate these points:

- Your credit score

- Market interest rates

- Monthly payment savings

- Total interest savings

- Refinancing costs

Your financial outlook is as unique as you are. That’s why there’s no standard answer for when the perfect time to refinance is. However, the best answer is to refinance when it is most beneficial to your financial situation and when it helps you reach your goals.

Before taking on the new loan, consider how your credit score and market interest rates have changed since your original loan. You’ll want to refinance only when both have improved.

When Should I Refinance My Car?

Refinancing your car loan can lower your monthly payment and free up funds to pay down debt. However, it’s only beneficial in certain situations. When considering refinancing your auto loan, consider these key factors:

Good time to refinance your car loan:

- Interest rates are lower

- Your credit score has improved

- The new loan offers a lower payment

- You’ll save on interest over time

- You’ll pay off your loan more quickly

Wait or avoid refinancing your car loan:

- You have had the loan for less than 1 year

- The loan is almost paid off

- Interest rates are higher

- Your credit score is lower

- You owe more on your car than it is worth

- High refinancing fees outweigh the savings

If you’re still on the fence, use this auto loan refinance calculator to help you determine how much you can save with a new loan. Then, check out these Top Auto Loan Refinancing Providers to find the best deal.

When Should I Refinance My Student Loans?

If your student loans are burdensome, refinancing may be beneficial. However, there are some scenarios in which refinancing is not the best option.

When refinancing student loans may be beneficial:

- If you are holding high-interest, private loans

- If you have a stable income

- If you have good to excellent credit

- If you don’t need deferment, forbearance, or loan forgiveness

For students with unstable income or those who need to take advantage of deferment, forbearance, or loan forgiveness options, refinancing student loans can be detrimental, as the new loan will not qualify for federal programs. However, if your loans are privately held or you have a stable income, you may save money by refinancing. Before moving forward, check out our overview of the best student loan refinancing companies.

Cash-Out Refinance: When Does It Make Sense?

A cash-out refinance is when you pull equity from your current mortgage by taking out a larger mortgage and walking away with a lump sum of money. This isn’t typically a way to save money on your current mortgage payment, but it allows you to use the equity in your home to fund home improvements, college tuition, debt repayment, or another large purchase.

Before committing to a cash-out refinance, consider these factors:

- Current interest rate

- New loan term and monthly payment

- How the lump sum will affect your overall financial outlook

- Closing costs

Before you sign on the dotted line, be sure that your new monthly payment fits within your household budget to avoid putting your home at risk of foreclosure. Use this free budget calculator to determine what you can afford.

Pro Tip: Use a Mortgage Refinancing CalculatorFrom our on-staff Certified Financial Educator If you’re weighing whether refinancing is worth it, running the numbers first can save you from costly mistakes. Our Mortgage Refinance Calculator helps you compare your current loan to a new option, estimate monthly payment changes, and identify your break-even point. It’s a simple way to see whether refinancing or a cash-out refinance fits your financial goals before moving forward. |

Is Refinancing Ever Not a Good Idea?

Depending on your current financial situation, refinancing may not be a good idea. For instance:

- If your credit score is poor

- If interest rates are the same or higher

- When the costs and fees exceed what you’ll save

- When you don’t plan to stay in your home long term

- When you can’t afford closing costs

Don’t fret. If refinancing isn’t the right route for you at this time, you can still improve your financial outlook through other means, such as careful budgeting or debt consolidation.

Can Debt Consolidation Be a Form of Refinancing Your Budget?

Yes, debt consolidation can absolutely work as a form of budget refinancing. In fact, for some, it is a great way to manage cash flow and save money in the long term.

Here’s how:

- Lower Payments

- Save on Interest

- Improve Debt Management

- Free Up Cash for Other Needs

Debt consolidation involves taking out a new loan to pay off multiple debts. In most cases, your new loan should offer a lower interest rate than your current debts, saving you money on your monthly payments and on interest over time. Furthermore, it streamlines your budget by combining multiple payments into a single, monthly bill.

To easily determine if debt consolidation is right for your situation, plug your debts (money owed, interest, and term) into this free debt consolidation calculator. You can then view a full report that includes your adjusted monthly payment, interest savings over time, and how long it’ll take to pay off your debt.