Every car insurance company would love for you to believe that its rates are the best in the industry, but some can be surprisingly expensive. While it’s only available in 26 states, Auto-Owners Insurance is one of the most affordable options in the business.

Generally considered to be one of the most affordable car insurance companies, Auto-Owners also offers some of the best cheap homeowners insurance and other coverage options, but its online capabilities aren’t as robust or convenient as the services offered by competitors, and it can’t manage the numerous discount programs that its larger rivals can.

Pros

One of the more affordable insurance options

Some discounts available

Local independent agents provide personalized customer service

Cons

Only available in 26 states

Discounts may be more limited than with other insurers

Limited services available online

About Auto-Owners Car Insurance

Auto-Owners Insurance has been in business for more than 100 years and has grown to cover almost three million policyholders. While it only operates in 26 states, the company has 48,000 local agents that provide personal service, earning Auto-Owners strong reviews from customers.

It offers strong discounts for teens and college students, but some of the programs require GPS monitoring that some might find invasive. Auto-Owners’ policyholders also enjoy many of the same benefits that larger national carriers offer, but its online services only include bill payment, with most other activities requiring an agent, including claims.

Features and Benefits

Despite its limited availability in the U.S., Auto-Owners Insurance offers a good number of discounts, and its customers report smooth sailing through most interactions with the company.

Beyond discounts, customers may enjoy unique benefits from bundling policies, including a discounted or waived deductible if a covered home and auto claim are necessary for the same covered event. At the same time, its online services are more limited than others, and the lack of service in 24 states is a real downer for people who don’t live in a covered area.

- Generous student discount programs

- Highly-rated customer service

- Unique deductible benefits that extend beyond discounts

- Only available in 26 states

- Auto-Owners charges less for driving record blemishes

- The company has far fewer regulatory complaints than others

- Online services are limited, including quotes

- Benefits include road trouble service and more

Auto-Owners Car Insurance Reviews: Editorial Rating

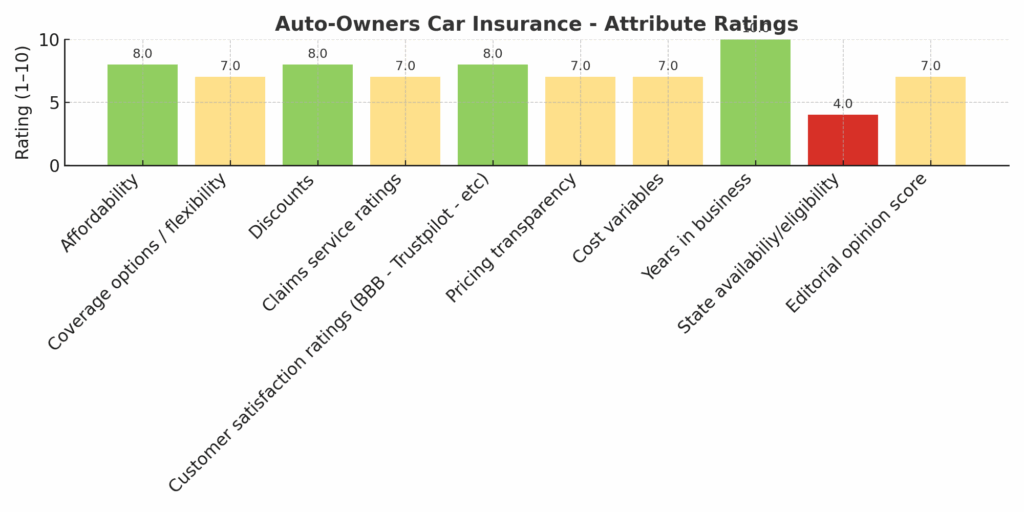

Trusted Company Reviews Rating Score for Auto-Owners: 8.6

We gave Auto-Owners a high score for its excellent customer service, lower-than-average pricing, and generous discount programs. The car insurance company offers unique benefits that extend beyond price cuts, and its customers report having very few issues with service. It would be nice if the company’s insurance products were available to drivers in all 50 states, but for those who qualify, Auto-Owners can be a great option.

| Local Agents | Agents are located across the 26-state service area |

| Discounts | Multiple available, including bundling, safe driver, good student discounts, and more |

| Pricing | Below national average, including for people with DUIs and other blemishes on their driving records |

| Convenience and Customer Service | Highly-rated customer service and insurance agents. Customers consistently rank the company among the best for service |

Why We Like It

We like Auto-Owners Insurance mainly for its excellent customer service. Its policyholders consistently say that it is one of the easiest insurance companies to deal with on the phone, noting that they received expert advice from the agents, and those same customers don’t seem to mind that Auto-Owners’ online capabilities are behind those of many national carriers.

The company’s pricing is also more reasonable than most, and it tends to be less expensive for people with DUIs, speeding tickets, or at-fault accidents on their driving records. Finally, Auto-Owners’ already reasonable pricing becomes more affordable with its range of discounts, which include some innovative benefits for people who bundle policies with, for example, its homeowner coverage options.

What We Don’t Like

Auto-Owners is only available in 26 states, and the company is also a bit behind the times by not allowing potential customers to get quotes and new policies online. That said, it does offer bill pay and a few other services online, but nowhere near the level of service available from its main competitors.

Auto-Owners Customer Reviews

Auto-Owners has positive and negative reviews, but many customers say its service is tops among auto insurance companies. Most report being able to resolve problems with one call, and many say their interactions with the company were smooth and painless. Others report fast claims processing with personal service and good communication from Auto-Owners agents.

On the other hand, many say Auto-Owners’ local claims adjusters fail to communicate as quickly or clearly as the company itself. Some say the company did not pay claims fully, or that something they thought was covered by insurance ended up not being paid. Because of this, it’s essential to review the terms and conditions of any insurance policy.

Who Is Auto-Owners Best For?

Auto-Owners is a great option for students and young drivers because of the multiple discounts it offers. Of course, that only applies if the driver lives in one of the 26 states where Auto-Owners operates. The company is not great for people who want a mostly digital experience with little need for human interaction.

Auto-Owners Vs State Farm

State Farm has a much wider reach than Auto-Owners, but it’s not as affordable. People looking for a more digital experience should check out State Farm, but Auto-Owners’ agents earn excellent marks for service and knowledge.

| Feature | State Farm | Auto-Owners |

| App | Yes, claims, service, payments, more | No |

| Availability | All 50 states plus Washington, D.C. | 26 states |

| Average Price | $2,167 annually | $1,677 annually |

| Customer Support | Highly-rated 24/7 customer service |

Auto-Owners Car Insurance Alternatives

Auto-Owners earns high marks for its outstanding customer service and competitive pricing, especially for drivers who prefer working with independent agents. However, its limited availability and minimal online tools may make it less appealing to those who value digital convenience or need national coverage. Here are a few strong alternatives from our overview of the best cheap car insurance companies worth considering:

- Geico: Best for nationwide availability and low rates with a fully digital experience.

- State Farm: Best for those who want local agent support and a broad range of coverage options.

- Lemonade: Best for low-mileage drivers who prefer app-based policy management and AI claims.

- USAA: Best for military families seeking top-rated service and highly competitive pricing.

Frequently Asked Questions

Is Auto-Owners better than Progressive?

Which car insurance companies have the most complaints?

Source

Logo image source: auto-owners.com

Chris Teague

Editorial Reviews

Must Reads

6 Common Budgeting Mistakes to Avoid

If budgeting feels harder than it should, you’re not alone. Many people struggle not because they lack discipline, but because they run into the same common budgeting mistakes over and over again. At Trusted Company Reviews, we review personal finance tools and...

When Should I Refinance – Anything?

If you’re carrying a loan, whether it’s a mortgage, car loan, student loan, or personal loan, you’ve probably heard the term “refinance.” Refinancing a loan is when you replace your current loan with a new one to reduce your interest rate, loan duration, or payment...

How Much Should I Be Saving Each Month?

How much should I be saving? In short: how much you should save depends on your income, expenses, and goals, but even saving 5–10% of your income or a small, consistent amount each month is a strong place to start. We’ve all heard the advice about saving. “You should...

How Much Car Can I Afford?

Buying a car is exciting. Many people skip the step of figuring out how much they can afford. Learning this before committing puts you ahead of most buyers. Lenders may approve you for more than you should spend, and dealers tend to focus on monthly payments rather...

Compound Interest Vs Simple

Saving and borrowing money are great ways to get ahead in life, but the interest earned or paid on those funds is where the rubber meets the road for most people. Borrowers pay interest on the amount loaned, and investors earn interest on the money they save, but...

9 Real-Life Factors to Consider When Borrowing Money

Life is expensive, and for many, borrowing for essential purchases is an absolute necessity. Furthermore, according to the United States Census Bureau statistics, debt is inversely related to age, with younger borrowers carrying higher balances overall, many with more...

What Is a Tier One Credit Score?

When applying for a mortgage, auto loan, or premium credit card, you might hear lenders refer to your credit tier rather than your exact credit score. This often leads to the question: What is a tier one credit score, and why does it matter? Lenders use credit tiers...

Petco Vs PetSmart

Often situated within a reasonable distance from each other, many pet owners wonder which retailer offers the best deals, grooming, training, adoption programs, rewards, pet food brands, and overall services. While both are leaders in the pet retail industry, their...

How Can I Lower My Credit-Card Interest Rate?

Credit cards are powerful financial tools that can help in a number of situations, but they don’t come without risks and costs. One of the most impactful costs is the interest rate, which for credit cards is typically far higher than for personal loans and other...

How to Pay for a Funeral: Costs, Options, Loans, and Plans

Our How to Pay for a Funeral article explores viable options for funding a meaningful service to honor your loved one. According to the National Funeral Directors Association, the average cost of a funeral with a viewing and burial has climbed to over $8,000. There’s...