It’s hard to miss State Farm when talking about car insurance, as it’s the largest company providing car and home insurance in the country. With more than 100 years in business and a long list of discounts, the company has accumulated tens of millions of customers, and it is consistently ranked among the most financially stable insurance companies in the business.

The company easily lands itself a prominent spot in our overview of the best cheap car insurance providers. However, of course, every company has its ups and downs, so let’s take a closer look at State Farm car insurance to see how it works and what its customers think about its operations.

Pros

Largest insurer in the country

State Farm offers a long list of discounts

Robust network of local State Farm agents

Cons

Not the absolute cheapest insurer

No new policies in Massachusetts or Rhode Island

About State Farm

State Farm has been in business for 103 years and has grown into America’s largest auto insurer. The company consistently ranks highly for its financial strength, and it has earned high marks for customer service from experts on several review platforms.

Features and Benefits

Like any large company, State Farm has plenty of positive and negative customer reviews, but its size and age have given it the ability to offer a range of insurance services and one of the most generous lists of discounts anywhere in the industry.

Additionally, State Farm’s local agent business model enables personalized customer service with more hands-on responses, but be advised that many interactions require an agent and cannot be handled independently.

- Available through our partner, Credible

- Largest auto insurer in the country

- Long list of discounts available

- Usage-based insurance coverage is available

- Local agents across the country

- Highly-rated customer service

State Farm Car Insurance Reviews: Editorial Rating

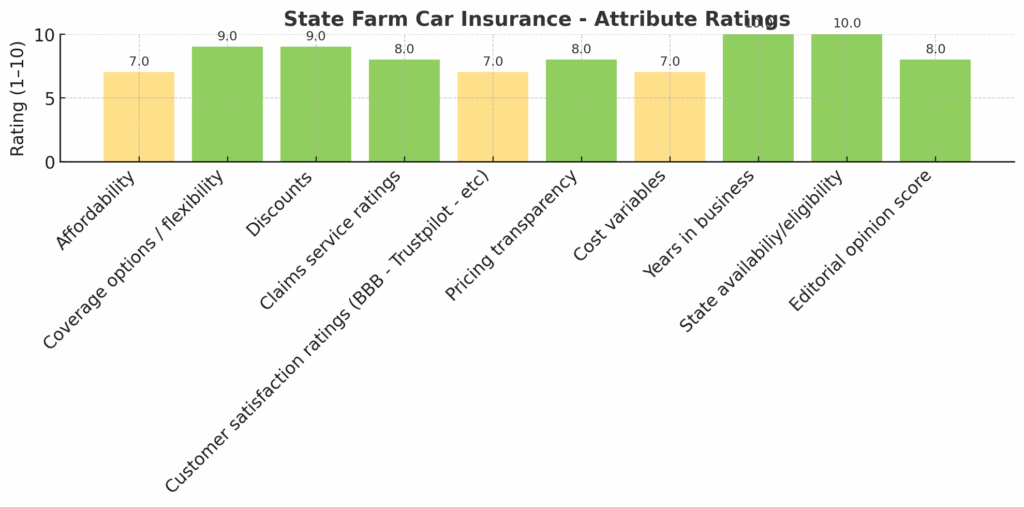

Trusted Company Reviews Rating Score for State Farm: 9.6

We gave State Farm a strong score for its highly-rated customer service and extensive insurance offerings. While going to a local agent for most interactions can be a hassle at times, those agents provide a high level of service that many people enjoy.

Additionally, State Farm offers a wider variety of discounts than most of its competitors, many of which make its policies significantly less expensive for the people who qualify.

Here are some of the most important high-level details about State Farm’s auto insurance coverage options.

| Local Agents | Extensive network of agents spread across the country |

| Discounts | One of the more generous discount programs around, including Drive Safe, and others |

| Pricing | State Farm’s rates are often higher than the national average |

| Convenience and Customer Service | Customers rate the company highly for service and convenience |

Why We Like It

It’s often more desirable to go with a smaller, local company for some needs, but the big national players often have coverage options and services that the smaller guys can’t offer.

State Farm earned solid marks in our research with a strong set of discounts and excellent customer service, which can’t be said about every company in the industry. Its local agents help resolve issues faster, which is reflected in the company’s excellent survey scores.

What We Don’t Like

While State Farm’s broad insurance offerings and great customer service earned it a lot of points using our rating criteria, the company’s rates are generally more expensive than its nearest competitors. Even with generous discounts, many people find that their insurance rates increase with State Farm, but most people likely qualify for at least one discount program.

Additionally, the company’s agents provide a high level of service, making the trade-off worth it for some consumers.

State Farm Car Insurance Reviews

State Farm customers are generally positive about their interactions with the company, but there are some recurring themes with problems. Many state that State Farm’s size makes it difficult to find the right agent or person to speak with about problems, and others say that it takes an abnormally long time to resolve claims.

Some report having denied claims for issues they thought would be covered, and others say they experienced unexpected charges. At the same time, the company’s proponents say the local agent model is extremely helpful, making it easier to solve problems and get information. The company has received fewer NAIC (National Association of Insurance Commissioners) complaints as well.

Who Is State Farm Best For?

State Farm is best for people who prefer a smooth experience and who want in-person service. Many of the company’s services require an agent, leaving few interactions that can be completed online. State Farm can also be a great option for people who bundle policies, as its multiple policy discounts are hard to beat in the industry. The company’s renters coverage options make our list of the best cheap renters insurance providers.

State Farm Vs. Geico Car Insurance

Geico and State Farm are two of the most well-known companies in the insurance business, and they’re remarkably similar. That said, Geico tends to be more affordable than State Farm, and many people prefer its low-touch customer service, which lets policyholders complete most interactions online or by phone.

| Feature | Geico | State Farm |

| App | Yes, claims, customer service, more | Yes, claims, service, payments, more |

| Availability | All 50 states, Washington, D.C. | All 50 states plus Washington, D.C. |

| Average Price | $1,730 for full coverage | $2,167 annually |

| Customer Support | Above average, 24/7 support | Highly-rated 24/7 customer service |

Summary

State Farm is a solid option for car insurance that offers a wide range of products and services, and a generous list of available discounts. As the nation’s largest car insurer, the company can offer a range of insurance products its smaller rivals can’t match, and most people report having smooth interactions and generally fast issue resolution, thanks to the company’s network of local agents. That said, no company is perfect, and you may find better rates or more favorable service options at a smaller, local insurance carrier.

State Farm Alternatives

State Farm is the largest auto insurer in the U.S. and is known for strong financial stability, reliable customer service, and a vast network of local agents. However, some drivers may find its rates higher than competitors or prefer more digital flexibility. If you’re exploring other options, here are a few standout alternatives, which also appear in our review of the best cheap car insurance providers:

- Geico: Best for low rates and a self-service digital experience.

- Lemonade: Best for tech-first, low-mileage drivers who want quick, app-based coverage.

- USAA: Best for eligible military members and families seeking top-rated service and pricing.

- Auto-Owners: Best for personal service and competitive pricing in select states through independent agents.

Frequently Asked Questions

What are the most common complaints about State Farm?

Is State Farm cheaper than Liberty Mutual?

Who is State Farm’s biggest competitor?

Source

Logo image source: statefarm.com

Chris Teague

Editorial Reviews

Must Reads

Does Debt Consolidation Affect Buying a Home? Here’s What You Need to Know

You may be wondering, “Does debt consolidation affect buying a home?” And you're correct to carefully consider such questions. Buying a home is exciting, and getting your finances in shape first makes the process much easier. Additionally, carrying too much debt when...

How to Budget with Credit Cards Without Going into Debt

Credit cards don’t have to wreck your budget. In fact, when used intentionally, they can make budgeting easier, safer, and even more rewarding. By learning how to budget with credit cards, you can leverage built-in tools like expense tracking, automatic...

Basepaws Vs Wisdom Panel Pet DNA Testing

Basepaws Vs Wisdom Panel Basepaws Cat DNA testing and Wisdom Panel were both featured on our list of the Best Pet DNA Test Providers. However, each stands apart for varying aspects of its testing and results, making them excellent options for different types of pet...

Wisdom Panel Vs Embark Pet DNA Testing

Wisdom Panel Vs Embark Pet DNA Testing Wisdom Panel DNA Testing and Embark Dog DNA Testing are standout options for testing and learning more about your pet's genetic background and overall health. While both are incredible and affordable options, each stands out in...

How Many Credit Cards Should I Have for Good Credit?

How many credit cards should I have? In short, for most people, two or three cards are ideal to generally provide enough flexibility and maintain a healthy credit profile, without becoming overly complex. Of course, like most things related to personal finance, the...

Are Balance Transfer Cards for Fair Credit Worth It?

Tired of high-interest credit card debt eating away at your budget? And you're hearing that a balance transfer card can provide a way out? Here's the catch—the offers you're hearing about generally only help those with good or excellent credit. If you have fair credit...

How do Balance Transfer Credit Cards Work?

How do balance transfer credit cards work? Are you struggling with credit card debt and looking for a way to save money on interest? If so, a balance transfer credit card might help. These cards allow you to move existing balances from one card to another, often with...

What Is Online Loan Prequalification?

You've seen it advertised. Are you now wondering: What is online loan prequalification? Online loan prequalification is a simple, no-obligation way to check if you might be eligible for a loan without affecting your credit score. It helps lenders estimate what kind of...

Can You Use a Personal Loan to Buy a Car?

Can You Use a Personal Loan to Buy a Car? You can use a personal loan to buy a car. However, it's only best in certain situations. While, personal loans aren’t the most common choice for vehicle financing, using personal loan funds to buy a car is perfectly legal, and...

How to Consolidate Credit Card Debt

Credit card debt can build up fast, and steep interest charges make it hard to catch up. When balances get out of hand, your minimum payments may barely cover the interest, keeping you in a cycle of revolving debt. The Federal Reserve made this statement in a recent...