Saving and borrowing money are great ways to get ahead in life, but the interest earned or paid on those funds is where the rubber meets the road for most people. Borrowers pay interest on the amount loaned, and investors earn interest on the money they save, but there are differences in the way interest rates are calculated over time. This overview covers compound interest vs. simple interest and explores some of the differences between the two. Let’s get started.

Key Takeaways

|

What People Mean When They Talk About “Interest”

- Interest can be defined as the cost of borrowing money

- Or as a reward for investing money

- How the interest is calculated is as important as the rate itself

- Compound and simple interest function differently, with compound accumulating “interest on interest.”

What Is Simple Interest?

Simple interest is, as its name implies, simpler to calculate than compound interest. It is calculated on the principal (base) amount, so if a borrower receives a $10,000 loan, the interest rate is always calculated against that amount. Over time, simple interest earns less than compound interest due to that fundamental difference.

How Simple Interest Is Calculated

- The simple interest rate is calculated based on the principal amount

- No interest is earned or charged “on the interest.”

- Simple interest is easier to calculate and track than compound interest

What Is Compound Interest?

Compound interest is calculated based on the principal amount plus any interest earned from previous periods. The same $10,000 loan from above, with a 5% annual interest rate, would earn $500 the first year. At the beginning of year two, the 5% interest is calculated on $10,500, yielding $525 in earnings and an ending balance of $11,025. Year three starts with that number and begins earning or charging interest.

How Compound Interest Works

- Compound interest builds on top of the interest already earned or charged

- That process builds value faster because the base balance increases over time

- The compound interest formula is more involved than with simple interest

- Many investment accounts use compound interest

- Some credit card companies also charge compound interest on unpaid balances

- Interest can be calculated annually, monthly, or on another schedule

Why Simple and Compound Interest Are Different Over Time

- Compound interest earns money faster due to the increasing principal balance

- Compound and simple interest earnings rates are similar early on because the compound balance hasn’t begun growing

- Compound interest creates more value over time because of the growing principal balance, upon which the rate is calculated

- Some people avoid or underestimate compound interest due to the more complex calculations involved

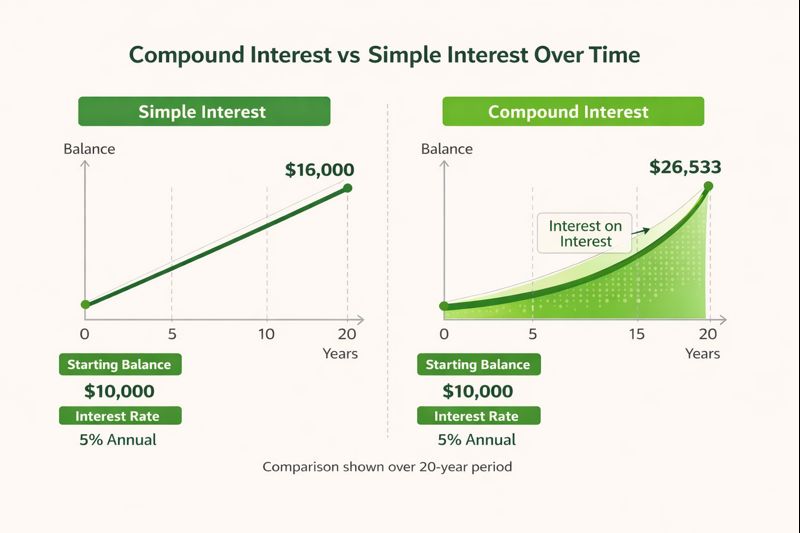

This infographic shows how compound interest vs simple interest diverge over time, even when starting with the same balance and interest rate.

APR vs APY: Why There Are Two Different Terms?

Annual percentage rate, or APR, is the rate you pay on money borrowed, while annual percentage yield is the amount you earn on investments. Both are calculated annually, but APY generally includes compounding, while APR does not.

What Does APR Mean

- APR calculates the cost of borrowing money on an annual basis

- That rate is often split and charged monthly

- APR is most commonly charged on credit cards and other loans

- APR is a cost over time, not a reward

What Does APY Mean

- APY calculates interest earned on an investment

- The interest may be paid monthly, annually, or on another schedule

- APY reflects compound interest over time

Why APR and APY Aren’t Interchangeable

- APR and APY are essentially opposites

- APR relates to debt, while APY relates to investments

- Because of that, it’s usually not possible to compare the two

Where You Encounter These Concepts in Everyday Life

Credit Cards and Compounding

- Credit cards charge interest on the balance and previously accumulated interest

- The rate is split into a daily amount, which is applied to the balance

- The interest rate continues adding to the balance, even if no additional money is spent

For people carrying multiple high-interest balances, a debt consolidation loan can sometimes make repayment more manageable.

Savings Accounts and Compounding

- Even low interest rates accumulate over time through compounding

- The APY may be split into a monthly amount

- The principal balance grows over time, increasing the regular payouts

Personal Loans and Interest Structure

- Interest is much easier to calculate for loans than for credit cards

- Installment loans, such as personal loans, usually rely on simple interest

An Easy Way to Think About Simple vs Compound Interest

One of the easiest ways to think about compound interest is to visualize a cotton candy machine. The cone forms the initial principal balance, while the sugar spinning around it is the interest. Over time, the interest accumulates around the principal balance, building layers on top of itself.

Imagine that sugar is the interest, building on top of the interest already earned. Simple interest is more like paying rent, spending the same amount each month. Both accumulate value over time, but the compounding structure wins out in the long run.

Pro Tip: Focus on Time, Not Just the RateFrom our on-staff Certified Financial Educator: When comparing simple and compound interest, the interest rate often gets the most attention, but time is usually the bigger factor. Small differences in compounding frequency or loan duration can significantly change how much you earn or pay over the long run. Before committing to a financial product, look beyond the headline rate and consider how long the interest will be applied and how often it compounds. |

See Our Calculators

Understanding the difference between simple and compound interest is easier when you can see the numbers in action. Our calculators let you model how interest grows or accumulates over time, compare outcomes, and test different balances, rates, and timelines. Whether you’re saving, investing, or paying down debt, these tools can help you turn concepts into clear, real-world projections.

- Personal Loan Calculator

- Debt Consolidation Calculator

- Mortgage Payoff Calculator

- Early Loan Payoff Calculator

- Auto Loan Refinance Calculator

Why Understanding Interest Matters

- You can negotiate your interest rate, but ultimately do not control it

- Understanding your interest rate can prevent costly surprises

- You’ll also be able to better understand financial advertising

- And make smarter financial decisions