Car insurance can be expensive, making it essential to save money wherever possible. USAA car insurance reviews highlight a great option if you are a current or former member of the military or a family member, as it’s the only nationwide insurer tailored exclusively to the armed forces community.

In business for more than 100 years, USAA is often the least expensive car insurance company for people who qualify, and it offers a range of services aimed at keeping them covered while they are deployed or otherwise occupied by military duty. The company lands itself a spot in our overview of the best cheap car insurance providers.

Pros

Great pricing

Long list of add-ons and benefits, including roadside assistance

Excellent customer service ratings

Cons

Only available to current and former military members and their families

USAA’s discounts aren’t as generous as many others

About USAA

USAA, or the United Services Automobile Association, has been around since the early 1920s and has grown into a popular national insurer with costs that undercut the national average rates by a significant margin.

It consistently ranks among the best companies for customer service, and its members rate it highly for auto claims resolution and timing. Additionally, USAA’s rates don’t climb as dramatically for people who have DUIs or other marks on their driving records, making it a great option to help rebuild their driving histories.

Beyond car insurance, USAA offers banking and investing services, and customers may be eligible for coverage under one of its numerous other insurance products, including renters insurance, health insurance, business insurance, and umbrella coverage. In fact, the company also rates well among the best cheap home insurance companies according to our research and data.

Features and Benefits

While its services are limited to members of the military and family members, the company offers a range of benefits and add-ons that make its coverage options extra-convenient. Additionally, unlike many of its competitors, USAA customers consistently rank it highly for service and claims resolution.

- Well above-average customer satisfaction scores

- Coverage available in all 50 states and Washington, D.C.

- Banking, investing, and other insurance products are available

- USAA is the fifth-largest car insurance company in the United States

- USAA’s rates are typically far below the national average

- Multiple add-ons, benefits, and discounts available

USAA Car Insurance Reviews: Editorial Rating

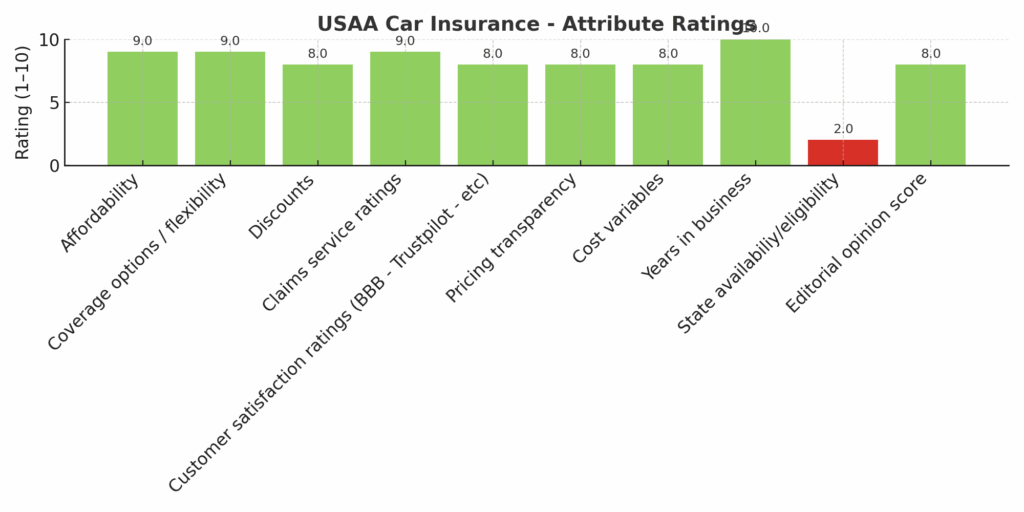

Trusted Company Reviews Rating Score for USAA: 8.3

We ranked USAA with a strong score due to its fantastic customer service scores, reasonable insurance premiums, and clever benefits for military members. Its limited availability puts it out of reach for most drivers in the country, but for those who qualify, USAA can be one of the best options.

| Discounts | Multiple available, including bundling policies, |

| Customer Complaints | USAA’s customers are far more satisfied than the industry average |

| Add-on Coverage options | Classic car coverage, pet protection, more |

Why We Like It

USAA’s overall customer service scores is one of its most significant achievements, as customers tend to rave about the company’s response times, agent knowledge, and the ability to resolve problems without needing multiple calls. It’d be easy to write that off due to USAA’s limited customer base, but it’s clear that a focus on service pays off with great reviews and customer retention.

The company’s pricing is also among the most reasonable in the industry, with USAA frequently undercutting national averages by double-digit percentages. Most customers qualify for at least one of its generous discount programs, which include multiple policy discounts and other offers. Even without them, USAA’s car insurance costs are generally well below those of others.

What We Don’t Like

USAA only covers current and former members of the military and their families, limiting its offerings and benefits. It’s hard to criticize the company for much else, as its customers generally report being happy with USAA, its policies, and pricing.

USAA Car Insurance Reviews

USAA customers rave about its low car insurance rates, with many saying its prices beat the best offerings from more widely available national insurance companies. At the same time, the company has accumulated a number of reviews from customers who say it unexpectedly raised rates or changed their pricing after an accident.

However, many of the same reviews also reported smooth and uncomplicated claims handling, saying that USAA’s customer service representatives are knowledgeable, fast, and courteous. Some report having difficult situations with multiple complicating factors, but said USAA was able to sort through the noise and deliver an acceptable resolution in a reasonable amount of time.

You can’t make everyone happy, of course. Despite its overwhelmingly positive customer sentiment, USAA has its share of unhappy reviews. Many say the company was unclear about what was covered, and some noted being charged more than they expected. Others report having claims denied for what seemed like straightforward accidents, and some said they have been fighting to have claims resolved for a year or longer.

Who Is USAA Best For?

USAA is only available for military families, and it’s often the best choice for the people who qualify. Its pricing and benefits are generous, and it offers a range of services designed to make military life easier.

USAA also offers a pay-as-you-drive insurance product, which can make its policies even cheaper for people who don’t drive a lot, but it’s important to review all of your options, even if you qualify for a USAA insurance product.

While it’s generally the cheapest option, every driver and vehicle is different, and it’s possible that another national insurer offers a lower rate or more helpful add-ons. Some insurance companies may price-match or offer a lower rate to compete with USAA.

Geico Vs USAA Car Insurance

Geico earns high marks for customer service and pricing, but its customers aren’t as happy as USAA’s. That said, Geico is open to almost anyone in the United States, making it a much less limited insurer than its competitor.

| Feature | Geico | USAA |

| App | Yes, file a claim, service, more | Yes, claims, service, more |

| Availability | All 50 states and Washington, D.C. | All 50 states and Washington, D.C. |

| Average Price | $1,937 annually | $1,407 annually |

| Customer Support | Hands-on support, highly-rated agents |

Highly-rated, hands-on customer support |

USAA Alternatives

USAA is widely praised for its excellent customer service, competitive rates, and military-focused benefits, but it’s not available to everyone. Eligibility is limited to active-duty military members, veterans, and their families, which means many drivers will need to look elsewhere. If you don’t qualify for USAA coverage or want to compare options, consider these alternatives:

- Geico: Best for affordable rates and easy online policy management, especially for budget-focused drivers.

- State Farm: Best for drivers who prefer working with local agents and want extensive coverage options.

- Lemonade: Best for those who value a streamlined, tech-driven experience and fast digital claims.

- Auto-Owners: Best for exceptional customer service and personalized coverage through independent agents.

Frequently Asked Questions

Is USAA really the cheapest insurance?

What other insurance products does USAA offer?

What kind of benefits come with a USAA auto policy?

Source

Logo image source: usaa.com

Chris Teague

Editorial Reviews

Must Reads

LendingTree Vs LendingClub

LendingTree Vs LendingClub LendingTree and LendingClub both provide access to personal loans, but they operate very differently. One functions as a lending marketplace, while the other is a direct lender and digital bank. Understanding that distinction is essential...

AmONE Vs LendingTree

When comparing AmONE vs LendingTree, the real question isn’t just which platform is more or less legitimate. It’s which marketplace structure better fits your needs. Both companies operate as financial product marketplaces, connecting borrowers with lenders offering...

Credible Vs LendingTree

Credible vs LendingTree, the real question is this: Do you want a streamlined personal loan marketplace, or a broader financial comparison platform with credit tools built in? While both companies let you compare multiple loan offers with only a soft credit check,...

How Does a HELOC Work?

If you’re a homeowner who needs access to funds, a Home Equity Line of Credit, or HELOC, can be a flexible option based on your home’s equity. Unlike traditional loans, it allows you to borrow only what you need over time. The Consumer Financial Protection Bureau...

Are Federal Tax Refunds Taxable?

A tax refund is the government giving you back your taxable income if you paid too much throughout the year. So federal tax refunds are not taxable; it’s yours to keep. However, there's an important exception that trips up many taxpayers, and it mainly involves state...

6 Common Budgeting Mistakes to Avoid

If budgeting feels harder than it should, you’re not alone. Many people struggle not because they lack discipline, but because they run into the same common budgeting mistakes over and over again. At Trusted Company Reviews, we review personal finance tools and...

When Should I Refinance – Anything?

If you’re carrying a loan, whether it’s a mortgage, car loan, student loan, or personal loan, you’ve probably heard the term “refinance.” Refinancing a loan is when you replace your current loan with a new one to reduce your interest rate, loan duration, or payment...

How Much Should I Be Saving Each Month?

How much should I be saving? In short: how much you should save depends on your income, expenses, and goals, but even saving 5–10% of your income or a small, consistent amount each month is a strong place to start. We’ve all heard the advice about saving. “You should...

How Much Car Can I Afford?

Buying a car is exciting. Many people skip the step of figuring out how much they can afford. Learning this before committing puts you ahead of most buyers. Lenders may approve you for more than you should spend, and dealers tend to focus on monthly payments rather...

Compound Interest Vs Simple

Saving and borrowing money are great ways to get ahead in life, but the interest earned or paid on those funds is where the rubber meets the road for most people. Borrowers pay interest on the amount loaned, and investors earn interest on the money they save, but...