Car insurance is an old business, and some companies still cling to the old ways of interacting with customers. While that can be comforting for some people, the world is moving on, and many people expect a more tech-forward experience from their car insurance providers.

Insurance company Lemonade is doing just that, with AI- and usage-based rate-setting tools and an entirely online experience. The company’s pricing structure allows it to provide exceptionally affordable rates for some drivers, but others have found its prices to be about the same as those of others.

Lemonade’s car insurance coverage requires using its app with location services enabled at all times. That can feel intrusive for some people, as it requires giving up a considerable amount of privacy. Despite that, Lemonade’s coverage, add-on options, and price advantages earn it a spot in our overview of the best cheap car insurance providers.

Pros

Lemonade plants trees for the miles its drivers travel

Infrequent drivers can save a ton of money

Full coverage policies may include pet insurance

Cons

Must agree to tracking at all times with Lemonade app for the best rates

Lemonade has accumulated a ton of negative reviews and complaints

About Lemonade

Lemonade is one of the youngest car insurers in the United States, having only been in business for 10 years. That said, the company covers almost two million customers, though its policies are limited to drivers in nine states.

Unlike the rest of the industry, Lemonade relies on artificial intelligence to process claims for its customers, which can drastically speed up the process. However, in some cases, it can complicate problem resolution, as there’s no clear way to connect with a human.

Lemonade also bases its rates on drivers’ habits, allowing the company to offer lower prices for people who don’t drive a lot. The downside to that, for some, is that drivers have to keep the Lemonade mobile app installed on their phones with location tracking active at all times.

Features and Benefits

Lemonade bills itself as the insurance company of the future, with “instant everything” available to its customers. That might be a little bit of a stretch, but the company does offer quite a few benefits and add-ons.

- Assistance switching insurance carriers

- Pay-per-mile insurance

- Roadside assistance

- Emergency crash assistance

- Glass protection

- Stolen car coverage

- Special electric vehicle discounts available

Lemonade Reviews: Editorial Rating

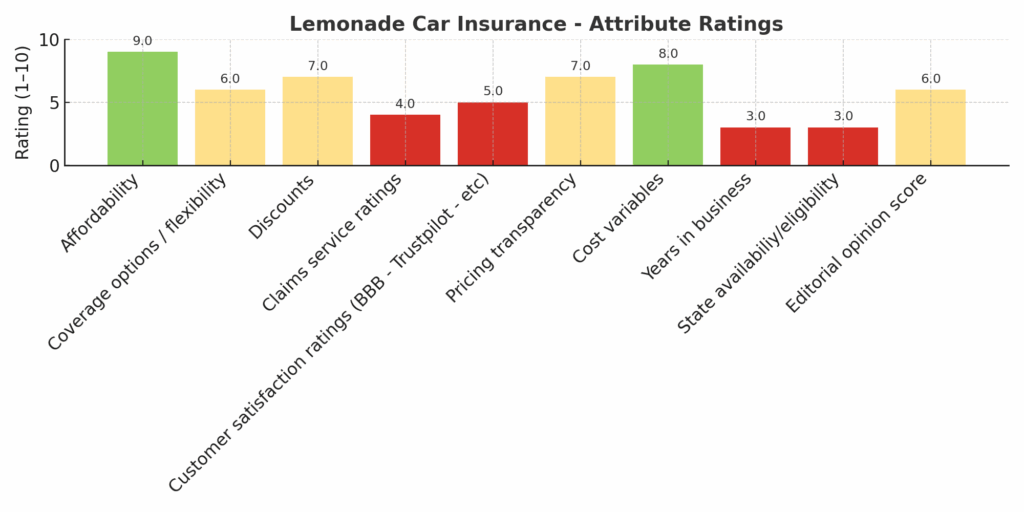

Trusted Company Reviews Rating Score for Lemonade: 8.1

Our somewhat middling score for Lemonade comes due to a few factors, mainly related to lackluster customer reviews of its claims services and its somewhat invasive tracking policies, which require customers to keep location services active on their mobile devices at all times.

It can be cheaper than other options, especially for people who don’t drive a lot, and its social impact strategies will likely be appealing to many. Still, the company has accumulated more negative reviews than other companies of similar size in the industry.

Additionally, Lemonade is only available in select states, severely limiting its coverage potential. That said, for those who qualify, Lemonade’s bodily injury and property coverage are on par with other providers.

The table below highlights some of the must-know features of a Lemonade auto insurance policy.

| Discounts | Multiple available, including bundling discounts and safe driving benefits |

| Customer Complaints | More than the industry average |

| Add-on coverage options | Rental car reimbursement, pet injury coverage, glass protection, more |

Why We Like It

While it’s a new company, Lemonade’s product offerings rival those of far more established companies in the industry. It offers a range of insurance options beyond auto coverage, but its unique approach to car insurance might not be for everyone.

We like Lemonade’s Certified B Corp status and its efforts to plant trees for every auto policy, and it can be a legitimately cheap option for people who don’t drive a lot. As an insurer, Lemonade’s pet insurance ranks much higher in reviews, and its renters insurance offerings are among the best deals going.

What We Don’t Like

Lemonade requires drivers to keep location tracking on their mobile phones at all times to monitors driving habits, and the company has a number of negative customer reviews.

It’s also only available in nine states, making it one of the most limited insurance companies in our review. Finally, while it’s a good option for light drivers, Lemonade becomes more expensive as miles are traveled, and it can surpass more traditional auto insurers’ pricing for frequent drivers.

Lemonade Car Insurance Reviews

Lemonade’s customer reviews are more negative than those of many of its industry competitors. Customers focus on poor customer service, slow or delayed claims processing, unexpected charges, and unfairly denied claims when they expected a repair or replacement of their car.

Others say they expected coverage for items that were later excluded from their policies. Many customers report being unexpectedly dropped from their policies, and some report that they continued seeing charges for months after canceling their policy.

Who Is Lemonade Car Insurance Best For?

Lemonade Auto Insurance is a great option for people who drive infrequently, as its value proposition fades as the miles accumulate. The company likely won’t be the best choice for people who aren’t comfortable with technology, as its policies are sold and managed online, and it requires location tracking services to be activated on a compatible smartphone. Customers who benefit most value savings over excellent customer service.

Lemonade Vs Geico Car Insurance

Geico is one of the most well-known and highly regarded companies in the insurance industry. While many of its policies are more expensive than Lemonade’s offerings, Geico’s customers rank it highly for service, claims processing, pricing transparency, and it operates in all states, giving it a far greater reach than Lemonade’s.

| Feature | Geico | Lemonade |

| App | Yes, claims, service, more | Yes, exclusively app-based |

| Availability | All 50 states | Only nine states |

| Average Price | $1,937 annually | As low as $30 monthly |

| Customer Support | Hands-on support, highly-rated agents | Poorly-rated customer service with slow response times |

Final Thoughts

Lemonade’s customer reviews and online-only presence may be off-putting, but the company can offer real savings for low-mileage drivers who don’t need an intensive customer service experience.

It offers many of the same add-ons and benefits that its bigger-name national rivals do, but it’s important to remember that the company’s limited service area puts it out of reach for most drivers in the country.

Lemonade Alternatives

Lemonade car insurance offers compelling perks for low-mileage drivers who prefer a tech-first experience, but it’s not ideal for everyone. Its limited availability, persistent location tracking, and frequent customer service complaints may turn some drivers away. If you’re looking for broader coverage options, human support, or stronger claims satisfaction, here are a few well-regarded alternatives from our overview of the best cheap car insurance companies:

- Geico: Nationwide coverage with competitive pricing and one of the largest discount programs in the industry.

- USAA: Exceptional customer service and affordability for current and former military members and their families.

- Auto-Owners: Great for drivers in eligible states who value personal service through independent agents.

- State Farm: Offers robust local agent support, wide coverage options, and one of the most trusted reputations in the industry.

Frequently Asked Questions

Why is Lemonade Car Insurance So Cheap?

Who Has the Cheapest Car Insurance Otherwise?

Source

Logo image source: lemonade.com

Chris Teague

Editorial Reviews

Must Reads

Best Egg vs LendingClub

When comparing Best Egg vs LendingClub, the difference between the two comes down to specialization versus wider product availability. Best Egg is a streamlined personal loan lender built primarily for borrowers with fair to excellent credit who want predictable loan...

Best Egg vs Upstart

Best Egg vs Upstart When comparing Best Egg vs Upstart, the key difference comes down to underwriting philosophy and borrower fit. Best Egg generally serves borrowers with fair to good credit who may be more comfortable with traditional credit evaluation. Upstart, by...

Should I Buy a Car or House First?

Should I buy a car or house first? The Short Answer: Buying a house first is usually the smarter financial move. In most cases, buying a house before a car is the better long-term financial decision. Homes can build equity and potentially increase in value over time,...

How Much Money Should I Save Before Buying a House?

The Short Answer: How Much Money Should I Save Before Buying a House? Saving money for a home is mostly about your down payment, but it also includes closing costs and a financial cushion after you move in. Equifax (a major credit bureau) has recommended saving 25% to...

LendingTree Vs LendingClub

LendingTree Vs LendingClub LendingTree and LendingClub both provide access to personal loans, but they operate very differently. One functions as a lending marketplace, while the other is a direct lender and digital bank. Understanding that distinction is essential...

AmONE Vs LendingTree

When comparing AmONE vs LendingTree, the real question isn’t just which platform is more or less legitimate. It’s which marketplace structure better fits your needs. Both companies operate as financial product marketplaces, connecting borrowers with lenders offering...

Credible Vs LendingTree

Credible vs LendingTree, the real question is this: Do you want a streamlined personal loan marketplace, or a broader financial comparison platform with credit tools built in? While both companies let you compare multiple loan offers with only a soft credit check,...

How Does a HELOC Work?

If you’re a homeowner who needs access to funds, a Home Equity Line of Credit, or HELOC, can be a flexible option based on your home’s equity. Unlike traditional loans, it allows you to borrow only what you need over time. The Consumer Financial Protection Bureau...

Are Federal Tax Refunds Taxable?

A tax refund is the government giving you back your taxable income if you paid too much throughout the year. So federal tax refunds are not taxable; it’s yours to keep. However, there's an important exception that trips up many taxpayers, and it mainly involves state...

6 Common Budgeting Mistakes to Avoid

If budgeting feels harder than it should, you’re not alone. Many people struggle not because they lack discipline, but because they run into the same common budgeting mistakes over and over again. At Trusted Company Reviews, we review personal finance tools and...