Select Home Warranty Reviews: All You Need To Know

Are you searching for a top-rated home warranty company? Select Home Warranty reviews highlight it as a strong contender, but there are both pros and cons to consider.

That’s why we’ve created this comprehensive review of Select Home Warranty to help you make an informed decision. Our goal is to provide a clear picture of what to expect, outlining both the advantages and potential drawbacks based on real customer experiences and expert feedback.

Select Home Warranty at a Glance:

Select Home Warranty is known for its competitive pricing and comprehensive coverage options. While it has earned praise for affordability and flexible plans, it’s equally important to be aware of recurring customer complaints regarding service quality and claim processing. This review dives into both sides, giving you an unbiased review of Select Home Warranty. You’ll also get a side-by-side comparison of Select Home Warranty versus Choice Home Warranty and American Home Shield.

Not sure if a home warranty is the right choice? Instead of paying upfront for a warranty, you may want to explore financing options for repairs. Below, you can compare personal loan offers to cover home repairs, ensuring you get the best rates possible.

Affordable Home Repair Financing: Compare Loan Offers

Pros

Nationwide coverage for homeowners in all 50 states!

You can design the ideal coverage for your home and its specific needs, including coverage for HVAC systems, plumbing, electrical, and even roof leaks.

You can extend coverage to pools, spas, sump pumps, and more, depending on your household requirements.

Quick turnaround times for responses on claims. You can expect to hear back within 12 business hours. Most claims are serviced in 48 hours.

Generous 90-day repair guarantee.

Cons

Some of the coverage caps are low compared to other home warranty companies. It’s disappointing that appliances are capped at just $500.

Many customers express frustration over denied claims, often due to policy exclusions or technicalities. This has led to perceptions of Select being overly strict or unclear about coverage terms.

The Select Home Warranty pre-existing conditions clause excludes all pre-existing conditions. You could even be denied for improper maintenance.

While service fees between $75 and $100 are on point with the rest of the industry, the process for how your fee is determined for each claim is unclear.

The list of Select Home Warranty coverage exclusions is pretty robust.

About Select Home Warranty (SHW)

Select Home Warranty (SHW) stands out for being one of the only home warranty companies to offer coverage in all 50 states. While it’s only been around since 2012, SHW has already earned a place among competitors that have been around for 20 to 50 years.

Three coverage plans that can be combined with semi-robust add-on options make SHW a choice to consider when looking for something that feels like customized coverage.

Check out the Top 3 Home Warranty Companies in California.

Is Select Home Warranty Worth the Cost?

Like many home warranty companies, Select Home Warranty offers three coverage tiers. With only a $4 difference between the most affordable and most expensive plan, SHW encourages upgrading to full coverage. While most customers opt for the comprehensive plan, we will review all available options to help you make an informed decision.

Home Warranty vs. Home Insurance

Before committing to a home warranty plan, it’s essential to check with your home insurance provider to determine what items in your home are already covered. Many homeowners assume they need a home warranty for full protection, but home insurance may already provide sufficient coverage for valuable home systems and appliances. Speaking with a reputable home insurance company can help you assess whether additional protection is necessary.

For a deeper understanding of how home insurance and home warranties complement each other, check out our comprehensive review of the best home insurance providers. Making an informed decision can help you avoid unnecessary costs and ensure your home is fully protected.

Plans and Pricing

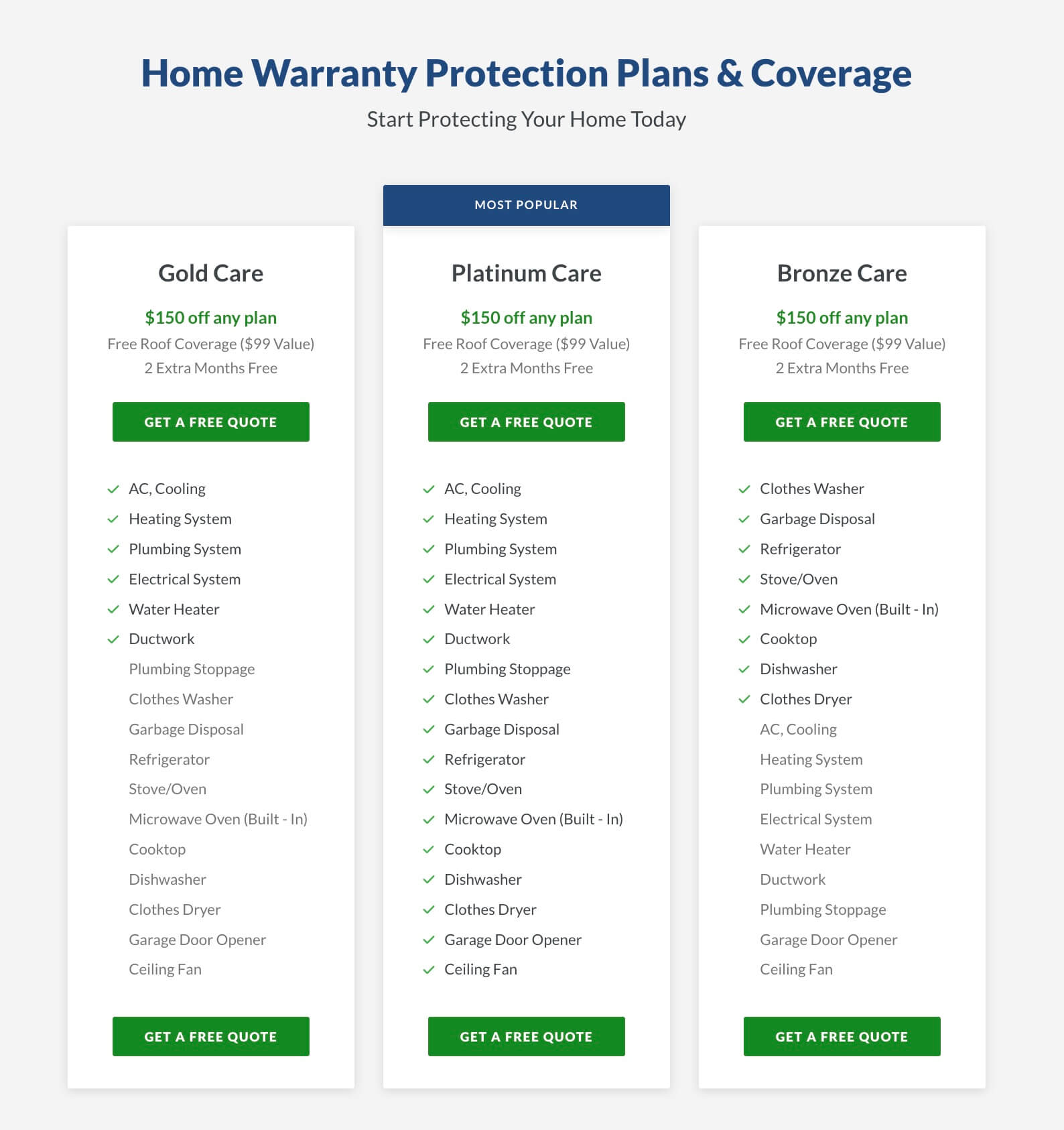

Select Home Warranty Warranty Plan 1: Bronze Care

At $52.50 per month, the Bronze Care plan covers all of the major appliances in your home’s kitchen and laundry room. Coverage is good for a clothes dryer, clothes washer, refrigerator, cooktop, dishwasher, garbage disposal, built-in microwave, dishwasher, stove, and oven. This tier also covers roof leaks at no extra monthly cost.

Select Home Warranty Plan 2: Gold Care

Next up is the Gold Care plan that covers all of your home’s major systems for $52.50 per month. While the $500 coverage limit for appliances can feel a little skimpy, SHW redeems itself a bit with a slightly more generous coverage cap of $3,000 for heating and cooling equipment. Gold Care’s full coverage list includes your home’s air conditioner, electrical system, heating system, plumbing system, water heater, and ductwork. That free roof leak coverage also applies for Gold Care.

Select Home Warranty Plan 3: Platinum Care

The fact that you can bump up to Platinum Care for just $3.75 more than the Bronze plan or Gold plan per month makes this tier the one to watch. For $56.25 per month, you’ll get everything in both of SHW’s other plans bundled into one package.

Select Home Warranty vs. Choice Home Warranty

The first big difference between Select Home Warranty and Choice Home Warranty is that Choice offers just two plans instead of three. While Choice’s Basic Plan covers your plumbing, electrical, heating, ductwork, water heater, oven/range/cooktop, dishwasher, built-in microwave, garbage disposal, garage door opener, whirlpool tub, ceiling fan, and exhaust fan for $46.67 per month, the Total plan covers all of the those things with an air conditioner, clothes washer, clothes dryer, and refrigerator thrown in for $55 per month. Choice Home Warranty’s Total plan is very similar to Select Home Warranty’s Platinum Care plan in both coverage breadth and price.

For people who want affordable appliances-only coverage, the fact that Choice Home Warranty only offers coverage for a refrigerator in its upgraded option can feel slightly manipulative. While Choice Home Warranty does offer add-on coverage for roof leaks, you won’t get the built-in coverage that comes with all of SHW’s plans. Finally, Choice Home Warranty’s 60-day workmanship guarantee falls short of SHW’s industry-leading 90-day warranty.

Select Home Warranty vs. American Home Shield

You may know American Home Shield as one of the biggest home warranty companies. This highly rated company earns loyalty by providing generous coverage caps on plans that cost $29 to $90 per month. While you’ll get $2,000 of coverage per appliance with the low-cost ShieldGold plan, that jumps up to $4,000 with the ShieldPlatinum plan. Just keep in mind that American Home Shield’s service fees that range from $100 to $125 are among the highest in the industry. Finally, American Home Shield has a much longer list of add-on options compared to Select Home Warranty.

Is Select Home Warranty Worth It?

Select Home Warranty offers what would be considered mid-sized pricing for what can be considered low-level to mid-level coverage. While it’s nice that the company throws in free roof coverage with all plans, the $500 cap per appliance could be a big deterrent if you have high-end appliances because that simply may not be enough to justify coverage once you factor in your service fee.

However, the generous $3,000 caps for Select Home Warranty HVAC coverage and air conditioning do help to redeem SHW. Just keep in mind that Select Home Warranty waiting periods require new customers to wait 30 days before filing claims. This is pretty standard among warranties.

Overall, Select Home Warranty’s coverage is “adequate” when you look at appliance coverage and systems coverage together.

Opting for just appliance coverage probably won’t be worth it for most customers. This company does shine with customer service. A claims response window that’s within 12 business hours of your inquiry sets SHW apart from most of its competitors. What’s more, SHW has a strong reputation with customers for making efforts to respond promptly when they reach out in emergency situations.

Select Home Warranty Reviews BBB

Select Home Warranty earns a grade of “B” from the BBB. Select Home reviews at the BBB aren’t as positive, with an average customer rating of 1.55 out of 5. Select Home Warranty’s BBB complaints may turn you off even more, sitting at 5,333 complaints.

While there has never been a major Select Home Warranty Lawsuit, the company has been sued in small claims court by unsatisfied customers.

Select Home Warranty Reviews on Google

While BBB data for this company is disappointing, Select Home Warranty manages to pull in lots of positive Google reviews from customers.

The company currently has nearly 4 stars out of 5 on Google. Trustpilot reviews are also overwhelmingly positive. Select Home Warranty currently has 4 out of 5 stars based on 4,118 reviews on Trustpilot.

The positive reviews are generally owed to good experiences with contractors sent by SHW, positive experiences with customer service, and the availability of discounts when signing up.

Select Home Warranty Coverage Details

All three of SHW’s plans come with free roof coverage that the company claims is a $99 value. Here’s a rundown of all items covered when you opt for the Platinum Care plan that costs just over $3 more compared to the appliance-only plan or systems-only plan:

- Air Conditioning/Cooling

- Heating System

- Plumbing System

- Electrical System

- Water Heater

- Ductwork

- Plumbing Stoppage

- Clothes Washer

- Garbage Disposal

- Refrigerator

- Stove/Oven

- Built-in Microwave

- Cooktop

- Dishwasher

- Clothes Dryer

- Garage Door Opener

- Ceiling Fan

Select Home Warranty also offers optional add-on coverage for some big-ticket items around your home. Select Home Warranty add-on coverages are available for a central vacuum, lawn sprinkler system, pool/spa, freezer, sump pump, and well pump.

Like all home warranty companies, SHW has a list of exclusions. Select Home Warranty coverage exclusions include:

- Cosmetic issues

- Appliances or systems that were improperly installed

- Appliances and systems that were improperly maintained

- Improperly installed ductwork

- Clogged drains or lines

- Electrical failures

- Manufacturer defects

- Refrigerants

- Damage caused by leaking refrigerant

There’s definitely an element of “buyer beware” any time a home warranty company adds improper maintenance to a list of exclusions because it can be easy to pass the buck when an issue arises that could potentially be caused by poor maintenance. The specific items that are excluded from coverage include water softeners, solar or tankless water heaters, geothermal heat pumps, humidifiers, and window air conditioners.

Select Home Warranty Claim Process

Select Home Warranty’s claims process is among the smoothest in the business. Claims can be submitted online 24/7. Customers can also place a call to file a claim if they prefer.

Next, an SHW representative will assign a contractor to your claim. If the problem you need repaired or replaced is covered, SHW will take care of it once you pay your service fee.

Select Home Warranty generally sends a contractor to your home within two business days on weekdays. If you file a claim over the weekend, it could take up to four days.

The company doesn’t make any guarantees for timelines on resolutions. However, customer reviews reveal that SHW is slightly speedier at resolving issues compared to other home warranty companies.

Select Home Warranty Customer Service and Support

Select Home Warranty has one of the better customer support teams in the industry. You can almost always count on the fact that you’ll get a meaty response within 12 hours of filing your claim. SHW has an easy customer portal that allows you to file a claim online 24/7 in minutes. Existing customers can also call 1-855-267-3532 to file a claim with a representative’s assistance.

Select Home Warranty Contractor Network

Like most home warranty companies, Select Home Warranty selects a contractor to come to your home to fix your problem.

SHW has fairly stringent guidelines for allowing contractors into its nationwide network. All SHW contractors visiting your home will be fully licensed.

SHW also requires contractors to maintain commercial general liability insurance, maintain coverage for automobile insurance for all vehicles, maintain workers’ compensation, and agree to SHW’s contractual terms.

Frequently Asked Questions

Is Select Home Warranty a ripoff?

Is Select Home Warranty worth it?

Is Select Home Warranty worth it, according to customer comments on Reddit?

Select Home Warranty vs. Landmark Home Warranty – Which plan is best?

How do I buy a home warranty from Select Home Warranty?

How do I file a claim with Select Home Warranty?

How long does it take after a claim is made for a technician to come?

Does Select Home Warranty cover roof leaks?

Does Select Home Warranty cover mold?

Does Select Home Warranty cover water damage?

Does Select Home Warranty cover termites and insects?

Does Select Home Warranty cover theft?

Does Select Home Warranty cover damage from trees?

What additional home warranty coverages are offered by Select Home Warranty?

Does Select Home Warranty have customer complaints?

Conclusion

Select Home Warranty Rating

| BBB Rating (C) | 1 |

| Customer Reviews | 5 |

| Lawsuits | 5 |

| Coverage Robustness | 12 |

| Coverage for Essential Components | 15 |

| Claims Processing Efficiency | 17 |

| Customer Support | 11 |

| Extra Features | 3 |

| Reviewer Opinion | 12 |

Ranking: 81/100

Source

Sources:

Better Business Bureau (BBB), Select Home Warranty LLC profile

Select Home Warranty website, Basics of Home Warranty Roof Leak Coverage

TrustPilot Reviews, Select Home Warranty profile page

Select Home Warranty, Protection Plans & Coverage

Reddit, Customer Reviews on Select Home Warranty, www.reddit.com

UniCourt, Small Claim lawsuit against Select Home Warranty of CA, Inc., HENRY YANG VS. SELECT HOME WARRANTY OF CA, INC INC.

Scott Dylan Westerlund

Editorial Reviews

Must Reads

Best Egg vs LendingClub

When comparing Best Egg vs LendingClub, the difference between the two comes down to specialization versus wider product availability. Best Egg is a streamlined personal loan lender built primarily for borrowers with fair to excellent credit who want predictable loan...

Best Egg vs Upstart

Best Egg vs Upstart When comparing Best Egg vs Upstart, the key difference comes down to underwriting philosophy and borrower fit. Best Egg generally serves borrowers with fair to good credit who may be more comfortable with traditional credit evaluation. Upstart, by...

Should I Buy a Car or House First?

Should I buy a car or house first? The Short Answer: Buying a house first is usually the smarter financial move. In most cases, buying a house before a car is the better long-term financial decision. Homes can build equity and potentially increase in value over time,...

How Much Money Should I Save Before Buying a House?

The Short Answer: How Much Money Should I Save Before Buying a House? Saving money for a home is mostly about your down payment, but it also includes closing costs and a financial cushion after you move in. Equifax (a major credit bureau) has recommended saving 25% to...

LendingTree Vs LendingClub

LendingTree Vs LendingClub LendingTree and LendingClub both provide access to personal loans, but they operate very differently. One functions as a lending marketplace, while the other is a direct lender and digital bank. Understanding that distinction is essential...

AmONE Vs LendingTree

When comparing AmONE vs LendingTree, the real question isn’t just which platform is more or less legitimate. It’s which marketplace structure better fits your needs. Both companies operate as financial product marketplaces, connecting borrowers with lenders offering...

Credible Vs LendingTree

Credible vs LendingTree, the real question is this: Do you want a streamlined personal loan marketplace, or a broader financial comparison platform with credit tools built in? While both companies let you compare multiple loan offers with only a soft credit check,...

How Does a HELOC Work?

If you’re a homeowner who needs access to funds, a Home Equity Line of Credit, or HELOC, can be a flexible option based on your home’s equity. Unlike traditional loans, it allows you to borrow only what you need over time. The Consumer Financial Protection Bureau...

Are Federal Tax Refunds Taxable?

A tax refund is the government giving you back your taxable income if you paid too much throughout the year. So federal tax refunds are not taxable; it’s yours to keep. However, there's an important exception that trips up many taxpayers, and it mainly involves state...

6 Common Budgeting Mistakes to Avoid

If budgeting feels harder than it should, you’re not alone. Many people struggle not because they lack discipline, but because they run into the same common budgeting mistakes over and over again. At Trusted Company Reviews, we review personal finance tools and...