It’s hard to miss State Farm when talking about car insurance, as it’s the largest company providing car and home insurance in the country. With more than 100 years in business and a long list of discounts, the company has accumulated tens of millions of customers, and it is consistently ranked among the most financially stable insurance companies in the business.

The company easily lands itself a prominent spot in our overview of the best cheap car insurance providers. However, of course, every company has its ups and downs, so let’s take a closer look at State Farm car insurance to see how it works and what its customers think about its operations.

Pros

Largest insurer in the country

State Farm offers a long list of discounts

Robust network of local State Farm agents

Cons

Not the absolute cheapest insurer

No new policies in Massachusetts or Rhode Island

About State Farm

State Farm has been in business for 103 years and has grown into America’s largest auto insurer. The company consistently ranks highly for its financial strength, and it has earned high marks for customer service from experts on several review platforms.

Features and Benefits

Like any large company, State Farm has plenty of positive and negative customer reviews, but its size and age have given it the ability to offer a range of insurance services and one of the most generous lists of discounts anywhere in the industry.

Additionally, State Farm’s local agent business model enables personalized customer service with more hands-on responses, but be advised that many interactions require an agent and cannot be handled independently.

- Available through our partner, Credible

- Largest auto insurer in the country

- Long list of discounts available

- Usage-based insurance coverage is available

- Local agents across the country

- Highly-rated customer service

State Farm Car Insurance Reviews: Editorial Rating

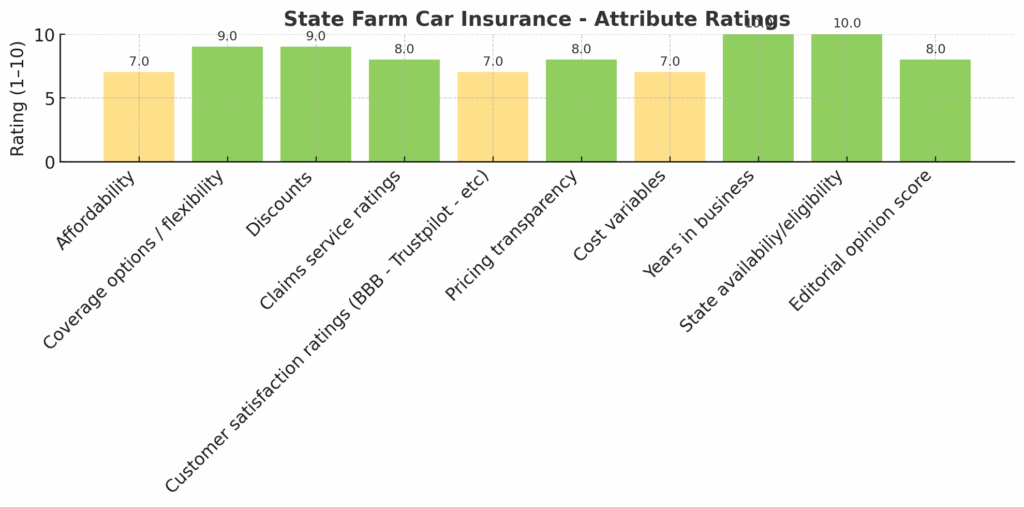

Trusted Company Reviews Rating Score for State Farm: 9.6

We gave State Farm a strong score for its highly-rated customer service and extensive insurance offerings. While going to a local agent for most interactions can be a hassle at times, those agents provide a high level of service that many people enjoy.

Additionally, State Farm offers a wider variety of discounts than most of its competitors, many of which make its policies significantly less expensive for the people who qualify.

Here are some of the most important high-level details about State Farm’s auto insurance coverage options.

| Local Agents | Extensive network of agents spread across the country |

| Discounts | One of the more generous discount programs around, including Drive Safe, and others |

| Pricing | State Farm’s rates are often higher than the national average |

| Convenience and Customer Service | Customers rate the company highly for service and convenience |

Why We Like It

It’s often more desirable to go with a smaller, local company for some needs, but the big national players often have coverage options and services that the smaller guys can’t offer.

State Farm earned solid marks in our research with a strong set of discounts and excellent customer service, which can’t be said about every company in the industry. Its local agents help resolve issues faster, which is reflected in the company’s excellent survey scores.

What We Don’t Like

While State Farm’s broad insurance offerings and great customer service earned it a lot of points using our rating criteria, the company’s rates are generally more expensive than its nearest competitors. Even with generous discounts, many people find that their insurance rates increase with State Farm, but most people likely qualify for at least one discount program.

Additionally, the company’s agents provide a high level of service, making the trade-off worth it for some consumers.

State Farm Car Insurance Reviews

State Farm customers are generally positive about their interactions with the company, but there are some recurring themes with problems. Many state that State Farm’s size makes it difficult to find the right agent or person to speak with about problems, and others say that it takes an abnormally long time to resolve claims.

Some report having denied claims for issues they thought would be covered, and others say they experienced unexpected charges. At the same time, the company’s proponents say the local agent model is extremely helpful, making it easier to solve problems and get information. The company has received fewer NAIC (National Association of Insurance Commissioners) complaints as well.

Who Is State Farm Best For?

State Farm is best for people who prefer a smooth experience and who want in-person service. Many of the company’s services require an agent, leaving few interactions that can be completed online. State Farm can also be a great option for people who bundle policies, as its multiple policy discounts are hard to beat in the industry. The company’s renters coverage options make our list of the best cheap renters insurance providers.

State Farm Vs. Geico Car Insurance

Geico and State Farm are two of the most well-known companies in the insurance business, and they’re remarkably similar. That said, Geico tends to be more affordable than State Farm, and many people prefer its low-touch customer service, which lets policyholders complete most interactions online or by phone.

| Feature | Geico | State Farm |

| App | Yes, claims, customer service, more | Yes, claims, service, payments, more |

| Availability | All 50 states, Washington, D.C. | All 50 states plus Washington, D.C. |

| Average Price | $1,730 for full coverage | $2,167 annually |

| Customer Support | Above average, 24/7 support | Highly-rated 24/7 customer service |

Summary

State Farm is a solid option for car insurance that offers a wide range of products and services, and a generous list of available discounts. As the nation’s largest car insurer, the company can offer a range of insurance products its smaller rivals can’t match, and most people report having smooth interactions and generally fast issue resolution, thanks to the company’s network of local agents. That said, no company is perfect, and you may find better rates or more favorable service options at a smaller, local insurance carrier.

State Farm Alternatives

State Farm is the largest auto insurer in the U.S. and is known for strong financial stability, reliable customer service, and a vast network of local agents. However, some drivers may find its rates higher than competitors or prefer more digital flexibility. If you’re exploring other options, here are a few standout alternatives, which also appear in our review of the best cheap car insurance providers:

- Geico: Best for low rates and a self-service digital experience.

- Lemonade: Best for tech-first, low-mileage drivers who want quick, app-based coverage.

- USAA: Best for eligible military members and families seeking top-rated service and pricing.

- Auto-Owners: Best for personal service and competitive pricing in select states through independent agents.

Frequently Asked Questions

What are the most common complaints about State Farm?

Is State Farm cheaper than Liberty Mutual?

Who is State Farm’s biggest competitor?

Source

Logo image source: statefarm.com

Chris Teague

Editorial Reviews

Must Reads

Best Egg vs LendingClub

When comparing Best Egg vs LendingClub, the difference between the two comes down to specialization versus wider product availability. Best Egg is a streamlined personal loan lender built primarily for borrowers with fair to excellent credit who want predictable loan...

Best Egg vs Upstart

Best Egg vs Upstart When comparing Best Egg vs Upstart, the key difference comes down to underwriting philosophy and borrower fit. Best Egg generally serves borrowers with fair to good credit who may be more comfortable with traditional credit evaluation. Upstart, by...

Should I Buy a Car or House First?

Should I buy a car or house first? The Short Answer: Buying a house first is usually the smarter financial move. In most cases, buying a house before a car is the better long-term financial decision. Homes can build equity and potentially increase in value over time,...

How Much Money Should I Save Before Buying a House?

The Short Answer: How Much Money Should I Save Before Buying a House? Saving money for a home is mostly about your down payment, but it also includes closing costs and a financial cushion after you move in. Equifax (a major credit bureau) has recommended saving 25% to...

LendingTree Vs LendingClub

LendingTree Vs LendingClub LendingTree and LendingClub both provide access to personal loans, but they operate very differently. One functions as a lending marketplace, while the other is a direct lender and digital bank. Understanding that distinction is essential...

AmONE Vs LendingTree

When comparing AmONE vs LendingTree, the real question isn’t just which platform is more or less legitimate. It’s which marketplace structure better fits your needs. Both companies operate as financial product marketplaces, connecting borrowers with lenders offering...

Credible Vs LendingTree

Credible vs LendingTree, the real question is this: Do you want a streamlined personal loan marketplace, or a broader financial comparison platform with credit tools built in? While both companies let you compare multiple loan offers with only a soft credit check,...

How Does a HELOC Work?

If you’re a homeowner who needs access to funds, a Home Equity Line of Credit, or HELOC, can be a flexible option based on your home’s equity. Unlike traditional loans, it allows you to borrow only what you need over time. The Consumer Financial Protection Bureau...

Are Federal Tax Refunds Taxable?

A tax refund is the government giving you back your taxable income if you paid too much throughout the year. So federal tax refunds are not taxable; it’s yours to keep. However, there's an important exception that trips up many taxpayers, and it mainly involves state...

6 Common Budgeting Mistakes to Avoid

If budgeting feels harder than it should, you’re not alone. Many people struggle not because they lack discipline, but because they run into the same common budgeting mistakes over and over again. At Trusted Company Reviews, we review personal finance tools and...