Work With Companies You Can Trust

- Find reputable personal finance companies and services you can trust

- Read unbiased finance company reviews by industry experts

- Improve your finances with educational insights

A Trusted Resource for Company Reviews

Trusted Company Reviews provides in-depth reviews and comparisons of products and companies across a wide variety of industries.

We work closely with consumers and experts to create our editorial ratings and resources that empower our users to make informed decisions.

Newsroom

401(k) Hardship Withdrawals Rise as More Workers Tap Retirement Savings

Written by Brett Holzhauer, Senior Financial Writer and graduate of the Walter Cronkite School of Journalism. Reviewed and edited by […]

Valuation Discipline in a Volatile Stock Market

Valuation Discipline in a Volatile Stock Market Written by Deane Biermeier, Certified Financial Educator, with analytical contributions from, and reviewed […]

Market Analysis March 2026 – 10 Blue-Chip Companies to Research

Market Analysis March 2026 March market analysis: From enterprise software volatility to valuation compression across established large-cap franchises, this report […]

5-Point Financial Contract Trust Checklist: How to Know If a Company Is Legit

How to Know If a Company Is Legit – Our 5-Point Trust Checklist Written by Deane Biermeier, Certified Financial Educator […]

New US Senior Driving License Rules: Myth Vs. Fact

New US Senior Driving License Rules: Myth Vs. Fact Written by Tammy McKinney, RN, a registered nurse and consumer […]

Featured Reviews

Auto Loans

Balance Transfer Cards

BNPL

Budgeting Apps

Car Insurance

Cash Back Cards

Credit Cards

Credit Monitoring Services

Best Credit Monitoring Services

This review covers the best free and paid credit monitoring services, with category winners included to help you pick the right service for your unique situation. According to the Federal Trade Commission, 2.8 million fraud reports plagued the US last year, translating to a staggering $5.8 billion in consumer losses – a 70% year-over-year jump.

Debt Consolidation

Extended Car Warranty Companies

Best Extended Car Warranty Companies

We’ve partnered with industry expert Chris Teague to bring you the “Top 7 Extended Car Warranties for the year.” These reputable extended warranty companies can help you save money on unexpected car repairs, whether you drive a reliable sedan or a luxurious dream car.

Food Delivery Services

Best Meal Kit Delivery Services for Singles & Families

Craving delicious, home-cooked meals, but short on time or culinary skills? Finding the “best” meal kit delivery service is a personal journey, influenced by factors like taste, portion size, prices, and health needs.

Hair Loss Treatment

Best Hair Loss Treatments

Hair loss treatments can vary significantly depending on gender. Happy Head offers proprietary hair growth formulas prescribed by dermatologists, while Keeps is praised for its effectiveness, affordability, and free doctor’s consultations.

Hearing Aids

Best hearing aid for tinnitus

Invisible Eargo hearing aids received the top rating for [tcr_current_year], but newer brands like EleHear offer clinically proven, AI-powered tinnitus relief at a more affordable price. EleHear uses artificial intelligence to filter out the unwanted sounds caused by tinnitus.

Home Equity

Home Insurance

Home Mortgage

Home Security Systems

What's the best home security system – Vivint vs SimpliSafe?

Choosing the best home security system can be a daunting task, especially with so many popular brands to choose from. To help you make an informed decision, we enlisted the expertise of Chris Teague, a home security systems expert who has tested the leading systems in his own home.

Home Warranty Companies

Best Home Warranties

Home warranty companies can save homeowners living in expensive cities like Malibu or San Francisco thousands of dollars per year, where the average home appliance repair ranges from $200 to $400—nearly twice the cost in states like Virginia or Texas.

Identity Theft Protection Companies

Discover ID Theft Protection You Can Trust

Protecting your identity in today’s digital world is crucial. Phishing scams, where criminals impersonate legitimate companies to steal personal information, remain a prevalent threat, according to the FBI’s 2023 IC3 report.

Mattresses

Best Mattresses and Mattress Brands

Choosing the best mattress for your sleeping style and preferences is crucial for a good night's sleep. The only trick is finding your perfect match. With so many mattress brands, each with numerous types and styles to choose from, picking one from the bunch is a daunting problem.

Medical Alert System

The Best Medical Alert Systems With an Emergency Alert Button

Medical alert systems are nothing new, but the industry has kept pace with fresh technologies, making devices more usable and discreet over time. The number of choices has also grown to the point that there is a company with products and services that match almost anyone’s needs.

Personal Loans

Best Personal Loan Companies for 2026

Compare the best personal loan companies for 2026. Find top-rated lenders like Credible and Best Egg with low rates for fair to excellent credit. Apply today!

Pet DNA

Pet Insurance

Renters Insurance

Small Business Loans

Best Private Lenders for Business Loans and Startups

Image Sources: lendingtree.com – credibly.com – fundbox.com – forafinancial.com – nationalfunding.com – taycor.com

Stairlift

Top 6 Best Stairlifts For Seniors

We’ll give you our top picks for the most luxurious, heavy-lifting, straight, curved, and standing stairlifts for seniors. For those of you on a fixed income and budget, we’ll also give you the most affordable stairlift!

Student Loan Refinancing

Best Student Loan Refinancing Companies of the Year

Image Sources: risla.com – credible.com – elfi.com – mefa.org – citizensbank.com

Student Loans

Travel Insurance

Walk-in-Bath

American Standard Walk-in Tubs Review

American Standard has earned a reputation for quality and reliability as a top-rated walk-in tub manufacturer. These tubs have become […]

Recent Guide & Tips

Best Egg vs LendingClub

Best Egg vs LendingClub? Which personal loan lender actually fits your credit profile? We break down approval standards, flexibility, funding speed, and debt consolidation features so you can choose with confidence before you apply.

Best Egg vs Upstart

Best Egg vs Upstart: One favors fair credit borrowers. The other uses AI to expand approval. See which personal loan platform fits you best.

Should I Buy a Car or House First?

Should I buy a car or house first? A house is usually the better long-term investment, but your income, debt, and transportation needs determine the right move.

How Much Money Should I Save Before Buying a House?

How much money should I save before buying a house? Learn how to plan for your down payment, closing costs, emergency savings, and debt before becoming a homeowner.

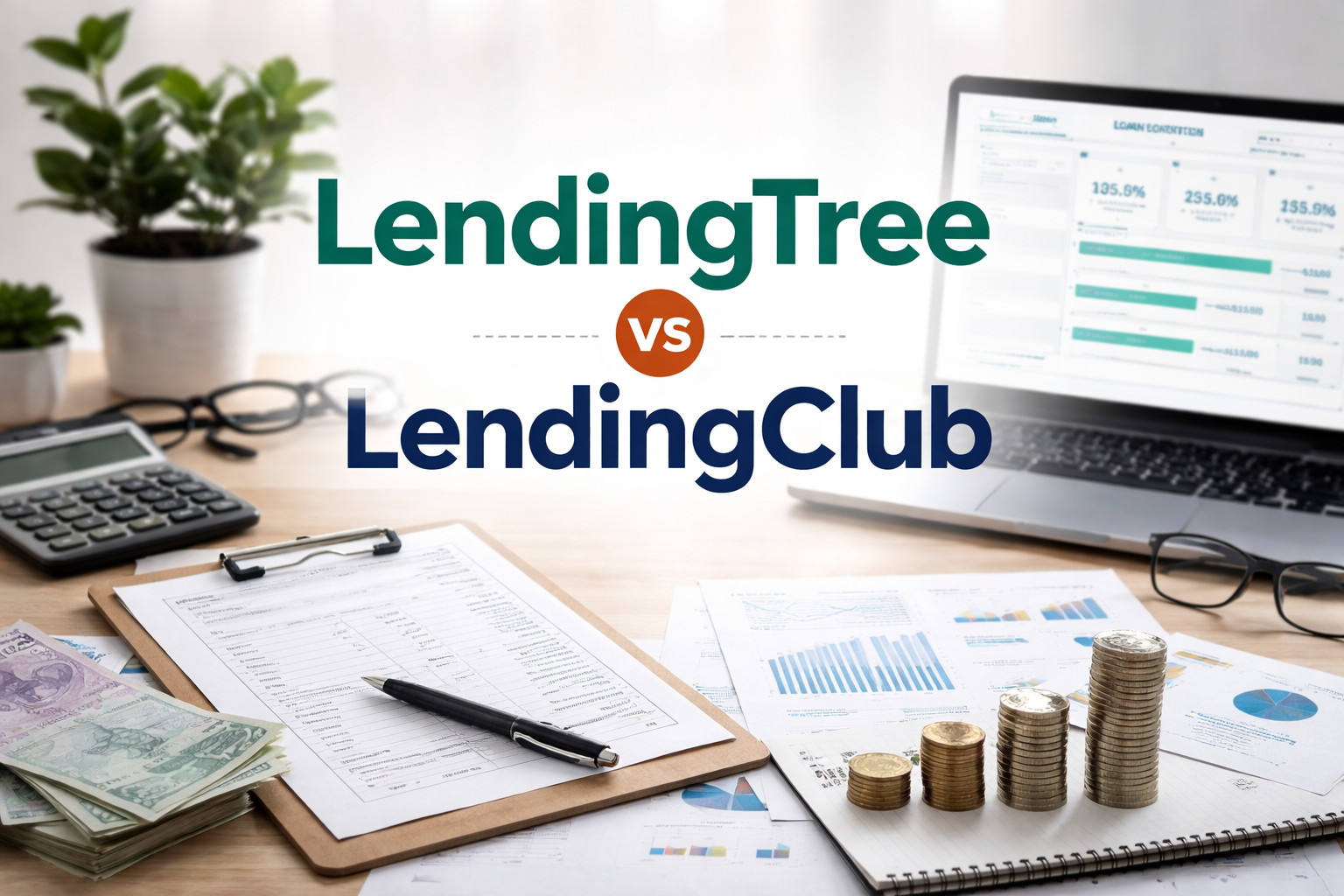

LendingTree Vs LendingClub

LendingTree vs LendingClub: marketplace vs direct lender. See how their personal loans, debt consolidation tools, and banking features stack up.