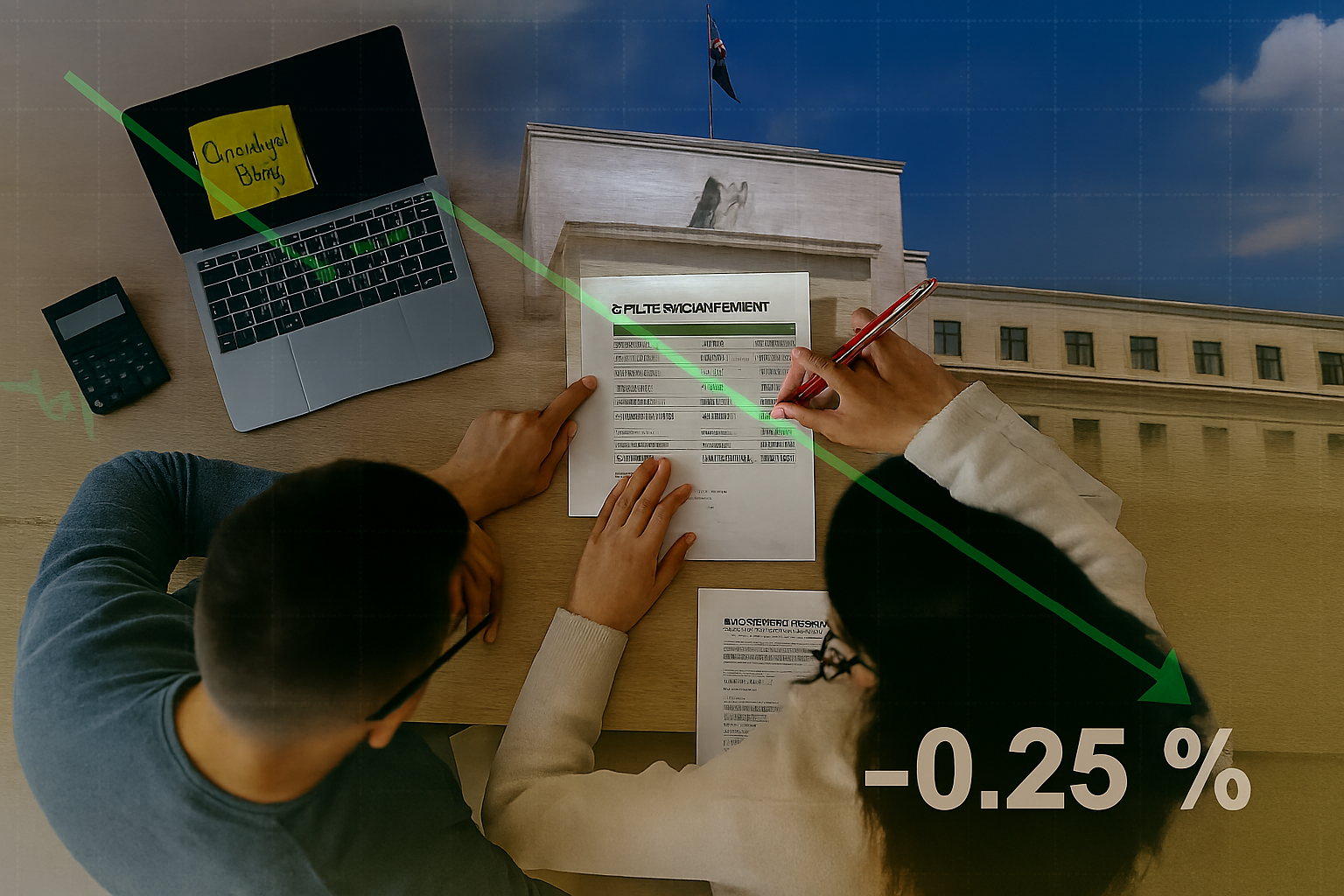

Fed Interest Rate Decision – What the New Lower Rate Means For You

Fed drops interest rates by 0.25%

The latest Fed interest rate decision could be just the start.

Copilot

The Federal Reserve announced last week it’s lowering interest rates for the first time in nearly a year. This rate affects how much interest banks have to pay one another if they borrow money. More importantly, it means that interest rates are also impacted on consumer products like credit cards, personal loans, and more. The Fed interest rate decision has been highly anticipated.

This could be an opportunity for you to save big on any outstanding debt you may have, and even begin planning for the future.

Here’s what you need to know about the Fed’s latest decision.

What The Fed Announced

The central bank meets nine times per year to discuss economic circumstances and to see if interest rates are currently serving the public’s needs. For nearly a year, the Fed has kept firm on its numbers. Due to weakening jobs data and tariff impacts, the Fed decided to lower interest rates by 0.25% (also referred to as 25 basis points).

What’s more, there could be further cuts on the way. Current odds are fairly certain that rates will come down in the final two meetings of the year in October and December. If that happens, it’s uncertain how much the rates will be cut in those meetings. But as rates are trimmed downward, it presents a strategic opportunity for Americans to make changes in their personal finances, for the better.

Here’s how you could approach this.

How the Fed Interest Rate Decision and Changes Affect You

Interest rates affect nearly every aspect of personal finance. Whether it’s student loans, mortgages, high-yield savings accounts, or personal loans, the opportunity cost has shifted slightly.

Here’s what to keep in mind as interest rates have dropped, and could potentially keep dropping in the coming months.

- Borrowing Costs: The cost of borrowing money has now decreased. This means that if you have high-interest debt like credit card debt or student loans, consolidating your debt could be worth considering. This even includes refinancing student loans to get a lower interest rate or obtaining an unsecured personal loan to cover unexpected expenses or a large purchase.

- Savings and Investments: The caveat to this is that high-yield savings accounts, CDs, and other accounts for saving money have also lowered their respective interest rates. Now, saving money is very slightly less valuable. However, it’s highly recommended to have an emergency fund in a high-yield savings account with 3-6 months of living expenses as part of your budget. But if you’ve already covered that, you may want to focus on paying off debt or investing for the future.

Things You Can Do Today

There are several financial items you can do today to understand where there may be opportunities for you to save money.

- List out all of your debts: It can be emotionally relieving to see all of your debts in front of you, along with their respective interest rates. With interest rates falling, you may be able to pay less in interest by either refinancing or consolidating. Additionally, if you have variable-rate debt, it may be beneficial to move into fixed-rate debt.

- Call your credit card provider: If you have revolving debt on a credit card, you could be paying significant interest each month. The average credit card interest rate is around 21%, and many consumers don’t even know their current interest rate on their card. Call your credit card company to see if they would be willing to lower your credit card interest rate. The worst thing they can say is “no.” And if they do, you can always try to get a 0% APR credit card and complete a balance transfer.

- Move your savings into a high-yield savings account: If you have money set aside in a savings account at a traditional bank, you’re likely earning next to nothing in interest. Despite interest rates going down slightly, it’s an easy way to have your money working for you.

Final Thoughts

The Fed is clear that this will not be the only rate cut in 2025. So while you don’t need to rush to capture the opportunity, it may be worth considering getting your personal finances in order to set a plan in place.

Opportunities

If you’re considering a personal loan or debt consolidation, now may be a good time to see what’s available. Current interest rates can make borrowing more affordable and help you pay down existing balances faster.

Several reputable online marketplaces and lenders, such as Credible, LendingTree, LendingClub, Upgrade, and Best Egg, make it easy to compare options side by side. The process is quick, and checking your approval odds through these providers involves only a soft credit pull, so it won’t affect your credit score.

Keep in mind that rates, terms, and eligibility vary by lender and are subject to credit approval. Exploring offers doesn’t mean you’re committing to a loan. It simply gives you more information about your potential borrowing power. With that knowledge, you can decide whether refinancing or consolidating debt fits into your financial plan.