Hurricane Helene and Homeowners Insurance

What will climate change mean for homeowners insurance?

Hurricane Season and Climate Change Can Affect Home Insurance Rates

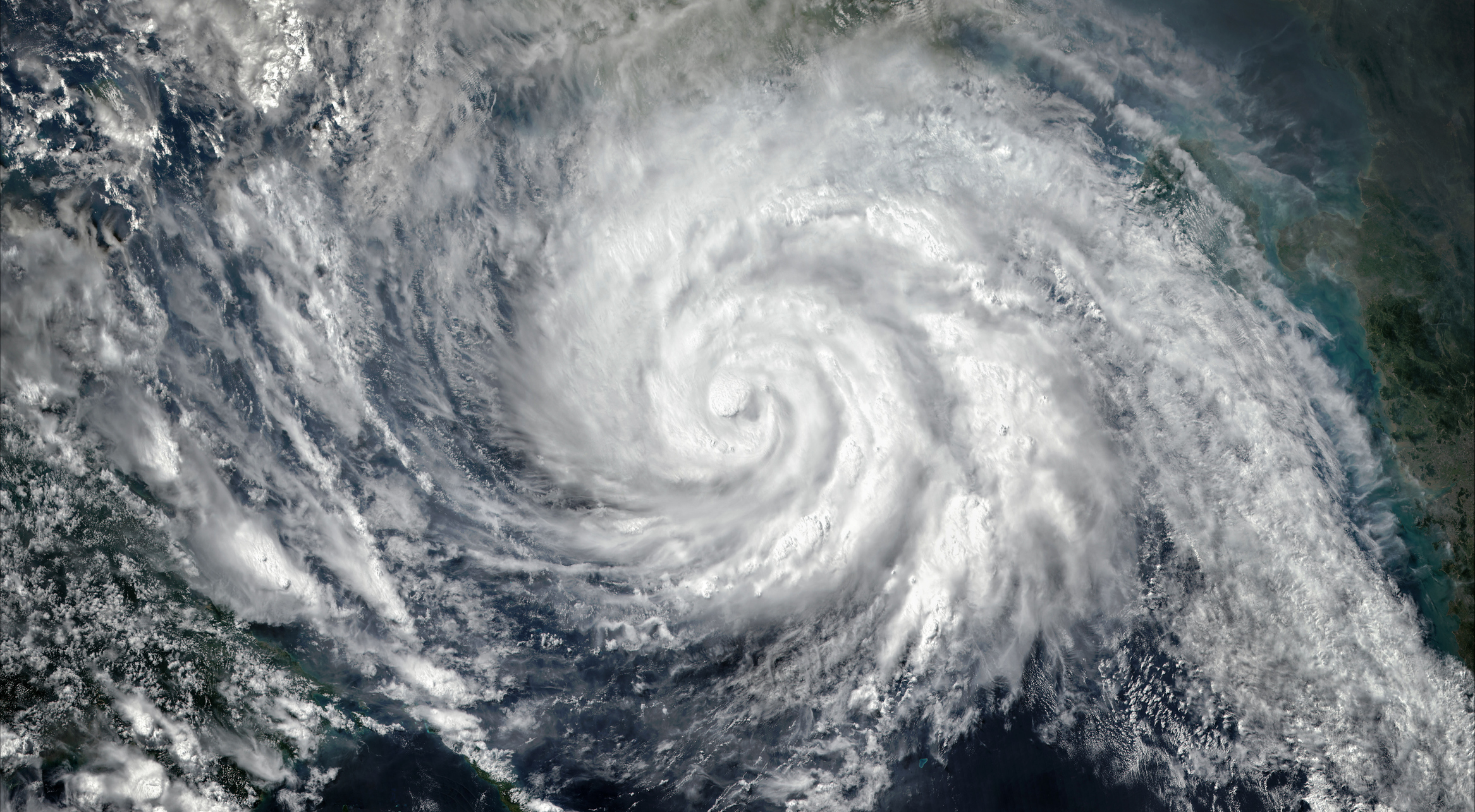

Image Credit: NOAA

As Hurricane Helene bears down on the Gulf Coast this week and into the weekend, and the hurricane season appears poised to ramp up, the perennial questions regarding home insurance and climate change pop back into mind.

The Congressional Budget Office released a report in August warning of property insurance concerns as the effects of climate change start to take hold.

The outlook isn’t great, and it’s not just a concern for those in storm-prone areas or those in the path of Hurricane Helene. According to the Congressional Budget Office, “Climate change heightens the risks of wildfires and other natural disasters. As insurance payouts for losses sustained in those disasters increase and as uncertainty about future losses grows, people in many high-risk areas have faced difficulty obtaining or affording insurance coverage for their property. As risk and costs increase, premiums will increase as well, which may make insurance less affordable for homeowners. If state regulators do not allow higher premiums, insurers may exit high-risk areas, reducing the availability of insurance.”

The report continues, including, “Higher land and ocean temperatures, drought, sea level rise, and excessive precipitation are all features of climate change that contribute to increasing the risks of natural disasters, including wildfires, hurricanes, and floods. With increased uncertainty attributable to climate change, insurers may limit coverage for risks that are difficult to quantify or where regulators constrain their ability to set prices reflecting risk.”

To make matters worse, the report explains that many homeowners underestimate the risks involved and underinsure their homes. Another concern is underinsurance due to unaffordability or unavailability.

Does Home Insurance Cover Hurricane Damage?

Most standard homeowners insurance policies in Florida, where Hurricane Helene hit hardest, cover hurricane-related damage, such as wind damage. However, these policies often come with separate hurricane or windstorm deductibles, which are typically higher than regular deductibles.

While hurricane insurance can help cover damage to homes in Florida, many policies carry higher deductibles and increased costs for this level of protection.

It’s also important to note that standard homeowners policies do not cover flood damage, which is common during hurricanes. For flood protection, homeowners will need a separate flood insurance policy, typically available through the National Flood Insurance Program (NFIP) or private insurers.

In some high-risk areas, homeowners may need to purchase separate windstorm insurance if wind coverage is excluded from their standard policy.

So Now What?

While we as homeowners can’t do much about home insurance rates or coverage restrictions, we can follow tried-and-true steps to ensure our home is protected as best as possible.

To ensure you have adequate home insurance, consider these steps:

- Assess Your Home’s Value: Get a professional appraisal to determine the current market value of your home and any improvements you’ve made.

- Inventory Your Belongings: Create a detailed list of your possessions, including photos and receipts. This helps in assessing the replacement cost for coverage.

- Understand Coverage Types: Familiarize yourself with different types of coverage—like dwelling, personal property, liability, and additional living expenses. Ensure your policy covers all relevant areas.

- Review Replacement Cost vs. Actual Cash Value: Opt for replacement cost coverage, which pays to replace items at current market prices rather than their depreciated value.

- Consider Natural Disasters: Check if your area is prone to natural disasters (like floods or earthquakes) and consider additional policies if needed.

- Check Policy Limits and Deductibles: Ensure your coverage limits are sufficient for rebuilding your home and replacing your belongings. Balance this with a deductible that you can afford.

- Shop Around: Compare quotes from multiple insurers to find the best coverage and rates. Don’t hesitate to negotiate.

- Ask About Discounts: Inquire about discounts for bundling policies, having security systems, or being claim-free.

- Review Annually: Regularly review your policy, especially after significant life changes (like renovations, purchases, or major life events).

- Consult an Insurance Agent: An experienced agent can help clarify coverage needs and recommend policies that suit your situation.

Who to Contact for Hurricane Home Insurance Protection?

Credible recently began working as a liaison between homeowners and home insurers to offer the best solutions based on your needs. To find the best coverage and compare rates, we recommend using Credible’s free platform to quickly compare home insurance plans.

Check out Credible’s online platform to see what you may be missing out on.

Additionally, because of the higher costs of today’s home insurance, consumers are looking for ways to help manage their finances. The best budgeting apps, personal loan providers, and student loan refinance companies can help. Consider trusted student loan refinance options like MEFA and Education Loan Finance. For balance transfer cards, Upgrade, Capital One, and Discover offer excellent choices. And when it comes to personal loans, LendingClub, Upstart, and LendingTree are highly rated for their low APR options and customer satisfaction.