Is Experian CreditWorks Premium Worth it?

You’ve likely heard the name Experian when discussing credit scores, credit bureaus, and financing. While the company is best known as one of the three well-known major credit bureaus, Experian also offers its consumer branch of business that it calls Experian CreditWorks—Not to be confused with Experian’s Identity Works program that focuses on identity protection.

Our Experian CreditWorks review focuses on Experian’s CreditWorks free and premium plans for credit monitoring. We’ll review the cost, ratings, customer reviews, and compare this product to other leading brands.

About Experian

Experian credit bureau officially began doing business under its current name in 1996. However, the company has a long history of gathering and reporting credit data under various names. In addition to acting as one of the three major credit data companies and operating in at least 37 countries worldwide, Experian also provides consumer resources, credit monitoring, and identity protection.

Experian credit monitoring, or CreditWorks, offers both a free service that tracks and reports on your Experian credit score using the FICO scoring model, as well as a monthly paid subscription that includes monitoring and reporting from all three bureaus and modest versions of identity protection benefits.

What’s the difference in Experian CreditWorks Basic vs. Premium Plan?

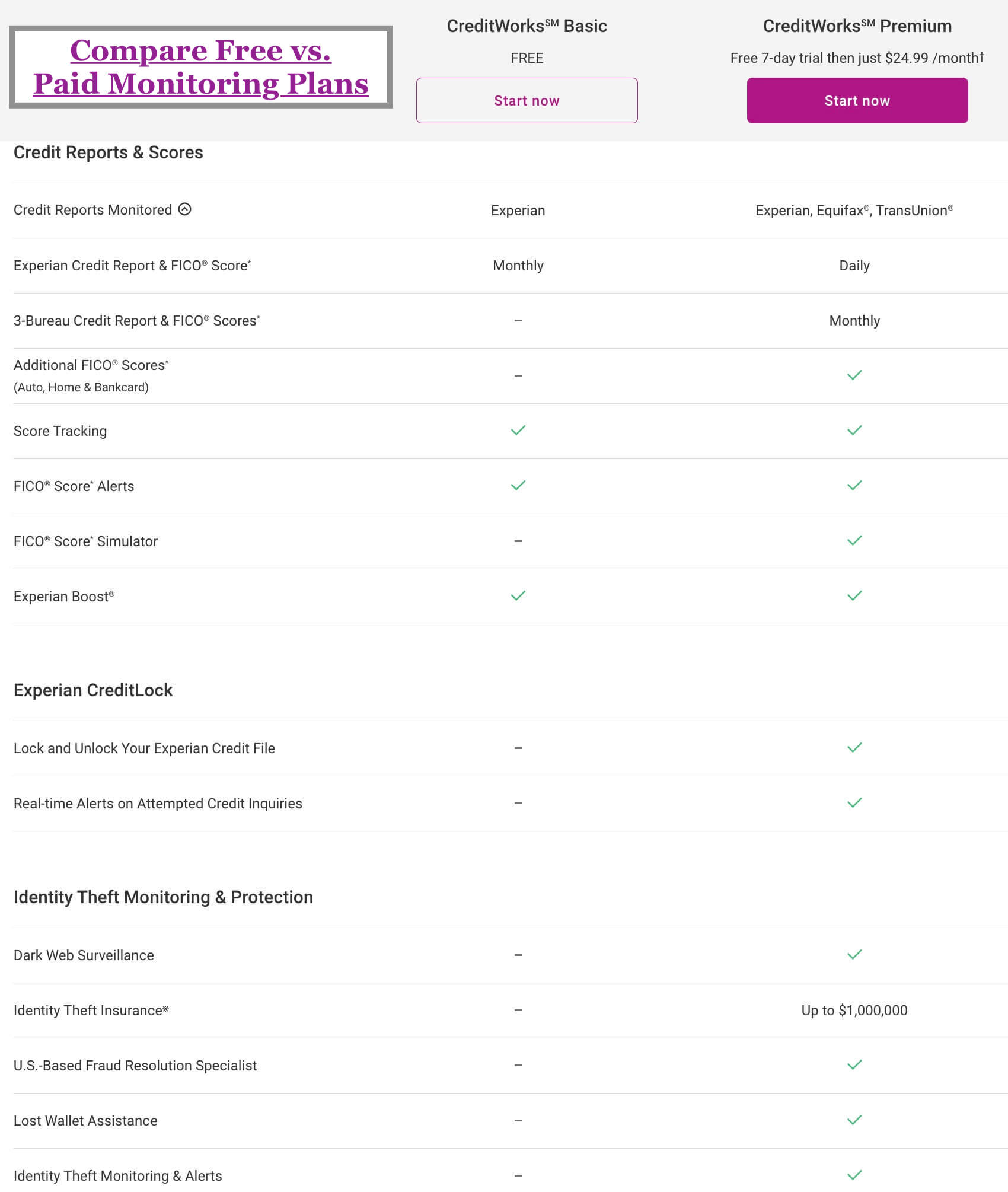

The CreditWorks free, or Basic, plan includes typical credit monitoring services, reporting, and monthly updates based on your Experian credit score, account alerts, and a mobile app. CreditWorks’ Premium plan, however, offers several additional benefits, including daily score updates, monthly access to all three of your full credit reports, and other FICO scores.

Here’s how Experian’s CreditWorks Free and Premium plans differ:

Experian CreditWorks Premium Review

Signing up with CreditWorks Premium also allows members to –

- lock and unlock their Experian credit file

- provides identity protection benefits, including $1 million identity theft insurance, fraud resolution and lost wallet assistance, and

- identity monitoring and alerts with dark web monitoring.

Experian’s website also offers anyone options to purchase a copy of their full Experian credit report or full copies from all three bureaus. Both credit monitoring plans offer Experian Boost, which offers the potential ability to rapidly improve your FICO credit score by providing additional utility bills and banking information.

Pros

Credit monitoring provided directly from one of the three major credit bureaus

Experian Boost availability can help quickly increase your credit score

$1 million identity theft insurance available

Widely used FICO score reporting

Free monthly credit report access with the paid plan

17% discount for annual plan purchases and pre-payment

Cons

The free trial period is likely too short to make an informed purchasing decision

Premium plan identity protections fall short of the competition at a similar cost

Review Experian Features and Benefits

Experian CreditWorks’ free and paid plans offer credit monitoring and reporting using the FICO 8 scoring model, the most commonly used score relied on by 90% of lending institutions. Experian CreditWorks offers several valuable features among both plans, including the following list.

- Monthly or daily credit score updates

- Experian Boost to help rapidly increase your FICO credit score

- Continuous activity monitoring of one or all three credit scores

- FICO score simulations

- Additional FICO score reporting

- Dark web monitoring

- Lost wallet and fraud recovery assistance

- $1 million identity theft insurance

Experian Editorial Rating

Trusted Company Reviews Rating Score for Experian: 9.0

| Criteria | Points |

| Better Business Bureau Grade | 4 |

| Trustpilot Review Rating | 4 |

| Free Credit Monitoring Available | 7 |

| Three-Bureau Reporting Available | 5 |

| Best Plan Monthly Cost | 7 |

| Identity Theft Features | 7 |

| Credit Score Update Frequency in Lowest-Cost Plan | 2 |

| Credit Score Update Frequency in Highest-Cost Plan | 8 |

| Family Plan Available | 0 |

| Additional Features | 10 |

| Expert Opinion Score | 36 |

Experian Plans and Prices

| CreditWorks Basic | CreditWorks Premium | |

| Monthly Price | $0 | $24.99 after a 7-day free trial, or $249.99 annually if paid in full at purchase |

| Features | Experian credit monitoring with monthly FICO score updates and access to credit card, loan, and insurance offers, plus Experian Boost | Same features as the free plan plus credit monitoring from all three bureaus and daily updates, monthly full credit report access, additional FICO score availability, identity theft protections, including $1 million in insurance, and credit file locking ability |

Is Experian Right for You?

Experian CreditWorks’ free plan offers standard credit reporting from a single credit bureau and a few other helpful features, including the potential to raise your credit score by providing detailed utility bill and banking information to the company. From that standpoint, there’s little risk in signing on with Experian’s free monitoring plan. However, expect an onslaught of numerous credit card and loan advertising in the app and online.

The paid plan, however, offers in-depth credit monitoring, reporting, and availability. While the Experian CreditWorks Premium plan includes a relatively steep monthly cost, the annual payment discount can help if you’re willing to make a year-long commitment.

In exchange for the subscription cost, the Premium plan offers some unique benefits that other credit monitoring providers simply miss. Monthly full credit report access and FICO score reporting stand out and may be worth the cost if you’re looking to build your credit score quickly or focusing on a large financed purchase.

While Experian does offer some identity theft protections with the CreditWorks paid plan, its cost is likely too high to be worth it compared to more focused ID protection providers. Experian’s IdentityWorks program may be a better fit in that situation.

Experian Vs. Equifax

Equifax is another of the three main credit bureaus and also offers credit monitoring and basic identity theft protections based on your chosen plan. The primary differences between Experian and Equifax are the number of available plans, the option for free credit monitoring, and the scoring model used.

While Equifax offers more plan choices than Experian, it doesn’t provide any free service options. Experian uses the FICO 8 scoring model instead of the VantageScore model used by Equifax.

| Experian | Equifax | |

| Free plan available | Yes | No |

| Credit score agency | FICO 8 | VantageScore 3.0 |

| 3-Bureau credit monitoring | Available with paid subscription | Yes, with all plans |

| Credit score improvement advice and tools | Yes | Yes |

| Credit score update frequency | Monthly with the free plan or daily with the paid plan | Daily |

| Digital banking options available | No | No |

| Identity theft protections | Available with paid subscription | Yes, with all plans |

| Mobile app | Yes | Yes |

| Family plan available | No | Yes, in the top-tier plan |

| Identity theft insurance | Yes | Yes |

| Lowest monthly cost | Free | $16.95 |

| Highest monthly cost | $24.99 | $29.95 |

Frequently Asked Questions

What is Experian?

Is Experian legit?

How does Experian monitor credit?

Why are my FICO score and VantageScore different?

Can Experian help me improve my credit?

Does Experian monitor all 3 credit bureaus?

Is Experian credit monitoring accurate?

How much does Experian credit monitoring cost?

Deane Biermeier

Editorial Reviews

Must Reads

Best Egg vs LendingClub

When comparing Best Egg vs LendingClub, the difference between the two comes down to specialization versus wider product availability. Best Egg is a streamlined personal loan lender built primarily for borrowers with fair to excellent credit who want predictable loan...

Best Egg vs Upstart

Best Egg vs Upstart When comparing Best Egg vs Upstart, the key difference comes down to underwriting philosophy and borrower fit. Best Egg generally serves borrowers with fair to good credit who may be more comfortable with traditional credit evaluation. Upstart, by...

Should I Buy a Car or House First?

Should I buy a car or house first? The Short Answer: Buying a house first is usually the smarter financial move. In most cases, buying a house before a car is the better long-term financial decision. Homes can build equity and potentially increase in value over time,...

How Much Money Should I Save Before Buying a House?

The Short Answer: How Much Money Should I Save Before Buying a House? Saving money for a home is mostly about your down payment, but it also includes closing costs and a financial cushion after you move in. Equifax (a major credit bureau) has recommended saving 25% to...

LendingTree Vs LendingClub

LendingTree Vs LendingClub LendingTree and LendingClub both provide access to personal loans, but they operate very differently. One functions as a lending marketplace, while the other is a direct lender and digital bank. Understanding that distinction is essential...

AmONE Vs LendingTree

When comparing AmONE vs LendingTree, the real question isn’t just which platform is more or less legitimate. It’s which marketplace structure better fits your needs. Both companies operate as financial product marketplaces, connecting borrowers with lenders offering...

Credible Vs LendingTree

Credible vs LendingTree, the real question is this: Do you want a streamlined personal loan marketplace, or a broader financial comparison platform with credit tools built in? While both companies let you compare multiple loan offers with only a soft credit check,...

How Does a HELOC Work?

If you’re a homeowner who needs access to funds, a Home Equity Line of Credit, or HELOC, can be a flexible option based on your home’s equity. Unlike traditional loans, it allows you to borrow only what you need over time. The Consumer Financial Protection Bureau...

Are Federal Tax Refunds Taxable?

A tax refund is the government giving you back your taxable income if you paid too much throughout the year. So federal tax refunds are not taxable; it’s yours to keep. However, there's an important exception that trips up many taxpayers, and it mainly involves state...

6 Common Budgeting Mistakes to Avoid

If budgeting feels harder than it should, you’re not alone. Many people struggle not because they lack discipline, but because they run into the same common budgeting mistakes over and over again. At Trusted Company Reviews, we review personal finance tools and...