Upgrade Loan & Card Reviews

Upgrade credit card and loan reviews describe a highly-rated FinTech online lending marketplace, providing a range of financial products such as personal loans, debt consolidation, cash-back credit cards, and checking and savings accounts. The company began in 2016 and consistently scores well across numerous ratings platforms.

Summary of Upgrade reviews (by the experts and its customers):

- Upgrade customer reviews: The Better Business Bureau (BBB) awards the company an impressive 4.5 of 5-star rating based on customer reviews. Over 39,000 Trustpilot reviewers award the company high marks, giving it an average score of 4.5 of 5 stars.

- The experts’ reviews: Upgrade is on our list of the top-rated personal loans for fair credit. Credit Karma also rates Upgrade’s personal loans with an excellent rating of 4.5 out of 5 stars.

- #1 rated cash-back card: Upgrade’s cash-back credit card also received the top rating for our list of the best credit cards for gas and groceries.

- Upgrade’s BBB rating: Upgrade is rated A+ and accredited at the BBB.

The following review reveals the pros and cons of using Upgrade to get a personal loan, helping you choose the right lender for your borrowing needs. Below, you can get prequalified loan offers from Upgrade and other top-rated lenders. As a lending marketplace, Upgrade operates differently than a traditional bank. The company allows potential debt consolidation and personal loan customers to gather real-time information about the financial products they might qualify for without affecting their credit scores.

Take 60 Seconds to Prequalify for Personal Loans (Upgrade and More!)

Pros

No fee to apply

No early payment fees

Fast funding turnaround

Highly-rated company

A+ BBB grade

Direct creditor payments available for consolidation loans

Adjustable payment date

Credit lines available

Upgrade credit cards offer 1.5% cash back, no annual fees or late fees

Cons

No autopay discount

Origination fees apply

Minimum credit score applies

$10 late payment fees apply

Upgrade Loan Features and Benefits

- Online lending company

- Online personal loan and debt consolidation marketplace

- $1,000 to $50,000 loan amounts

- 24 to 84-month repayment terms

- No fee to pre-qualify

- No autopay discount

- Origination fees apply

- Mobile app available

- 600 credit score required for approval

- Allows joint applicants

- Deposit accounts and credit lines also available

- Available nationwide

Upgrade Editorial Rating

| Origination Fee | 1.85 to 9.99% |

| Loan Terms | 24 to 84 months |

| Minimum Credit Score | 600 |

| Loan Amounts | $1,000 to $50,000 |

| BBB Rating | 4.48 / A+ |

What is Upgrade?

Upgrade Personal Loan and Debt Consolidation Interest Rates

- Allow Upgrade to pay lenders directly for consolidation loans

- Choose the auto-pay option for loan repayment

By taking these steps, you can potentially lower your interest rate and save money on your loan.

How to Get an Upgrade Loan

Obtaining an Upgrade debt consolidation or personal loan is a two-step process.

Step 1: Review Upgrade Pre-Qualified Loan Offers.

Begin by applying for pre-qualification on the company’s website by inputting personal and financial information, such as employment status, income amounts, and your social security number.

Upgrade will evaluate the information and return one or more loan or debt consolidation offers within minutes in most cases if you pre-qualify.

Step 2: Apply for Upgrade Loan

Upgrade Loan Requirements

- Ownership of a valid checking or savings account

- Applicants must be 18 years of age or older in most states

- Be a U.S. citizen, permanent resident, or visa holder in the country

- Have a valid email address

- Have required verifying documentation

- Prove an acceptable debt-to-income ratio (DTI)

Calculating Debt to Income Ratio

Approval and Acceptance

How Long Does Upgrade Take to Approve a Loan?

Why Is My Upgrade Loan Taking So Long?

Upgrade Loan Reviews

Is Upgrade Legit?

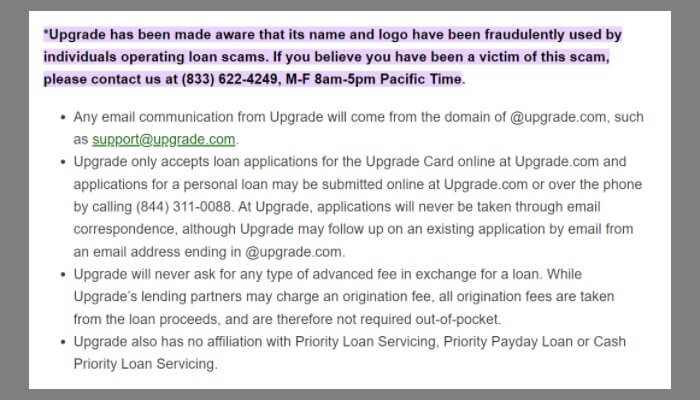

Upgrade Loan Scam

Upgrade Vs. The Competition

Upgrade Loans Vs. Upstart Loans

| BBB Grade / Rating | Average Reviews Rating | Origination Fee | Loan Terms | Minimum Credit Score | Loan Amount | |

| Upgrade | 4.48 / A+ | 4.6 | 1.85 to 9.99% | 24 – 84 months | 600 | $1,000 to $50,000 |

| Upstart | 1.24 / A+ | 3.4 | 0 – 12% Varies by Lender | 36 – 60 months | 300 | $1,000 to $50,000 |

Upgrade Vs. Credible

| BBB Grade / Rating | Average Reviews Rating | Origination Fee | Loan Terms | Minimum Credit Score | Loan Amount | |

| Upgrade | 4.48 / A+ | 4.6 | 1.85 to 9.99% | 24 – 84 months | 600 | $1,000 to $50,000 |

| Credible | 1.29 / A+ | 4.6 | 0 – 12% Varies by Lender | 12 – 84 months | No minimum stated | $600 to $100,000 |

Upgrade Vs. LendingClub

| BBB Grade / Rating | Average Reviews Rating | Origination Fee | Loan Terms | Minimum Credit Score | Loan Amount | |

| Upgrade | 4.48 / A+ | 4.6 | 1.85% to 9.99% | 24 – 84 months | 600 | $1,000 to $50,000 |

| Lending-

Club |

4.56 / A+ | 4.4 | 3% – 8% | 36 or 60 months | 600 | $1,000 to $40,000 |

Upgrade Credit Card Reviews

We cannot end this review on Upgrade without discussing its credit card. Upgrade credit cards offer unlimited 1.5% cash back with no annual fees or even late fees ever to be charged.

A $200 bonus is also offered to new Upgrade credit card holders with an Upgrade checking account.

Positive Reviews on Upgrade Credit Cards:

- Customer reviews on Credit Karma mention how easy it was to qualify for a high credit limit on the Upgrade Card.

- The Nerdwallet review on Upgrade’s Cash Rewards Visa credit card talks about how the card offers high reward points and cash back, no annual fees, and it’s available for credit scores as low as 600. Nerdwallet also discusses how customers are charged a fixed interest rate without pre-payment penalties, unlike most other cards that carry variable rates.

- Customer reviews at the BBB mention that qualifying for the Upgrade credit card is easy and fast. Customers also praised Upgrade’s customer service department for being helpful and easy to reach.

Learn more about the Upgrade Credit Card.

Negative Customer Reviews on Upgrade Credit Cards

While most online reviews for Upgrade are positive, our in-depth analysis uncovered some negative feedback. The common theme in the negative reviews concerns customers expressing dissatisfaction with Upgrade’s decision to lower their credit limits without apparent justification.

While it may be understandably unsettling for cardholders, the practice of creditors reducing credit limits is not unique to Upgrade. Many credit card companies resort to this measure when seeking to minimize risk amid rising interest rates and default rates.

Credit limit reductions may occur due to factors such as perceived insufficient card usage, tightened lending policies aimed at mitigating risk, or other underlying considerations. It’s important to note that this practice extends beyond Upgrade alone.

Upgrade Checking and Savings Account Review

Upgrade’s Rewards Checking Plus account, provided through Cross River Bank, offers an impressive 5.07% APY and up to 2% cash back on everyday purchases.

With no monthly fees, and the option to add the Upgrade Performance Savings account to boost potential rewards, Upgrade is a great option for those looking for a high-yield checking account with cashback rewards.

Key Features:

- High APY: Earn an impressive APY on all balances without monthly fees.

- Cashback Rewards: Earn up to 2% cash back on everyday purchases with the Upgrade VISA® Debit Card.

- Early Direct Deposit: Direct deposit users may receive payments up to two days early.

- No ATM Fees: No fees for ATMs nationwide.

- No Overdraft Fees: There are no overdraft fees.

- No Transfer Fees: No fees for transfers between Upgrade accounts or to other banks.

Frequently Asked Questions

How long does an Upgrade loan review take?

Is Upgrade a good loan company?

Does Upgrade do a hard pull?

What bank does Upgrade use?

How many Upgrade loans can I have?

Does Upgrade credit card payment history help build credit?

Source

Image Sources: upgrade.com – bbb.org – trustpilot.com

Disclosure

Personal loans made through Upgrade feature Annual Percentage Rates (APRs) of 7.99%-35.99%. All personal loans have a 1.85% to 9.99% origination fee, which is deducted from the loan proceeds. Lowest rates require Autopay and paying off a portion of existing debt directly. Loans feature repayment terms of 24 to 84 months. For example, if you receive a $10,000 loan with a 36-month term and a 17.59% APR (which includes a 13.94% yearly interest rate and a 5% one-time origination fee), you would receive $9,500 in your account and would have a required monthly payment of $341.48. Over the life of the loan, your payments would total $12,293.46. The APR on your loan may be higher or lower and your loan offers may not have multiple term lengths available. Actual rate depends on credit score, credit usage history, loan term, and other factors. Late payments or subsequent charges and fees may increase the cost of your fixed rate loan. There is no fee or penalty for repaying a loan early. Personal loans issued by Upgrade’s bank partners. Information on Upgrade’s bank partners can be found at https://www.upgrade.com/bank-partners/.