Trustedcompanyreviews.com offers free content, reviews and ratings for consumers to read, aimed at helping them compare their options. We may receive advertising compensation from companies featured on our website, influencing the positioning and sequence in which brands (and/or their products) are displayed, as well as affecting the assigned ratings. Please note that the inclusion of company listings on this page does not constitute an endorsement. We do not feature all available providers in the market. With the exception of what is explicitly outlined in our Terms of Service, we disclaim all representations and warranties regarding the information presented on this page. The details, including pricing, displayed on this site may undergo changes at any time.

2024's Top 5 Best Personal Loans | Colorado Springs, CO

Searching for the best personal loans in Colorado Springs, CO? Personal loans in Colorado Springs for fair credit applicants are available with APRs starting at just 6.99%, as of July 2024. Our financial experts have analyzed, ranked, and rated Colorado loan companies (online lenders included) and are ready to reveal the top picks! However, before we reveal the best Colorado Springs personal loan companies, let us first alert you to a potential new game-changing law and personal loan scams to avoid.

Josh Planos, from the Better Business Bureau (BBB), warns of rising scams from fraudsters pretending to offer personal loans. Colorado Springs residents in need of “fast funds” to “pay their bills” are being targeted by these scammers. The fraudsters contact consumers, pretending to be from a legitimate Colorado Springs personal loan company, and then offer fake payday loans. Colorado Credit Union’s fraud department warns consumers not to respond to unsolicited text messages and phone calls. Scammers will often “spoof phone numbers,” so it appears on your caller ID that they are calling from a Colorado Springs bank or lender. Their only goal is to get your bank account information and Social Security number to access your bank funds or, even worse – steal your identity. Don’t be fooled! To ensure you only deal with reputable Colorado lenders, start by checking if they are licensed to offer loans in Colorado by visiting the Colorado Department of Regulatory Agencies or the Colorado Division of Banking, which oversees state-chartered banks.

A recent law change in Colorado might also impact future access to Colorado Springs’ personal loans. In June 2024, Colorado opted out of the Depository Institutions Deregulation and Monetary Control Act (DIDMCA). Experts warn this could limit competition and potentially raise rates or reduce loan availability, particularly for borrowers with poor credit. However, this new law specifically affects Colorado’s state-chartered banks. To avoid dealing with these implications, consumers should consider online loan companies, which are generally exempt from the new regulations impacting state-chartered and national banks. Online lenders often offer lower fees, competitive rates, and faster approval times. Here are the top 5 personal loan companies in Colorado Springs. These top-rated Colorado Springs loan companies are all licensed with the Nationwide Multistate Licensing System & Registry (NMLS).

Best Colorado Springs Personal Loans with Low Rates and Fast Approvals.

Why trust Trusted Company Reviews

- Comprehensive review rating system.

- We work closely with consumers and experts to create editorial ratings.

Trusted Company Reviews #1 Pick for 2025

- Pre-qualification won't affect your credit score

- A multitude of companies and financial products available

- Some lenders have no minimum credit score requirements

Why we love it 💖

Credible’s personal loans in Colorado Springs stand out as our top performers. The company provides multiple loan options from various lenders with pre-approvals that won’t affect your credit score.

Our Highest Rated Colorado Springs Personal Loan Companies

- Loans from $600 to $100,000 available

- 12-year loan terms available

- Origination fees may apply for some lenders

- Many lenders require no minimum credit score

Via Credible.com's website

- Partners with over 500 lenders

- Loans as small as $1,000

- Up to 12-year loan terms are available

- Other lending and banking services are also available

- A+ grade at the BBB

- Great for those with short credit histories

- 24-hour fund availability

- Payment-date choices

- No minimum credit score necessary

- Pre-qualify without affecting credit score

- Other banking and borrowing services available

- Consolidation loans feature direct creditor payments

- Your choice of payment dates

- Repayment terms of 2 to 5 years

- Co-signers accepted

Via Credible.com's website

- Choose your payment date

- No early payment fees apply

- 12 – 84-month repayment terms

- Banking and credit lines also available

- No application fees apply

The Best Personal Loans – Colorado Springs

| Trusted Company Reviews Rating | Loan Amounts | Min. Qualifying Annual come | Min. Qualifying Credit Score | Best For | |

| Credible | 9.5 | $600 to $100,000 | Varies by Lender | None | Overall |

| Lendingtree | 9.2 | $1,000 to $50,000 | Varies by Lender | 580 | Best Borrowing Options |

| Upstart | 9.1 | $1,000 to $50,000 | $12,000 | None | Best for Short Credit Histories |

| LendingClub | 8.7 | $1,000 to $40,000 | Nondisclosed | 600 | Best for Additional Services |

| Upgrade | 8.6 | $1,000 to $50,000 | Nondisclosed | 580 | Best for Repayment Flexibility |

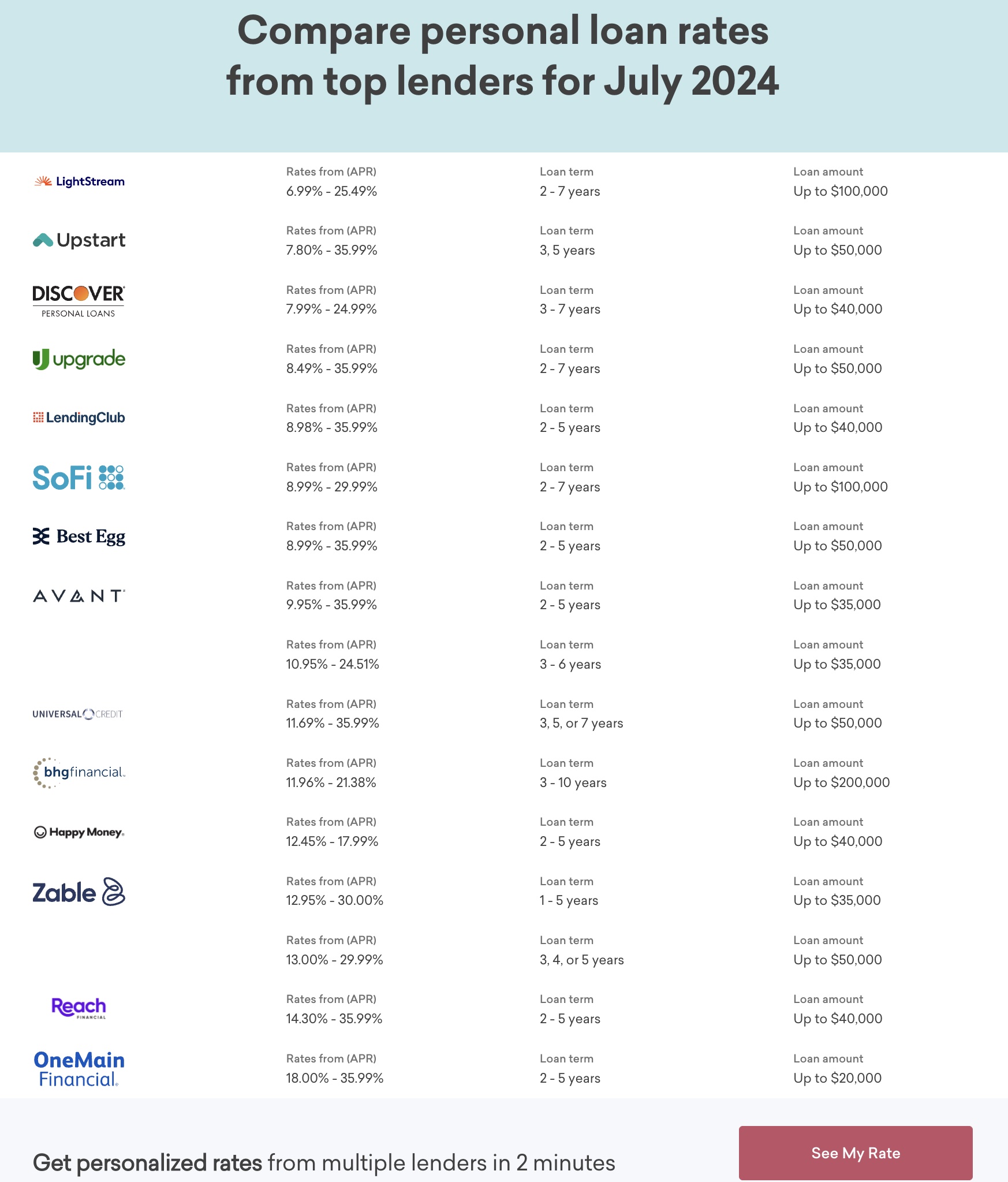

APRs for Online Lenders

How Do Online Companies Provide the Best Personal Loans – Colorado Springs?

Online, also known as fintech, lending companies offer a wide range of banking and borrowing services. Everything from bank accounts to personal loans, business loans, auto and boat loans, peer-to-peer lending, and home loans are available online, in the place of traditional banks, which used to be the only option.

Typically, the best personal loan lenders and the best debt consolidation companies that operate strictly or mostly online can provide benefits even beyond the added convenience of not having to leave home to apply. While many online lenders are also the lending institution, many aren’t. Instead, these fintech loan marketplaces allow borrowers to shop around for the best deals.

With fewer overhead costs and more ability to specialize, online lenders can offer better flexibility regarding who can borrow, how much, and for what. They can often approve loans for borrowers who may not otherwise qualify for a loan at a traditional lender.

Additionally, fintech lenders typically offer a simple application process that often includes pre-qualifying for your financial product. Pre-qualifications are typically not subject to hard credit inquiries and therefore, won’t affect your credit score. Pre-qualification can also allow the lender to offer several borrowing options to choose from.

Features of the Best Personal Loans In Colorado Springs

At first glance, the world of online lending can appear confusing. Modern advertising methods are excellent for attracting customers but aren’t often big on explaining details. While online lenders do offer their own unique product selections, most fintech companies are quite similar in nature. That said, there are some criteria to look for to start sorting through all the hype. The best personal loans in Colorado Springs generally offer versions of the following features.

- Easy and intuitive application process

- Pre-qualifying that won’t affect your credit score

- Rapid funding after approval

- Reasonable approval requirements

- Acceptable borrowing costs.

- Flexible payment terms and options

Qualifying for Personal Loans: Colorado Springs

Every personal loan provider in Colorado Springs will have varying minimum eligibility and approval requirements. While some are based on credit scores, many rely on other criteria, such as income level or bank records. Typically, as in traditional lending, the strength of a customer’s borrowing capacity depends on several factors and will affect the personal loan interest rates they may pay.

While no single factor is likely to automatically determine the loan amount or annual percentage rate at which you can receive approval, there are some basic minimum requirements in Colorado Springs.

- Minimum credit score determined by each lender—Many lenders have no minimum requirement.

- Lenders that don’t require a credit score may use AI to determine eligibility.

- Stable income—Some lenders have minimum requirements

- No recent bankruptcies

- Bank account for most loans

- Proof of identification and address

- Social Security number

Pros and Cons of Online Personal Loans In Colorado Springs

Understanding the pros and cons of borrowing from one of the best personal loan lenders in Colorado Springs can go a long way toward improving your financial well-being. While online lending is easy and convenient, it may not be the best option for every borrower.

Pros

- Proper loan management can help to improve poor credit scores

- Debt consolidation can reduce monthly payments and streamline bookkeeping

- Many online lenders offer pre-qualifying with only a soft credit inquiry

- Many lenders offer flexible repayment terms

Cons

- Interest rates are often higher than more traditional borrowing options.

- Loan origination and other fees may apply with some lenders

- Late payments can affect credit scores

- The initial application will temporarily affect your credit score

How to Choose the Best Personal Loans: Colorado Springs

Because of the large number of online lenders available, choosing the best personal loan provider in Colorado Springs can appear overwhelming.

Identifying your borrowing needs and capacity before getting started can help you choose the right personal loan provider. To help get you started, determine the answers to these financial questions.

- How much do I need to borrow, or what financial product do I need?

- Do I meet the minimum qualifications for approval with the lender I’m considering?

- How much will borrowing cost, and can I afford the monthly payments now and in the future?

- Will my payment be significantly lower if I’m consolidating debt?

- Can I put off getting a loan until I can improve my credit score to save interest money?

Which Are the Best Personal Loans In Colorado Springs?

The best personal loan provider in Colorado Springs is Credible in our opinion and based on our evaluations. Our judging criteria placed Credible at the top of our list in nearly every category. However, our criteria may not apply as well to your personal financial needs. Therefore, the best option for you may be one of our other top picks.

Credible

Best Overall

Credible tops our list for the best personal loan provider in Colorado Springs. As an online lending platform rather than a lending institution, the company partners with multiple lending organizations to provide a wide range of borrowing and financial product options.

Borrowers in Colorado Springs can use the pre-qualification tool to pre-qualify when using Credible without affecting their credit scores. Additionally, Credible clients can choose from several lender offers before formally applying for a loan or other service.

Credible Pros and Cons

Pros

- No fees apply to use the platform

- Pre-qualification won’t affect credit score

- Loan terms of up to 12 years

- Some lenders require no minimum credit score

Cons

- Borrowers with poor credit can face high APRs of up to 36%

- Some lenders have relatively low customer satisfaction ratings

Credible Features and Benefits

Credible is a leader in providing Colorado Springs residents with loan options simply by offering numerous financial products that meet the needs of many types of customers. The company’s marketplace setup allows customers to choose the best option for their financial situation.

- Pre-qualify without affecting credit score

- No fees to use Credible

- Large selection of companies and financial products available

- No minimum credit score necessary for some lenders

- A+ grade at the BBB

- Loan amounts from $600 to $100,000

- Terms of up to 12 years

- Fees and eligibility vary by lender

Credible Editorial Rating

Trusted Company Reviews Rating Score for Credible: 9.5

Review ratings from multiple platforms give Credible an average of 4.4 out of 5 stars. Our evaluation of the company revealed the same general findings and produced a score of 9.5 out of 10 possible points.

Credible gained points for its ability to provide a wide range of products to a large number of consumers. Its ability to allow customers to choose from a variety of borrowing choices, including options for those with less-than-great credit, also scored well in our review.

Read Full Review: Credible

| Loan Amounts | $600 to $100,000 |

| Terms (Months) | 12 to 144 |

| Origination Fee | Varies by Lender |

Lendingtree

Best Borrowing Choices

Lendingtree stands apart from typical Colorado Springs personal loan lenders. The company’s online financial marketplace features a virtual buffet of borrowing and banking products and choices. Lendingtree’s collection of over 500 lending partners provides a huge selection of varying financial products, many of which are obtainable by those with underwhelming credit scores.

Lendingtree Pros and Cons

Pros

- Partners with 500+ lending organizations

- Wide range of loan terms of up to 12 years

- Banking and other products are also available

Cons

- Maximum borrowing amount of $50,000

- Potential for high APR of nearly 36% for some borrowers

Lendingtree Features and Benefits

As one of the premier online financial companies, Lendingtree provides a long list of features and benefits related to its personal loan, debt consolidation, and other financial products.

- Partners with more than 500 lending companies and organizations

- Graded A+ at the BBB

- Offers lending, banking, and other products

- No hard credit inquiry during pre-qualification

- Choose from multiple borrowing options from various lenders

- Offers free credit score monitoring

- Peer-to-peer lending available for some borrowers

- 580 minimum credit score is necessary for some services

- Several lenders allow co-signers

- Fees vary by lender

Lendingtree Editorial Rating

Trusted Company Reviews Rating Score for Lendingtree: 9.2

A prominent feature that Lendingtree offers for those with imperfect credit is the ability to add a co-signer to help qualify them for some of its loan products. Of course, approval will depend on the partner company involved. We awarded Lendingtree additional points for offering that feature in our review. For borrowers with fair or poor credit, having a cosigner option can fetch a better interest rate and better terms overall.

Read Full Review: Lendingtree

| Loan Amounts | $1,000 to $50,000 |

| Terms (Months) | 12 to 144 |

| Origination Fee | Varies by Lender |

Upstart

Best for Short Credit Histories

Upstart is our top pick for personal loans in Colorado Springs for those with short credit histories that are often associated with lower credit scores. Upstart’s list of features also includes the ability to choose your payment dates, no minimum credit score, and pre-qualifying that won’t appear on your credit report or affect your score.

Upstart Pros and Cons

Pros

- Options for those with short credit histories

- 24-hour funding is often available

- Flexible payment dates

- No minimum credit score requirements

Cons

- Origination fees may apply

- No discounts for autopayments

- Cosigners not accepted

Upstart Features and Benefits

Upstart offers services to a wide range of borrowers in many financial situations. Many individuals with lower credit scores also contend with short credit histories, making it even more difficult to get approval for an unsecured personal loan. Upstart can often work with borrowers in tricky situations and doesn’t automatically refuse service on that basis alone.

- Borrowing options for those with short credit histories

- Uses AI to determine creditworthiness

- No minimum credit score to hit

- Pre-qualifying doesn’t affect credit score

- Funds often available in a single day

- Payment date flexibility options

- Consolidation loans can feature direct creditor payments

- Loan Amounts of $1,000 to $50,000

- Loan terms or 36, 60, or 84 months

Upstart Editorial Rating

Trusted Company Reviews Rating Score for Upstart: 9.1

While Upstart offers some of the best personal loans in Colorado Springs, the company missed out on a few points in our review for its limited loan-length terms, potential for origination fees, and lack of autopay or other discounts.

However, the company scored well in several other areas, including requiring no minimum credit score, offering payment date flexibility, and providing the potential ability to overlook a short credit history.

Read Full Review: Upstart

| Loan Amounts | $1,000 to $50,000 |

| Terms (Months) | 36,60, and 84 |

| Origination Fee | 0% to 12% |

LendingClub

Best Additional Services

LendingClub Pros and Cons

Pros

- Bank accounts and other services are available

- Cosigners accepted

- Flexible payment dates

Cons

- Offers only two payment term options

- Origination fees of 3% to 6% apply

- No rate discount for autopayments

LendingClub Features and Benefits

- Minimum credit score of 600 required for eligibility

- Loans typically funded in one week or less

- Payment date flexibility options

- Cosigners allowed

- Online application and approval

- Deposit, banking, and credit line accounts are also available

- 24 to 60-month borrowing terms

- Loan origination fees apply

LendingClub Editorial Rating

| Loan Amounts | $1,000 to $40,000 |

| Terms (Months) | 24 to 60 |

| Origination Fee | 3% to 6% |

Upgrade

Best for Payment Flexibility

Upgrade features excellent personal loan and debt consolidation payment options By offering customers several loan-length choices from one to seven years, allowing cosigners, and providing flexible payment dates. Upgrade makes finding one of the best personal loans in Colorado Springs easy.

Upgrade Pros and Cons

Pros

- Payment date flexibility available

- Credit lines and cards are also available

- Cosigners allowed

Cons

- Autopay discount not available

- Origination fees may apply

- $10 late payment fees

Upgrade Features and Benefits

Among Upgrade’s multiple features and benefits, the company also provides credit card options and other banking tools for borrowers in a wide eligibility range.

- 12 to 84-month loan repayments

- $1,000 to $50,000 loan amounts

- Autopay discounts unavailable

- Origination fees apply

- Mobile app availability

- A 580 credit score is necessary for eligibility

- Accepts joint applicants

- Deposit accounts and credit lines are also available

Upgrade Editorial Rating

Trusted Company Reviews Rating Score for Upgrade: 8.6

Upgrade scored points with our research team for its flexible personal and debt consolidation payment terms, along with other benefits. However, we deducted points from Upgrade for charging origination fees and not offering autopay discounts.

Read Full Review: Upgrade

| Loan Amounts | $1,000 to $50,000 |

| Terms (Months) | 24 to 84 |

| Origination Fee | 1.85% to 9.99% |

Frequently Asked Questions

These are some of the most common questions surrounding personal loans in Colorado Springs

Typically, personal loan interest isn’t tax deductible in Colorado Springs or anywhere else. However, that’s not always the case, depending on how the funds are used and in what capacity. Personal loan interest may be deductible in limited cases where business funding is involved. But, it’s crucial to talk with a tax expert on this issue to avoid potential trouble.

Depending on your lender or online marketplace, you may not need a credit score at all to qualify for some personal loan options. However, loans of this nature tend to be more expensive in terms of APR than loans obtained using a high credit score. Typically, a minimum credit score of 580 is necessary for most lenders to start considering loan approval.

Perhaps the easiest place to get a personal loan in terms of not having to prove your creditworthiness is at a payday loan lender.

However, these businesses are often predatory and can cost far more than they are worth in terms of assisting you financially. Some Colorado Springs payday lenders have been found charging over 400% interest to vulnerable borrowers.

Colorado banks and local credit unions offer a secure and well-established lending environment, along with a range of other financial services. If you need quick access to cash, personal loans from a bank can provide competitive interest rates and flexible repayment terms. However, banks often have stricter lending rules and requirements compared to online lenders, making it more challenging to secure a loan through a bank.

At TrustedCompanyReviews.com, we believe Credible is the safest place to get a personal loan. Credible is owned by Fox Corporation, a multinational mass media company, adding a layer of trust and reliability. Additionally, our review team has received only positive feedback from customers in Colorado Springs who have used Credible for personal loans. Furthermore, TrustPilot.com has over 7,500 customer reviews for Credible, with an impressive average rating of 4.8 out of 5 stars.