Trustedcompanyreviews.com offers free content, reviews and ratings for consumers to read, aimed at helping them compare their options. We may receive advertising compensation from companies featured on our website, influencing the positioning and sequence in which brands (and/or their products) are displayed, as well as affecting the assigned ratings. Please note that the inclusion of company listings on this page does not constitute an endorsement. We do not feature all available providers in the market. With the exception of what is explicitly outlined in our Terms of Service, we disclaim all representations and warranties regarding the information presented on this page. The details, including pricing, displayed on this site may undergo changes at any time.

The Best Balance Transfer Cards for Fair Credit

Are you trying to figure out the best way to consolidate high-interest debt with fair credit? Balance transfer cards can offer you a path to slash your interest rates and reach your debt-free goals faster. We’ve carefully researched and compiled a list of the best offers for 2024, with the latest information on rates and terms. Reputable companies like Upgrade, Capital One, Discover, and First Tech are among our top picks.

We’ll equip you with the details you need to find the best balance transfer card for your situation. We’ll also explore top-rated personal loans for fair credit as an alternative. If you find this review helpful, check out our 2024 reviews on top-rated credit cards for cash back and building credit.

Why trust Trusted Company Reviews

- Comprehensive review rating system.

- We work closely with consumers and experts to create editorial ratings.

Trusted Company Reviews #1 Pick for 2024

Why we love it 💖

Upgrade balance transfer cards offer a fixed rate and term to help customers pay off balances faster and save on interest.

Our Highest Rated Balance Transfer Cards for Fair Credit Companies

- BBB Accredited

- Highly rated by customers

- Low-Fair credit OK

- Earn 1.5% Cash back

- Pay less interest with a fixed APR

- APR 30.74% variable APR

- No annual fee

- 4% balance transfer fee

- No foreign transaction fees

- High consumer satisfaction ratings

- Robust mobile app

- First Tech Credit Union membership required to apply

- 13.5% –18% variable APR

- $0 and 0% balance transfer fees

- Bonus and spending rewards are available

- Other banking services available

- No annual, foreign transaction, or cash advance fees

- Available for enrolled students

- Other student card options available

- 18.24% - 27.24% variable APR

- No annual fee

- Little or no credit score necessary for approval

- 0% intro APR for 6 months

Debt Consolidation Loan vs. Balance Transfer Cards

Personal loans can be a powerful tool for fair credit borrowers seeking to consolidate high-interest debt. Let’s explore the pros and cons of personal loans compared to balance transfer cards for this purpose.

Advantage: Personal Loans

- Potentially Lower Rates: Personal loans often boast lower interest rates than credit cards, especially for borrowers with fair credit.

- Fixed Rates for Predictability: Personal loans typically offer fixed interest rates, providing clear budgeting advantages over variable credit card rates.

Ready to compare top personal loans for debt consolidation? Simply click on the lender’s name to learn more and potentially apply.

Compare Personal Loan Rates for 2024

Best Balance Transfer Cards for Fair Credit Comparison

| Card | APR | Trusted Company Reviews Rating | Balance Transfer Fee | Annual Fee | Minimum Credit Score |

| Capital One Platinum® | 30.74% (Variable) | 9.3 | 4% | $0 | 630 |

| First Tech Choice Rewards World Matercard® | 13.5% –18% (Variable) | 9.1 | 0% | $0 | 640 |

| Discover it® Student | 18.24% – 27.24% (Variable) | 9.0 | 5% | $0 | N/A |

Check top-rated personal loans:

- Top Rated Personal Loans in Colorado Springs

- Top Rated Personal Loans in NY

- Top Rated Personal Loans in Iowa

- Highest Rated Online Lender for 2024

- Best Rated for Debt Consolidation

- Best Rated Personal Loans for Fair Credit

What is Fair Credit?

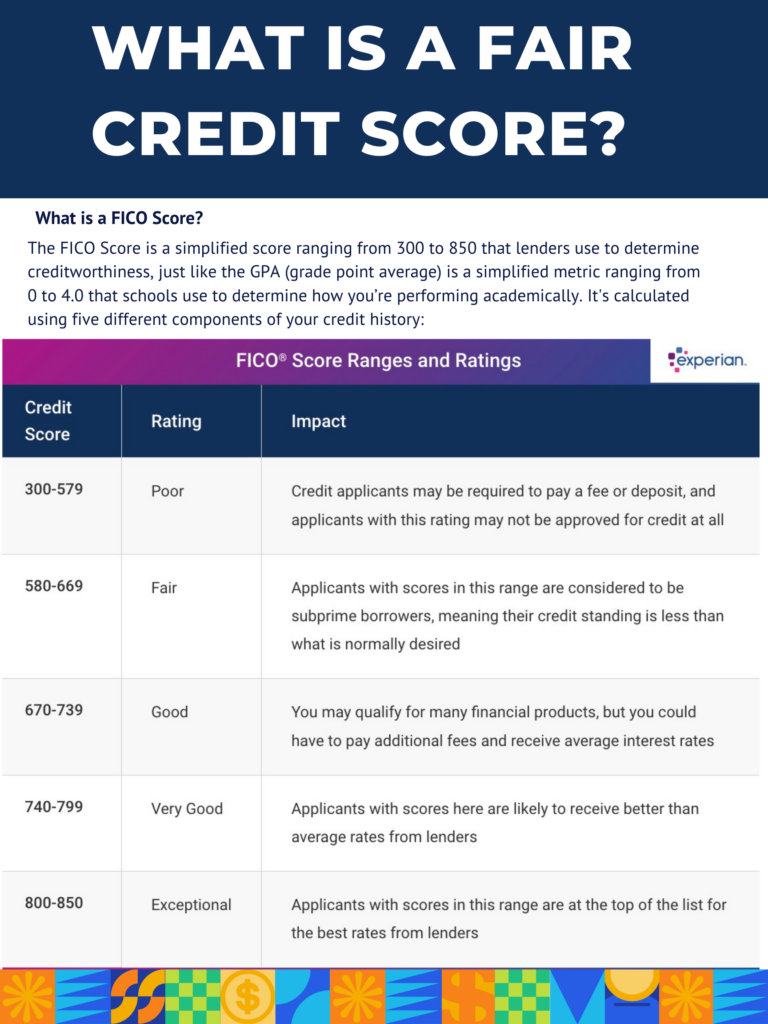

According to an article at Credit.org, the average FICO credit score in the U.S. is around 711. Card providers generally use two types of credit scores when determining credit card approvals—FICO scores and VantageScore 3.0. A 711 FICO score is approximately equivalent to a 690 VantageScore.

In FICO terms, the average credit score rates as good, while in VantageScore 3.0 terms, the average is listed only as fair. A fair credit score is common among individuals with a short credit history or who are just getting started developing their credit profile. Fair credit scores can also result from negative marks on a credit report for things like late or missed payments or other issues.

A fair credit report, between 580 and 669 for FICO or 650 and 699 for VantageScore 3.0, isn’t the worst possible score. However, having a low score can limit your credit approval odds and result in paying higher interest and other fees.

Image Credit: Experian

What is a Balance Transfer Credit Card for Fair Credit?

Having a fair credit score can hurt the chances of individuals obtaining financial tools such as balance transfer credit cards. Most balance transfer cards are reserved for those with good to exceptional credit. As rare as they are, a balance transfer card for fair credit is designed to help build credit, consolidate debt, and potentially save money.

Features of the Best Balance Transfer Cards for Fair Credit

Like the best personal loans, the best balance transfer cards for fair credit provide access to funds to help you achieve financial goals. In the case of balance transfer cards, the goal is to combine one or more debts, including credit cards or other unsecured debts, into a single payment to help streamline bill paying and potentially save money both now and in the relatively near future. The best balance transfer cards for fair credit often include the following attributes.

- Low to moderate interest rates

- Cash-back rewards or other types of card-ownership benefits

- Low balance transfer costs

- Lower-than-average approval requirements

- General ease of use

- Little or no annual fee

- Some offer pre-approvals to help protect your credit score

How We Chose the Best Balance Transfer Cards for Fair Credit

We chose the best balance transfer cards for fair credit by first identifying the small number of them available that are worth pursuing. After gathering several of them, we eliminated ones that offered benefits that were too insignificant to make a financial difference for the good. After all, the worst outcome for those with fair credit is to make things worse.

After whittling down our list, three balance transfer cards for fair credit in our review proved worthy of pursuing. However, not all of them are available to every consumer. One of the most significant factors in our ranking is how large of an audience each card is available to. The ones you choose from may come down to your eligibility, not because of credit history but because ownership availability may be limited to particular groups.

How to Choose a Balance Transfer Credit Card: What to Look For

When searching for a credit card available to those with fair credit or below, the first objective is to identify which ones you may qualify for. Beyond that, identifying the one that offers the best and most useful benefits to you and your financial situation is essential. Here are some factors to consider when searching for the best balance transfer cards for fair credit.

- Low to moderate APR, or at least a low intro APR effective long enough to help considerably pay down debt

- Low balance transfer fees or low introductory APR on balance transfers

- Rewards, even if not robust, that are available for the items you purchase and the vendors you shop at most often if desired

- Pre-approval availability to reduce the chance of generating unnecessary hard inquiries on your credit report

- Approval requirements that meet your financial and credit score standing

- Credit-building benefits, such as regular reviews for limit increases and three-bureau credit reporting

Balance Transfer or Debt Consolidation?

More than one way to consolidate credit card debt exists. The best debt consolidation companies also offer several attractive and often effective ways to reduce overall debt loads. Many can also help increase your credit score over time if used correctly.

So, is a balance transfer or debt consolidation better? The answer is in the details of the method you choose. Balance transfer debt consolidation may involve transfer fees and revolving credit APR, which are often more costly over time than a personal loan for debt consolidation.

Debt consolidation loans provide a fixed APR and sometimes slightly lower interest rates. However, the interest rate may not be substantially lower for those with fair credit, and a loan origination fee may apply as well.

One method isn’t better or worse than the other. The answer to the question lies solely in your financial needs and situation.

| Fixed Payment | Funds Availability | APR Range | Consolidation Cost | |

| Balance Transfer Credit Card | No | Continous | 13% – 31%

(Variable) |

0% – 5% |

| Debt Consolidation Personal Loan | Yes | One-Time | 15% – 36% | 0% – 12% |

Alternative to Balance Transfer Cards: Best Personal Loans

Check out recent reviews on credit cards and personal loans:

- Amex Blue Cash Preferred

- Citi Custom Cash Card

- Top Rated – Chase Freedom Unlimited

- Check top-rated personal loans for free at Credible

Consider Top-Rated Personal Loans for Fair Credit

| Lender | Fixed (APR) | Loan Amounts |

Minimum Credit Score

|

| Upstart Personal Loan | 6.40% to 35.99% | $1,000 to $50,000 | 620 |

| LightStream Personal Loan | 7.49% to 25.49% | $5,000 to $100,000 | 700 |

| Discover Personal Loan | 7.99% to 24.99% | $2,500 to $40,000 | 660 |

| PenFed Credit Union Loan | 8.49% to 17.99% | $600 to $50,000 | 700 |

| Upgrade Personal Loan | 8.49% to $35.99% | $1,000 to $50,000 | 600 |

| Sofi Personal Loan | 8.99% to 25.81% | $50,000 to $100,000 |

Does Not Disclose

|

| Best Egg Personal Loan | 8.99% to 35.99% | $20,000 to $50,000 | 600 |

| LendingClub Personal Loan | 9.57% to 35.99% | $1,000 to $40,000 | 660 |

| Avant Personal Loan | 9.95% to 35.99% | $20,000 to $35,000 | 550 |

| Universal Credit Personal Loan | 11.69% to 35.99% | $1,000 to $50,000 | 560 |

| OneMain Financial Personal Loan | 18% to 35.99% | $1,500 to $20,000 |

Does Not Disclose

|

| Zable Personal Loans | 8% to 30% | $1,000 to $25,000 | 600 |

| Happy Money Debt Consolidation Loan | 11.72% to 24.67% | $3,000 to $40,000 | 640 |

Source: TrustedCompanyReviews.com, Top-Rated Personal Loans Review

What’s the Best Balance Transfer Card for Fair Credit?

Our choice for the best balance transfer card for fair credit is the Capital One Platinum credit card. Despite the card’s higher-than-average variable interest rate of around 30.74%, it offers low balance transfer fees of 4% and features no annual fee. The card is also useful for traveling with no foreign transaction fees.

However, the most prominent feature putting it in front of all others is its availability to a wide audience with no affiliations or memberships necessary. Many with credit scores as low as 630 can qualify for the card, and a pre-qualification step is available to see your approval odds before taking a hit on your credit report.

Capital One Platinum®

Our Capital One Platinum Card review showcases a balance transfer card that’s available to a wide range of credit situations. There are other credit cards out there with more reward offerings and lower interest rates. However, if building or rebuilding your credit profile is part of your financial plan, the Capital One Platinum could be a solid solution.

The Platinum® card features no annual fee, low balance transfer fees, and a feature-packed mobile app to help you monitor and manage everything about your card. Most importantly, Capital One instills confidence when applying for credit with its pre-qualification step.

By offering a pre-approval step that doesn’t affect your credit score, you can understand your approval odds before risking a hard inquiry on your credit report. While pre-approval doesn’t guarantee acceptance, it allows a more calculated risk than applying for a different card without the extra step.

Pros

- Low credit score requirements for approval

- No annual fee

- Low balance transfer fees

- Robust mobile app available

- Pre-approval available

Cons

- High interest rate on purchases and balance transfers

- High late payment fees

- No spending rewards available

Capital One Platinum Card Review: Features and Benefits

The Capital One Platinum card features many of the benefits of carrying a card from a major financial institution without the need for an ultra-high credit score to become approved.

- APR 30.74% variable rate

- No annual fee

- 4% balance transfer fee

- Late payment fee up to $40

- High consumer satisfaction ratings

- $0 fraud liability coverage

- Robust mobile app

- Free credit score access

- No foreign transaction fees

- $3 or 3% cash advance fee

- Late payment fees of up to $40

- 630 minimum credit score necessary for approval

Capital One Platinum Card Review: Editorial Rating

Trusted Company Reviews Rating Score for Capital One Platinum Card®: 9.3

One of the most significant factors when rating the Capital One Platinum® card is its availability. While many of the best balance transfer cards for fair credit require membership to a credit union, organization, or educational institution, the Platinum card is open to all applicants. It makes the top of our list due to that fact, even though it carries a fairly high variable interest rate and offers minimal rewards.

| APR | 30.74% (Variable) |

| Balance Transfer Fees / APR | 4% / 30.74% (Variable) |

| Credit Score Requirements | 630 |

| Annual Fee | $0 |

| Rewards | $0 fraud liability |

About Capital One Platinum®

The Capital One Platinum card allows balance transfers with a 4% fee. That’s in line with most of the company’s other cards. However, the card also comes with benefits for customers with fair credit that cards from some other banks simply don’t offer.

As a cardholder, Capital One allows you to choose your monthly payment due date, offers automatic credit reviews of your account—which can result in a higher credit limit after the first six months, provides account alerts to keep track of your activity, and charges a fee for late payments but doesn’t subject your account to a permanent interest rate hike because of it.

Capital One Platinum® for Credit Card Refinancing

This Capital One credit card presents a compelling option to reduce credit card interest payments significantly.

Let’s illustrate with an example:

Imagine you’re carrying a $25,000 balance across multiple credit cards with a hefty 25% APR. If you transferred this debt to the Capital One Platinum® and managed to pay it off entirely within the introductory 0% APR period, you could potentially save a whopping $6,250 in interest charges over a year!

However, it’s crucial to remember the balance transfer fee is typically around 4% of the transferred amount. In this example, that would amount to $1,000. So, while you’d save significantly on interest, the fee impacts the overall savings.

If paying off the full balance within the intro period feels challenging, consider exploring low-interest personal loans through Credible for debt consolidation instead.

On a positive note, Capital One Platinum® reports your activity to all three credit bureaus, potentially boosting your credit score along the way.

Additionally, this card allows balance transfers for various debt types, including student loans, beyond just credit cards.

Capital One Platinum Card Benefits

The Capital One Platinum card is pretty short on extra benefits. However, the company does provide cardholders with its $0 fraud protection policy and the ability to pick your monthly due date. Additionally, it regularly reviews your account’s standing to see if you’re eligible for a credit line increase.

Capital One Platinum Card Limit

Credit limits between $300 and $3,000 are available with the Capital One Platinum card. The company awards starting credit limits based on several factors, including credit score, history, income, and others.

Capital One Platinum® Approval Odds

While there are no guarantees for approval—even after taking the pre-qualification step, the company typically considers approving applicants with credit scores as low as 630 or in the mid to high fair range.

Is Capital One Platinum a Good Credit Card?

The Capital One Platinum credit card is good for those looking to boost their credit score using the tools of a major banking institution. Other cards exist that carry better benefits. However, most of them are reserved for those with good to exceptional credit scores. Capital One offers most features found in a major credit card brand, plus tools to help better manage debt when used wisely.

How to Use the Capital One Platinum® Credit Card

Using the Capital One Platinum to consolidate other debt is possible. However, a transfer fee and interest rate apply to the transaction. Calculate your potential savings and benefits before committing to balance transfers. The best way to use the Capital One Platinum card to build a credit profile is to stay below the borrowing limit and pay the balance in full monthly to avoid interest charges.

Capital One Platinum® Review

Capital One Platinum reviews are mixed, but the card is mainly rated highly across numerous platforms. Customers rebuilding credit like the low credit limit set by the company to help make paying the balance each month doable. Critics would like to see more frequent credit limits.

Overall, the card averages between 3.5 and 4.5 of 5 stars, while some outliers rate it at 2 or 5 stars.

Capital One Platinum Card Vs. Quicksilver

The Capital One Platinum card versus Quicksilver is a good comparison to make for those with slightly higher credit scores. The Capital One Quicksilver card offers more rewards and lower interest rates than the Platinum. However, approval for the Quicksilver requires a credit score of at least 700.

Capital One offers a pre-qualifying step option for both cards on its website. For those with a credit score that could qualify, it’s a worthwhile step to see if taking advantage of 1.5% cash-back and a lower rate is possible.

| Capital One Platinum® | Capital One Quicksilver® | |

| APR | 30.74% (Variable) | 19.99% – 29.99% (Variable) |

| Balance Transfer Fees / APR | 4% / 30.74% (Variable) | 4% / 29.99% |

| Credit Score Requirments | 630 | 700 |

| Annual Fee | $0 | $0 |

| Rewards | N/A | 1.5% cash-back |

First Tech Choice Rewards World Mastercard®

There are several benefits to working in the world of technology. One such perk is the opportunity to investigate joining the First Tech Federal Credit Union. Credit union memberships have qualities many prefer over working with a large banking institution.

The First Tech Choice Rewards World Mastercard offered by First Tech Credit Union is an excellent choice for those with less-than-stellar credit scores who are looking to consolidate debt. However, cardholders must join the credit union to apply for the card.

To become a member, you must work for one of the over 900 companies First Tech acknowledges as partners. However, there are other ways to become a member, including being related to a family member who’s already a customer, belonging to one of a couple various associations, or working for the state of Oregon. If none of these apply to you, it may be worth calling the Credit Union to see if there are other ways to join.

First Tech Choice Rewards World Mastercard® Pros and Cons

Pros

- Up to 2% cash back on qualified purchases

- Low interest rate potential

- $200 cash-back for spending $3,000 in the first 2 months

- No annual fee

- 12-month 0% intro APR on purchases

Cons

- Must be First Tech Credit Union member to apply

- Steep requirement to achieve $200 intro bonus

- No pre-approval step available

First Tech Choice Rewards World Mastercard® Features and Benefits

The First Tech Choice Rewards World Mastercard® carries with it several benefits that many would expect only from a card with higher credit score approval requirements.

- First Tech Credit Union membership required to apply

- 13.5% –18% variable APR

- $0 and 0% balance transfer fees

- Bonus and spending rewards are available

- Other banking services available

- No annual fee

- No cash advance fee

- No foreign transaction fee

- $200 cash-back for spending $3,000 in the first 2 months

- 2% cash-back at gas and grocery stores, plus others

- 1% cash-back on other purchases

- 90-day purchase protection

- 0% introductory purchase APR available for 12 months

- 640 credit score necessary for approval

First Tech Choice Rewards World Mastercard® Editorial Rating

Trusted Company Reviews Rating Score for First Tech Choice Rewards World Mastercard®: 9.1

With a variable APR of between 13.5% and 18%, zero balance transfer fees, and up to 2% reward points earning potential, it’s not surprising to learn that the First Tech Choice Rewards World Mastercard® rates well with consumers. We like the card for its low qualifying credit score requirement of 640 or higher after joining the First Tech Credit Union.

| APR | 13.5% –18% (Variable) |

| Balance Transfer Fees / APR | 0% / 13.5% –18% (Variable) |

| Credit Score Requirements | 640 |

| Annual Fee | $0 |

| Rewards | Up to 2x points |

About First Tech Choice Rewards World Mastercard®

The First Tech Choice Rewards World Mastercard offers many perks that one might expect to find when examining balance transfer cards from larger banking institutions. These include perks like earning a potential 20,000 bonus rewards points after spending $3,000 in the first two months, up to 2% cash-back rewards, complimentary temporary memberships to Doordash DashPass and ShopRunner, and travel and trip cancellation insurance.

While the card offers all those perks, it does so without requiring an overly impressive credit score to apply. However, talking to the Credit Union about your approval odds before applying is wise, as the company doesn’t offer a pre-qualification step to protect against an unnecessary hard credit inquiry.

Another advantage of being a First Tech Choice Rewards World Mastercard cardholder is membership in the Credit Union, which gives you access to a full suite of other banking and lending services.

First Tech Credit Union Reviews

Trustpilot customer reviewers award First Tech Credit Union 4 of 5 stars, including 74% of respondents giving the company a perfect 5 stars. However, some lesser-impressive reviews exist from some customers. Complaints range from apparent record-keeping mistakes and some mixed customer service issues.

How to Use First Tech Choice Rewards World Mastercard®

Using the First Tech Choice Rewards World Mastercard is like using any other balance transfer card from other banking companies. The card features no annual fee, 90-day purchase protection, a rewards program worth up to 2% cash-back, and no foreign transaction fees, so customers can use it wherever they travel without incurring extra expenses for the convenience of carrying the card.

Balance transfers are available with the card and have no fee attached. As with any credit card, responsible use is essential for maintaining good credit, building new credit, or rebuilding damaged credit.

First Tech Choice Rewards World Mastercard Review

Our First Tech Choice Rewards World Mastercard review highlights a specific credit card offered by a single credit union institution. While the card rates well among consumers, including an average of slightly over 4 of 5 stars, it’s only available to First Tech Credit Union members. While this can be a barrier for some individuals, the fact also has perks worth exploring.

First Tech Choice Rewards World Mastercard® Vs. Navy Federal Platinum® Credit Card

First Tech Credit Union and Navy Federal Credit Union are both large contenders in the federal credit union arena. There are some noticeable differences when comparing the First Tech Choice Rewards World Mastercard against the Navy Federal Platinum credit card. However, remember that membership to each card’s respective credit union is necessary to apply for either one.

While the Navy Federal Platinum card features potentially lower interest rates, approval requires a higher credit score than the First Tech Choice Rewards World Mastercard. Additionally, the Navy Federal card comes up short when comparing First Tech’s available 2% rewards against Navy Federal’s lack of a rewards program.

| First Tech Choice Rewards World Mastercard® | Navy Federal Platinum® Credit Card | |

| APR | 13.5% –18% (Variable) | 11.24% – 18% (Variable) |

| Balance Transfer Fees / APR | 0% / 13.5% –18% (Variable) | 0% / 11.24% – 18% (Variable) |

| Credit Score Requirments | 640 | 700 |

| Annual Fee | $0 | $0 |

| Rewards | Up to 2x points | N/A |

Discover it® Student Cash Back Credit Card

The Discover it® Student Cash Back credit card is available to college and university students with almost any credit score. The card allows balance transfers with a 5% fee. It features a reasonable interest rate, up to 5% cash back in quarterly rotating spending categories, and 1% cash back on all other qualified purchases.

While only available to students, the card offers prime benefits to those looking to build their credit profile with a card that can potentially grow with them. Credit limit increases are available after graduation, and the benefits available in the meantime can start earning rewards well before then.

Discover it® Student Cash Back Pros and Cons

Pros

- No credit score or history necessary for approval

- Up to 5% cash-back available

- 1% cash-back minimum on qualified purchases

- Pre-approval available

- No annual fee

Cons

- Must be college student to apply

- Intro offers limited to 6 months

- Best cash-back rewards are on rotating calendar

Discover it Student Cash Back Review: Features and Benefits

The Discover it Student Cash Back card features several benefits that more experienced credit card holders often enjoy. The card also offers features that make balance transfers, especially in the first six months, appealing to those looking to consolidate debt with a card.

- 18.24% – 27.24% variable APR

- No annual fee

- Little or no credit score necessary for approval

- Must be enrolled college student to apply

- Potential credit limit increase after graduation

- 5% balance transfer fee

- 5% cash-back on qualified purchases on quarterly rotation

- 1% cash-back on other purchases

- 0% intro APR for 6 months

- Balance transfer intro APR of 10.99% for six months

- No penalty APR increase for late payments

- $41 late fee applies to late payments

- $10 or 5% cash advance fee

- Cash advance interest rate equals 29.99%

- Other Discover it® Student cards available

Discover it Student Cash Back Review: Editorial Rating

Trusted Company Reviews Rating Score for Discover it® Student: 9.0

While the Discover it Student Cash Back credit card is only available to a specific demographic, if you’re a student and looking to build credit and perhaps consolidate debt, the card may offer a solid solution. We rate the Student Cash Back card highly because it lacks an annual fee and provides up to 5% rewards on things students buy and use.

| APR | 18.24% – 27.24% (Variable) |

| Balance Transfer Fees / APR | 5% / 18.24% – 27.24% (Variable) |

| Credit Score Requirements | N/A |

| Annual Fee | $0 |

| Rewards | Up to 5% cash-back |

About the Discover it® Student Cash Back Credit Card

In addition to the other perks the Discover it Student Cash Back credit card offers, the company also provides an opportunity to take advantage of its pre-qualification step. There’s more than one Student credit card available from Discover—Pre-qualifying may provide other card options.

More importantly, while pre-qualifying doesn’t guarantee approval, taking the step can create confidence when applying or warn against risking a hard inquiry on your credit report if the odds aren’t in your favor.

The Discover it Student Cash Back card features a variable interest rate from 18.24% to 27.24%, which aligns with many major bank APRs. However, this card requires little or no credit history to apply.

Other card details include a balance transfer fee of 5%, which is higher than some cards charge. However, the moderate interest rates may still allow customers to save money when transferring balances to the Discover it card. There’s also no annual fee associated with the Discover it Student Cash Back card.

Discover it Student Cash Back Foreign Transaction Fee

For students who travel, the Discover it Student Cash Back credit card provides international transactions with no fees.

Discover it Student Cash Back Credit Limit

The starting credit limit for the Discover it Student Cash Back card is modest. Most applicants will receive the lowest available limit of $500 to start. However, some cardholders report receiving credit limits of up to $2,000.

Discover it Student Cash Back Approval Odds

There are no credit score or credit history requirements to apply for the Discover it Student Cash Back credit card. Discover uses other metrics, such as income, employment history, and others, to match students with its credit card products. The company also offers a pre-qualification step when applying to see which Student card is best for your situation.

How to Use the Discover it® Student Cash Back Credit Card

Use the Discover it Student Cash Back credit card as you would any other major credit card with balance transfer and rewards-earning potential. Pay the balance in full each month to avoid interest costs.

Discover provides a six-month window to pay down debt at an intro APR of 10.99% instead of its normal variable rate for balances transferred to the card. Late payments incur a steep $41 late fee. However, an increased APR penalty won’t apply to late payments.

Discover it Student Cash Back Review

Discover it Student Cash Back reviews portray a cash-back, balance-transfer credit card with high consumer and expert satisfaction ratings. Reviews range from 4 to 4.8 of 5 stars across several respected platforms. Cardholders like the cash-back rewards and generally low fees—important when building credit while tackling an education on a budget.

Discover it Student Cash Back Vs. Chrome

The Discover it Student card series offered by the company stacks up well against its more widely available card offerings, such as the Discover it Chrome. In fact, Discover also offers a Chrome version of its Student cards.

The approval odds are the primary difference between the Student cards and the Chrome. The Student Cash Back card has few requirements, while approval for Chrome and other cards from the company requires higher credit scores and longer credit histories.

| Discover it® Student Cash Back | Discover it® Chrome | |

| APR | 18.24% – 27.24% (Variable) | 17.24% to 28.24% (Variable) |

| Balance Transfer Fees / APR | 5% / 18.24% – 27.24% (Variable) | 5% / 17.24% to 28.24%

(Variable) |

| Credit Score Requirments | N/A | 700 |

| Annual Fee | $0 | $0 |

| Rewards | Up to 5% cash-back | 2% cash-back |

Check out recent reviews on credit cards and personal loans:

- Amex Blue Cash Preferred

- Citi Custom Cash Card

- Top Rated – Chase Freedom Unlimited

- Check top-rated personal loans for free at Credible

Consider Top-Rated Personal Loans for Fair Credit

| Lender | Fixed (APR) | Loan Amounts |

Minimum Credit Score

|

| Upstart Personal Loan | 6.40% to 35.99% | $1,000 to $50,000 | 620 |

| LightStream Personal Loan | 7.49% to 25.49% | $5,000 to $100,000 | 700 |

| Discover Personal Loan | 7.99% to 24.99% | $2,500 to $40,000 | 660 |

| PenFed Credit Union Loan | 8.49% to 17.99% | $600 to $50,000 | 700 |

| Upgrade Personal Loan | 8.49% to $35.99% | $1,000 to $50,000 | 600 |

| Sofi Personal Loan | 8.99% to 25.81% | $50,000 to $100,000 |

Does Not Disclose

|

| Best Egg Personal Loan | 8.99% to 35.99% | $20,000 to $50,000 | 600 |

| LendingClub Personal Loan | 9.57% to 35.99% | $1,000 to $40,000 | 660 |

| Avant Personal Loan | 9.95% to 35.99% | $20,000 to $35,000 | 550 |

| Universal Credit Personal Loan | 11.69% to 35.99% | $1,000 to $50,000 | 560 |

| OneMain Financial Personal Loan | 18% to 35.99% | $1,500 to $20,000 |

Does Not Disclose

|

| Zable Personal Loans | 8% to 30% | $1,000 to $25,000 | 600 |

| Happy Money Debt Consolidation Loan | 11.72% to 24.67% | $3,000 to $40,000 | 640 |

Source: TrustedCompanyReviews.com, Top-Rated Personal Loans Review

Frequently Asked Questions

These are some of the most common questions surrounding the best balance transfer cards for fair credit.

We feature three excellent credit cards for balance transfers that offer decent approval odds for those with fair credit. However, one requires credit union membership, and the other requires the customer to be a student. The easiest balance transfer card for fair credit is the Captial One Platinum® card simply because it’s available to the broadest audience.

Credit cards that offer a low transfer fee for balance transfers and a low introductory APR or generally low regular interest rate are good for balance transfers. The best balance transfer cards are typically only available to those with above-average credit scores. However, we’ve showcased the featured products above as the best balance transfer cards for fair credit.

Transferring balances on credit cards can be an effective tool to consolidate debt, save money, and streamline monthly payments. However, there are some pitfalls to be wary of, including opening up more credit availability than one can handle. Transferring credit card balances can also incur transfer fees that can reduce the amount of money saved. Acquiring a new credit card for balance transfers will draw a hard credit inquiry on your credit report, temporarily affecting your credit score.

Authorized users of a shared credit card can perform balance transfers, charges, and cash advances on the shared credit card.

Credit card issuers limit how much money customers can transfer to their cards. The limit is sometimes set around 75%. However, many cards allow up to 100% of the credit limit for transfers. Other cards may limit the amount you can transfer by dollar amount.