Trustedcompanyreviews.com offers free content, reviews and ratings for consumers to read, aimed at helping them compare their options. We may receive advertising compensation from companies featured on our website, influencing the positioning and sequence in which brands (and/or their products) are displayed, as well as affecting the assigned ratings. Please note that the inclusion of company listings on this page does not constitute an endorsement. We do not feature all available providers in the market. With the exception of what is explicitly outlined in our Terms of Service, we disclaim all representations and warranties regarding the information presented on this page. The details, including pricing, displayed on this site may undergo changes at any time.

Best Home Warranty Companies in California

Is a California home warranty worth it? Home warranty companies can save homeowners living in expensive cities like Malibu or San Francisco thousands of dollars per year, where the average home appliance repair ranges from $200 to $400—nearly twice the cost in states like Virginia or Texas. California homeowners without a home warranty plan spend nearly $17,000 annually on property maintenance alone!

Top home warranty companies can repair or replace your appliances within a day or two after you report an issue, saving you time and money. For example, HVAC system repairs can cost between $150 to $450 for minor repairs and $4,000 to $8,000 for a full replacement. A home warranty often reduces these costs to the service fee, typically between $75 and $125. Top-rated companies also make it very easy to report a problem through a simple app on your phone. So you can say goodbye to having to shop around endlessly for contractors that often end up either not showing or failing to fix the issue.

Our rating criteria compare each company’s customer reviews, online complaints, coverage details, and prices. Higher scores were awarded to companies licensed through The California Department of Insurance.

Related Article: Home Insurance Questions to Ask When Buying a Policy

Why trust Trusted Company Reviews

- Comprehensive review rating system.

- We work closely with consumers and experts to create editorial ratings.

Trusted Company Reviews #1 Pick for 2024

Why we love it 💖

Liberty Home Guard, with a 9.4 out of 10 rating is the best-ranked home warranty company in CA and VA.

Our Highest Rated Home Warranty in CA Companies

- Best customer reviews

- 24/7 customer service

- All technicians are licensed

- Most comprehensive coverage

- Affordable prices in CA

- Prices Start at $46

- 60-day workmanship and 90-day parts guarantee

- Best coverage for pools and spas

- Excellent customer service

- Covers all major systems

- Low service call fees ($75 or less)

- Pre-existing conditions OK

- Free Perks: AC refrigerant, HVAC tune-up, and more!

- Low cost: $36 per month

- Transferable coverage if you move

- Coverage per appliance: up to $7,000

- Free cancellation within 30 days

Costs of Home Maintenance and Appliance Repairs in California

To help you determine whether a home warranty in California is worth it, here’s a summary of statistics illustrating the average home maintenance and appliance repair costs in some of the most expensive places to live in CA.

Sacramento

- Average Home Maintenance Cost: Sacramento homeowners typically spend around $12,000 annually on home maintenance (California Real Estate Blog).

- Appliance Repair Costs: Common appliance repairs in Sacramento average between $200 and $400.

Malibu

- Average Home Maintenance Cost: Maintaining a home in Malibu can cost around $15,000 to $20,000 per year, largely due to the high costs associated with beachfront properties (California.com).

- Appliance Repair Costs: Appliance repair costs in Malibu are on the higher end, ranging from $250 to $500, reflecting the luxury nature of many homes.

Santa Monica

- Average Home Maintenance Cost: Homeowners in Santa Monica spend approximately $14,000 to $18,000 annually on maintenance (California.com).

- Appliance Repair Costs: In Santa Monica, the cost to repair appliances typically ranges from $225 to $450.

Best Reviews: Liberty Home Guard CA Home Warranties

Liberty Home Guard is a California home warranty company with excellent customer service and reviews. Liberty Home Guard’s average customer review rating between the BBB, Google, U.S. News, Consumer Affairs, and Forbes is above 4.5 out of 5 stars.

What can this excellent track record be attributed to?

According to its customers, they have saved money using Liberty Home Guard.

The company makes doing business with them a pleasure, too, making it easy to file claims and get things covered (i.e., replaced and repaired), without causing customers stress or making it difficult to use their claims process. There are even positive reviews about how easy it was to cancel the service. Liberty Home Guard customer service representatives are friendly and patient with clients.

The technicians are highly skilled and professional, getting appliances either quickly replaced or fixed. Customer service is always easy to reach and responsive. Very few complaints or negative reviews are found online about claims getting denied or problems with payment.

There are even positive reviews on how Liberty Home Guard went above and beyond to help customers save money by getting them deals on items that weren’t included in the plan or by providing exceptions to the rules and covering items that shouldn’t have been covered, as a one-time courtesy to the client, showing their desire to go above and beyond their contractual agreements.

Summary of Liberty Home Guard Customer Reviews

Summary of Liberty Home Guard Customer Reviews

- Customers consistently highlight Liberty Guard’s customer-centric approach as a key strength. Excellent customer service is exemplified through stories like Trina L’s, who found a quick resolution for a leaking garbage disposal. This dedication to responding quickly and thorough coverage is echoed by countless others who’ve had positive experiences.

- Liberty Guard’s innovative practices shine through, even as a newer entrant in the industry. Zachary C’s feedback underscores the company’s modern account setup and service approach, reflecting their commitment to user convenience.

- Guidance and professionalism set Liberty Guard apart. As John G’s review demonstrated, their representatives patiently lead homeowners through the claims process, even if it’s their first time.

- Leslie N’s repeat experiences emphasize how Liberty Guard consistently delivers reliable and prompt support.

- The resounding theme of trustworthiness emerges as customers like Nesha W. and Alex R. highly recommend Liberty Guard. This level of endorsement speaks volumes about the quality of service provided.

In summary, Liberty Guard excels in responsiveness, innovative practices, and professionalism. Their dedication to customer satisfaction and efficiency in resolving issues places them at the forefront of California’s home warranty providers.

Let’s explore the pros and cons of Liberty Home Guard of California, Inc.

Liberty Home Guard: Pros:

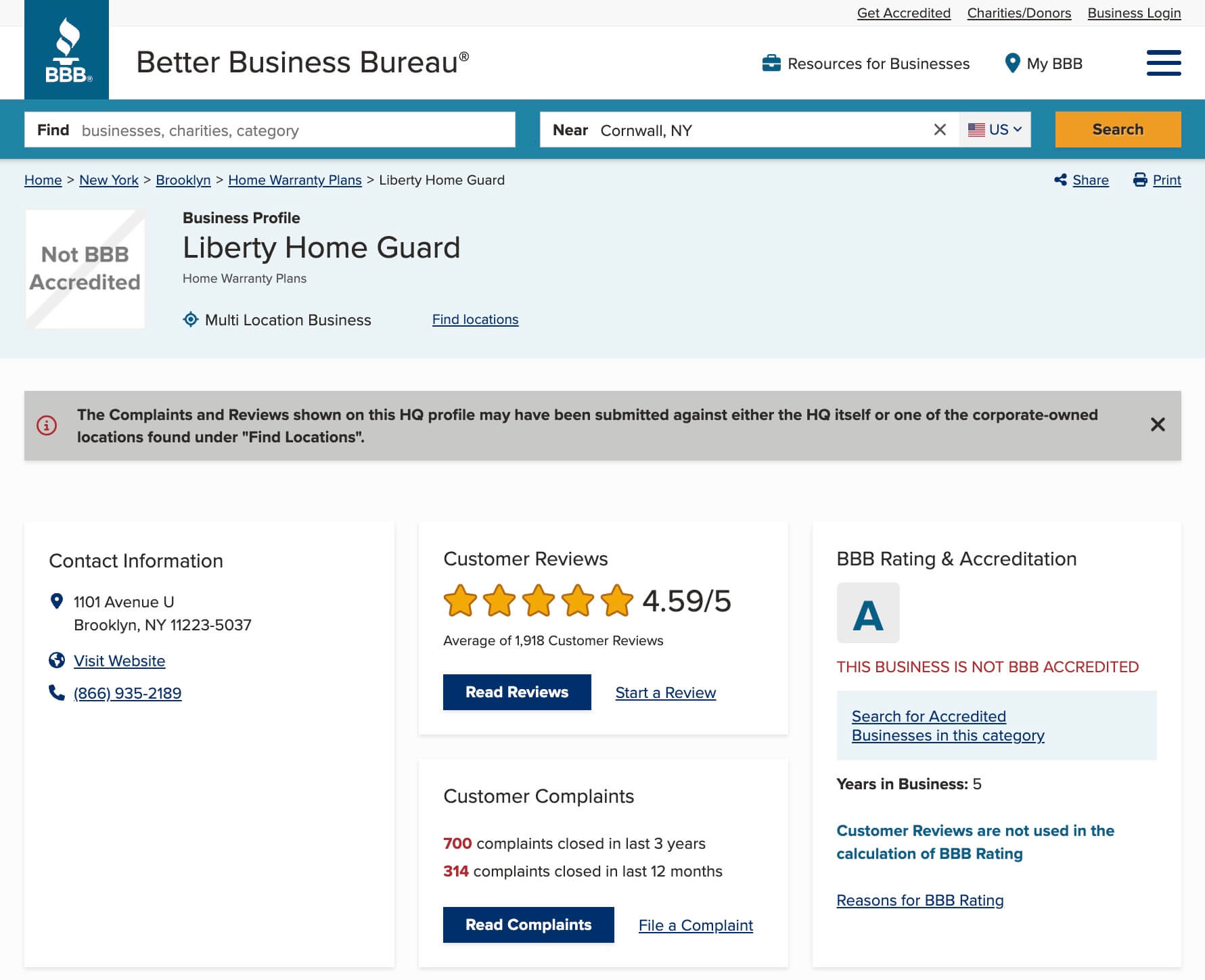

- “A” Rated at Better Business Bureau (BBB)

- Best customer reviews at the BBB compared to any other CA home warranty company

- Liberty Home Guard offers a generous 60-day workmanship guarantee.

- The convenience of 24/7 online claims filing with online chat

- Excellent customer service, even making it easy to cancel

- Offers add-on coverage for services like gutter cleaning and carpet cleaning

- Low service fee, starting at $60

Liberty Home Guard: Cons

- It is more expensive than other plans on this list

- Not Accredited by the Better Business Bureau (BBB)

- Only five years in business

- $2,000 coverage limit per item, which is on the low end

- Expensive pools and spa coverage

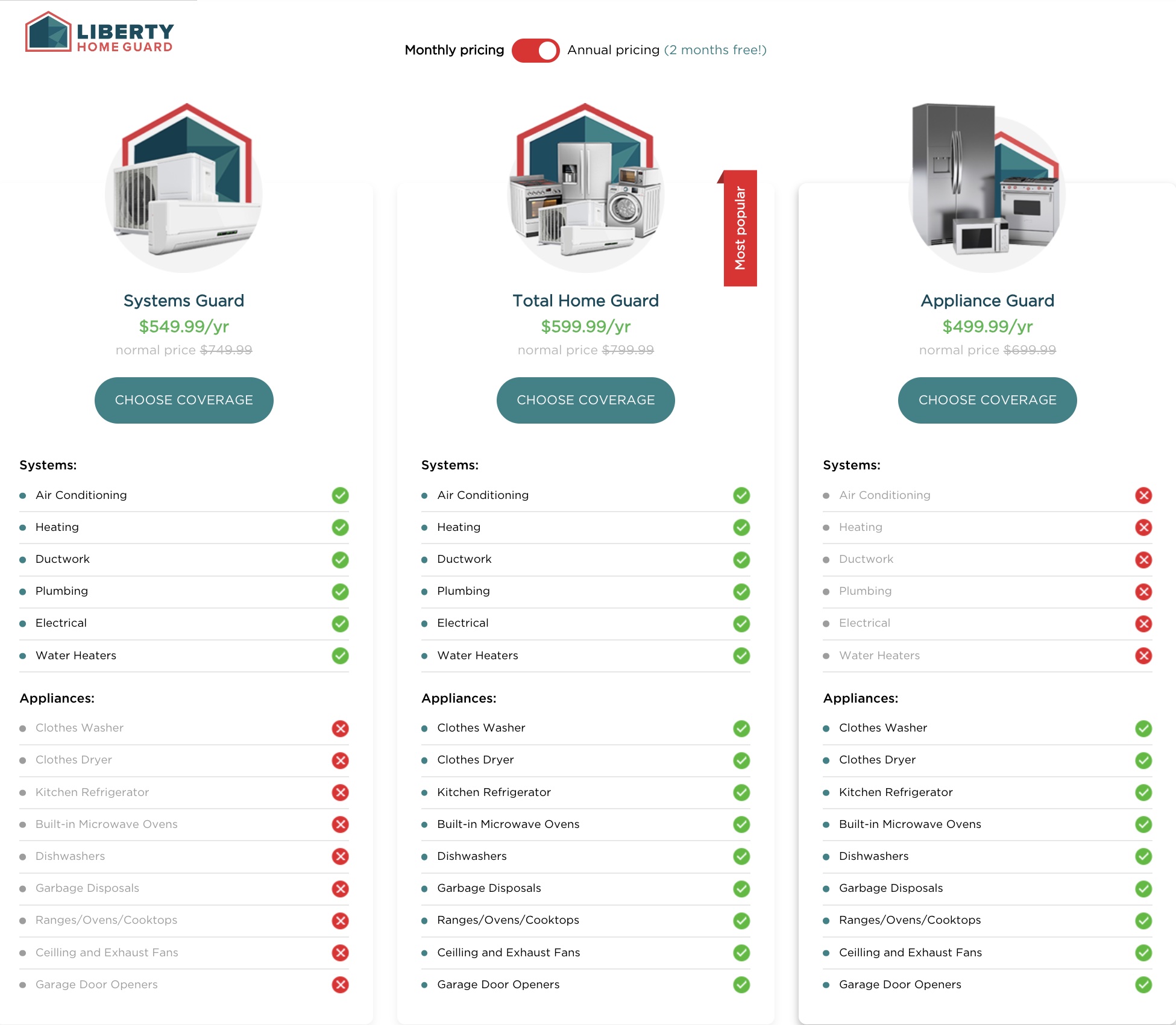

Liberty Home Guard Home Warranty in CA Prices and Plans

Regarding securing your California home with a reliable warranty, Liberty Home Guard offers transparent and flexible pricing options that cater to different needs.

1.) Appliance Guard: This plan covers essential home appliances like clothes washers, dryers, refrigerators, and dishwashers. It costs $49.99/month or $499.99/year, so it’s a cost-effective solution for safeguarding your appliances.

2.) Systems Guard: If you’re more concerned about major home systems like air conditioning, heating, plumbing, electrical, and water heaters, the Systems Guard plan at $54.99/month or $549.99/year have you covered.

3.) Total Home Guard: The Total Home Guard plan is priced at $59.99/month or $599.99/year for comprehensive coverage that includes appliances and systems. It provides peace of mind by protecting all covered items from both the Appliance and Systems Guard plans.

Liberty Home Guard Exclusions

- Routine Maintenance: Liberty Home Guard does not cover routine maintenance tasks, including regular cleaning, servicing, or tune-ups of appliances and systems.

- Pre-existing Conditions: Any items or systems that are already damaged or not in proper working condition when purchasing the warranty are not eligible for coverage.

- Installation of New Systems or Parts: The warranty does not cover the cost of installing entirely new systems or components.

- Damage from Improper Installation: If an appliance or system was improperly installed, any subsequent damage or issues arising from that installation are not covered.

- Rust and Corrosion Damage: Liberty Home Guard does not cover damages caused by rust, corrosion, or similar gradual wear and tear.

- Damage from Pests or Mold: Damages caused by pests, insects, rodents, or mold are excluded from coverage.

- Damage from Improper Maintenance: The repair or replacement may not be covered if an appliance or system breaks down due to improper maintenance or neglect.

- Commercial-Grade Systems and Appliances: Coverage typically applies only to residential-grade appliances and systems.

- Chimneys and Solar Systems: Chimneys, solar systems, and other specialized installations are not covered.

- Lighting Fixtures and Smart Devices: While appliances and systems are covered, lighting fixtures and smart devices fall outside the scope of coverage.

- Valves and Leaks: Valves and certain types of leaks may not be covered, depending on the circumstances.

- Swimming Pools and Spas: Unless specifically added as an optional coverage, swimming pools and spa equipment are typically not included in the standard plans.

- Damage from Natural Disasters: Events like earthquakes, floods, and other natural disasters are generally not covered under a standard home warranty.

- Items Beyond Depreciated Value: The warranty covers replacements up to the depreciated value of an item, which might not fully cover the cost of a brand-new replacement.

It’s crucial to thoroughly review the terms and conditions of your Liberty Home Guard warranty to understand the extent of coverage and any limitations. While Liberty Home Guard offers comprehensive protection, being aware of these exclusions can help you make informed decisions regarding repairs and replacements in your home.

Check out other reviews on TrustedCompanyReviews.com.

- Senior medical alert systems: Medical Guardian vs. Life Alert

- Top identity theft protection services

- Best home security

Best Pool Coverage in CA: Choice Home Warranty

Over 1.9 million homeowners trust Choice Home Warranty to safeguard their home systems and appliances.

With a vast contractor network of 25,000 licensed professionals, they’ve managed millions of claims.

Yet, in California, Choice Home Warranty is exclusive to the Home Service Club of California.

Now, let’s explore the pros and cons of CHW/HSC:

CHW/HSC: Pros:

- HSC is highly affordable, starting at just $46 per month for their plans.

- The Standard Plan includes appliance coverage.

- The $85 flat-rate service fee is cost-effective compared to competitors.

- HSC offers an impressive 60-day workmanship guarantee and an exceptional 90-day parts guarantee – the best among all home warranty companies in California.

- It stands out for offering budget-friendly add-on options, particularly for pool and spa coverage.

- Given the high number of pools in California (1.34 million), this is a significant advantage.

- The convenience of 24/7 online claims filing adds to the user experience.

CHW/HSC: Cons

- Customers can’t choose their own service fees.

- No Better Business Bureau (BBB) accreditation.

- Only offers two plans.

- Your refrigerator won’t be covered under the company’s Standard Plan.

The Home Service Club of California Home Warranty Cost

The Home Service Club’s Standard Plan ($46.67 per month) covers 14 appliances and systems under a single low-cost plan.

In addition to your oven/range/stove, dishwasher, garbage disposal, and built-in microwave, coverage also includes heating, electrical, and plumbing systems.

Whirlpool bathtubs, ductwork, garage door openers, ceiling fans, and exhaust fans are also included.

What’s not covered in your CA home warranty plan with The Home Service Club?

You may have noticed that your air conditioning system, refrigerator, washer, and dryer are all absent from that list.

Unfortunately, HSC does make you upgrade to the Comprehensive Plan ($55 per month) to get coverage for these essentials.

While that may seem frustrating at first, the generous $3,000 coverage limit for air conditioning can make upgrading make sense.

All covered items under both the Standard Plan and Comprehensive Plan are actually covered up to $3,000.

Best Home Warranty in California for Pool Coverage

HSC offers one of the best home warranty plans for coverage of pools and spas:

Add-on options available through HSC include roof leak repairs, second refrigerators, standalone freezers, central vacuums, well pumps, septic pumps, septic tank pumping, pools, and spas.

At just $15 per month, HSC’s add-on coverage for pools and spas is one of the industry’s best deals!

Best Appliance Coverage: First American Home Warranty

Why is First American Home Warranty California’s best-rated home warranty company?

First, this California-based company has been a leading provider of home warranties since 1984. The company has been BBB accredited since 5/30/2000, with no regulatory or government actions filed against it.

Secondly, look at First American Home Warranty’s prices compared to other top California home warranty companies.

Average Cost for Home Warranties in California: $59 per month / $708 annually

First American Home Warranty offers California plans starting at $38/month for Basic and around $48.50/month for Premier, featuring an $85 service call fee.

This is highly competitive, as the average California home warranty costs about $59 per month or $708 annually.

MarketWatch states, “First American’s appliance and systems protection within its base plan makes it our top pick for basic home warranty plans.”

Thirdly, they are a licensed home warranty provider in California. You can verify their license directly with the California Department of Insurance.

First American Home Warranty Pros:

- Three plans to choose from starting at just $36 per month!

- “B” rating with the Better Business Bureau (BBB).

- 24/7 online claims filing.

- Robust add-on coverage makes it easy to customize a plan.

- Control your monthly rates by selecting your service fee.

- Coverage per appliance goes up to $7,000 when you upgrade to the Premium plan.

- Covers up to $3,500 per home appliance in its Starter and Essential plans, and $7,000 in its Premium Plan, one of the most generous in the industry.

- No preset coverage caps for heating, air conditioning, or ductwork!

First American Home Warranty Cons:

- Coverage for air conditioning systems isn’t included in the cheapest plan.

- While FAHW’s 30-day guarantee for work is appreciated, it’s less robust compared to warranties offered by competitors.

FAHW Prices for Home Warranty in CA

First American Home Warranty’s Starter plan ($36.67 per month) covers your plumbing system, electrical system, heating system, dishwasher, refrigerator, oven/cooktop, and built-in microwave.

The Essential plan ($57 per month) adds a clothes washer, clothes dryer, garage door opener, water heater, garage door opener, and air conditioning on top of everything included in the Starter plan.

Based on research conducted by The Sacramento Bee, American Home Shield and First American Home Warranty offer the best prices for home warranties in California, compared to other prominent competitors such as Select Home Warranty, Liberty HomeGuard (Progressive), and The Home Service Club.

Best Luxury Home Warranty Protection

In addition to covering everything in the Starter and Essential plans, the company’s Premier plan ($72 per month) also provides coverage for luxury appliances, faucets, garbage disposals, full garage door systems, and instant hot water dispensers.

If you need coverage for a special item in your home, AFHW offers optional add-on coverage for extra refrigeration appliances, pool and spa equipment, roof leak repairs, septic systems, water softeners, and well pumps.

There’s even a special category that offers coverage for hauling away old items, improper installation, permits, and more.

Service fees through First American are $75, $100, or $125 per claim. This lack of a flat fee allows you to pay higher service call fees to lower your monthly premium.

Best Home Warranty for Older Homes: American Home Shield

American Home Shield (AHS) is a popular home warranty company in California, especially for older homes, as their plans cover pre-existing conditions and normal wear and tear. With more than 2 million customers, AHS is one of the industry’s most trusted home warranty companies.

AHS does have mixed customer reviews. ConsumerAffairs.com rated AHS 4.3 out of 5 stars based on 97,967 customer reviews. Meanwhile, over at Yelp, AHS has a 1 out of 5 stars rating based on 1,187 customer reviews. At the BBB, AHS has a 2 out of 5 stars rating based on 11,086 reviews. Between these three sites alone, that’s close to 110,000 customer reviews. Needless to say, this is a very large company, and that’s a positive sign!

What do all of these customer reviews talk about?

AHS Home Warranty Customer Reviews

Positive Experiences: Customers appreciate efficient service request processing and prompt problem resolution. Contractors are often praised for their professionalism and effective repairs.

Longevity and Loyalty: Many reviewers have been with AHS for decades, citing its reliability and quality service as reasons for their continued loyalty.

Service Process: The online claim submission process is generally considered easy and convenient. Contractors are engaged promptly, and AHS coordinates repairs effectively.

Coverage Satisfaction: Customers find satisfaction in the coverage provided by AHS plans, including HVAC systems, appliances, and plumbing. The versatility of coverage options is a highlight.

Communication and Transparency: While sometimes involving hold times, communication with AHS is generally helpful and informative. Reviewers appreciate the clarity of contracts and access to information.

Resolution of Issues: While some instances of contractor-related issues have been noted, AHS is observed to address concerns and ensure repairs are completed to satisfaction.

Value for Investment: The cost of AHS plans is considered reasonable for the coverage offered, making it a good investment for protecting against unexpected expenses.

Improvement Areas: Some reviewers express frustration with hold times during phone calls and perceived limitations in contractor abilities due to AHS policies.

Timeliness and Convenience: Quick responses from contractors and efficient claim handling contribute to a positive overall experience for many customers.

Long-Term Relationship: Several reviewers mention a history of using AHS’s services for various repairs over the years, highlighting the reliability and trust built with the company.

American Home Shield Pros:

- Three plans to choose from, priced between $29.99 and $69.99.

- A generous $4,000 maximum for appliances is one of the industry’s best.

- There is no preset coverage cap for major home systems.

- Unlimited coverage for air conditioning.

- Roof leak coverage goes up to $1,500.

- It is one of the only plans in the nation to cover pre-existing conditions, which is why we rate this one of the best home warranties in CA for older homes.

- Customer support is available 24/7.

- Robust add-on options allow homeowners to get coverage for pools, spas, roof leaks, septic pumps, electronics, and guest units.

- A “B” rating with the Better Business Bureau (BBB).

- This company has been in business for 50 years!

- Authorization for claims often takes just 15 minutes to four hours.

American Home Shield Cons:

- Lacks budget-friendly appliance-only plans.

- 30-day workmanship guarantee in California is shorter than competitors’ 60 or 90-day warranties.

- ShieldSilver plan ($49.99/month) covers heating, cooling, electrical, and plumbing, but excludes appliances. ShieldGold plan ($69.99/month) is needed for robust coverage of 23 major appliances and systems, including washers, dryers, and kitchen appliances.

- ShieldPlatinum plan ($99.99/month) includes leak roof coverage and expands on ShieldGold’s coverage. AHS offers service fee options of $75, $100, or $125 for flexible monthly rates.

Summary of Complaints Against AHS

- Some customers have reported issues with AHS contractors’ ability to resolve problems promptly and effectively.

- Others have expressed frustration with the company’s hold times and perceived limitations in its coverage.

- There have also been reports of AHS denying claims or offering inadequate reimbursement.

Overall, American Home Shield is a reputable home warranty company with a strong track record of customer satisfaction. However, it is important to be aware of the potential drawbacks before signing up for a plan.

Here are some additional tips for choosing a home warranty plan:

- Compare plans from different companies to find the best coverage and pricing for your needs.

- Read the fine print carefully to understand what is and is not covered.

- Ask about the company’s claims process and customer service reputation.

- Get everything in writing before you sign up for a plan.

Source, Better Business Bureau, American Home Shield, 08/25/23

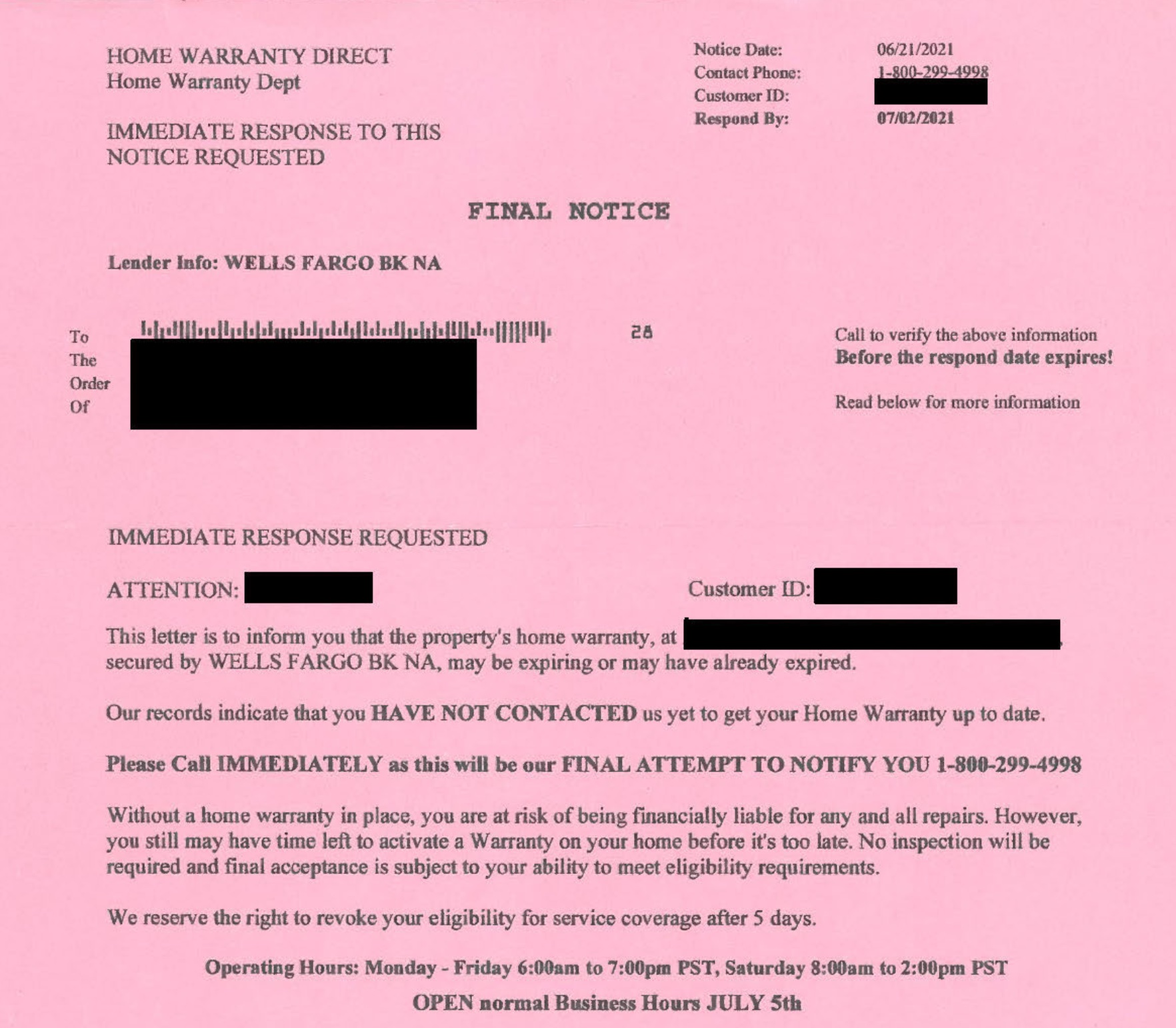

Home Warranty Scams in CA

The California Department of Insurance exposed a home warranty scam wherein an unlicensed marketing company, Integrity Admin Group, Inc., partnered with Response Indemnity to forge fictitious home warranty brands.

These deceitful “final notice” mailers reached consumers statewide, flaunting fake brand names like Home Warranty Direct and Home Warranty Resolutions. Driven by fear, many consumers dialed the number on the mailer and bought a plan, having been misled into doing so. All of this could have been prevented had these consumers initially verified whether these companies were genuinely licensed or not.

Thankfully, the Department took action by issuing a Cease and Desist Order to Integrity Admin Group and providing affected consumers with a refund solution. While this case ended on a positive note, it serves as a crucial warning for consumers.

In accordance with the settlement, individuals who bought warranties due to the deceptive mailers can cancel their policies and secure full refunds. They can achieve this by contacting carefunds@integrity.car with the subject line “Refund Request (policy number, last name, first name)” before October 9, 2023 (source: https://www.insurance.ca.gov/0400-news/0100-press-releases/2023/release022-2023.cfm).

Tips to Avoid Home Warranty Scams in CA

To protect yourself from such scams, it’s imperative to confirm if a company is a licensed home warranty provider in California. Licensed providers are reputable entities bound by stringent regulations designed to shield consumers.

This ensures you receive transparent information about coverage and fees. Additionally, licensed providers come with the added assurance of Department support.

Should any issues arise, you possess the capability to efficiently file complaints against licensed CA home warranty companies, benefiting from the Department’s invaluable assistance in resolving concerns. For more guidance, visit: https://www.insurance.ca.gov/01-consumers/101-help/index.cfm.

California Home Warranty vs. Homeowners Insurance

The last thing any homeowner desires is an unforeseen emergency expense for a major home system or appliance. This is where the appeal of home warranties comes in. Home warranties are service plans that offer protection in the event of breakdowns involving significant items within a home.

Similar to traditional homeowner insurance policies, home warranties provide coverage through monthly premiums. Although home warranty plans don’t strictly feature deductibles, they do involve service fees that must be settled to facilitate a technician’s visit after a claim has been initiated.

Is home warranty and home insurance the same?

California insurance and home warranty policies are distinctly separate forms of homeowner protection to contemplate, and they are unequivocally dissimilar. In essence, there should be no overlap between these two types of policies.

Home warranty companies pledge to repair or replace appliances and components of home systems—such as dishwashers, microwaves, HVAC systems, ceiling fans, washers, dryers, and similar items—typically not covered by a California homeowners insurance policy. Homeowners insurance serves to safeguard homeowners from unexpected catastrophes, such as damages to your home and possessions resulting from Northern California wildfires, for instance.

From a legal perspective, partnering with a licensed California home warranty company ensures protection against exploitation and ensures legal support. Nonetheless, before purchasing a home warranty plan, it remains essential to examine other factors to guarantee savings and optimal value from the chosen plan.

California New Home Warranty Laws

Looking beyond catchphrases and advertisements is essential to attain an accurate understanding of the caliber of each company.

Initiating your assessment involves confirming the legitimacy of a home warranty provider, ensuring they hold proper legal authorization to render services within the state.

As we have extensively discussed, verifying the credibility of a home warranty company necessitates prior scrutiny of licensing before engaging in any contractual agreements. Licensed providers are bound by legal obligations to transparently disclose specific elements, which we will elaborate on in the subsequent paragraphs.

When entering a home warranty agreement, meticulously review the fine print to grasp how the contract’s enforcement applies across diverse scenarios.

According to California law, home warranty terms must encompass the following:

- Comprehensive enumeration of appliances, systems, and components covered by the contract.

- Explicit listing of exclusions and limitations impeding coverage.

- Definition of the contract’s effective duration.

- Disclosure of all contract fees.

- Elaboration on renewal terms.

- Identification of applicable service fees. This is vital since home warranty plans incorporate supplementary service fees akin to deductibles upon each claim initiation.

- Specification of services to be executed by the company.

- Clear delineation of terms and conditions governing service execution.

- Comprehensive clarification of constraints potentially influencing service provision, encompassing temporal, geographical, and other constraints.

- Acknowledgment that services can be requisitioned through phone communication without necessitating claims forms or applications.

- Affirmation that the company will instigate services within 48 hours of a service request made by the contract holder, pertaining to services entitled.

Licensed entities in California are also obligated to safeguard customer privacy. In line with the Insurance Information and Privacy Protection Act (IIPPA), companies must extend safeguards for personally identifiable information typically furnished via an agent or insurance company for policy applications, renewals, or claim submissions.

Furthermore, entities are mandated to furnish customers with a Privacy Notice detailing:

- The entity’s safety policies and practices.

- The nature of consumer information collected in association with applications, claims, or other transactions.

- Mechanisms for sharing personally identifiable information.

- Entities with whom personally identifiable information could be shared.

- Consumer rights and choices for limiting information sharing.

Per the Department of Insurance’s Privacy Regulations, all Privacy Notices must “clearly and conspicuously” delineate the categories of personal data open to disclosure. Furthermore, a precise designation of third parties eligible to access this information is imperative. Ultimately, a “clear and conspicuous” opt-out mechanism for personal information sharing must be provided to consumers at no cost.

Engaging with a licensed home warranty entity can also grant access to additional resources in case of suspected wrongful denial of claims. The California Department of Insurance extends aid to consumers facing claim appeal rejections from warranty providers.

Any licensed entity failing to adhere to the privacy provisions stipulated in the Department of Insurance Privacy Regulations may be subject to legal repercussions.

Notably, First American Home Warranty and American Home Shield of California, as detailed in our above rundown, possess licenses issued by the California Department of Insurance. Choice Home Warranty follows a slightly different approach.

In California, plans are offered through a licensed entity known as Home Service Club of California, established under a special agreement. This arrangement enables customers in California to access the same plans and warranties as those offered in the remaining 48 states where Choice operates.

Choosing a Home Warranty Company in CA

Finding the best home warranty company in CA is about more than just breaking down the legal jargon. It’s also about finding a company that delivers the types of coverage that are important to you.

Here’s a rundown of some traits to consider before making a decision.

Customer Ratings

Customer reviews offer essential glimpses into what you can expect after signing on with a California home warranty company. Set aside time to do more than take a glance. Reading reviews carefully lets you see where a company falls short versus where it shines. For example, a customer may post a heated complaint online because the full cost of a new oven was not covered.

However, this isn’t the scandal it appears to be at first glance. After looking closely at the situation, you realize the home warranty contract clearly stated a coverage cap for appliances based on the plan the customer signed up for.

It’s also wise to read comments about customer service closely. When a malfunctioning appliance or system already flusters you, the last thing you want is to be frustrated by a hard-to-reach customer service team. While almost every business has negative complaints, it’s wise to ensure that a company doesn’t have a heavy track record of home warranty company lawsuits.

Learn how to quickly read through home warranty customer reviews and complaints:

You can copy the last year’s worth of customer complaints and reviews from the BBB, Yelp and Reddit.

Then using an AI tool such as ChatGPT, simply copy and paste this content, prompting the tool to condense the essential information from these complaints and reviews while filtering out irrelevant or unimportant data. In just a matter of seconds, you can gain a well-defined understanding of the pertinent details, enabling you to rapidly sift through numerous customer complaints and reviews with ease.

Easy Claims

A good California home warranty will let its customers open claims either online or via a user-friendly app 24/7. We mentioned earlier that California law requires home warranty companies to offer a way for customers to make claims by telephone. While this is a legal requirement for accessibility, a phone call is not necessarily the preferred way for most people today. A warranty provider gets bonus points for making it easy to track claims online!

Fast Service

Not every issue in your home can be fixed the same day. While home warranty companies can’t always promise that the issue will be 100% resolved immediately, they do need to get back to you when you reach out to file a claim to let you know when you can expect a technician to be arriving.

Workmanship Guarantees

Pay attention to this detail because it makes a costlier plan worth it by protecting you against shoddy or incomplete work. Home warranty companies handle guarantees in a few different ways. As you’ll see in the reviews of top California home warranty companies below, some companies offer workmanship-only guarantees. Others offer guarantees for parts and workmanship. These guarantees can run anywhere from 30 to 90 days.

Comprehensive Coverage

Some home warranty companies play games to get you to jump up to pricier coverage tiers. One way that they do this is by not including a refrigerator, washing machine, or other essential appliance with all of the other appliances in the low-cost tier. This essentially forces you to upgrade to feel like you’re covered for the most important items in your home.

The structure of coverage is also important. Home warranty companies will either offer two or three plans. Companies that offer three typically offer an appliance-only plan, systems-only plan, and combo plan. Companies that offer just two usually do a budget option and premium option. Consumers should select plans based on the specific household items causing them to worry about unexpected costs.

Additional Coverage

Always read beyond what’s outlined in a company’s core coverage plans. In some cases, it’s the add-on coverage that makes one company more “worth it” than another. Some common items that can be added on to policies for just a few dollars per month include pools, spas, second refrigerators, and septic systems. Some also provide coverage for roof leaks.

Coverage Caps

Don’t just look at what’s covered. Take a deeper glance at how much coverage is offered for each item. The best home warranty companies offer robust coverage that allocates enough for an appliance or system to be reasonably repaired or replaced. While 100% of the cost may not be covered for bigger items, the amount that is covered should at least be enough to dramatically reduce your cost burden. For example, some of the best California home warranty plans cover each appliance up to $7,000.

Air Conditioning

For Californians, this category might be the most important. Home warranty plans are all over the place when it comes to coverage for air conditioners. You know you’ve found a good company when you’re getting unlimited coverage for air conditioning units at all plans tiers offered, as what American Home Shield offers!

Home Warranty Rating Methodology

Compare Ratings of CA Home Warranty Companies side-by-side.

| Criteria | Liberty Home Guard | Choice Home Warranty | American Home Shield Warranty | First American Home Warranty | Select Home Warranty |

| BBB | 9 | 4 | 6 | 6 | 6 |

| Customer Reviews | 9 | 9 | 8 | 8 | 8 |

| Lawsuits and Complaints | 8 | 7 | 7 | 7 | 8 |

| Cost | 8 | 9 | 7 | 8 | 9 |

| Coverage–Essential Components | 10 | 10 | 10 | 10 | 9 |

| Claims Processing Efficiency | 10 | 10 | 10 | 10 | 9 |

| Customer Support | 10 | 10 | 10 | 10 | 8 |

| Extra Features | 10 | 9 | 10 | 9 | 8 |

| Reviewer Opinion | 20 | 18 | 16 | 15 | 15 |

| Total Points | 94 | 86 | 84 | 83 | 80 |

Rating Explanation:

| Criteria | Description | Total Possible Points |

| BBB Rating | A+ = 10, A = 9, A- = 8, B+ = 7, B = 6, B- = 5, C = 4, D = 3, E = 2, F = 1, No industry license = 0 | 1-10 |

| Customer Reviews | Average weighted rating across multiple sources, including BBB, Best Company, U.S. News 360 Reviews, Consumer Affairs, Google Reviews, TrustPilot, Investopedia, and MarketWatch. | 1-10 |

| Lawsuits and Complaints | Complaints and lawsuits, resolution, responsiveness, and client-to-complaint ratio. | 1-10 |

| Cost | Based on Total Cost, Monthly and Service Fees | 1-10 |

| Coverage | Points awarded for covering all major home system and appliance components, along with pre-existing conditions. | 1-10 |

| Claims Processing | Ease of filing claims and efficient claims processing. | 1-10 |

| Customer Support | Availability of 24/7 support, response time, and friendliness of customer service. | 1-10 |

| Extra Features | Points for high-quality add-on coverage options. | 1-10 |

| Reviewer Opinion | Includes the reviewer’s opinion, taking into account time in business, overall customer reviews, financial stability and transparency (as highlighted below) | 1-20 |

| Financial Stability | A financially stable company is more likely to honor its commitments. | |

| Transparency | Is the company transparent about its terms and conditions? (online, through sales and contracts) |

Frequently Asked Questions

A home warranty is a service contract that covers repairs and replacements of major home systems and appliances due to normal wear and tear, which typically won’t be covered by homeowners insurance.

When an item covered by the warranty breaks down, the homeowner can file a claim with the warranty provider. The provider will then send a qualified technician to diagnose and repair the issue, or if necessary, replace the item.

American Home Shield, Choice Home Warranty/Home Service Club, and First American Home Warranty all occupy the top shelf when it comes to offering comprehensive coverage with generous caps, clear pricing, and robust customization options.

With so many homeowners looking specifically for high-quality appliance coverage, American Home Shield’s $4,000 coverage cap for appliances with its ShieldPlatinum plan can be a big win for homeowners.

The cap for major home systems is $5,000. What’s even more impressive is that even the lower-priced ShieldSilver and ShieldGold plans keep that same $5,000 cap for replacements and repairs for major home systems.

Meanwhile, a flat service fee of $85 that’s combined with a 60-day workmanship guarantee and 90-day parts guarantee can certainly make Home Service Club a top contender for homeowners looking for predictable, affordable coverage. Just make sure you’re okay with not having coverage for a refrigerator if you choose the ultra-affordable Basic Plan.

By offering the possibility of having appliances covered up to $7,000 under its Premium plan, First American Home Warranty can definitely help homeowners to sleep easier at night. The company’s $3,500 cap per home appliance through its cheaper plans is still impressive.

What might seal the deal is that FAHW doesn’t have preset coverage caps for heating, air conditioning, or ductwork! However, Californians who are used to living with heat waves might resent the fact that FAHW does exclude coverage for air conditioning from its $36 Starter plan.

The first step is to learn about the home warranty companies offering coverage in California. Not all home warranty companies offer nationwide coverage. In fact, most cover homes in just 10 to 49 states. Luckily, all three highly rated home warranty companies in the review above offer plans in California.

Next, homeowners can vet home warranty companies by looking at BBB ratings and online reviews. It’s also a good idea to go with companies that have been around the longest.

It’s also important to review plan pricing to see which option is the most affordable based on your needs. While some California homeowners may prioritize appliance coverage because they’ve inherited older appliances when purchasing homes, others may be more concerned about making sure the air conditioning can be fixed quickly and affordably in anticipation of local record-breaking temperatures on the West Coast. Just keep in mind that you need to weigh monthly costs and service fees against the coverage caps included with a plan.

The final step is to collect quotes! It never hurts to get up to three quotes. While all of the rates shared in the reviews above reflect general plan pricing, most home warranty companies will offer custom rates based on everything from the service fee you select to your specific zip code. Once you have your quotes in hand, you can do true apples-to-apples comparisons of cost versus coverage.

Home warranties generally cover essential systems like HVAC, electrical, plumbing and major appliances such as refrigerators, ovens, and washing machines. Coverage may vary between companies and plans, so reviewing the contract is crucial to understanding what’s included and excluded.

In our list of the top 3 best home warranty companies in California, we looked for companies that provided comprehensive coverage and included coverage for items that we Californians need, like pool and air conditioning coverage.

The majority of home warranty companies in California do not provide coverage for pre-existing conditions, which pertain to issues that were present prior to purchasing the warranty. Nevertheless, in our compilation of the top 3 best home warranties in CA, we actively sought out a company that offers coverage for pre-existing conditions. And indeed, we discovered such a company: AHS Home Warranties in CA extend their coverage to include pre-existing conditions.

Many California home warranty companies have a network of pre-approved service technicians. The Home Service Club of California has a contractor network consisting of 25,000 licensed professionals, which explains how they’re able to service their 1.9 million customers.

It’s recommended to use these technicians, as using an unauthorized one might void your warranty. However, some companies allow you to request a specific technician for an additional fee.

On average, home warranties in California come to approximately $708 per year, equivalent to $59 per month. However, within our selection of the top 3 highest-rated home warranty companies, prices do exhibit variation, spanning from $36 to $69 per month. Generally, the higher pricing tiers often encompass broader coverage.

For instance, taking The Home Service Club of California’s Basic Plan as an example, it does not include coverage for air conditioning, refrigerator, washer, and dryer. To include these items in your coverage, an upgrade to their comprehensive plan at $55 per month is necessary.

In contrast, American Home Shield presents unlimited coverage for air conditioning across all plan tiers. Hence, it’s imperative to identify the areas you prioritize for coverage and confirm their inclusion within the contract.

Claims are typically filed online or through a customer service hotline. Response times can vary, but reputable companies strive to respond within 24-48 hours. The technician’s visit depends on their availability and the urgency of the issue.

Yes, you can usually cancel a home warranty contract, but the terms vary by company. Some companies offer a pro-rated refund if you cancel within a specific period, while others might have cancellation fees. Read the cancellation policy before purchasing.

Whether a home warranty is worth it depends on your circumstances, such as the age of your home, the condition of your systems and appliances, and your willingness to pay for potential repairs. It provides peace of mind, especially for older homes with aging systems.

The customer reviews on Reddit about the best home warranty companies are generally positive.

Liberty Home Guard, American Home Shield, and Choice Home Warranty are all highly rated by customers on Reddit.

Here is a summary of the customer reviews on Reddit for each company:

Liberty Home Guard:

- Customers appreciate Liberty Home Guard’s responsiveness, helpfulness, and quick turnaround times on claims.

- Customers also like that Liberty Home Guard offers a variety of coverage options and that it is easy to file a claim.

American Home Shield:

- Customers appreciate American Home Shield’s long history and reputation for good customer service.

- Customers also like that American Home Shield offers a variety of coverage options and that it is easy to file a claim.

Choice Home Warranty:

- Customers appreciate Choice Home Warranty’s affordable prices and comprehensive coverage.

- Customers also like that Choice Home Warranty is easy to work with and that it has a good reputation for customer service.