Trustedcompanyreviews.com offers free content, reviews and ratings for consumers to read, aimed at helping them compare their options. We may receive advertising compensation from companies featured on our website, influencing the positioning and sequence in which brands (and/or their products) are displayed, as well as affecting the assigned ratings. Please note that the inclusion of company listings on this page does not constitute an endorsement. We do not feature all available providers in the market. With the exception of what is explicitly outlined in our Terms of Service, we disclaim all representations and warranties regarding the information presented on this page. The details, including pricing, displayed on this site may undergo changes at any time.

Top 7 Best Extended Car Warranty Companies

Looking for the best extended car warranty company? We’ve partnered with industry expert Chris Teague to bring you the top extended car warranties for 2026! These trusted providers can help you save money on unexpected repairs—whether you drive a dependable sedan or a luxury vehicle.

No matter if your car is new or used, these reputable companies offer coverage that can help you avoid costly repairs. Plus, we’ve named category winners for the best high-mileage warranty, plans with no waiting period, and top luxury car coverage—including options for brands like BMW and Audi.

Why trust Trusted Company Reviews

- Comprehensive review rating system.

- We work closely with consumers and experts to create editorial ratings.

Trusted Company Reviews #1 Pick for 2026

Why we love it 💖

Olive excels as a top extended car warranty provider, offering easy sign-up, claim management, and immediate warranty activation for customers.

Our Highest Rated Extended Car Warranty Companies

- Get Free Quote (No VIN# needed)

- Low prices ($30–$65 per month)

- No Waiting Period

- 30-Day Money-Back Guarantee

- A+ BBB Rating

- Excellent Customer Reviews

- Choose Any Repair Shop

- Covers High-Mileage Vehicles

- Month-to-Month Contract

- Rental Car Reimbursement

- Trip Interruption Coverage

- Large, Well-Known, and Reputable

- 24 Years in Business

- A+ Rated and Accredited

- Wide Variety of Plan Choices

- No Pushy Sales Pitches

- Polite Phone Representatives

- Offers 30-day Money-Back Guarantee

- Affordable and Flexible Payment Options

- Fair prices for older cars

- Covers almost all vehicles

- Excellent Google reviews

- Available nationwide

- Best for Trucks, Vans, and SUVs

- 4.7 out of 5-Star Rating on Google

- A+BBB rating

- No Waiting Period

- Bargain prices

- 24/7 roadside assistance

- Responsive customer service

- Large selection of vehicle repair shops

- 30-day money-back guarantee

- Everything handled in-house

- Lowest prices

- Covers 95% of factory coverage

- Free oil changes and tire rotations

Laws and Regulations for Extended Car Warranties: A Buyer’s Guide

Purchasing an extended car warranty can be a complex decision. Before committing, it’s crucial to understand the laws and regulations governing these contracts to ensure you’re making an informed choice.

General Laws:

- Magnuson-Moss Warranty Act: This federal law protects consumers from deceptive warranty practices. It requires clear disclosure of terms, conditions, and exclusions in the contract.

- Magnuson-Moss Warranty Federal Trade Commission Improvement Act: This amendment strengthened consumer rights concerning warranties, including cancellation periods and claim denial procedures.

- Service Contract Laws: While not all states have specific laws for extended warranties (often termed Vehicle Service Contracts or VSCs), many have general consumer protection laws that apply.

State-Specific Regulations:

- Classification: Some states differentiate VSCs from insurance, leading to different regulatory requirements. Understanding this classification within your state is crucial.

- Required Disclosures: Many states mandate specific disclosures in VSC contracts, like cancellation rights, deductibles, exclusions, and repair network details.

- Cancellation Periods: Most states grant a grace period to cancel the contract and receive a full refund, typically 30-60 days. Check the legally required grace period for extended vehicle warranties in your state before making a purchase.

- Consumer Protections: Some states require VSC providers to be licensed or bonded, or have a financial backstop to ensure claims are paid.

Common Names for Extended Car Warranties

- Vehicle Service Contracts (VSCs): This is the most widely used term, especially in states without specific legislation for extended warranties.

- Vehicle Protection Plans: Another frequently encountered term, often used interchangeably with VSCs.

- Mechanical Breakdown Insurance (MBI): This term is used in states with stricter regulations for VSCs, where MBIs are regulated as insurance products offering stronger consumer protections.

- Auto Repair Insurance: Primarily used in a few states like California, where VSCs aren’t permitted, and MBIs serve as the alternative.

State-Specific Variations:

- Indiana: Motor Vehicle Service Agreements (MVSAs)

- Massachusetts: Extended Service Agreements (ESAs)

- New Hampshire: Service Contracts

- New York: Automobile Extended Service Contracts (AESCs)

- Virginia: Vehicle Extended Service Agreements (VESAs)

Tips to Buyers:

When comparing quotes, ensure you’re comparing apples to apples, regardless of the terminology used. Pay attention to coverage details, exclusions, and terms of the contract.

- If unsure about the type of coverage offered, ask the provider to clarify whether it’s a VSC, MBI, or another alternative.

- Research your state’s specific regulations for extended warranties to understand the applicable consumer protections and any unique terminology used.

Examples of how laws and regulations impact coverage in different states:

California Car Warranties:

- Stricter regulations: California requires VSCs to meet more stringent standards compared to many other states. This often translates to longer cancellation periods (up to 60 days), more comprehensive disclosures, and stronger repair network requirements.

- Availability of MBIs: California is one of the few states where MBIs are widely available as an alternative to VSCs. MBIs, being regulated as insurance, offer additional consumer protections like guaranteed claim payment and independent adjusters.

Massachusetts Car Warranties:

- Mandatory cooling-off period: Massachusetts mandates a 14-day cooling-off period after purchasing a VSC, allowing buyers to cancel and receive a full refund without explanation. This provides extra time to review the contract and make an informed decision.

- Limited exclusions: Massachusetts restricts the types of exclusions VSC providers can include in their contracts, protecting consumers from unexpected coverage gaps.

New York Car Warranties:

- Financial requirements: New York requires VSC providers to maintain a minimum level of financial reserves to ensure claims are paid. This adds a layer of security for consumers worried about provider solvency.

- Limited repair network restrictions: New York allows VSC providers to have more restrictive repair networks compared to some other states. This could potentially limit consumer choice when seeking repairs.

Texas Car Warranties:

- Minimal regulations: Texas has comparatively lax regulations for VSCs, leading to greater potential for variability in coverage and consumer protections. While some providers might offer comprehensive plans, others might have significant exclusions or limitations.

- Cancellation period: Texas only requires a 10-day cancellation period for VSCs, compared to the longer periods in many other states. This leaves less time for buyers to review the contract and potentially change their minds.

These are just a few examples, and the specific impacts will vary depending on the state and the type of VSC or MBI being considered. Remember, it’s always crucial for consumers to research their state’s regulations and carefully review any VSC contract before making a purchase.

Additional Resources:

- Car Talk – Understanding Extended Warranty Laws: https://www.cartalk.com/extended-warranties/understanding-extended-warranty-laws-state-by-state-guide

- National Association of Attorneys General: https://www.naag.org/

- Federal Trade Commission: https://www.ftc.gov/

#1 Rated: Olive Car Warranty

Olive is a fully-online extended car warranty company that offers three tiers of coverage: Powertrain Plus, Complete Care, and Powertrain. Olive’s plans are affordable and flexible, and they come with a variety of benefits, including no waiting period, towing reimbursement, and rental car reimbursement.

Olive is also one of the best-rated extended car warranty companies in the industry, with a 4.5-star rating on Trustpilot and a 4.4-star rating on Google.

Olive Vehicle Repair / Extended Warranty Plans

Type of Car: 2020 Toyota Corolla with 45,000 miles on it.

Plan 1:

This plan covers all major components.

- Engine

- Transmission

- Front-wheel drive

- Rear-wheel drive

- Towing reimbursement

- Rental car reimbursement

Powertrain Plan Cost

- Option 1: $25.36 per month with a $100 deductible

- Option 2: $24.95 per month with $250 deductible

Plan 2: Olive Complete Care Mechanical Breakdown Coverage

This plan is Olive’s most comprehensive vehicle service contract.

- Engine

- Transmission

- Front-wheel drive

- Rear-wheel drive

- Odometer & speedometer

- Steering

- Suspension

- Brake system

- Air conditioning

- Electrical

- High tech

- Towing reimbursement

- Rental car reimbursement

Complete Care Cost

- Option 1: $46.11 per month with $100 deductible

- Option 2: $32.27 per month with $250 deductible

- Option 3: $24.95 per month with $500 deductible

Plan 3: Olive Powertrain Plus Auto Warranty Plan

Covers all major components, suspension and AC.

- Engine

- Transmission

- Front-wheel drive

- Rear-wheel drive

- Odometer & speedometer

- Steering

- Front suspension

- Brake system

- Air conditioning

- Electrical

- Towing reimbursement

- Rental car reimbursement

Powertrain Plus Cost

- Option 1: $32.27 per month with $100 deductible

- Option 2: $24.95 per month with $250 deductible

- Option 3: $24.95 per month with $500 deductible

As you can see, Olive offers affordable car warranty plans. If you purchase a plan today, you’re covered by tomorrow with no waiting period! You can get quotes and purchase an extended car warranty plan all online with ease.

Olive Extended Car Warranty Restrictions:

The following are not included in Olive warranty coverage:

- Oil changes, spark plugs, aligment and routine maintenance

- Damage from accidents

- Pre-existing conditions

- Vehicles used for work (for example, if you get in an accident while delivering pizzas)

- Vehicles with damaged titles (e.g., re-built or salvaged titles)

Olive Car Warranty Rating

| Rating Criteria | Points (1-10) |

| Coverage Options and Flexibility | 9 |

| Claim Process and Customer Service | 9 |

| Plan Cost and Value for Money | 9 |

| Customer Reviews and Reputation | 7 |

| Financial Stability and Industry Ratings | 7 |

| Additional Benefits and Features | 7 |

| Deductible and Repair Shop Network | 8 |

| BBB Rating and Accreditation Status | 10 |

| Time in Business | 10 |

| Expert’s Subjective Rating (1-20 Points) | 19 |

| Olive Total Points | 95 |

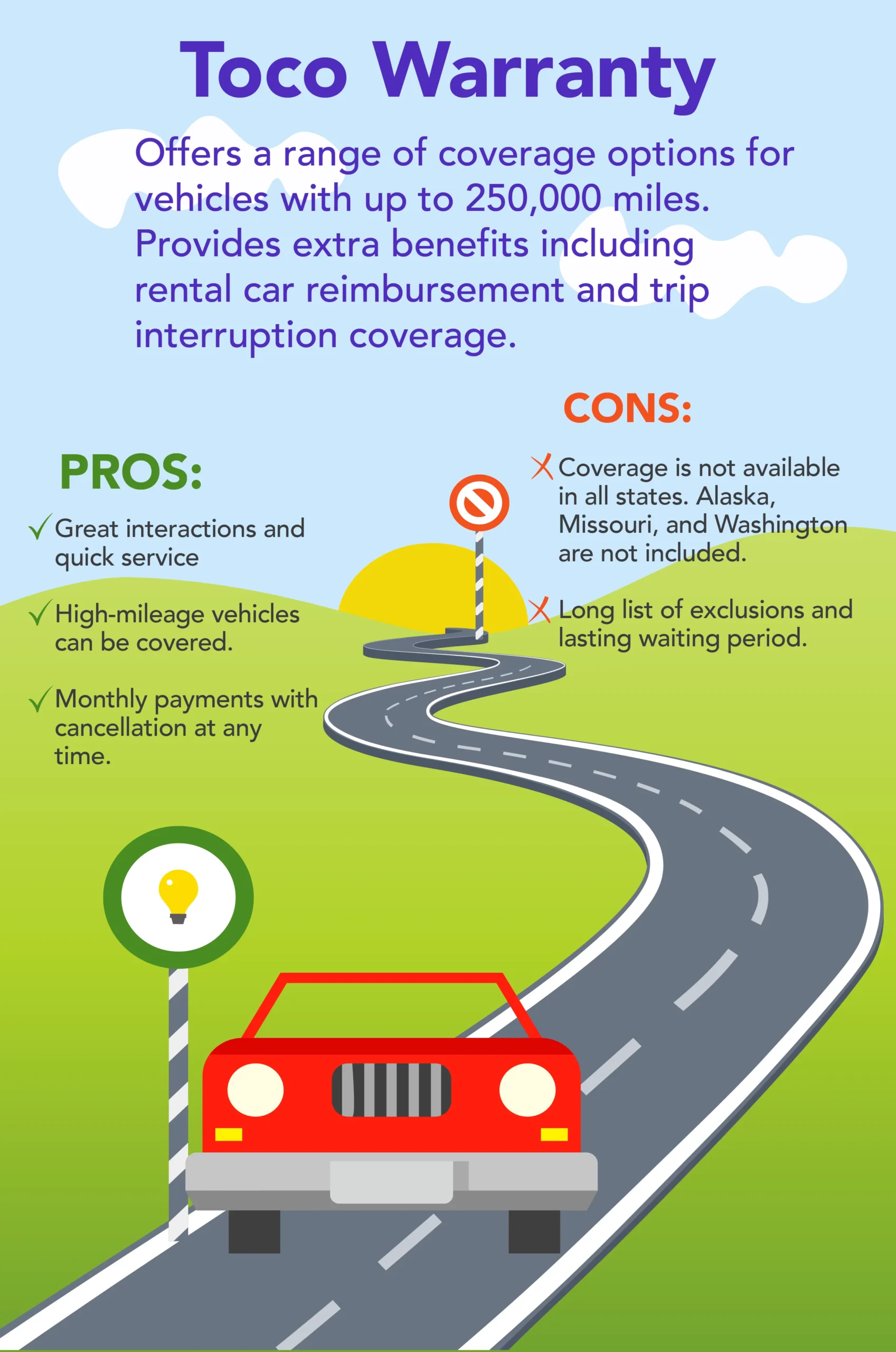

#2: Toco Car Warranty: Best Reputation

Toco Warranty is one of the most reputable extended car warranty companies in the industry, based on customer reviews. Toco offers a variety of plan options, including bumper-to-bumper coverage, powertrain coverage, drivetrain coverage, and add-on benefits such as roadside assistance and rental car reimbursement. Toco customers can choose any repair shop, and most vehicles are eligible for a Toco warranty. Toco’s plans are simple and easy to understand, and payment options are flexible.

Toco Warranty BBB Reviews

Toco Warranty Corp. has an A+ rating with the Better Business Bureau (BBB). The company has received 88 reviews from customers, with an average rating of 4.1 out of 5 stars. The majority of Toco’s customers have had positive experiences with the company, praising its customer service, comprehensive coverage, and affordable pricing. However, there are a few negative reviews from customers who have had difficulty getting their claims approved.

Toco Warranty Pros and Cons

Pros:

- Excellent customer service

- Comprehensive coverage

- Affordable pricing

- Easy to file claims

- Convenient network of repair shops

Cons:

- Some customers have had difficulty getting claims approved

- Some customers have complained about long wait times for customer service

- Toco Warranty does not operate in Alaska, Missouri, or Washington

Toco Warranty Quote for High Mileage Nissan

Toco offers monthly payment options and coverage for high-mileage vehicles. For a 2016 Nissan Rogue with 91,200 miles, Toco offered a monthly payment of $150.75.

Toco Warranty Coverage Levels

Toco’s warranty coverage is divided into four levels: Green Coverage, Blue Coverage, Yellow Coverage, and Orange Coverage. Each level covers specific components of your vehicle based on the odometer reading at the time of the claim.

Green Coverage: Covers components 1-8, including the engine, transmission, drive axle, 4×4 transfer case (if applicable), turbo/supercharger (if applicable), hybrid vehicle components (if applicable), seals & gaskets, and taxes/fluids.

Blue Coverage: Encompasses all components from Green Coverage, and adds components 9-12, including the cooling system, air conditioning, fuel system, and electrical components.

Yellow Coverage: Incorporates all components from Green and Blue Coverage, and adds components 13-18, including steering, brakes, suspension, electronic high-tech systems, technology package (original factory installed), and modern features package (original factory installed).

Orange Coverage: Applies when the odometer reading is under 100,000 miles at the time of the claim. This level covers all parts except for exclusions listed in the contract.

Toco Warranty Exclusions

Toco Warranty has a number of exclusions, including batteries, safety restraint systems, glass, lights, emissions components, normal maintenance items, damage from accidents, misuse, lack of maintenance, and more.

Toco Warranty Rental and Trip Interruption Benefits

Toco Warranty offers a rental benefit and a trip interruption benefit. The rental benefit reimburses you for renting a replacement vehicle or using alternate public transportation while your vehicle is being repaired. The trip interruption benefit reimburses you for hotel and restaurant expenses if your vehicle breaks down more than 100 miles from home and requires an overnight stay for repairs.

Toco Warranty Roadside Assistance

Toco Warranty also offers 24-hour roadside assistance services, including towing, battery jump start, flat tire change, fuel delivery (cost of fuel not covered), and locksmith services.

Conclusion

Toco Warranty is a reputable extended car warranty company with a variety of plan options and flexible payment options. However, it is important to read the contract carefully before purchasing any extended car warranty plan, and to be aware of the exclusions.

Toco’s Extended Car Warranty SAMPLE CONTRACT

Toco Rating

Toco Extended Car Warranty Rating |

Points (1-10) |

| Coverage Options and Flexibility | 8 |

| Claim Process and Customer Service | 7 |

| Plan Cost and Value for Money | 8 |

| Customer Reviews and Reputation | 9 |

| Financial Stability and Industry Ratings | 7 |

| Additional Benefits and Features | 8 |

| Deductible and Repair Shop Network | 8 |

| BBB Rating and Accreditation Status | 9 |

| Time in Business | 6 |

| Expert’s Subjective Rating (1-20 Points) | 17 |

Total Points |

87 |

#3: CarChex Warranty Review

CarChex, a Maryland-based extended car warranty company, is one of the largest companies in the industry. They have over twenty years of experience and offer assistance in every state. They offer a wide variety of vehicle protection plans to choose from, including bumper-to-bumper coverage, powertrain coverage, and drivetrain coverage. CarChex also offers a variety of add-on benefits, such as roadside assistance and rental car reimbursement.

CarChex Extended Car Warranty Plans:

CarChex is known for its polite phone representatives and its no-pressure sales pitches. Plans are affordable and offer flexible payment options.

CarChex Pros and Cons:

Pros:

- Large and established company with a good track record

- Wide range of coverage options and add-on benefits

- Affordable prices

- Flexible payment options

- Knowledgeable and polite customer service representatives

Cons:

- Some customers have had difficulty understanding their coverage and have been surprised by deductibles and excluded repairs

- CarChex is not a direct administrator, so there can be customer service hiccups when dealing with multiple companies on a claim

Overall, CarChex is a reputable extended car warranty company with a good selection of coverage options and add-on benefits. However, it is important to read the contract carefully and understand the terms and conditions of coverage before purchasing a plan.

Here is a summary of the CarChex claim process:

- When your car breaks down, take it to a certified repair shop.

- The shop will assess the damage and contact CarChex to determine if the repair is covered under your warranty.

- If the repair is covered, CarChex will work with the shop to schedule a repair date.

- You may need to pay a deductible, depending on your plan.

- Once the repair is complete, CarChex will pay the shop directly.

Here are some reasons why CarChex might deny a claim:

- The repair is not covered under your warranty plan.

- The car has been modified.

- The car has been abused or neglected.

- The damage was caused by a wreck, vandalism, theft, or natural disaster.

- The repair is for routine maintenance or wear and tear.

- The component that failed has not yet moved past what the automaker considers to be a safe or normal operating range.

If you are considering purchasing a CarChex extended car warranty plan, be sure to compare it to other plans from other providers to find the best coverage and price for your needs.

CarChex Rating Breakdown

| Rating Criteria for Extended Car Warranty Companies | Points (1-10) |

| Coverage Options and Flexibility | 8 |

| Claim Process and Customer Service | 8 |

| Plan Cost and Value for Money | 6 |

| Customer Reviews and Reputation | 7 |

| Financial Stability and Industry Ratings | 8 |

| Additional Benefits and Features | 8 |

| Deductible and Repair Shop Network | 8 |

| BBB Rating and Accreditation Status | 5 |

| Time in Business | 8 |

| Expert’s Subjective Rating (1-20 Points) | 17 |

| Carchex Total Points | 85 |

Secret Shopper Details of CarChex Sales Call

One of our secret shoppers called CarChex for a quote. Here are the details.

Vehicle Type: Toyota Corolla Mileage: 45,000 Driving habits: 10,000 – 15,000 miles per month

Qualification: Titanium level (highest level of coverage)

Coverage: Engine, transmission, cooling, fuel delivery, air conditioning and heating, high-tech electronics, emissions components, bumper-to-bumper protection, and more.

Features:

- Use any dealership

- 24/7 towing

- 30-day cancellation policy

- Unlimited time and unlimited miles

Waiting period: 25 days and 500 miles

Cost:

- Titanium level: $139.99 per month

- Friends and family discount: $109 per month

- Employee discount: $89 per month

Discounts:

- Friends and family discount: $30 per month

- Employee discount: $50 per month

Money-back guarantee: 30-day money-back guarantee

BBB Rating: A+ rated and fully accredited

Secret shopper review:

The secret shopper was impressed with CarChex’s Titanium level coverage, which is the highest level of coverage on the market and includes emissions components and luxury electronics that other companies don’t. The secret shopper also appreciated the fact that CarChex allows customers to use any dealership and offers 24/7 towing.

The secret shopper was initially quoted $139.99 per month for the Titanium level coverage, but the sales rep offered a friends and family discount of $30 per month, as well as an employee discount that brought the price down from $139 to $89 per month.

Overall, the secret shopper was very happy with their experience with CarChex. They found the sales rep helpful and informative and were impressed with the company’s coverage options and pricing.

Additional notes:

- The secret shopper was told that the employee discount was not supposed to be used by the public, but they really wanted to help the consumer.

- The secret shopper was also told that the extended car warranty industry is unregulated, so it is important to check the BBB rating of any company you are considering doing business with. Make sure they are BBB accredited.

- The secret shopper described the sales call as high-pressured, but the offer was attractive.

My recommendation:

CarChex offers comprehensive extended car warranty coverage, but it is important to be aware of the high-pressure sales tactics that they may use. Be sure to shop around and compare quotes from multiple companies before deciding. Don’t just sign up on your first phone call to the company.

Extended Car Warranty Scams

Are extended car warranties scams?

Extended car warranties have been the subject of scorn, anger, and ridicule, as many consumers feel the industry is nothing but a cesspool of scams and fraudulent companies.

This reputation is due to a handful of scams and fraudulent companies that have previously taken advantage of people.

Extended Car Warranty Meme

One example is American Vehicle Protection (AVP), which scammed consumers out of over $6 million.

The Federal Trade Commission (FTC) charged that AVP –

- Made unsolicited calls (including robocalls) to consumers all across the nation.

- Pretended to be affiliated with vehicle makers.

- Deceptively claimed its products, which cost thousands of dollars, offered “bumper to bumper” protection.

- AVP took approximately $6.6 million from consumers and failed to provide services as agreed.

While there are bad actors in almost every industry, from hearing aids to home warranty companies, at least some of the bad rap given to extended auto warranties is unwarranted. Many reputable car warranty companies can offer you peace of mind and protect you from the high cost of unexpected repairs.

Cheapest Extended Car Warranty: Concord Auto Protect

When it comes to finding the most budget-friendly and least expensive extended car warranty, Concord Auto Protect stands out as a reliable choice.

During our recent undercover investigation, our secret shopper engaged with Concord and managed to secure an outstanding deal for a comprehensive bumper-to-bumper extended auto warranty protection plan, all for a mere $39 per month. However, there’s a minor caveat to consider.

Here are the key details from our interaction:

Initial Quote from Concord:

Vehicle Protection Quote: Toyota Corolla, covering 12,000 miles per year or 36,000 miles over three years.

Negotiating for a Better Extended Auto Warranty Plan

After receiving the initial quote, our caller inquired about the possibility of covering 15,000 miles per year, expressing the need for more mileage.

Concord’s adept sales representative promptly placed our caller on hold and, within minutes, returned with a promising offer:

“We can elevate the plan to encompass 15,000 miles annually and extend the coverage to a remarkable 4 years or 60,000 miles. As an added bonus, we’re extending a generous $100 rebate and including rim and tire coverage. Furthermore, rest assured with our 30-day money-back guarantee.”

Concord Extended Car Warranty Plan Details:

- Premium Coverage: Concord’s highest-tier plan, akin to comprehensive bumper-to-bumper coverage.

- Inclusions: GPS, power seats, power windows, and the full spectrum of cutting-edge electronics.

- Initial Quote: Coverage for 3 years and 36,000 miles.

- After Upgrades: Extending the coverage to 15,000 miles annually and 4 years or 60,000 miles.

- Alternate Payment Option: They also presented an alternative payment plan of 4 installments of $475, equivalent to a monthly cost of $39.

- Waiting Period: A brief 30-day waiting period is in place before the coverage becomes effective.

- Service Flexibility: Valid at any dealer or licensed mechanic.

- Comprehensive Coverage: Encompasses both parts and labor.

- Deductible: A manageable $100 deductible to be paid directly to the shop.

- Additional Perks: Includes essential features like roadside assistance, rental car, towing, and locksmith services.

- Discount Opportunities: Concord extends additional discounts if you’re affiliated with AAA or AARP.

According to other customer reviews, Concord’s extended car warranty plans start as low as $32 per month, making it an attractive option for budget-conscious consumers.

Popular vehicles like the Toyota RAV4 can benefit from coverage as low as $45 per month. However, it’s worth noting that older vehicles with higher mileage may incur slightly higher costs.

Check out this Concord Auto Protect review.

Best Extended Car Warranty (Category Winners)

If you’re in search of a particular type of extended car warranty, consider the following category winners, as they may address your specific needs.

For instance, if you own a new car, Olive car warranties are an excellent choice.

For California residents, Endurance has garnered top ratings.

If you’re looking for extended car warranties tailored to high-mileage vehicles, CarChex wins that race.

1) Best Extended Warranty for New Cars: Olive-READ REVIEW

2) Best Extended Warranty for Used Cars: CarChex-READ REVIEW

3) Best Extended Car Warranty in California: Endurance-READ REVIEW

4) Most Reputable Extended Car Warranty Company: Toco-READ REVIEW

5) Best Extended Warranty for High Mileage Cars: CarChex–READ REVIEW

Car Warranty Reviews & Alternatives

You may want to check out more detailed reviews on each of these top 7 extended car warranty companies–

- Olive Auto Warranty Review

- CarCheck Reviews

- Toco

- CarShield Reviews

- Concord Auto Protect Reviews

- Endurance

- Protect My Car

Best-Rated for Convenience and Transparency: Olive

Olive scored an impressive 8.5 in our rankings thanks to its transparent communications and exceptionally easy signup process. The company does not require prospective customers to call and jump through hoops to get a quote, and everything can be completed online.

Plans come with adjustable deductibles, so they offer a level of flexibility not seen in many others, and Olive’s overall pricing is more reasonable than most. Conversely, the company’s exclusions and policies around preexisting conditions are strict and may be more restrictive than expected.

Additionally, Olive is more limited in the age and mileage of the vehicles it accepts and may not cover models that many others do. Finally, the company’s adjustable deductibles do not include a $0 option, which is at odds with some in the industry.

Best Extended Warranty for Used Cars: Carchex

We’ve already talked a lot about CarChex, but here are a few more things to consider if you’re looking for the best used car extended warranty plan:

- Price: CarChex offers flexible and affordable payment plans, allowing you to tailor the payment plan to your lifestyle and budget.

- Coverage: CarChex offers a wide range of coverage options for most vehicles, even those with high mileage.

- Customer service: Customer reviews on CarChex highlight its sales and customer service reps as being transparent and making it easy to file claims.

- Deductible: CarChex offers low deductibles that cost as low as $0.

- Term: CarChex offers extended car warranty plans that can last for up to 10 years or 150,000 miles, depending on your needs.

- Shop of your choice: You can have your vehicle repaired at the shop of your choice.

Things to keep in mind:

- Waiting period: Customers must wait 30 days and 1,000 miles before coverage kicks in, but that’s a relatively standard waiting period for the industry.

- Third-party administrators: CarChex relies on third-party administrators to handle its claims, and the customer service experience can vary wildly between providers.

- Limited coverage options: CarChex does not offer coverage options for exotic cars or other vehicle types like RVs and motorcycles.

How to get a quote for a used car warranty with CarChex:

CarChex accepts call-ins for quotes at 866-261-3457 if you have a used vehicle.

Overall, CarChex is a good option for consumers looking for an affordable and comprehensive extended car warranty for their used car. However, it’s important to remember the waiting period and that CarChex relies on third-party administrators to handle its claims.

Best Mechanical Breakdown Insurance (MBI) in California: Endurance

The best extended car warranty company in California is Endurance Warranty Services, LLC. However, in California, due to laws and regulations, extended car warranties are called Mechanical Breakdown Insurance (MBI). Although the service is nearly identical, due to the laws in California, they are called different names. Companies selling MBI must also be licensed by the California Department of Insurance. You can check if a company is licensed by searching for its name here.

Endurance is a licensed MBI provider in CA (License #6009544).

MBI is not a manufacturer’s warranty; it provides repair coverage after your manufacturer’s warranty expires.

Why Endurance is the best extended car warranty company in California:

- Comprehensive coverage plans: Endurance offers a variety of MBI plans to choose from, so you can find one that fits your needs and budget. The plans range from basic coverage to comprehensive plans that include routine maintenance services like oil changes and brake pads.

- Direct provider: Endurance is a direct provider, which means you’ll deal directly with the company when you purchase your MBI plan and file a claim. This can help streamline the process and make it easier to get your car repaired.

- Positive customer reviews: Endurance has a positive reputation among customers. The company has a 4.5-star rating on Trustpilot, and many customers praise the company’s comprehensive coverage, responsive customer service, and easy claims process.

Other honorable extended car warranty companies in California:

These companies also offer a variety of MBI plans to choose from, and they have an excellent reputation among customers. However, Endurance is our top pick for CA because of its comprehensive coverage plans, direct provider status, and positive customer reviews.

Best Extended Warranty for Luxury Cars (Audi/BMW)

After your new car factory warranty ends, don’t let unexpected Audi or BMW repair bills blindside you. These top extended car warranty providers offer luxury-worthy protection:

- Endurance: Top-rated for extensive coverage options, including high-mileage plans and tech-heavy packages perfect for modern Audis and BMWs.

- CarShield: Affordable monthly payments and a focus on powertrain coverage, ideal for budget-conscious luxury car owners looking for peace of mind.

What are Factory Auto Warranties?

All new cars come with warranties that protect owners against manufacturing defects and premature failures. The length and scope of each warranty differ between automakers, as some offer coverage that extends to ten years and 100,000 miles.

Auto warranties are usually split into coverage for powertrain components and separate coverage for other parts and systems.

New vehicles also typically come with corrosion coverage that protects against perforating rust, and some automakers combine the powertrain and standard vehicle coverage into one warranty.

Electric vehicles, hybrids, plug-in hybrids, and others come with separate battery and drivetrain coverage for their electrified components.

They are required to come with at least eight years and 100,000 miles of coverage, and California requires ten years.

Are Extended Auto Warranties Worth It?

As cars age, repairs are needed.

Do you drive a Ford F-150?

- A headlamp switch replacement could cost $220.

- Window regulator replacements cost over $400.

- Suspension ball joint replacements cost $250.

- A few small car repairs throughout the year can cost you $1200 or more.

Meanwhile, if you already had an extended car warranty, these few repairs could have cost you only $600, including the monthly payments over 12 months.

Do you drive a used Honda?

- Suspension shock replacements cost $800.

- Windshield wiper motor replacements cost $250.

- Exhaust manifold replacement repairs cost $1350.

- Airbag occupant sensor replacements cost $850.

- A few costly repairs in any given year could cost you $ 1,500 to $2,000!

If you had a vehicle protection plan, you could have saved hundreds of dollars!

Common repairs on used cars can be costly.

- Transmissions alone can cost $5,000.

- Radiators cost over $1,000.

- Heater cores cost around $1200 on average.

- Brake calipers can cost $700.

With an extended car warranty, these same items can be covered while only having to pay an affordable monthly payment.

Overall, whether or not an extended car warranty is worth it depends on a number of factors, including the age and condition of your vehicle, your driving habits, and your budget. However, an extended car warranty can provide peace of mind if you are concerned about the high cost of unexpected repairs.

Here are some additional things to consider when deciding whether or not to purchase an extended car warranty:

- Read the fine print carefully. Make sure you understand what is and is not covered by the warranty.

- Compare plans from multiple companies. This will help you find the best price and coverage for your needs.

- Check the company’s reputation. Read customer reviews and see what others say about the company’s coverage and customer service.

- Ask about the deductible. The deductible is the amount you must pay out of pocket before your warranty coverage kicks in.

- Make sure you can cancel the warranty. Some companies make it difficult to cancel their warranties. Ensure you can cancel without penalty if you are unhappy with the service.

How Do Extended Auto Warranties Work?

As the name implies, extended auto warranties bring longer coverage than factory warranties. Unlike factory warranties, extended warranties cost money, though many companies offer flexible payment options or the ability to break up enormous costs over long periods.

Though they’re advertised as covering the same types of components as a factory warranty, extended warranties sometimes have restrictive policies and exclusions that can lead to claims denials. At the same time, most extended warranty companies offer tiers of coverage that range from basic powertrain warranties to more comprehensive options that include vehicle technology features, climate controls, and cosmetic components.

It’s also worth noting that extended warranties are not always known as the most generous with coverage, and many complaints about the industry stem from customers’ inability to have their claims paid. That said, paying for an auto warranty is generally less expensive than paying large sums for engine replacements and other costly repairs.

Where to Buy Extended Auto Warranties

Extended auto warranties can be purchased almost any time, and some dealers work with third-party companies to sell coverage when selling a new or used vehicle. That said, it’s not always the best idea to purchase a warranty at the point of the vehicle sale, as the dealer has you as a captive audience.

That could cause you to pay more than necessary for the warranty, and it’s almost always a good idea to shop around. The most prominent warranty companies in the industry have websites with detailed information on the types of coverage they offer, what is included, and how to sign up. Though making phone calls and filling out forms on the internet are not the most entertaining afternoon activities, the extra time spent shopping can save you loads of money.

It’s also essential to research the type of warranty company you want to work with. You’ll want to buy the company and its reputation as much as you do the coverage itself, meaning you need to trust the company you work with and should have a clear understanding of what you’re getting for the money. Additionally, don’t fall victim to aggressive sales tactics that could leave you feeling like you don’t have an option.

Even if your car is on its last legs, buying an extended warranty you don’t necessarily want or need is not a good deal for anyone but the warranty company.

First, extended car warranties go by various names, often depending on the state in which they are being sold. For example, in California, Endurance markets extended car warranties under the name Mechanical Breakdown Insurance. In Florida, Olive markets them as Vehicle Service Contracts.

Car warranties go by many different names, including:

- Vehicle service contract

- Extended auto warranty

- Aftermarket warranty

- Extended protection plan

- Vehicle protection plan

- Mechanical breakdown insurance

- Vehicle service agreement

- Powertrain warranty

- Bumper-to-bumper warranty

- Exclusionary warranty

- Stated-component warranty

Types of Extended Auto Warranties

Extended auto warranties typically fall into one of a few categories. Exclusionary coverage is the most comprehensive available, and the name comes from the policies’ list of covered items, which generally includes non-covered components since there are so few.

These policies come closest to automakers’ factory warranty coverage and generally include protection for several vehicle components and systems, including electronics, climate control, and safety equipment.

Most extended warranty providers also provide “enhanced” or “supreme” coverage as a middle tier. These plans typically cover the powertrain and added components that include the fuel delivery system, cooling system, and more.

While not comprehensive, these middle-tier plans can offer better coverage for expensive components above and beyond simple powertrain coverage.

At the low end, extended warranty providers offer basic powertrain warranty coverage that may also include a turbo or supercharger (if equipped) and other components. Many companies also include auxiliary benefits with their coverage, including 247 roadside assistance, rental car reimbursement, and additional bonuses.

Average Monthly Cost of Extended Car Warranty?

While costs vary wildly between vehicle types, most of the best 3rd party extended auto warranties and extended service plans cost between $2,000 and $6,000, with many costing on the low end of that range and monthly payments landing between $80 and $250.

- CarChex is an excellent value

- Olive also offers fantastic pricing with flexible payment options.

What Do Extended Auto Warranties Not Cover? (exclusions)

While some extended warranties can be quite comprehensive, all of them have limits on what is included in the coverage. Warranty companies are incredibly particular about coverage exclusions, though some are stingier than others.

In general, extended auto warranties do not cover:

- Damage caused by normal vehicle operation

- Components that fail as a result of abuse or neglect

- Common wear items like tires, brakes, and fluids

- Components that fail as a result of a non-covered component failure

- Failures caused by continuing to drive the vehicle after a problem occurs

- Stolen or vandalized vehicles

- Modified components

- Third-party parts not authorized by the OEM

- Unauthorized or improperly completed repairs

Common wear items are one of the most common exclusions in extended auto warranties. The list includes tires, engine oil, brake pads and rotors, and other components that are designed to wear during everyday use.

Automakers’ factory warranties do not cover these items, so it’s unsurprising to see extended warranties sidestep covering them, but customer complaints continue to pile up. Many people don’t seem to understand the concept of wear components, and the expectation that they’ll be covered under warranty has caused significant drama for vehicle owners who want the items to be replaced for free.

This is not a comprehensive list, and every warranty company differs in how they approach and communicate claims issues. It’s vital that you carefully read your service contract and understand the steps you need to follow to file a claim and have it paid.

Some providers require you to take the vehicle directly to a shop at the first sign of a problem and will communicate directly with the repair person to determine whether the work will be covered under warranty.

Reasons Not to Buy an Extended Auto Warranty

As nice as it is to have the peace of mind from an extended auto warranty, you don’t always need the coverage.

This is especially true if your vehicle is still under the factory warranty and is new enough to retain that coverage for at least a few years.

Paying the money for an extended warranty while the factory coverage is still active can waste money, as there’s no real benefit or reason to do so.

Avoid buying an extended car warranty if you’re the type of person who buys a new car every few years, since you are less likely to experience a catastrophic breakdown.

Frequently Asked Questions

These are some of the most common questions surrounding extended auto warranties.

As long as the engine is covered by your plan and the failure was not caused by a non-covered component, your engine replacement should be covered. That said, some companies limit the amount they pay, so it’s a good idea to be prepared to shell out the difference.

From our research, even the best extended car warranties on the market including Toco, do not cover routine vehicle maintenance, like oil changes and tire rotations.

In fact, Toco’s auto warranty contract in the small print specifically states, “Properly Maintain YOUR Vehicle and RETAIN THE RECEIPTS – This Contract is only valid if YOUR Vehicle has been maintained in accordance with the manufacturer’s specifications. Please retain copies of all receipts (oil changes, lubrication, etc.), as proof of maintenance will be required when YOU file a claim. “

In simpler terms, neglecting responsibilities like oil changes, tire rotations, and other essential vehicle maintenance could potentially lead to the rejection of your claim.

Yes, many warranty plans come with add-ons that increase their value and make it easier to operate your vehicle. Many companies offer roadside assistance, towing benefits, trip interruption reimbursement, and even rental car coverage.

You might not be able to obtain warranty coverage on vintage cars or custom-built vehicles, but it is possible to get excellent insurance coverage to protect against crash damage.

While dealers might have the best price, it’s certainly not the rule. In fact, buying a warranty while you’re in a captive vehicle sales situation may end with you paying more.

When deciding between an aftermarket extended warranty and a manufacturer extended warranty, it’s essential to weigh the advantages and disadvantages of each option.

Manufacturer plans are typically offered when purchasing the vehicle or before the factory warranty expires, ensuring coverage directly from the automaker and often guaranteeing factory-trained technicians and genuine parts.

However, these plans may have strict eligibility requirements and potential dealership markups. On the other hand, third-party plans, like those offered by reputable companies such as Olive, are available at any time and from licensed repair shops, providing affordable contracts with various warranty options.

While some disreputable providers exist, diligent research can help you avoid scams. These plans are transferable and offer a range of coverage choices, but may lack the assurance of factory-trained technicians or genuine parts.

Regardless of the provider, it’s crucial to thoroughly review the contract details, including labor rate coverage, mechanical failure definitions, payout limits, OEM parts coverage, waiting periods, maintenance documentation requirements, emergency repair procedures, and cancellation policies. This ensures you make an informed decision and avoid surprises when needing repairs.

Many new vehicles come with a manufacturer’s warranty that covers various components for a certain period of time or mileage. Manufacturer warranties often include a bumper-to-bumper warranty that covers most parts and systems, as well as a powertrain warranty that covers the engine and transmission. In most cases, there is no point getting an extended car warranty for new cars.

Let’s examine a quote example from Toco, as recounted by a recent Toco customer. Toco’s extended car warranty offerings are tailored to each individual car, taking into account factors such as mileage, car type, and condition. In this instance, we have a Toco extended car warranty quote specific to a 2016 Nissan Rogue. Despite its good condition, this Nissan Rogue has covered 91,200 miles.

Notably, this vehicle had a prior extended car warranty from Carmax, incurring an approximate cost of $5,000, and each repair visit involved a $200 deductible. Expenses beyond this deductible were covered, proving to be an advantageous arrangement. With substantial repairs, including costly issues like brake replacements, amounting to over $1,200, the warranty proved its value by limiting the cost to just $200. The Carmax warranty’s coverage extended up to 75,000 miles before expiring, prompting the pursuit of a new car warranty – ultimately leading to a quote from Toco.

To obtain the quote, Toco mandated the provision of the VIN number. After receiving this identifier and responses to a few basic inquiries, the quote was furnished. The Toco extended car warranty plan offers coverage up to 250,000 miles, demonstrating its suitability for high-mileage vehicles. The monthly payment for this plan would be $150.75.

Mechanical breakdown insurance (MBI) and extended car warranties are similar in that they both provide coverage for certain repair costs in the event of mechanical or electrical failures in your vehicle.

However, there are key differences between the two:

Mechanical Breakdown Insurance (MBI):

MBI is typically offered by insurance companies and is considered a form of insurance coverage.

It covers the cost of repairs for mechanical and electrical failures due to normal wear and tear, such as engine, transmission, suspension, and other major components.

MBI often has a deductible that you need to pay before coverage kicks in.

MBI is usually available as an optional add-on to your existing auto insurance policy.

MBI might include additional benefits such as rental car coverage, trip interruption coverage, and roadside assistance.

Extended Car Warranty (Vehicle Service Contract):

An extended car warranty, also known as a vehicle service contract, is a contract between you and a warranty provider.

It provides coverage for repairs to specific components of your vehicle after the manufacturer’s original warranty has expired.

Extended warranties often have different coverage levels and options, allowing you to choose the level of protection you want.

They may or may not have a deductible, depending on the terms of the contract.

Extended warranties are usually purchased separately from your car and can cover a range of components, from basic powertrain coverage to more comprehensive coverage.

Unlike MBI, which is often associated with insurance companies, extended warranties are typically offered by warranty companies or dealerships.

A bumper-to-bumper warranty stands as the pinnacle of protection available for your vehicle, albeit at a premium cost. Yet, it poses an intriguing question: is it merely an expense or rather an investment that can yield long-term savings? When you purchase a new car, the package often includes the safeguard of a bumper-to-bumper warranty, a shield against the financial blow of most repair expenses in the event of a mechanical breakdown.

However, as the factory-offered bumper-to-bumper warranty eventually concludes, it’s prudent to explore extended coverage options from trusted third-party providers such as Endurance, ForeverCar, Olive, CarShield, and Carchex. These providers furnish comprehensive plans tailored to various needs, accompanied by an array of benefits and additional perks that can redefine your driving experience.

Once more, echoing the sentiment expressed throughout this entire content page, it’s essential to grasp your specific needs and preferences before delving into a comparison of offers from top-rated providers.